Eugene Gologursky/Getty Images Entertainment

WW International, Inc. (NASDAQ:WW) is a weight loss company struggling to regain momentum, as it continues to lose customers while attempting to implement a turnaround plan that has yet to take hold.

While approximately 70 percent of American adults struggle with weight issues, it seems many of them are choosing to go with pharmaceuticals as a solution to their problem, or to engage in do-it-yourself remedies to shed the pounds without the additional cost.

According to WW CEO Sima Sistani, the major competitor it has is the DIY weight loss market. When the company asked former subscribers why they left to the company, it was because they decided to take their weight loss into their own hands, suggesting they didn’t see the value in signing up with WW as a means to the end of losing their weight, having alternatives like social media to support their efforts.

In a nutshell, the challenge for the company is in creating value that convinces potential customers that it’s worth the time and money to use the service.

In this article we’ll look at some of the recent numbers and what they suggest, the subscription model of WW and the accompanying free cash flow, and what the future probably holds for the company.

Some of the numbers

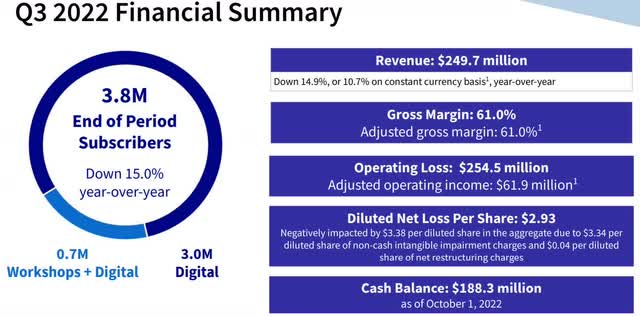

Revenue in the third quarter was $249.7 million, down from the $293 million in revenue generated in the third quarter of 2021. Revenue for the first nine months of 2022 was $817 million, falling approximately $120 million from the first nine months of 2021.

Operating loss in the quarter was $254.5 million, with adjusted operating income of $61.9 million, a decline of $26 million in the same quarter of 2021. Net loss per share was ($2.93).

Adjusted gross margin in the third quarter was $51 percent, level with 2021.

At the end of the reporting period the company had 3.8 million subscribers, down by 15 percent year-over-year.

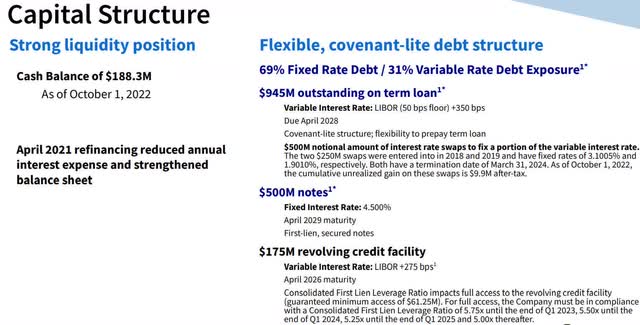

Cash and cash equivalents at the end of the quarter were $188.3 million, compared to $154 million at the end of calendar 2021. Management noted that its subscription model continues to generate strong flow, producing about $40 million more than the prior quarter. Long-term debt was $1.4 billion.

Seasonal concerns

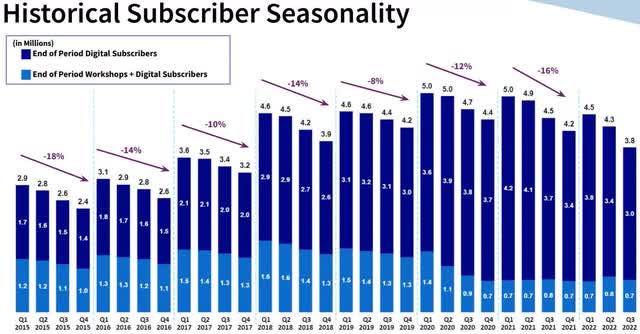

Not only has the company been shedding subscribers in general but heading into 2023 it is approaching its seasonal low. At the end of the third quarter, it had 3.8 million subscribers, but that was the lowest it has been since the third quarter of 2017, and it’s going to get lower next month based upon seasonality alone, not including the organic downward trend.

With that in mind, already low expectations should be lowered in the near term, and further out, until the company proves its turnaround plan is the right one, and it executers upon it, I don’t see the stock having any catalyst that will support it other than the fact its share price has crashed, and it may have found a bottom, and that’s the best-case scenario I can see at this time.

Macro-economic environment and subscribers

Taking into considerations the internal headwinds the company faces, along with changing consumer behaviors in the weight loss marketplace, the current weak macro-economic conditions couldn’t come at a worse time for WW, as consumers are increasingly forced to prioritize spending.

Combined with the above-mentioned seasonal and organic weakness in the company, the headwinds in the first couple of quarters for WW are probably going to be formidable.

Inflation remains high, interest rates are going to continue to climb, buying on credit will bet more expensive, all while people seeking weight loss are either going the do-it-yourself way, or choosing a pharmaceutical to control their weight.

Based upon historical performance and data, the next couple of quarters are going to be weak, and with the recession probably going to get worse before it gets better, consumers, even if they want to lose weight, are unlikely going to make that the priority to spend money on. I think they’ll either ignore the issue, take it upon themselves to work on it without paying for help, or as mentioned above, using a prescription to deal with it.

For those reasons I think subscriptions are probably going to drop more from a decline in demand for WW’s products and services than it does from a lack of desire to lose weight.

The major problem besides a shift in weight loss trend is the value proposition offered by WW, which at this time isn’t considered something worth hanging on to on the long-term subscription side.

Until and if that problem is solved, WW is going to struggle to even tread water, let alone grow the business.

Conclusion

The problem with WW at this time doesn’t appear to be in identifying the problem, but in really knowing how to solve it, assuming it is even solvable in light of changing weight loss trends.

Even if there is some positive response to some of the changes WW is making in order to create more value, I’m far from convinced the company will be able to return to a sustainable upward growth trajectory.

Based upon the time it’ll take to see if the response of the company to the challenges in the weight loss market to take effect, it probably won’t be until mid-2023 at earliest before we start to see if the changes are starting to take with consumers; more than likely it’ll take quite a bit longer than that, in which case we’ll have to draw the conclusion the weight loss business and the business model represented by WW is essentially over.

Management rightly stated that there was a time when Weight Watchers was a movement, and the company was better off when it was. While I agree with that statement, the question is whether or not it’ll be able to regain that swagger in a way that will be a compelling proposition for people looking to lose weight via a support community.

The problem there is it can already be done on a variety of social media platforms, so WW is going to have to come up with an attractive solution that attracts new customers while appealing to the old.

As the company stands today, and based upon the solutions it has proffered, I’m far from convinced it’s the answer people are looking for.

It’ll of course take some time to find out, but in the macro-economic environment we’re currently now in, the changing consumer habits concerning weight loss, the slow season that’s historically upon the company, and an unproven strategy, makes this a company that is best avoided until it forms a bottom and management proves it has the right plan in place, and can deliver on it.

Be the first to comment