elenaleonova/E+ via Getty Images

Introduction

In my opinion, Silvergate (NYSE:SI) is probably in the midst of an existential liquidity crisis as we speak and, as a result, I regard Silvergate as a strong sell. In this article, I will dive into their balance sheet and uncover worrying business relationships with FTX (now bankrupt) and Gemini (currently experiencing liquidity issues). There are even more worrying reports about Silvergate’s alleged enabling of money laundering, which for the purpose of this article, I will not elaborate on.

For those of you who might not be familiar with Silvergate, it is a California-based bank that provides depository and transaction facilitation services for the crypto industry, with most of its business coming from the big cryptocurrency exchanges. As with any other bank, their balance sheet is mainly composed of customer deposits on the liabilities side of the equation and investments in financial assets on the assets side. Silvergate’s deposit base is mainly comprised of crypto exchange ‘non-interest-bearing demand accounts’, meaning that crypto exchanges can draw down their deposits on demand.

Withdrawals Likely To Outstrip Cash Reserves

It has come to the attention of market participants that the now-bankrupt crypto exchange FTX, founded by Sam Bankman-Fried and the lesser-known and lesser-understood Gary Wang, “represented less than 10%” of the $11.9 billion of deposits held by its digital assets customers. It is safe to assume that Silvergate is not overstating the ‘10%’ because it is not in their interest to do so at all.

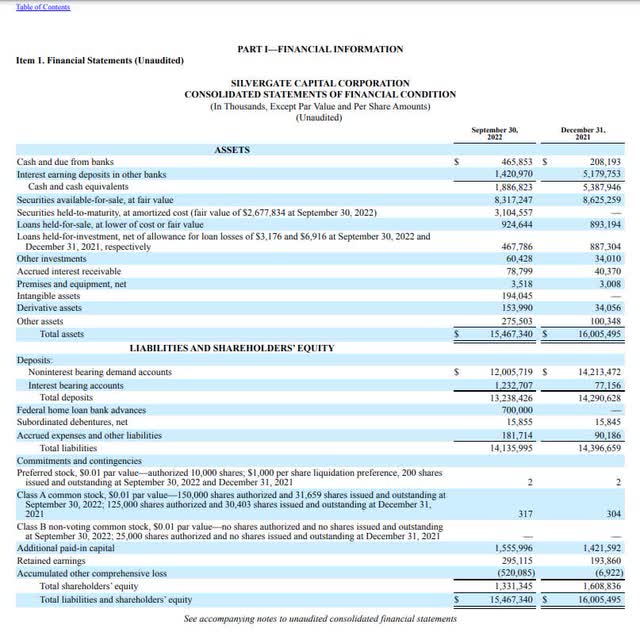

In order to unpack the true consequences of the expected $1 billion dollars of FTX funds that have been or will be withdrawn from Silvergate, we need to dig deeper into their financial statements. As of September 30, 2022, Silvergate held $1.887 billion in ‘cash and cash equivalents’ – $466 million of which is labelled ‘cash and due from other banks’ and $1.421 billion of which is labelled ‘interest earning deposits in other banks’. FTX has either withdrawn its deposits from Silvergate during its recent collapse, or it will be required to withdraw all of its deposits held at Silvergate to distribute to its customers in the course of bankruptcy.

Silvergate Balance Sheet (SEC Filings)

So, at this point, Silvergate has a guaranteed outflow/withdrawal of around $1 billion (it is quite likely that these funds have already been withdrawn), which is around 70% of what it had immediately available in its own cash reserves as of September the 30th. The remaining 30% of Silvergate’s cash reserves, which amounts to around $426 million, is all that will be left to fulfil any other withdrawals.

Gemini, a known customer of Silvergate and a major player in the crypto space, according to CoinDesk (the site that broke the FTX balance sheet story), experienced $485 million of outflows in a 24-hour period mid-week. According to Bloomberg, they have also recently paused withdrawals from their ‘Earn’ borrowing platform amid a liquidity crunch.

Gemini SEN Network (Gemini)

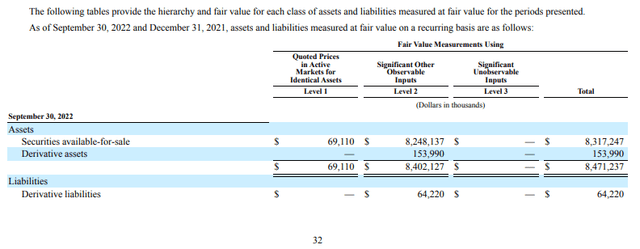

With massive withdrawals already underway at all the major crypto exchanges, I believe the natural follow-on effect will be withdrawals from the bank that serves as the custodian for much of the US dollar funds held at these exchanges – Silvergate. This will leave Silvergate with the next most liquid asset in their balance sheet – ‘Securities available-for-sale, at fair value’. These assets consist of commercial and residential government agency mortgage-backed securities, non-mortgage-backed government agency securities, govt. agency collateralized mortgage obligations and municipal bonds. The vast majority of these assets are ‘level 2’ assets valued using ‘Significant Other Observable Inputs’, meaning, their stated value in Silvergate’s balance sheet is based on highly amenable financial models that use non-market-price observations as inputs.

Silvergate’s Illiquid securities-for-sale (SEC Filings)

When you look at the situation that I’ve just laid out through the lens of the Diamond-Dybvig model of bank runs, the situation appears to be more than dire – it becomes existential. The Diamond-Dybvig model, which is named after the two 2022 Nobel laureates who proposed the theory, explains that banks who have liquid liabilities (i.e., deposit base) and illiquid assets are prone to bank runs regardless of how profitable their illiquid investments may be the future. This is because simultaneous withdrawals from depositors can quickly outstrip a bank’s cash reserves in short order, leading to liquidity issues that can cascade through counterparties in a financial system.

Silvergate’s CEO Sold $1.5 Million of SI Stock in Q3 2022

As per SEC filings pulled from quantview.io, on the 21st of July, Silvergate’s CEO acquired 16,314 shares of Class A Common Stock through the exercise or conversion of derivative securities. On the same day, he sold every one of those 16,314 shares for a sum total of $1,508,324. One can never be sure of the reason why a CEO might sell their own company’s shares, but for a small-cap ‘growth’ stock, you would hope that management would maximise their ownership in the company that they are running. He does, however, still own 232,857 indirectly through the ‘Self and Spouse as Trustees of Lane Trust’ which will be an important data point to keep tabs on over the coming months.

Alan Lane Q3 Acquisitions of Silvergate Stock:

Alan Lane SI Acquisitions (quantview.io, SEC)

Alan Lane Q3 Disposals of Silvergate Stock:

Alan Lane SI Disposals (quantview.io, SEC)

Making a Trade

If you are an owner of Silvergate stock, I believe that now is a good time to exit your position. If you are not an owner of Silvergate and wish to bet against the stock, there are a couple of ways you can go about doing that.

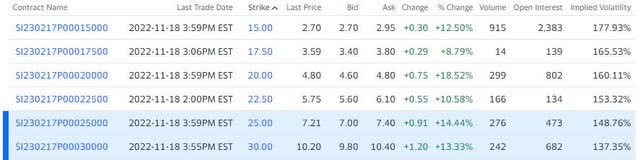

Trade Option A: An Options Play

The less risky way to get short Silvergate is to buy put options (this is because when you buy an option, your maximum loss is capped). I’d be looking at February 2023 puts, as I believe that 3 months is a long enough period of time for my thesis to play out. Take, for example, a Feb 17, 2023 puts at a strike price of $25, which was traded on last Friday’s close for $7.21. In the case of SI dropping to $5 a share by 17th of Feb puts bought at last Friday’s closing price would be worth $20, a handsome 177% return. On the other hand, if Silvergate ends up anywhere above $25 by expiration, these puts would be worthless. Moving to strike prices further out-the-money (OTM), the potential returns increase, as does the likelihood of your options expiring worthless. What strike price and expiry you choose depends on your risk appetite and the liquidity/open interest of the contract in question.

Silvergate 17th Feb 2023 Put Options (Yahoo Finance)

Trade Option B: Classic Short

Another way to bet against SI is to simply short the stock.

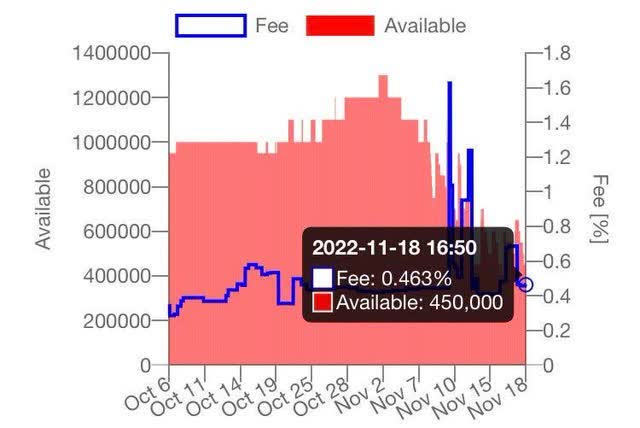

As of Friday, the cost to borrow SI stock at Interactive Brokers as per stocksera, was 0.463%, meaning your cost to put on the position would 0.465% per annum, charged daily, of your notional exposure (no. of shares short multiplied by price).

SI short interest is relatively low, with short interest at 10.33% of Silvergate’s float and a days-to-cover ratio of 0.37 according to NYSE. As such, I believe the probability of a short squeeze in the short to medium term is low.

It is always worth noting that the payoff profile is asymmetric to the downside with a pure short position and I do not recommend inexperienced traders engage in short selling, period. For example, if for every dollar worth of SI you posted an equivalent amount of margin, you would be wiped out (lose all of your margins) if SI doubled in price. If SI tripled in price you would lose 100% of your margin and owe your broker 100% of your initial margin, and if it quadrupled you would owe your broker 200% of your initial margin, and so forth.

Silvergate borrow cost (stocksera, Interactive Brokers)

Conclusion

Elevated levels of withdrawals experienced by some of Silvergate’s key clients are likely to erode their cash reserves, which in my opinion, puts Silvergate at risk of bankruptcy. In my view, buying put options on, or outright short selling, Silvergate stock is a high-conviction trade opportunity that occurs very rarely in the markets.

Be the first to comment