Editor’s note: Seeking Alpha is proud to welcome Dongjun Lee as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

jetcityimage

Investors are focusing too much on near-term difficulties, such as a looming recession, high inflation, high interest rate, and ongoing global supply chain issue, creating downward pressure on valuation. However, I believe Five Below (NASDAQ:FIVE) can weather the storm by relying on its strong balance sheet and ultimately become a long-term winner amongst discount retailers by executing its long-term plan (“Triple-Double“) and by gaining from a partnership that analysts mostly ignore. In addition, the management plans on opening at least 200 stores in 2023, hitting a new milestone of opening the highest number of stores in a year since its inception in 2002. Finally, the high visibility into the profitability for next year seems most likely to be realized, given the success management had in the past in executing its plans. Based on these reasons and opportunities to scale the business, offering an omnichannel shopping experience, and investing in initiatives that could fuel growth while staying debt free, I rate Five Below as a Buy with a 12-month price target of $203.

Overview

Five Below is a specialty discount retailer that offers consumables, household products, and other basic discretionary items at low prices. FIVE’s primary target customers are teens and tweens, and the business is highly seasonal, with ~40% of sales raised during the fourth quarter. A typical Five Below store occupies ~9,000 square feet and is located within shopping centers across urban, suburban, and semi-rural markets. As of 2Q22, there are over 1,200 stores across 40 states in the US. The current CEO is Joel Anderson, who served as the CEO of Walmart from 2011 to 2014 and also worked at Toys “R” Us for over 14 years.

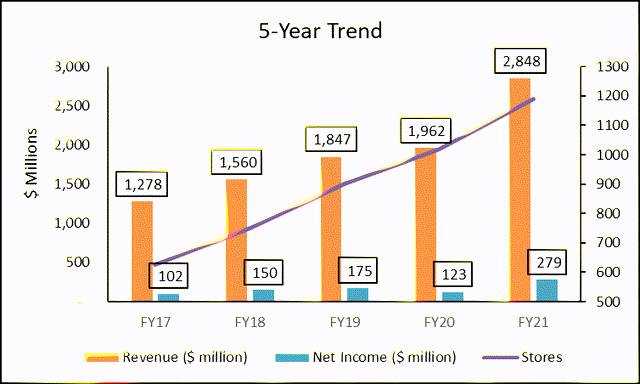

During the last five years, Five Below’s revenue has grown at a 17% CAGR, from $1.27 billion to $2.8 billion, net income has grown at a 22% CAGR, from $102 million to $278 million, and the number of stores increased from 625 in FY17 to 1,190 in FY21. In March 2022, the management announced its long-term plan called “Triple-Double,” which entails tripling the number of stores to over 3,500 by the end of 2030 and doubling the sales and EPS from the current level. With a differentiated concept to capture niche markets and grow scale quickly to offer even more value, Five Below is a fast-growing business with many upsides in the near and long terms.

Investment Thesis

Five Beyond – improves same store sales (SSS)

Five Below company website

In 1Q20, Five Below introduced a new concept called “Five Beyond,” a separate section in a store with higher-priced goods (mostly between $6 and $10). Currently, Five Beyond is in ~50% of the chain, and the company is renovating existing stores to include more Five Beyond in its chain (250 stores to be renovated this year and 750 stores by the next four years). Five Beyond’s appeal to customers is apparent, as the management has said during the 2022 ICR Conference that customers who purchased Five Beyond products spent 2x more than the typical basket size and bought 50% more units per transaction than customers who did not purchase any Five Beyond products. The management also mentioned that there was no pushback from customers when higher-priced products, such as a basketball hoop priced at $25, were introduced during last year’s holiday season. These data support management’s constant message that Five Below resonates with customers by offering high value at low prices and not by simply selling low-priced goods. With the success of Five Beyond, expanding the number of stores with Five Beyond will provide a meaningful upside in Five Below’s SSS in the near and long terms.

Associate Assisted Self-Checkout (ACO) – improves efficiency & turnover

ACOs are machines that customers can use to do self-checkouts, and they are currently installed in 60% of the chain and will be available chainwide by 2025. The company is seeing the benefit of installing ACOs in throughput in sales as they help to eliminate long lines at the counter. ACOs also free up the associates working behind the counters to be on the floor and help the customers, transforming the stores into more interactive environments where customers can find help immediately.

Tokenization / Digital Marketing – helps with targeted advertisement

Digital advertisements targeted toward teens and tweens can yield better brand awareness and ultimately increase sales. The investment in targeted advertising shows the company’s effort to become an omnichannel retailer that serves customers not only through its brick-and-mortar stores but also through e-commerce as well. A loyalty program is also expected to be introduced soon, as the management discussed during the 2022 ICR Conference that they have collected ~75% of customers’ data and will present a loyalty program once enough data has been collected. This new initiative will incentivize customers to revisit the stores and buy more from Five Below.

The rollout of Buy Online Pick-up In Store (BOPIS) is yet another way the company is trying to expand its omnichannel presence, and it’s currently available in all of the Five Below stores.

Partnership with Nerd Street Gamers

Five Below is investing in a partnership that has the potential to be a game changer to its business. In 2019, Five Below led a Series A funding of an eSports facility developer called Nerd Street Gamers, making a deal to build eSports facilities next to their stores. eSports, as defined in an article from CNN, “describes the world of competitive, organized video gaming. Competitors from different leagues or teams face off in the same games that are popular with at-home gamers: Fortnite, League of Legends, Counter-Strike, Call of Duty, Overwatch, and Madden NFL, to name a few. These gamers are watched and followed by millions of fans all over the world, who attend live events or tune in on TV or online. Streaming services like Twitch allow viewers to watch as their favorite gamers play in real-time, and this is typically where popular gamers build up their fandoms.” The eSports facilities that they’re building are called “Localhost,” and a typical Localhost is approximately 3,000 square feet in size with dozens of professional-grade PCs, and people come to play the latest games using these computers. Nerd Street Gamers regularly open camps to train people to become better gamers and hold competitions. The two companies plan on building 70+ facilities next to Five Below stores over the next several years. This development is significant in many ways, as can be seen below:

It gives another reason for customers to visit Five Below stores

Management’s focus on its brick-and-mortar stores might seem backward, given the recent prevalence of online-based DTC companies and the retail industry’s focus on the e-commerce business. However, the majority of retail sales still come from physical stores (~85% according to the US Census Bureau, as of November 18, 2022), and Five Below’s success is built upon a treasure hunt-like experience that customers get from finding great value while shopping in the store. Localhost is similar to Five Below stores in that it offers excellent value at a low cost (people get to play games using a professional-grade gaming setup at a low price), and this ideology aligns with Five Below’s mantra of let go and have fun.

A more constant stream of traffic could be achieved, making the sales more consistent YoY

Five Below’s sales fluctuate year over year, depending on whether it was able to capture ongoing trends and be able to monetize them quickly. The company has been successful in doing so, as low single-digit growth in SSS has shown over the last several years, but its inherent risk in fluctuation in sales can’t be ignored.

According to Fortune Business Insights, the eSports industry has a global market size of $1.22 billion and is expected to grow at 21% CAGR until 2029, reaching a market size of $5.48 billion. Also, according to research from Statista, the online games market in the US is projected to reach $4.93 billion in 2022 and $6.50 billion by 2027. With eSports’s growth in popularity, the management is investing in a market that’s growing in popularity among its customer base, and an increase in the number of customers to these gaming facilities will act as a buffer to not only stabilize but also grow the sales.

Potentially increase units per transaction (UPT) and basket size, leading to higher SSS

Half of Five Below’s revenue comes from products categorized as “Leisure,” which includes electronic products such as computer mouse and keyboards. People who come to play computer/video games will likely find products offered by Five Below to be relevant to their needs.

Valuation

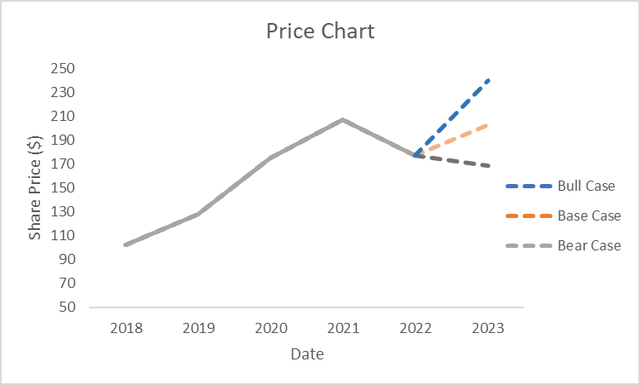

| FY23 forecast | Bear Case | Base Case | Bull Case |

| # of New Stores | 180 | 200 | 220 |

| Revenue ($ million) | 3,364 | 3,542 | 3,719 |

| Operating Margin | 9% | 11% | 13% |

| EBIT ($ million) | 370 | 390 | 409 |

| Net Income ($ million) | 269.2 | 283.3 | 297.5 |

| EPS | 4.82 | 5.08 | 5.33 |

| P/E | 35x | 40x | 45x |

| Share price | $168.82 | $203.10 | $239.91 |

My price target for FIVE under the base case is $203. The management mentioned during the recent 3Q22 earnings call that the company is expected to open at least 200 stores in FY23, which I used as my base figure. Revenue from the new stores was derived assuming that a typical new store generates $2 million during the first year of its opening, and revenue from the existing stores was derived by multiplying historical SSS of 3% to the FY22 revenue of $3.05 billion. For the FY23 operating margin, the management expects some leverage to the operating margin in FY22, which I derived to be 11%. Net income was calculated using the historical net margin of ~9%, and P/E was derived by holding shares outstanding constant at 55.8 million shares.

My estimated FY23 EPS came out to be $5.08 (vs. Bloomberg consensus of $5.52), and I’ve used a slightly conservative P/E of 40x, considering the current P/E is 43x and the 5-year median P/E is 45x. Despite the company’s multi-faceted growth opportunities, I used a conservative number to reflect uncertainty in the near-term macro environment. By multiplying the estimated FY23 EPS to P/E, I arrived at my target price of $203.

Peer Analysis

Five Below’s competitors include other discount retailers, namely Dollar General (DG), Dollar Tree (DLTR), and Dollarama (OTCPK:DLMAF) (DOL:CA). Among these, Dollar General has the highest number of stores, 18,566 stores as of 2Q22, and Five Below has the lowest number of stores, with 1,252. However, Five Below has reported the highest SSS growth in a 2-year stack for FY21 & 2Q22 (refer to the below chart for a more detailed comparison). Significant differences in SSS among the peers could be attributed to the different types of products these companies carry. Because Dollar General and other competitors carry mostly consumables, including perishables, cleaning products, packaged food, etc., their sales did not experience considerable growth in sales when the consumers cashed in their stimulus checks.

On the other hand, the multiples reflect Five Below’s high growth and investors’ high expectations, with P/E of 43.02 (vs. average: 29.83), EV/Revenue of 3.79 (vs. average: 3.26), and EV/EBITDA of 27.56 (vs. average: 19.82). Despite its higher-than-average multiples, I still believe Five Below should be priced even higher, considering its high visibility into 2023 and the potential boon from its partnership with Nerd Street Gamers.

|

Company |

# of Stores (As of the end of 2Q22) |

Avg. Sales/Store |

# of SKUs / store |

SSS 2-year Stack (FY21) |

SSS 2-year Stack (2Q22) |

|

Five Below |

1,252 |

$2.5 million |

~4,000 |

24.8% |

33.4% |

|

Dollar General |

18,566 |

$2 million |

~10,000 |

13.5% |

-0.1% |

|

Dollar Tree |

16,231 |

$1.6 million |

~7,000 |

7.1% |

3.7% |

|

Dollarama |

1,444 |

C$3.1 million |

~4,000 |

4.9% |

8.1% |

(As of 12/09/2022)

|

Company |

Stock Price |

P/E |

EV/Revenue |

EV/EBITDA |

PEG |

|

Five Below |

$176.76 |

43.02 |

3.79 |

27.56 |

1.41 |

|

Dollar General |

$243.26 |

24.19 |

1.97 |

18.42 |

1.81 |

|

Dollar Tree |

$142.31 |

20.15 |

1.51 |

14.16 |

1.05 |

|

Dollarama |

C$82.43 |

31.95 |

5.77 |

19.15 |

1.18 |

|

Peer Average (Including Five Below) |

N/A |

29.83 |

3.26 |

19.82 |

1.36 |

Risks

Highly sensitive to the economic cycle

Like other discretionary retail businesses, Five Below is also subject to swings in sales due to economic cycles. During the COVID outbreak, FIVE saw considerable gains in SSS due to stimulus checks and near-zero discount rates that boosted household discretionary spending in the US. As the Fed pursues more restrictive monetary policy by raising interest rates and the threats of recession seem imminent, FIVE will inevitably suffer some damage from near-term macro events. However, the company has no bank debt, and its cash balance of $155 million will serve them well during difficult times.

Management’s failure to spot a trend or lag in offering these items in stores

Five Below differentiates itself from other specialty retailers by capitalizing on popular trends in toys and collectibles and presenting them fast enough so that people’s enthusiasm for these products is still present. Looking back on the past, the management has successfully captured the trends (e.g., Poppers in 2021 and Squishmallows in 2022), and the company’s quickly expanding scale will enable them to offer more variety of products at affordable prices.

Any significant disruption in the supply chain

Because FIVE sources nearly half of its products from China, the trade war between China and the US and the recent lockdown in China had adverse effects on FIVE’s inventory level. To mitigate their over-reliance on China, the management announced during Investor’s Day in March that the company would diversify its suppliers by making new contacts in India and Vietnam.

Inflation

Because Five Below is a discount retailer, they have comparatively little room to charge higher prices on their products. To counteract this force, the management is working on expanding Five Beyond, which allows Five Below to carry higher-priced goods without going against customers’ expectations to find goods at attractive prices.

Conclusion

Five Below’s partnership with Nerd Street Gamers to build gaming facilities next to its stores will be a critical tailwind that results in more constant foot traffic and mitigate extreme seasonality in sales. The company’s long-term plan of tripling the number of stores to over 3,500 and doubling its sales by 2030 seems highly feasible, considering its prior success in opening new stores and the fact that most of the increase in sales comes from new stores. The current restrictive macro environment and supply chain issue have resulted in FIVE being traded at a discount, but I believe any near-term improvement in these areas will be a catalyst for the stock. In conclusion, FIVE is an excellent under-the-radar company that has the potential to be a big winner in the long term.

Be the first to comment