Darren415

Voya Financial, Inc. (NYSE:VOYA) has changed considerably its business profile in recent years, and now has a much better risk profile. Despite improving fundamentals, its valuation is quite cheap and lower than its historical average, which doesn’t seem to be justified.

Company Description

Voya is a diversified financial services company operating in the U.S., with activities across health, wealth and investment solutions. The company offers health insurance, retirement, and asset management products and services, to both individual and institutional customers. Voya offers products and services to a wide range of individual and corporate customers, but generally it targets the middle market and mass affluent markets, and had some 14.3 million customers at the end of last September.

Voya currently has a market capitalization of about $6 billion and has been listed since 2013, following its spinoff from the ING Groep (ING) as part of the Dutch bank’s restructuring program at the time.

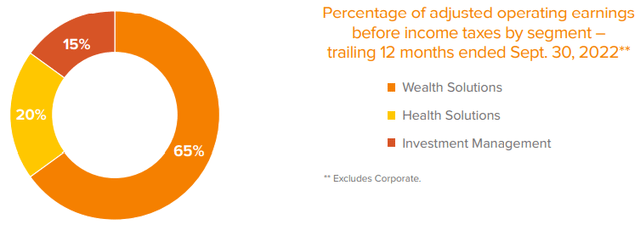

The company currently has three business segments, namely Wealth Solutions, Health Solutions, and Investment Management. As can be seen in the next graph, its Wealth segment is responsible for the vast majority of its operating income, while Health and Investment Management have much lower weight on the overall group.

Voya’s business model has changed somewhat in recent years, especially after its deals to sell the annuity business in 2018 and individual life insurance in 2019, which led to less business complexity and lower exposure to capital markets. The company has now top-five market positions in both Wealth and Health markets, while in Investment Management it does not have any particular competitive advantage compared to peers.

Following the divestments in the life insurance segment, Voya’s business is now mainly exposed to fee-based activities, which have lower capital requirements compared to traditional life insurance companies, and also should lead to lower earnings volatility across the economic cycle. Voya’s main strength is now its established position in the U.S. pensions market, while its health and investment solutions can be seen as complementary to its core segment.

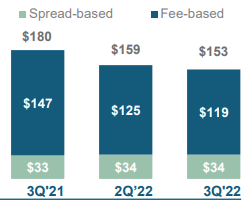

This means that Voya’s risk profile has improved considerably compared to some years ago, given that most of its assets under management (“AuM”) are fee-based, leading to a recurring revenue profile over the medium to long term. Indeed, in its largest segment (Wealth), close to 80% of clients’ assets are fee-based, being a positive factor for a relatively recurring revenue stream in various business cycles.

Wealth segment (Voya)

Beyond a better risk profile and organic growth initiatives, following its divestments in the past, Voya’s strategy has changed in the past few months to acquisitions, as the company had significant excess capital which allowed it to pursue external growth.

A few months ago, Voya announced a transaction to acquire the majority of Allianz Global Investors U.S., the U.S part of the asset management business of Allianz Group (ALIZF, OTCPK:ALIZY). This transaction increased Voya’s presence in the investment management industry, considering that its AuMs increased from $253 billion to $373 billion, and financially speaking was immediately cash accretive for Voya and improved the operating margins of its investment management segment.

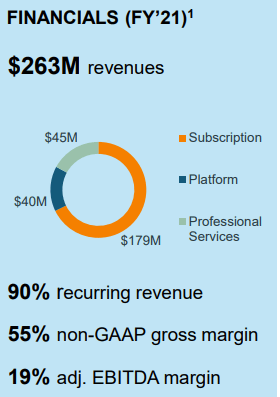

More recently, Voya made an offer to acquire Benefitfocus, Inc. (BNFT) at $10.50 per share, valuing the company at some $350 million. This company is a provider of cloud-based software solutions for consumers, employers, insurance carriers, and brokers. This transaction will help Voya to offer a better customer service and improve efficiency in its Wealth and Health segments, adding administrative capabilities that would be hard to develop on its own.

Voya is expected to finance this deal thorough excess capital, and is not expected to raise debt in this transaction, showing that its strong financial profile allows it to pursue bolt-on acquisitions without compromising its balance sheet. This transaction is expected to close during the first few months of 2023, increasing Voya’s focus on Wealth solutions for its customers.

From a business profile perspective, Benefitfocus generates some $250 million in revenues per year, which means that Voya is buying the company for a valuation of about 1.4x revenue, which is quite cheap for a technology company like Benefitfocus. It also increases Voya’s revenue stream coming stable sources, considering that Benefitfocus’ revenue is mainly subscription-based and is highly recurring. Moreover, it also increases Voya’s digital capabilities and data insights, allowing it to offer more innovate solutions to its customers in the future.

Acquisition (Voya)

Going forward, Voya’s growth strategy should not change much, being mainly focused on organic growth and also pursuing small bolt-on acquisitions when the opportunity arises.

Financial Overview

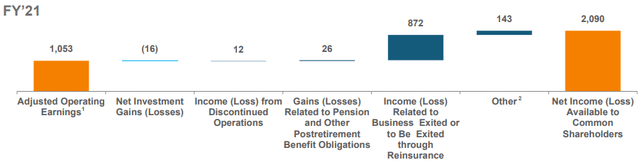

Regarding its financial performance, Voya has delivered relatively good results over the past few years, even though its reported profit has been somewhat volatile. In 2021, its revenue amounted to $4.2 billion, which aren’t comparable with the previous year as Voya sold its individual life insurance business and legacy non-retirement annuities. Due to this transaction, Voya booked an extraordinary gain of $872 million, boosting its net income in the year to more than $2 billion. Its return on equity (ROE), a key measure of profitability in the financial services industry, increased to more than 24%, but considering only its adjusted operating earnings, its adjusted ROE was around 12%.

During the past few quarters, despite the challenging macroeconomic situation, Voya reported a positive operating momentum, supported by higher interest rates and lower Covid related claims. In Q3 2022, its adjusted EPS increased by 28% YoY to $2.19, justified by organic growth, higher margins, and significant share buybacks. For the full year, Voya now expects to achieve its annual growth target in the range of 12% to 17%, a target that seems difficult to achieve at the middle of the year.

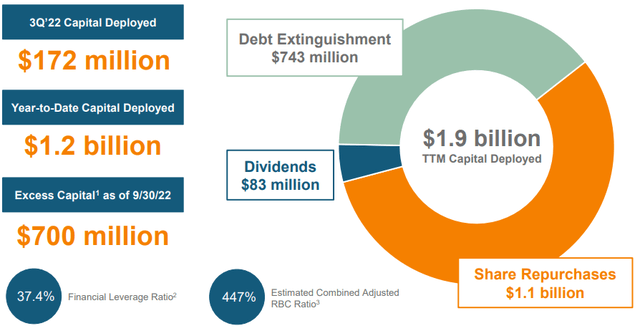

During the past few quarters, Voya returned significant excess capital to shareholders, both through share buybacks and dividends. Additionally, it also used excess capital to reduce its balance sheet leverage, which increased its total capital deployed over the past twelve months to $1.9 billion, of which the vast majority was used to repurchase its own shares.

Despite performing large share repurchases and reducing debt levels, Voya ended the last quarter with excess capital of about $700 million and a RBC capital ratio of 447%, showing that it can easily finance its recent Benefitfocus offer with its own capital. Investors should note that following the sale of its life businesses, Voya’s capital requirements are lower and the company’s own RBC target is 375%, thus it still has a good capital buffer allowing to perform small accretive acquisitions and distribute excess capital to shareholders at the same time.

Despite that, Voya has retuned most of its excess capital through share repurchases and is likely to maintain that preference over dividends in the future. Indeed, Voya currently pays a quarterly dividend of $0.20 per share, or $0.80 per year, which at its current share price leads to a dividend yield of only 1.3%. This is a somewhat low yield, which means that Voya’s income appeal is rather low.

Going forward, according to analysts’ estimates, Voya is expected to report mid-single digit revenue growth over the next couple of years, supported by higher fees in its Wealth and Investment Management segments, as net inflows have been resilient during a tough market period, which means there can be some upside if capital markets recover in the near future. Its bottom line is also expected to improve, to more than $800 million by 2024 from just $571 million in 2022.

Conclusion

Voya’s business profile has changed significantly in recent years, as the company divested more risky areas and focused its business in fee-based operations, providing a more recurring revenue and earnings stream over the long term. Its recent acquisitions made sense from a strategic point of view, showing that management is taking the right steps to increase Voya’s growth prospects over the long term.

Despite this, Voya is currently trading at only 9.3x forward earnings, which seems to be quite undemanding and is below its own historical average over the past five years, which means that Voya seems to be undervalued. As Voya Financial, Inc. has nowadays a much better financial profile than some years ago, its stock should warrant a higher valuation, making it an attractive value play right now within the financial services industry.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment