Henrik5000

My followers know I am a big proponent of holding a well-diversified portfolio throughout up-n-down market cycles in order to reap what the market is more than willing to give them. Over the long-term, that appears to be the best winning strategy for the ordinary investor. Speaking of the long-term, I recently came across research that appears to indicate that mid-cap stocks offer a superior risk/reward opportunity for investors as compared to small- and large-cap stocks. That being the case, today I will take a close look at the Vanguard Mid-Cap Growth ETF (NYSEARCA:VOT) to see if it might be a good choice to add to your well-diversified portfolio.

Investment Thesis

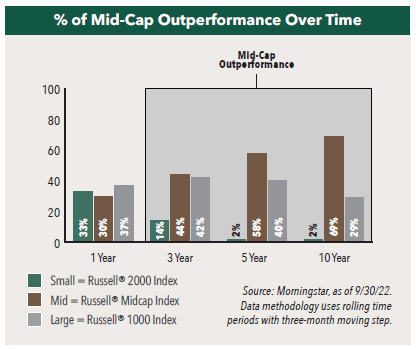

Research from the Hennessy Funds indicates that mid-cap stocks dominant its small- and large-cap peers in long-term performance and that the longer mid-cap stocks are held, the more they outperform. Hennessy says that “69% of the time, mid-caps outperformed small- and large-cap stocks over any 10-year rolling period in the past 20 years.”

Hennessey Funds

As can be seen in the graphic above, the Russell MidCap Index significantly outperformed the Russell small- and large-cap indexes and the longer the time frame, the greater the out-performance.

That being the case, today I will examine the Vanguard Mid-Cap Growth ETF to see if it might be a good choice for some capital allocation to the mid-cap space within your portfolio.

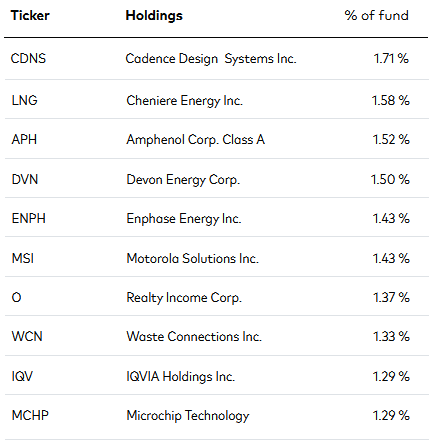

Top-10 Holdings

The graphic below shows the VOT ETF’s top-10 holdings, as taken from the Vanguard VOT Homepage. The top-10 holdings equate to what I consider to be a very well-diversified 14.5% of the entire 174 company portfolio:

Vanguard

The #1 holding with a 1.7% weight is Cadence Design Systems (CDNS). Cadence provides software, hardware, and services for IC design engineers. These tools include verification services – including SW emulation and prototyping hardware. Cadence and Synopsys (SNPS) dominant the chip-design tools space and equate to what I consider to be a relative duopoly. Despite the 2022 bear-market, Cadence is up 250% over the past 5-years and has a market-cap of $40.7 billion.

Cheniere Energy (LNG) is the #2 holding with a 1.6% weight. Cheniere owns and operates the Sabine Pass LNG terminal in Louisiana (see graphic below) and the Corpus Christi LNG terminal outside of Corpus Christi, Texas. That being the case, LNG has been a big beneficiary of the rise in natural gas prices due to Putin’s weaponization of natural gas deliveries to Europe – the stock is up 66% this year.

Cheniere Energy

Source: Cheniere Investor Presentation

The #4 & #5 holdings are also energy related companies. Devon Energy (DVN) is a primarily a shale oil & gas producer in the United States. In August, Devon reached an agreement to buy Eagle Ford shale producer Validus Energy for $1.8 billion. Devon stock has ridden higher oil & gas prices to a 94% gain over the past 12-months.

On the other hand, the #5 holding Enphase (ENPH) is focused on the solar energy market. Enphase designs, develops, and manufactures semiconductor-based microinverters. ENPH’s microconverters convert energy at the individual solar module level for the global solar photovoltaic (“PV”) market. ENPH is up 36% over the past year and has a market-cap of $41.6 billion. Enphase should be a general beneficiary of the Biden administration’s recent ability to get powerful clean energy legislation passed (the so-called “IRA” Act) due to its support for utility-scale PV projects.

Motorola Solutions (MSI) is the #6 holding with a 1.4% weight. Motorola is up 38% since my initial Seeking Alpha BUY recommendation in February of 2021 (see MSI: Record Backlog, Strong FCF, 11% Dividend Boost, Emerging ARR Story). In addition to its strong global presence in the land-mobile-radio (“LMR”) market, MSI has been using its strong free-cash-flow profile to make strategic acquisitions in the video surveillance market. The stock is relatively flat over the past year – greatly outperforming the S&P500. MSI has a $40.4 billion market cap, yields 1.3%, and has a forward P/E of 24.8x.

The #10 holding, with a 1.3% weight, is Microchip Technology (MCHP). MCHP runs a somewhat different version of the SaaS-based model you are most familiar with (“software as a service”). MCHP’s motto is “silicon-as-a-service”. The company provides somewhat commoditized solutions for the embedded micro-controller market. The stock trades with a forward P/E of only 11x, yields 1.9%, and has a market cap of $33.8 billion.

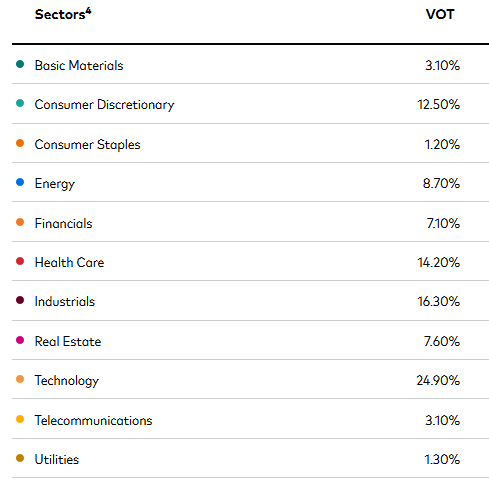

From an overall portfolio perspective, the VOT ETF is most exposed to the Technology, Industrials, and Health Care sectors:

Vanguard

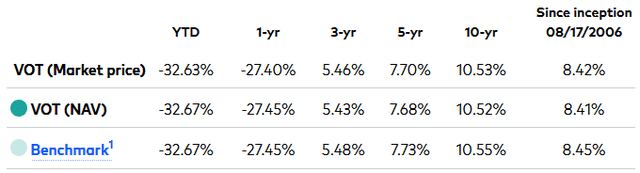

Performance

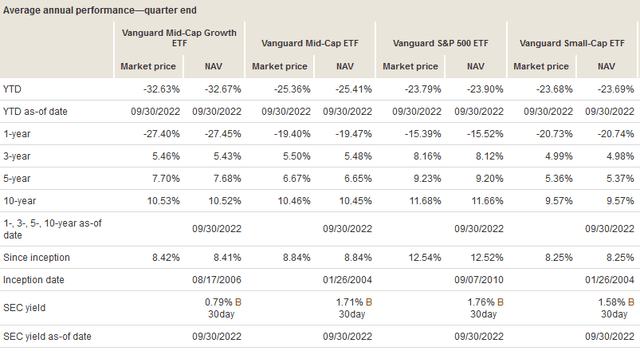

Despite the research cited earlier from the Hennessey Group, the long-term performance of the VOT ETF is somewhat disappointing:

Vanguard

As you can see, the 10-year average annual return of 10.5% is solid, but certainly not overly impressive. Indeed, while the VOT Mid-cap Growth ETF has outperformed the Vanguard Mid-Cap ETF ETF (VO) and Vanguard Small-Cap ETF (VB) over the past decade, it has trailed the Vanguard S&P500 (VOO) fund by over 1% from an average annual return perspective:

Vanguard Fund Compare Tool

Perhaps coincidentally, note the VOO ETF yields ~1% more than VOT. Also, VOT’s expense ratio is 40 basis points higher than the VOO ETF (0.07% versus 0.03%).

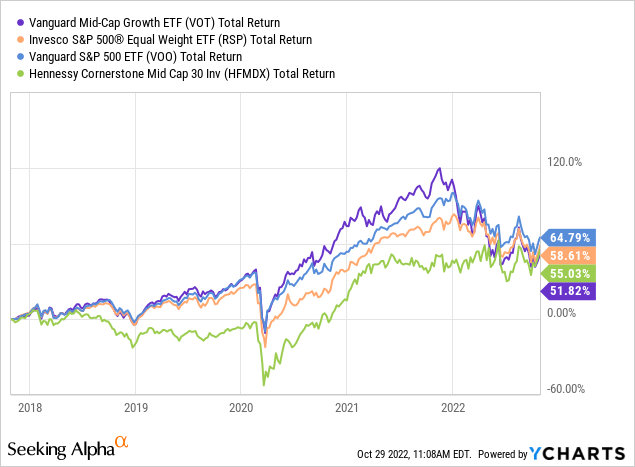

The graph below compares the total return performance of the VOT ETF to that of the Invesco S&P500 Equal Weight ETF (RSP), the VOO S&P500 ETF, and the Hennessy Cornerstone Mid Cap 30 Fund Investor Class Inv (HFMDX) over the past 5-years:

As can be seen, the VOT S&P500 ETF significantly under-performed the VOO and RSP ETFs. As you can see from some of the stocks in VOT’s top-10 holdings, there are obviously some very attractive winners in the mid-cap space. However, the graphic above shows that even a more concentrated and actively managed approach – as the Hennessy Core Mid-Cap 30 Fund employs – still significantly under-performed the S&P500 over the past 5-years.

Summary & Conclusions

While I am a big fan of the well diversified portfolio, I also have been trimming down the overall number of holdings in my portfolio in order to make it easier to manage and analyze (not to mention increase its overall performance). For myself, any new holdings need to provide sufficient diversification and/or performance relative to the S&P500. And while the idea of diversifying into the mid-cap space sounds and looks good on paper, the VOT ETF does not appear to be worth the effort. Its long-term performance significantly lags that of the S&P500, which is the core of my portfolio. Meantime, VOT’s yield is lower and its expense fee is higher as compared to the VOO ETF.

The VOT ETF is certainly better than being in cash, but given its under-performance I would SELL the VOT ETF and move the proceeds into the VOO S&P500 ETF as a superior long-term alternative.

Be the first to comment