sutlafk/iStock via Getty Images

Investment Thesis

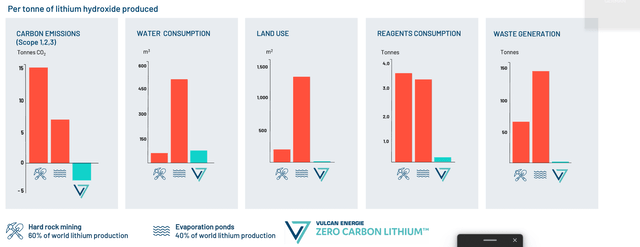

Vulcan Energy Resources (OTCPK:VULNF) produces geothermal energy and plans to extract lithium from deep hot springs from the river Rhine in Germany. The competing forms of lithium extraction are often harmful to the local environment and cause significant CO2 emissions. In addition, the hot thermal water can also be used to produce geothermal energy, an energy source that would fit very well into the EU’s goal of CO2-free energy production.

Company Overview

In the last weeks, I have written several articles about lithium producers, and in this context, I came across Vulcan Energy. It is an almost unknown Australian company whose main plans are in Germany.

Backed by a team of world-renowned experts in chemistry, engineering and geology, we aim to produce the world’s first, premium, battery-quality lithium chemicals with zero carbon footprint, by harnessing renewable geothermal energy to drive lithium production, without using evaporation ponds, mining or fossil fuels.

We will do this from our combined deep geothermal and lithium brine resource, which is Europe’s largest lithium resource, in the Upper Rhine Valley of Germany. Our resource is large enough to satisfy Europe’s lithium needs for many years to come, and ensure the transition to electric vehicles is done with minimal environmental footprint.

Source: Vulcan Energy

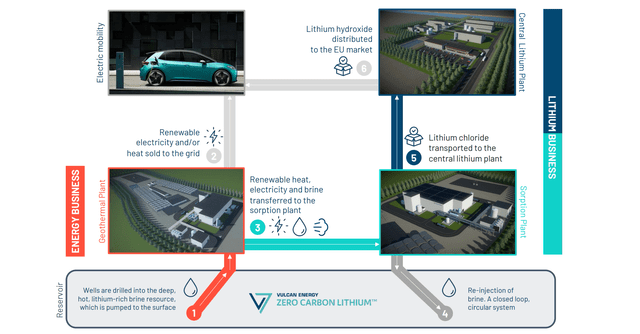

In detail, it works like this: Hot brine containing lithium is pumped to the surface from deep underground through wells. Renewable heat from the geothermal brine will power the lithium extraction process without using fossil fuels. This even leaves a surplus of renewable energy that can be sold as electricity. The result is battery-grade lithium hydroxide that has no carbon footprint. Used brine will then be re-injected in a closed loop. In one sentence, one can say that the plan is to dissolve lithium from deep hot spring water. The whole process is illustrated once again here.

Overall, the company says this process has significant advantages over hard rock mining and evaporation ponds, especially in environmental aspects. But the costs are also said to be lower. One ton of lithium hydroxide mined in hard rock costs about $6855, in evaporation ponds $5872, whereas the company claims their costs are $3140.

I don’t know where the company got this data from, so I wanted to double-check. S&P Global states the cost of hard rock mining at $6,250/t and evaporation ponds at $5386. These figures are 10% lower than those from Vulcan Energy but still considerably more than the $3140 their method is said to cost.

Geopolitical importance

According to the company, Europe is the fastest-growing market for lithium and, until now, has no supply of its own. The area of the upper Rhine is supposed to be the largest lithium resource in Europe, with 15.85Mt LCE (lithium carbonate). For comparison, the global demand for LCE in 2021 was 0.5M tons. Europe is generally a continent with few natural resources and is constantly dependent on imports. The energy transition to solar and wind, among other things, is still very reliant on solar cells from China, rare earth metals, and many other resources. Furthermore, it looks like we will have more demand than lithium supply from about 2025. More details can be found in my Global X Lithium ETF article.

Therefore, local lithium production in Europe would have a very high geopolitical importance. What is currently happening with gas from Russia is merely a shift in dependence toward the USA and China. The root cause of this cannot be changed because it is predetermined by nature and consists of the abovementioned shortage of natural resources. But with time, political leaders will realize that Europe should achieve the greatest possible degree of independence, at least for the raw materials that can be mined.

At what stage is the company

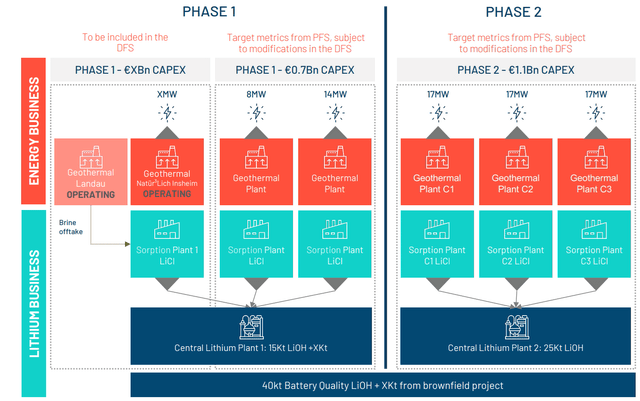

The company is not yet a major lithium producer; otherwise, we would probably know it. What stage is it in? The following chart shows that the company is mainly in the exploration stage. The exception is in the town of Insheim, where they have already taken over a geothermal power plant and have a pilot project for lithium extraction. By the way, this area is very close to the main production centers of Mercedes, Porsche, and other German and French car manufacturers.

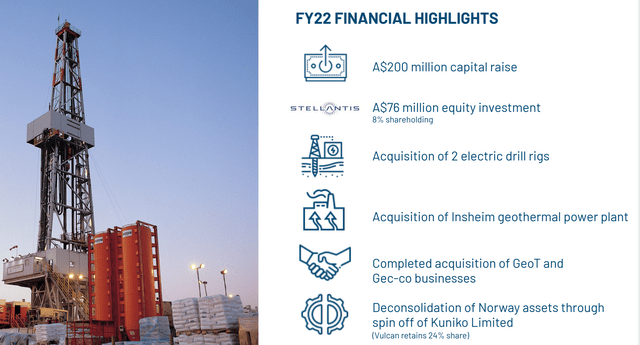

In addition, binding offtake agreements have already been signed with Volkswagen (OTCPK:VWAGY), Stellantis (STLA), Renault (OTCPK:RNSDF), and Umicore (OTCPK:UMICF). Car manufacturer Stellantis also invested 50M Euros, making it the second-largest shareholder. These offtake contracts start in 2025 and are of such volume that they would purchase Vulcan Energy’s entire production.

A demo plant to convert lithium chloride into lithium hydroxide is planned for H1 2023. Considerable lithium production is still several years away and is expected to begin in 2025.

Financials & Valuation

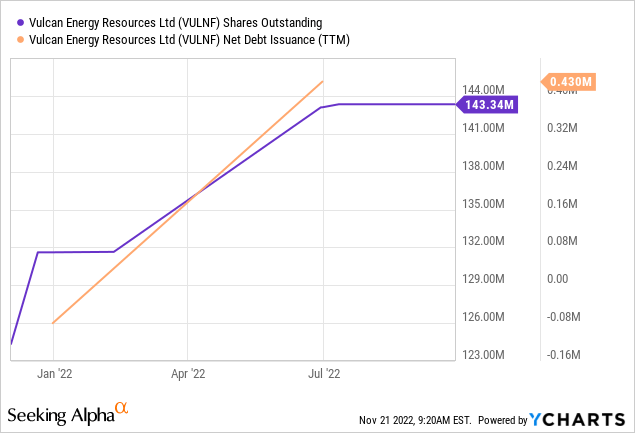

Currently, the company has a market cap of $703M and $175M in cash resulting in an enterprise value of $528M. According to the illustration above, phase 1 has a CapEx of $0.78B. Therefore, we can assume that the company will need to raise additional capital in one way or another.

Total revenue in 2022 is expected to be approximately $4.3M, and the net loss is $18M. The revenues currently being generated come mainly from electricity and hot water generation, fed into the local grids. Overall, the company is making progress in terms of financing and when has purchased the first geothermal power plant.

Risks

Of course, there are a lot of risks with a company still in such an early stage of development. In theory, the idea of extracting dissolved lithium from water in a resource-saving way sounds excellent. But since this still needs to be done on a large scale, it is uncertain whether it will work as planned. This means that there are numerous risks in the conversion from theory to practice. And be it only such risk that lithium production is much more expensive than assumed.

Furthermore, there is a big issue of financing, which is still far from sufficient. Is this done through large investors? Debt? Nobody knows. But it is very likely that until there is significant lithium production, there will be further share dilution.

Also, a risk is that of regulation. In Germany, permitting processes are lengthy, difficult to obtain, and often face resistance from the local population. This is especially true in scenic areas like this one (I am from Germany and know this area). In other words, whether it will be allowed to produce as the company would like is not yet certain.

Conclusion

I will keep this interesting company on my venture watchlist, but the distant targets for 2025 and the long list of risks show that it would be very early to invest now. I think it makes more sense to wait and watch the company from time to time. I will do that here in the form of articles in the future since the company has no coverage at Seeking Alpha so far. Until then, it is much safer to invest in companies like Albemarle or somewhat riskier in Lithium Americas, which I wrote about recently.

Be the first to comment