worananphoto/iStock via Getty Images

Introduction

For the past five years I have put cannabis company financial statements under a financial microscope to identify strengths and weaknesses. Two of my most recent articles focused on MSO cash flows and were read by thousands. My “Cash Crises Loom At Cannabis MSO Companies” Seeking Alpha article examined Q1 2022 financial reports for 11 MSOs and noted all had significant negative free cash flows. Based on those Q1 results, that article calculated the number of months before each MSO had before it would run out of cash.

When Q2 2022 financial reports became available I updated my analysis in a new article “Life Expectancy Declining At Some MSO Companies.” That article incorporated debt obligations that were coming due in the near future. The dire title emanated from the fact that a number of MSOs were getting desperately short of cash and had large amounts of nearby debt with specific maturity dates.

This article updates the previous ones by putting the financial microscope to Q3 2022 financial reports. The emphasis, once again, is on MSO cash generation since prior articles noted a number of MSOs were rapidly running out of cash.

Jushi Holdings (OTCQX:JUSHF) is omitted from this article for two reasons. First, it has not officially filed its Q3 financial report. Second, it has not indicated when it would file and I am anxious to complete this article.

MSOs Included In This Article

This article identifies MSO cash flows by analyzing Q3 2022 data obtained from company financial reports filed with SEDAR and/or the SEC. Eleven (11) cannabis companies were selected because they were included in my prior two articles. Eight Tier 1 and Tier 2 companies are included along with three smaller MSOs. Columbia Care (OTCQX:CCHWF) is a smaller MSO, which is expected to be acquired by Cresco Labs (OTCQX:CRLBF) in Q4 2022. Goodness Growth (OTCQX:GDNSF) is included even though it was recently stood-up at the acquisition altar by Verano (OTCQX:VRNOF). Frankly, I did not have the heart to drop it and 4Front (OTCQX:FFNTF) from this article, because I had already collected Q1 and Q2 financial data on each for my earlier articles.

Q3 Financials

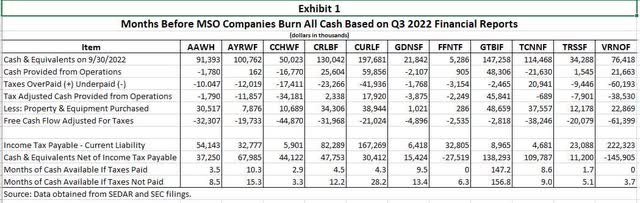

Line one (1) of Exhibit 1 shows the amount of cash and cash equivalents each MSO had on September 30, 2022. Line two (2) shows the cash provided from operating activities. Line three (3) shows current income taxes paid relative to the amount incurred in Q3.

If an MSO paid the exact amount of income tax incurred for Q3 then line 3 would be “0.” If it paid less than the amount incurred for Q3, then the amount shown on line 3 would be a negative amount. If it paid more than the amount incurred for Q3, line 3 would be a positive amount.

MSO Q3 Monthly Cash Burns (SEDAR and SEC)

The only one of the 11 MSOs to show a profit (net income after taxes) in Q3 was Green Thumb. It reported net income after taxes of $9.869M. Its net income was the primary reason it was able to produce the most favorable cash burn rate among the 11 MSOs. As shown in Exhibit 1, if GTBIF paid off all its past due income taxes it would still have enough cash to last 147.2 months. None of the others had cash burn figures in the same ballpark.

MSO CEOs are finally embracing the importance of net income and free cash flow as a critically important performance metric. They are, however, finding it extremely difficult to produce pr

Line 4 of Exhibit 1 shows tax-adjusted cash provided from operations, which factors in the nonpayment and overpayment of income taxes incurred in Q3. Cash flow needs to be adjusted, because an MSO can artificially inflate its cash provided from operations if it pays less than the taxes incurred during a quarter. Underpayment of quarterly income taxes is standard operating procedure for MSOs, since the IRS charges a lower rate of interest on past due corporate income taxes than MSOs would otherwise have to pay to borrow elsewhere.

Line 5 of Exhibit 1 shows the amount of cash spent on property and equipment purchased during Q3 and is frequently referred to as CAPEX. Line six (6) shows free cash flow “FCF,” which is obtained by deducting CAPEX from tax-adjusted cash provided from operations.

Line 9 shows the number of months it will take the MSO to totally deplete its cash if Q3 results persist and the MSO immediately pays all its past due income taxes. The number of months shown on line 9 equals cash & equivalents (line 1) minus income tax payable (line 7) divided by past due taxes divided by 3.

Line 10 shows the number of months it will take the MSO to exhaust its cash if Q3 results persist and the MSO immediately DOES NOT pay any of its past due income taxes.

MSO Cash Flows

The cash positions of Ascend Wellness (OTCQX:AAWH), Ayr Wellness (OTCQX:AYRWF), Columbia Care, 4Front, Trulieve (OTCQX:TCNNF), TerrAscend (OTCQX:TRSSF), and Verano were lower than they were at the end of Q2. The total cash position of the 11 MSOs amounted to $969M at the end of Q3, which was down from the $1.106B they had at the end of Q2 and dramatically lower than the $1.5B they had at the end of Q1.

Cash positions at 10 of the MSOs were artificially inflated by conscious decisions to not pay income taxes incurred in Q3. The only MSOs that did not inflate its cash position by delaying its quarterly income tax payment was Trulieve. In fact, Trulieve actually deflated its cash position by $20.9M, because it paid more taxes in Q3 than it incurred.

The actual cash flow statements of these 11 MSOs showed 7 had positive net cash provided from operating activities. All 7 were able to report positive amounts because they paid less in income taxes during Q3 than they actually incurred. Once the cash flow statements were adjusted to reflect payment or non-payment of income taxes incurred in Q3, only Cresco Labs, Curaleaf (OTCPK:CURLF), and Green Thumb (OTCQX:GTBIF) were able to produce positive tax-adjusted cash provided from operations.

Free cash flow in this article is defined as tax-adjusted cash provided by operations minus purchases of property and equipment shown on the cash flow statement in the section labeled “cash flow from investing activities.” In that regard, Exhibit 1 line 6 shows that all 11 MSOs had negative free cash flow in Q3. That is not unusual since they also had negative free cash flows in Q1 and Q2 of 2022. The 11 combined for negative free cash flow of $279.9M in Q3, $289.9 in Q2, and $370.6 in Q1.

A significant reason for the $90.7M improvement in free cash flow from Q1 to Q3 has been reduced CAPEX. The 11 MSOs in this article had combined capital expenditures on plant and equipment of $244.9M in Q3, which was actually up from Q2 expenditures of $226M, but significantly below Q1 of $298M. A continued decline in CAPEX should be expected as MSOs complete their build-outs in individual states.

Current Income Tax Liabilities

The 11 MSOs in this article at the end of Q3 2022 had income tax payable ranging from a high of $222.3 at Verano to a low of $4.7M at Trulieve. The amounts owed the IRS by these MSOs totaled $640.7M at the end of Q3 compared to $483.8M at the end of Q2, and $749.4M at the end of Q1.

At the end of Q3 Verano’s income tax liability exceeded its cash by $145.9M. Stated another way, Verano’s past due income taxes were ~3X its available cash.

4Front also had past due taxes well above its Q3 ending cash position. It owed the IRS $32.8 but only has $5.3M in cash and equivalents.

Months of Cash Available

Two monthly cash burn rates are calculated for each of the MSOs in Exhibit 1 and assume that financial results in future months will equal what was experienced in Q3.

Data in Exhibit 1 line 10 show that if these 11 MSOs continue to not pay past due income taxes, their cash will last between 3.3 months at Columbia Care and 156.8 months at Green Thumb. If, however, each MSO pays off its entire past due income tax bill, Verano and 4Front would have very serious problems.

In fact, if Verano and 4Front paid all their past due taxes on September 30, 2022, they would have overdrafts of $145.9M and $27.5M, respectively. They would, in fact, have to write “hot checks” to the IRS!

The MSO in the best shape to pay off its tax bill at the end of Q1 was Green Thumb. If it paid its tax bill, it would still have enough cash to last 147.2 months.

Benefit of Not Paying IRS

Corporations do not pay penalties for nonpayment of taxes; instead, they are charged interest. The rate of interest the IRS charges cannabis and other corporations on underpayment is determined quarterly according to IRS Code Section 6621. The IRS interest rate on unpaid taxes was 6% in Q2 2022 and was raised to 7% for Q3 2022. It has been raised to 8% for Q4 2022. The rate being paid by MSOs on past due income taxes remains far below what they otherwise would have to pay to borrow money.

Post Q3 MSO Actions to Address Cash Crises

Recognition of cash burn rates encouraged a number of MSOs to take ameliorative action after Q3. On October 11, 2022 TerrAscend, which Exhibit 1 showed had only 5.1 months of cash available, announced it borrowed $45.478M from Pelorus Fund REIT, LLC on a senior secured term loan due October 11, 2027. The loan interest rate floats at 950 basis points above SOFR and provides interest-only payments for the first three years. At a monthly cash burn rate of $6.7M that loan bought it an additional 6.8 months if its Q3 financial results persist.

On October 14, 2022 Verano unilaterally announced it terminated the arrangement agreement to acquire Goodness Growth Holdings. On October 27, 2022 Verano, which Exhibit 1 showed only had enough cash to last 3.7 months, announced it had refinanced a $250M loan that was scheduled to mature on April 28, 2023 and a $100M loan scheduled to mature of August 28, 2023. The refinancing extended the maturity date to October 30, 2026, and it also made available an additional $270M in funds, subject to various financial covenants.

Cresco Acquisition of Columbia Care

Cresco Labs is expected to acquire Columbia Care in Q4 2022. The likelihood of this transaction being transformative and suddenly creating a positive free cash flow is remote.

A pro forma of Cresco’s acquisition of Columbia Care based on Q3 results reveals the new merged entity would only have enough cash to last 7 months if it did not pay off its taxes and 4 months if it did. A combined Cresco/Columbia Care entity shows $180M in cash, negative free cash flow of $76.8M, and past due income taxes of $88.2M. These figures will obviously change when purported forthcoming $185M Sean “Diddy” Combs deal to acquire New York, Illinois, and Massachusetts assets.

Unlike mergers in other industries where there are considerable cost savings, mergers in the cannabis sector have not yielded meaningful savings. The illegality of interstate shipping of cannabis and state laws requiring intrastate cultivation and processing take away the possibility of many economies of scale through centralization. Truth be told, the driving force for cannabis company mergers has been the desire to grow revenue by adding states and it has been fostered by investment bankers interested in M&A fees and CEO egos. Economies of scale in the cannabis MSO model appear to be nonexistent in most states.

Importance of Net Income After Taxes

Line 1 of the statement of cash flows presented in SEDAR and SEC filings begins with the net income (loss) shown on a company income statement. The importance of achieving net income in achieving healthy cash flow cannot be overstated.

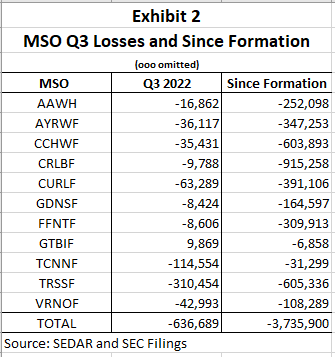

CEOs have generally avoided talking about net income after taxes, because they had none to talk about. The dearth of profits is illustrated in Exhibit 2 which shows that as of September 30, 2022 the 11 MSOs covered in this article had cumulative losses since their formation. The biggest loser has been Cresco with cumulative losses of $915M followed by TerrAscend with $605M, and Columbia Care with $604M. The smallest cumulative loss since formation has been recorded by Green Thumb at $6.9M followed by Trulieve at $31.3.

MSO Losses(SEDAR and SEC)

Among the 11 MSOs only Green Thumb reported a profit (net income after taxes) in Q3. It reported profits of $9.869M which helped it produce the most favorable cash burn rate of the 11. As shown in Exhibit 1, if Green Thumb paid all its past due income taxes, it would still have enough cash to last 147.2 months. None of the other 11 MSOs had nearly as favorable cash burn rates.

MSO CEOs are finally embracing net income and free cash flow as among the most important performance metrics. At the same time, however, they are finding it extremely difficult to achieve profits and free cash flow. They are now belatedly focusing on cost control and reducing CAPEX.

Increasingly competition and the impact of rising food, fuel, and housing prices on consumer budgets are making it difficult for MSOs to become profitable and generate free cash flow. MSOs are also combating inflationary forces and persistent supply shortages. These conditions make it difficult for MSOs to rekindle organic revenue growth and reverse declines in profit margins.

Summary

This article reveals that some major MSOs will run out of cash in the near future if they continue to experience free cash flows like they did in Q3 2022. MSOs are taking various remedial actions to address the issue, but it remains to be seen if their actions are too little and/or too late. One thing is certain, more MSO announcements should be expected in the near future regarding debt issuance and restructuring existing debt.

Negative free cash flows and high cash burn rates are painful and can be fatal when debt comes due and external equity sources of funds vanish. Investors wanting to avoid getting wiped out by MSO creditors need to pay close attention to MSO free cash flows and the ability of MSOs to extend or pay off debt as it comes due.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment