JHVEPhoto

High petroleum and surging natural gas prices have led to record profits in Exxon Mobil (NYSE:XOM)’s third-quarter. Exxon Mobil benefits greatly from higher market prices for petroleum products, which in part are supported by OPEC+’s gift to cut its daily output by 2M barrels. Exxon Mobil also raised its dividend from $0.88 per-share to $0.91 per-share, giving investors a 3% dividend raise. Since shares of Exxon Mobil have surged from $84 in September to $111 in October, however, I am changing my recommendation from strong buy to hold.

A record quarter for Exxon Mobil

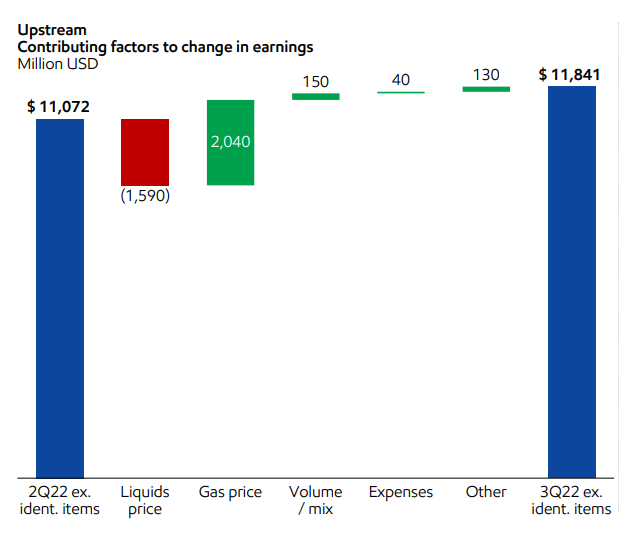

Exxon Mobil presented a strong earnings sheet for the third-quarter. The petroleum company reported adjusted earnings of $18.7B in Q3’22, showing 6% quarter-over-quarter growth. Exxon Mobil already generated record profits in Q2’22 with total adjusted profits totaling $17.6B. Growth in earnings quarter over quarter was driven by higher natural gas prices which helped compensate for a decline in petroleum prices throughout the quarter. Exxon Mobil’s largest business — production — generated $11.8B in profits in Q3’22, chiefly due to higher natural gas realizations. All other business segments — with the exception of Chemical Products — saw quarter over quarter profit growth.

Source: Exxon Mobil

Free cash flow

Exxon Mobil had another record quarter regarding free cash flow as well. Due to an overall favorable pricing environment, but especially in natural gas, Exxon Mobil generated $22.0B in free cash flow in Q3’22, showing an improvement of 144% year over year. Exxon Mobil’s free cash flow soared 30% compared to the second-quarter, which was also already a record for the petroleum company.

|

FY 2022 |

FY 2021 |

||||

|

$B |

Quarter 3 |

Quarter 2 |

Quarter 1 |

Quarter 4 |

Quarter 3 |

|

Cash Flow from Operating Activities |

$24.4 |

$20.0 |

$14.8 |

$17.1 |

$12.1 |

|

Proceeds from Asset Sales |

$2.7 |

$0.9 |

$0.3 |

$2.6 |

$0.0 |

|

Cash Flow from Operations and Asset Sales |

$27.1 |

$20.9 |

$15.1 |

$19.7 |

$12.1 |

|

PP&E Adds / Investments & Advances |

($5.1) |

($4.0) |

($4.3) |

($4.6) |

($3.1) |

|

Free Cash Flow |

$22.0 |

$16.9 |

$10.8 |

$15.1 |

$9.0 |

(Source: Author)

YTD, Exxon Mobil generated $49.7B in free cash flow while my estimate for full-year FY 2022 free cash flow was $45-47B until just a few weeks ago… so after just three quarters, Exxon Mobil already has stronger free cash flow than I estimated would be possible for the entire year. I now estimate that the company could add another $10-12B in free cash flow in the fourth-quarter, assuming that prices for petroleum and natural gas remain high. In total, I believe investors could be looking at Exxon Mobil generate $60-62B in free cash flow in FY 2022.

Exxon Mobil’s shares are likely trading at a fair price now

Based off of FCF expectations, Exxon Mobil’s stock is valued at a P-FCF ratio of 7.6 X which, in the current pricing environment, is likely a fair price. However, depending on how long high commodity prices will prevail, Exxon Mobil will sooner or later face a normalization in pricing conditions in petroleum and natural gas markets, which could then result in a lower valuation factor.

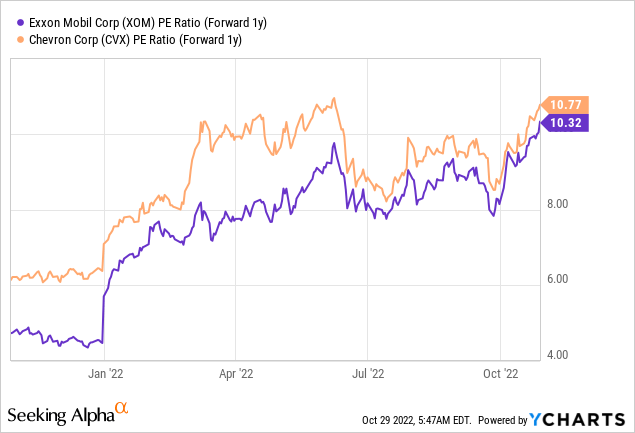

Based off of earnings, Exxon Mobil’s stock is valued at a P-E ratio of 10.3 X… which is slightly cheaper than Chevron (CVX)’s P-E ratio of 10.8 X.

Raised dividend income

Exxon Mobil raised its quarterly dividend from $0.88 per-share to $0.91 per-share, showing a dividend increase of 3%. The increase shows Exxon Mobil’s confidence in its business as well as earnings and free cash flow potential. Based off of a new dividend payment of $0.91 a quarter, Exxon Mobil has a dividend yield of 3.3%.

Risks with Exxon Mobil

The biggest commercial risk for Exxon Mobil is a decline in commodity market prices. Exxon Mobil is currently pulling in record profits and free cash flow due to a very favorable market environment and in the short term, petroleum and gas prices may even continue to climb, especially if a cold winter awaits Europe and supply fears creep back into the market. If market prices start to decline, however, then Exxon Mobil’s is facing a rapid decline in earnings and free cash flow prospects as well, and the company’s stock is almost guaranteed to drop off of recent highs.

Final thoughts

I am changing my recommendation from strong buy to hold due to Exxon Mobil’s share price surging from $84 in September to $111 in October. However, I am increasing my free cash flow estimate for FY 2022 drastically, from a prior range of $45-47B to $60-62B due to a strong pricing environment which is supported by the recent OPEC+ decision to cut supplies. Exxon Mobil’s shares, I believe, are likely trading at fair value now and have very limited upside here!

Be the first to comment