Sckrepka/iStock via Getty Images

OrganiGram Holdings Inc. (NASDAQ:OGI) is expected to deliver revenue generation and free cash flow growth. Management announced that new products will be announced in the rest of 2022. Besides, with cash in hand, I would be expecting that more M&A activity would enhance revenue, and bring economies of scale. Even considering risks from further regulatory pressure around the cannabis industry and inflationary pressures, I believe that the current stock is considerably undervalued.

OrganiGram: Product Development And M&A

Founded in 2013, OrganiGram is a medical cannabis provider as well as a seller of cannabis to adult recreational consumers. Right now, the company appears to be more valuable for its know-how creating new brands than for its medical cannabis.

Source: Company’s Website

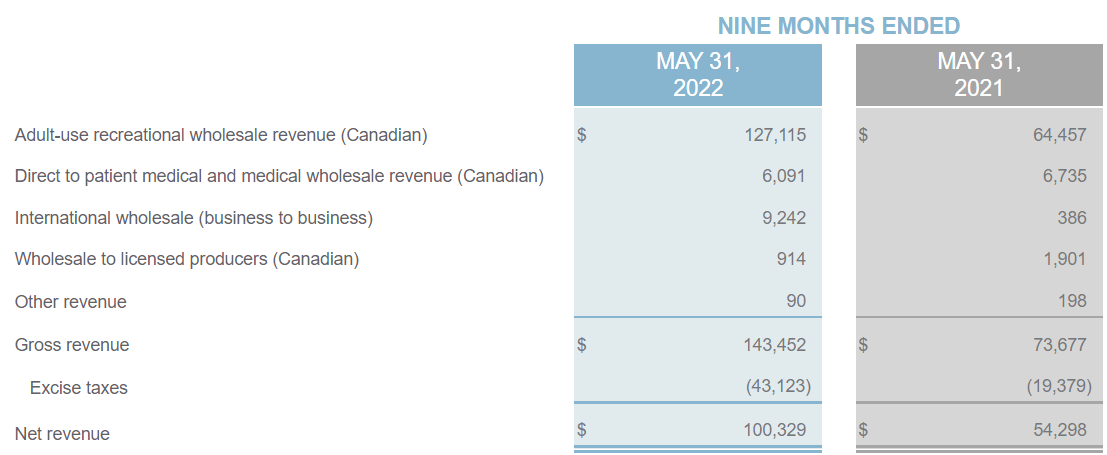

I believe that looking at the impressive recent growth of the company’s recreational wholesale, revenue is enough to become interested in OrganiGram. In the nine months ended May 31, 2022, adult-use recreational revenue increased by close to 98%, and net revenue reached close to CAD100 million.

Source: Quarterly Presentation (expressed in CDN $000’s)

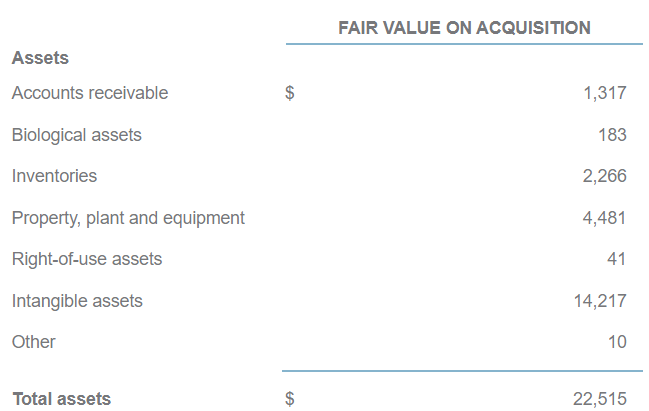

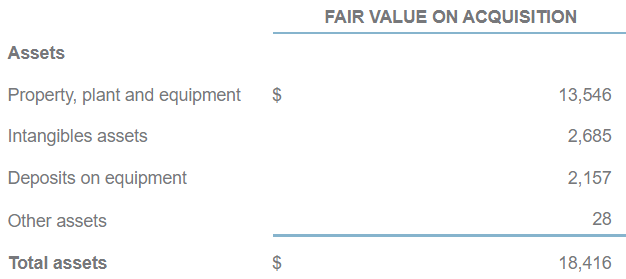

Let’s note that management is acquiring a significant number of competitors out there, which explains the revenue growth. The company acquired its intangibles, biological assets, and inventory. The following are some examples of previous acquisitions.

On December 21, 2021, the Company acquired 100% of the shares and voting interests of the non-listed Laurentian for CAD36,000, consisting of CAD10,000 in cash consideration. Source: Quarterly Presentation

Source: Quarterly Presentation

On April 6, 2021, the company acquired 100% of the shares and voting interests of the non-listed EIC. Source: Quarterly Presentation

Source: Quarterly Presentation

I do appreciate quite a bit the fact that OrganiGram has a significant amount of expertise in the M&A markets. Future transactions will likely help the company maintain its revenue growth.

Expectations From Analysts Are Quite Beneficial

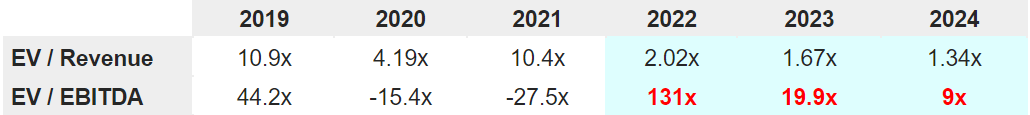

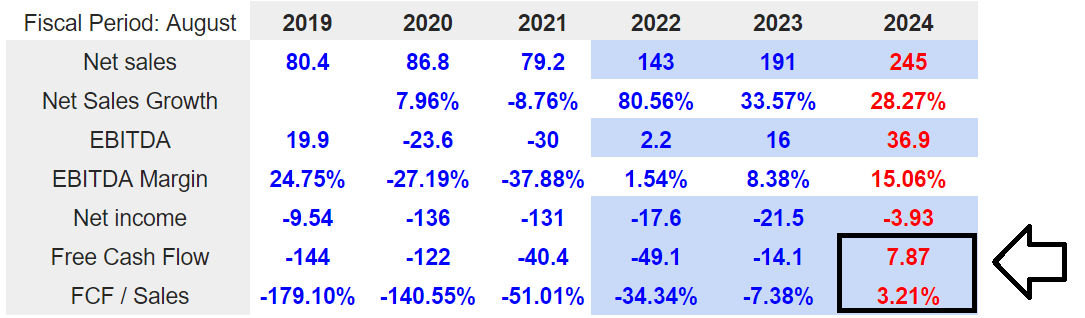

I had a look at the figures reported by other financial analysts. They are expecting that OrganiGram could trade at close to 9x 2024 EBITDA and 1.34x 2024 Revenue. Keep in mind that sales in 2024 and the EBITDA are expected to creep up significantly.

Source: Marketscreener.com

According to analysts, net sales growth in 2022 would reach 80%, 33% in 2023, and 28% in 2024. It is also worth noting that the EBITDA margin will likely increase from around 1% in 2022 to more than 15% in 2024. As a result, the free cash flow would finally be positive for the first time in 2024 after many years of negative results. In my view, if the results are as expected by market analysts, the stock price will likely trend north.

Source: Marketscreener.com

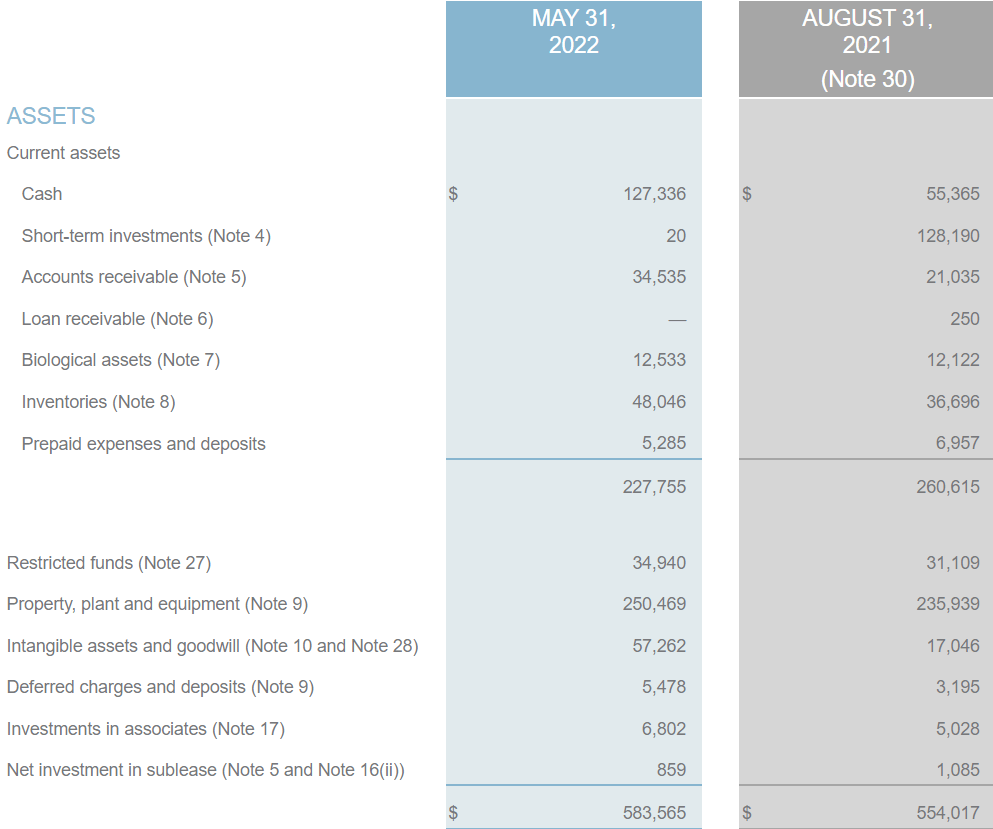

Balance Sheet

As of May 31, 2022, management reported cash worth CAD127 million, property, plant and equipment of CAD250.4 million, and total assets worth CAD583 million. With an asset/liability ratio exceeding 7x, I believe that the balance sheet is in very good shape.

Source: Quarterly Presentation (expressed in CDN $000’s)

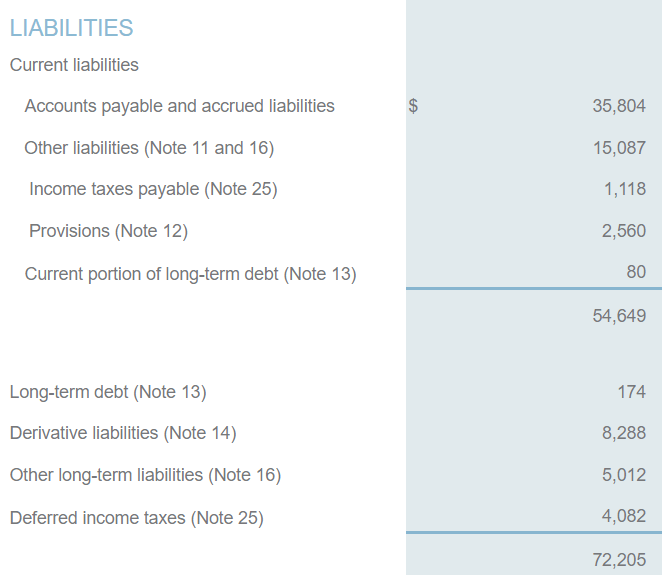

With regard to the total amount of liabilities, OrganiGram reports derivative liabilities worth CAD8.2 million and current portion of long-term debt of CAD0.08 million. I believe that more investors may be interested in OrganiGram once they learn about the company’s negative net debt.

Source: Quarterly Presentation (expressed in CDN $000’s)

More Products, New Initiatives In The Vape Industry, And Partnerships Could Push The Stock Up To $1.77 Per Share

Under my best case scenario, OrganiGram’s new strains will successfully differentiate from that of competitors. For instance, I assumed that Edison Kush Cakes and Edison Frozen Lemons, launched in 2022, will likely receive demand from consumers. As a result, sales growth will most likely trend north.

The completion of these initiatives is expected to increase Edison sales, that have a higher ASP than value brands and therefore attract higher margins. In March of 2022, the Company launched two new strains – Edison Kush Cakes and Edison Frozen Lemons. To address the growing demand for strain differentiation in the value segment, in Q3 of Fiscal 2022 the Company introduced the strain Pink Cookies to its Big Bag O’ Buds line. This high THC strain differentiates Big Bag O’ Buds in the value segment and brings the SKUs in market to five. Source: OrganiGram Holdings Inc. – MDA

Besides, if the company’s vape strategy is also successful, and new initiatives become a catalyst for revenue generation, the P&L may improve. In this regard, let’s note that management is preparing new products for the rest of 2022.

OrganiGram has renewed its focus on building share within the vape category through unique formulations, premium hardware, and high-quality inputs. For the remainder of Fiscal 2022, the Company intends to introduce numerous innovative offerings in the vape segment, all geared towards building our share in this category. Source: OrganiGram Holdings Inc. – MDA

In my view, management may also receive significant stock demand if more agreements are announced with partners. In this regard, let’s highlight the investment with a subsidiary of BAT, a consumer goods business, established in 1902. In my opinion, know-how accumulated in the consumer industry and research about cannabis could enhance new product generation:

On March 11, 2021, the Company announced a $221 million strategic investment from a wholly-owned subsidiary of BAT. Source: OrganiGram

OrganiGram and BAT have agreed to jointly develop cannabis vapour products, cannabis oral products and any other products, IP or technologies the parties mutually agree to develop. Source: OrganiGram and BAT Form Product Development Collaboration

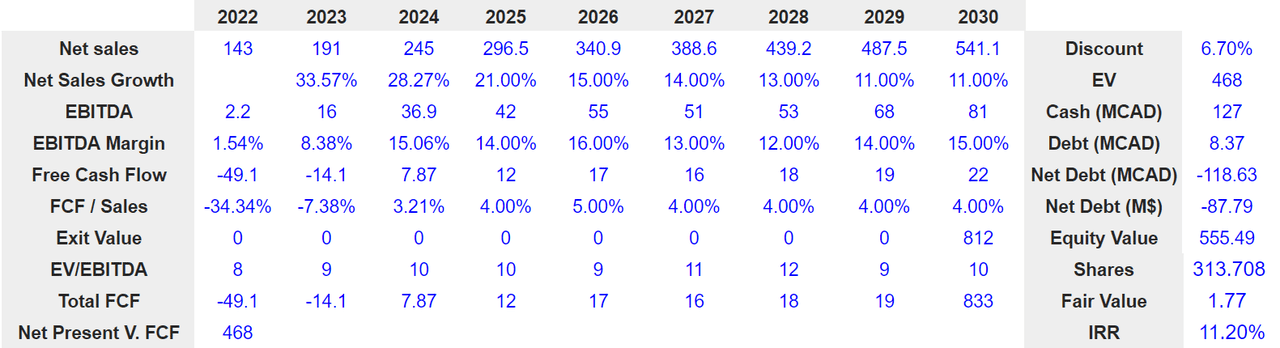

Under this case scenario, I assumed a decline in sales growth from 33% in 2023 to around 11% in 2030. I believe that the larger the sales figure, the more difficult it will be for OrganiGram to maintain high levels of sales growth. I also assumed an EBITDA margin around 12% and 16%, which is not far from what other analysts are expecting. Finally, my FCF/Sales ratio would stand at around 5% or 4%.

If we also assume a moderate 2030 EV/EBITDA of 10x, the exit valuation would stand at $812 million. We would be talking about free cash flow close to $7 million in 2024 and $22 million in 2030. The sum of future free cash flow discounted at 6.7% would be close to $468 million. Finally, if we include net debt close to -$118.6 million, the equity value would be worth $556 million, and the fair price would be $1.77 per share. Note that I am also expecting an IRR close to 11.2%.

My DCF Model

Regulatory Changes, Inflation, And A Significant Decrease In Revenue Growth Could Lead To A Fair Price Of $0.65 Per Share

Considering very bearish assumptions, I would say that regulators could significantly harm OrganiGram’s P&L. If governments decide to regulate the transportation, marketing, storage, sale, and manufacturing of cannabis, the company’s free cash flow may not enlarge.

Besides, if regulators decide to increase the level of disclosure necessary to sell cannabis, revenue growth may be lower than expected. Under these conditions, OrganiGram may see a decline in its fair price.

OrganiGram’s financials may also suffer from increases in the price of equipment, labour, and raw materials necessary to grow cannabis. In this regard, the recent increase in inflation may push salaries and electricity prices higher than expected. If OrganiGram cannot increase the price of its products, inflation would affect the company’s EBITDA margins. Besides, an interruption or a decrease in the supply of raw materials may also stop production, which would most likely decrease the revenue growth.

Finally, in my opinion, in the future, management will likely not report the same level of sales growth reported in the past. Construction of new facilities may not be as fast as in the past. With this in mind, if sales growth diminishes faster than expected, some investors may decide to sell their stock, which would increase the company’s cost of equity. As a result, I would say that OrganiGram’s stock price would decline.

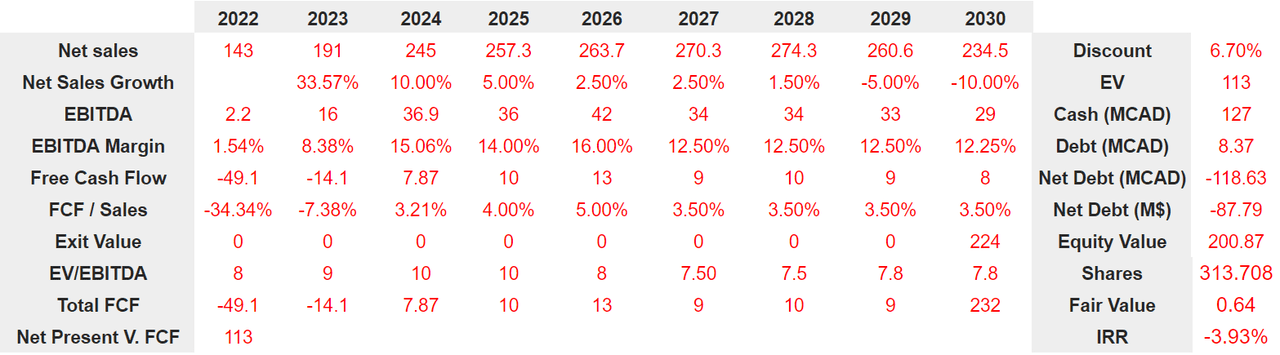

Under my worst case scenario, I assumed that sales growth would likely decrease faster than in the previous case. I assumed sales growth of 10% in 2024 and close to -10% in 2030. The EBITDA margin may also decline from around 15% in 2024 to close to 12.5% in 2030. Finally, with a FCF/Sales margin around 3.5% from 2027 to 2030, FCF would stand at around $7.5 million from 2027 to 2030.

Considering an exit multiple of 7.8x, I obtained an exit valuation close to $225 million, which implied an enterprise value of around $113 million. The equity valuation would be equal to $200 million, and the fair value would reach $0.65 per share.

My DCF Model

Conclusion

OrganiGram’s revenue growth is very impressive. With plenty of cash in hand, in my view, the company’s acquisitions and further product development will likely serve as revenue catalysts. Considering the expectations of other analysts, moderate EBITDA margin, and FCF margin, future free cash flow would imply a valuation of close to $1.7 per share. I do also see risks from further regulation, inflation, and supply chain disruptions. However, the downside risk in the stock price appears small.

Be the first to comment