OwenPrice

W. P. Carey Inc. (NYSE:WPC) is a diversified real estate investment trust (“REIT”), specializing in customized capital solutions throughout the net lease industry. It’s one of the more followed REITs on Seeking Alpha, approaching 70,000 followers.

There are so many aspects that I love about WPC, including its investment strategy, real estate portfolio, property and industry diversification, the large occupancy rates across its portfolio, and long-standing dividend. My hesitation as to starting a position in WPC is the current valuation. Based on the factors I look at when comparing REITs, there is a premium placed on shares of WPC. Many would speculate that WPC has earned the right to trade at a premium, and while this could be true in the eyes of current shareholders, there are other REITs that are more attractive to me at this point in time.

Investors have many options to generate income, as living in a yield-starved environment has become obsolete. A wide range of 1-year CDs offers 4% or higher interest rates, while a 1-year Treasury bill offers 4.23%. When I am looking at income-producing investments, if I am going to take on equity risk with my capital, I want to generate significantly more income than I would in a CD or T-bill that are risk-averse. WPC is a great company, and I wish I had caught it at the bottom of its recent decline. However, its premium has grown too much for me, so I will be waiting to add WPC to my portfolio.

WPC has everything that I look for in a REIT, and it’s moved to the top of my watchlist

Prior to reviewing why WPC is an attractive REIT, its story is captivating to me. WPC is named after WM. Polk Carey, its founder who sold soda and writing ink that he made in his basement to his neighbors as a child. When he got to Princeton, he was one of the only individuals with a small refrigerator. Mr. Carey got the idea to purchase as many refrigerators as he could afford and leased them to other students at Princeton. This business venture formed the groundwork for pioneering the concept of pooled net leased commercial real estate assets for individual investors. I found the origins of WPC to be quite interesting, as Mr. Carey was a lifelong entrepreneur who built what has become one of the largest equity REITs.

WPC is one of the largest net lease REITs, which has built a diversified portfolio of single-tenant industrial, warehouse, office, retail, and self-storage properties subject to long-term net leases with built-in rent escalators. WPC has 1,428 properties that have amassed 175 million sq feet within its portfolio. WPC has 391 tenants generating $1.22 billion in annualized base rents. While these numbers are impressive, I am more impressed that WPC has a 98.9% occupancy rate, with 99.3% of its leases tied to rent escalations.

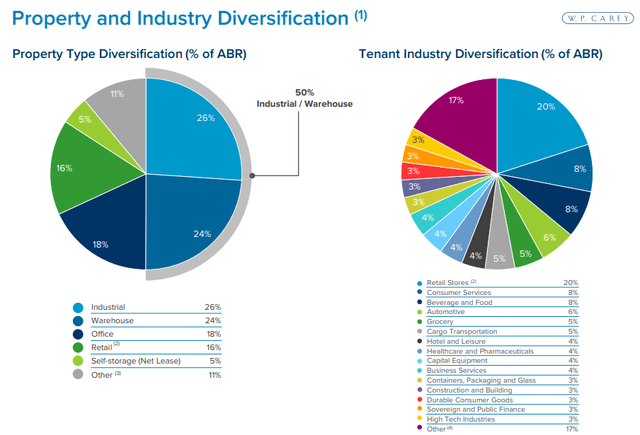

One of the most appealing aspects of WPC to me is its actual business model. Their net lease methodology has protected the company through vast diversification and structuring of leases with rent escalations. Unlike many well-known REITs that specialize in a specific sector, WPC’s largest sector, which is Industrial, only represents 26% of its portfolio. WPC’s exposure is well diversified into warehouse, office, and retail spaces. Looking at the tenant industry diversification, WPC has a large pool of sectors, with retail stores representing its largest tranche at 20%. WPC’s largest tenant, which is U-HAUL, represents 2.9% of the portfolio, followed by State of Andalusia, which are government office properties in Spain.

WPC’s historical occupancy rate has never dropped below 96.6% over the past 14 years and has operated at an average occupancy rate of 98.47%. The lowest annual occupancy rate since COVID has been 98.5%, just above its 14-year average. To me, this is important because it indicates the changing commercial real estate market doesn’t impact WPC, and its diversification has mitigated occupancy risk. WPC has structured its contractual rent escalators in a way that 55% is tied to CPI, 40% is at a fixed rate, and 4% is based on a different methodology. WPC has a weighted average lease term of 10.9 years, which helps secure its annual rents and provides WPC the ability to continue making strategic investments.

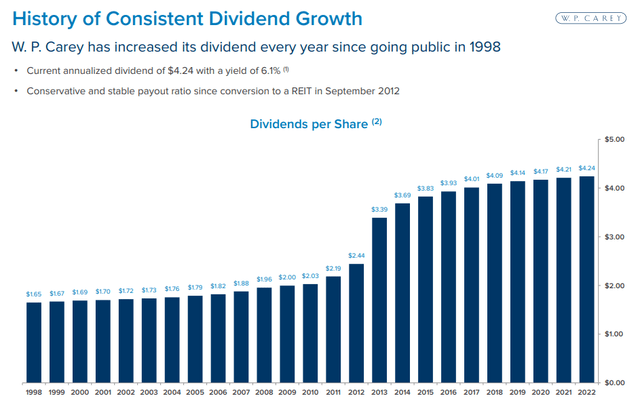

From a business standpoint, WPC has everything I look for, and from a dividend standpoint, WPC hasn’t left much to complain about. WPC has provided 25 consecutive years of paying dividends to its shareholders, with a consecutive annual increase. Since its IPO, WPC’s dividend has grown 156.97%, increasing from $1.65 to $4.24. WPC looks to have closed its first day of trading at $20.95.

Prior to compounding, if you had purchased 100 shares of WPC for $2,095, you would have generated $6,773 in dividends, and your shares today would be worth $7,972. Since its IPO, WPC has generated 323.29% of its initial price in dividends, while its shares have increased by 289.52%. While 25 years is a long time, WPC has been an actual set-it-and-forget-it investment that has continued to generate large amounts of value for its shareholders through the initial investment of capital and income generated.

The two things stopping me from investing in WPC are the valuation and dividend yield

Since I am not a long-term investor of WPC, I need to look at the investment going forward as I do not have the luxury of getting in on the ground floor. Since I can tie up capital for a year and generate between 4-5% through a CD or 1-year T-bill, I am not that thrilled about a 5.32% yield where I have to take on equity risk. In 2021 this would have been different, but we were not living in a yield-starved environment where the only options for modest yield were investments that assumed a level of risk. Due to this, I really want to see 6% or more from a dividend, and after the next Fed hike, we could see CDs or T-bills possibly cross over the 5% threshold.

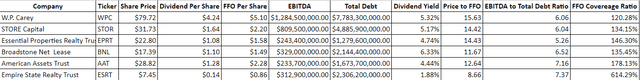

Based on Seeking Alpha’s peer group for WPC, I will be comparing WPC to the following companies:

- STORE Capital (STOR)

- Essential Properties Realty Trust (EPRT)

- Broadstone Net Lease (BNL)

- American Assets Trust (AAT)

- Empire State Realty Trust (ESRT).

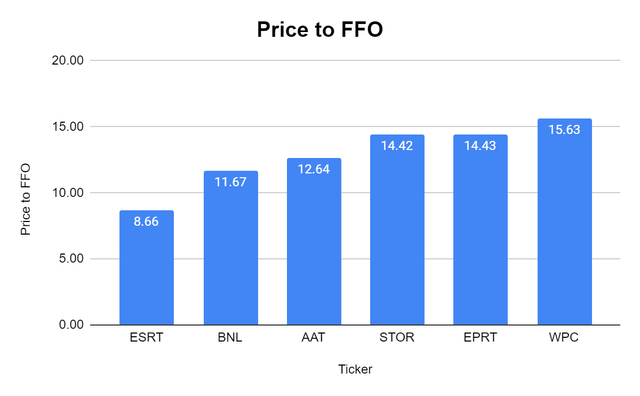

Steven Fiorillo, Seeking Alpha

WPC currently trades at a price to FFO (funds from operations) of 15.63x, which is the largest valuation in its peer group, and well above the 12.91x peer group average. I am also not excited about the yield. While its 5.32% yield is above the peer group average of 4.65%, it has the lowest FFO coverage ratio in the peer group of 120.28%. The 5.32% yield doesn’t provide a large enough spread over a 1-year T-Bill for me to get very interested.

Steven Fiorillo, Seeking Alpha

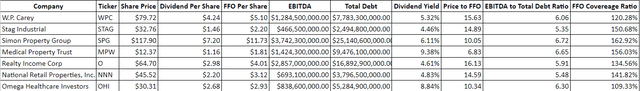

I also compared WPC to some REITs that I am currently invested in, which include:

- Stag Industrial (STAG)

- Simon Property Group (SPG)

- Medical Property Trust (MPW)

- Realty Income (O)

- National Retail Properties (NNN)

- Omega Healthcare Investors (OHI).

While these are different types of REITs, and I invested in them at different periods, I am finding better deals with higher yielding REITs I am already a shareholder of.

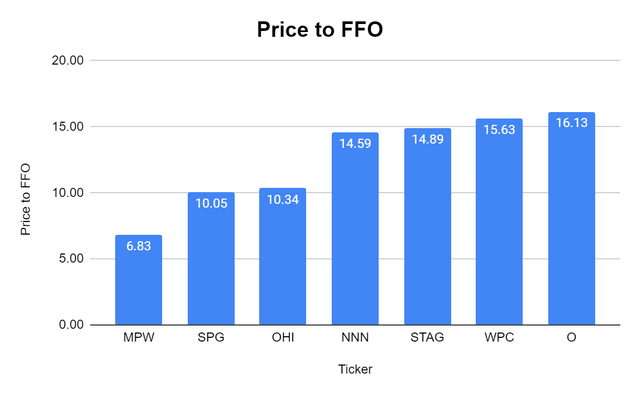

Steven Fiorillo, Seeking Alpha

The average price to FFO when comparing WPC to these REITs is 12.64x, and the average yield is 6.22%. WPC trades at a larger valuation while having a smaller yield than this group’s averages. I could buy additional shares of SPG at a 10.05x price to FFO, which would generate a 6.11% yield, or buy MPW at 6.83x its FFO with a 9.38% yield. OHI is also trading at 10.34x its FFO and yielding 8.84%. WPC is a great company, but this valuation is too rich, and the yield isn’t enough for me to start a position at this point in time.

Steven Fiorillo, Seeking Alpha

Conclusion

W. P. Carey Inc. is a company that I want to own, just not at this valuation. WPC has all of the qualities I look for in a REIT and its business model has proven it can withstand any economic cycle as its occupancy rate has been maintained throughout the pandemic. WPC is hedged against inflation through its price escalators, and long-term investors have done exceptionally well through capital appreciation and 25 years of growing dividends. I would get really excited around $60 per share as this would put WPC’s dividend yield at 7.07% and its price to FFO at 11.76x. If W. P. Carey Inc. gets there is another story, but it’s on my watchlist, and if another dip occurs, I will be paying close attention.

Be the first to comment