Torsten Asmus

After gaining 3.65% the week of 9/5, the S&P’s rally once again was short-lived as it declined -5.35% last week. The majority of selling came after a hotter CPI print, and the focus has now shifted to next week’s Federal Reserve (Fed) policy meeting as a decision on interest rate increases will be announced on Wednesday, 9/21. While some investors were speculating that CPI would decline for August and cause the Fed to become slightly more dovish, the CPI increase has halted any optimism going into the Fed meeting. The markets are now anticipating a 75 basis point hike this week and factoring in the fact that the Fed will signal that additional 75 basis point hikes may be needed to curb inflation in 2022. The S&P’s recent decline is pushing the index toward another chapter of living in bear market territory as the S&P has now declined by -19.25% YTD. The S&P’s chart looks as if a double bottom is forming.

The questions become, will the S&P reach its previous June lows of 3,636.87, or will the double bottom be taken out and fresh lows made going into the holidays? My favorite S&P index fund is the Vanguard S&P 500 ETF (NYSEARCA:VOO) as it’s a low-cost index fund that provides a basket of America’s largest companies to invest in. My question to investors would be, does it matter if a double bottom or new lows occur? Every investor should ask themselves why they are investing and be honest about their expectations and long-term goals. If you need liquidity tomorrow, equity investments probably aren’t the best idea, as volatility can occur in good markets, let alone bear markets. Too many retail investors worry about day-to-day pricing in equities, and it mimics rooting for their favorite sports team. When you make an investment, you buy an asset that you believe will appreciate in value over time. I believe 2022 has been a great opportunity for millions of investors who have long-term time horizons. If you believe America’s GDP and the economy will continue to grow over the next several decades and have time on your side, then VOO is a great long-term investment to start a position in or add fresh capital to.

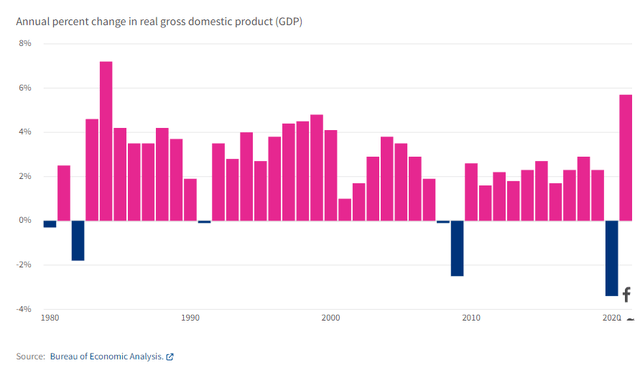

Looking at GDP and S&P data

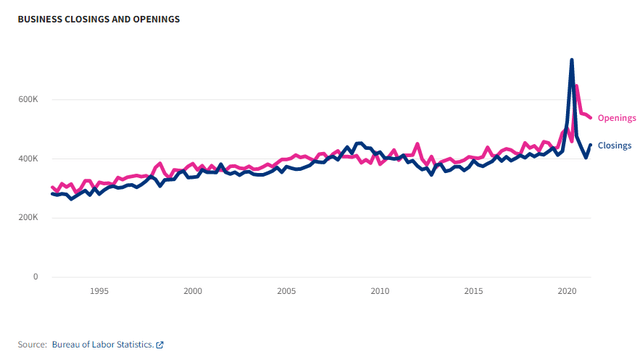

This isn’t the first bear market, and it won’t be the last bear market that investors will face. Since 1980 back to back negative declines in GDP have occurred once in 2008 and 2009. There have been 6 occurrences of negative GDP growth since 1980, which is a rate of 14.29%. 2021 had the largest GDP growth rate in 37 years, as GDP reached almost $23 trillion. The trend in business openings continues to outpace business closures, and the recent periods where closures eclipsed openings has been in periods of negative GDP growth.

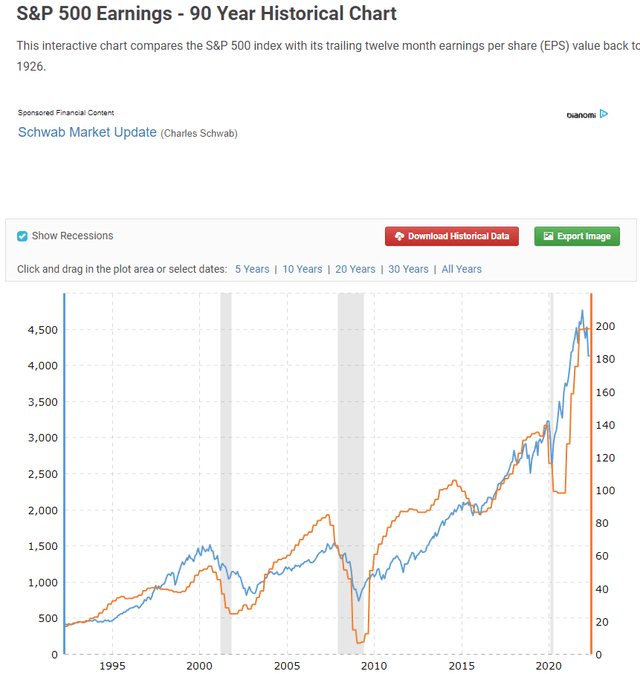

Earnings drive the performance of the S&P 500. The orange line in the chart below tracks the earnings of the S&P 500, which have significantly declined going into recessionary periods. Ultimately, earnings recovered, and the market followed. Looking back at the earnings decline after the dot-com bubble, the financial crisis, or the pandemic crash, the businesses that created America’s economic foundation recovered, earnings recovered, and the markets ultimately appreciated. To think that this time will be any different is shortsighted, the question is, how long will the markets continue to decline for before the next leg up begins? I don’t have the answer to that question, and it’s almost impossible to pick exact tops and bottoms in the market. The reality is that we are living in a period of uncertainty, and the markets could continue to decline for some time. If they did, I am not sure anyone would be shocked, but it’s a two-way street, and if the markets started to work their way back to new highs in 2023, I am not sure anyone would really be that surprised either. Since I can’t predict day-to-day prices, I believe investing in VOO and continuously adding capital to the position is one of my best investment strategies as a long-term investor. I can dollar cost average my way into a sizeable position over time without having to worry about timing the markets.

Earnings projections for the S&P’s largest components

The largest positions within VOO are:

- Apple (AAPL) 7.16%

- Microsoft (MSFT) 5.79%

- Amazon (AMZN) 3.29%

- Tesla (TSLA) 2.05%

- Alphabet Class A (GOOGL) 1.92%

- Alphabet Class C (GOOG) 1.79%

- Berkshire Hathaway (BRK.B) 1.5%

- UnitedHealth Group (UNH) 1.44%

- Johnson & Johnson (JNJ) 1.26%

- Exxon Mobil Corp (XOM) 1.19%

The top ten positions of VOO make up 27.39% of the fund. I am going to look at their future projected earnings to determine the likelihood of the orange line in the chart above continuing to ascend in 2023.

|

2022 EPS Estimate |

2023 EPS Estimate |

YoY change |

% Increase |

|

|

AAPL |

$6.10 |

$6.44 |

$0.34 |

5.57% |

|

MSFT |

$10.19 |

$11.98 |

$1.79 |

17.57% |

|

AMZN |

$0.05 |

$2.29 |

$2.24 |

4480.00% |

|

TSLA |

$4.26 |

$5.83 |

$1.57 |

36.85% |

|

GOOGL |

$5.22 |

$5.94 |

$0.72 |

13.79% |

|

GOOG |

$5.22 |

$5.94 |

$0.72 |

13.79% |

|

BRK.B |

$14.34 |

$15.57 |

$1.23 |

8.58% |

|

UNH |

$21.83 |

$24.78 |

$2.95 |

13.51% |

|

JNJ |

$10.08 |

$10.61 |

$0.53 |

5.26% |

|

XOM |

$12.74 |

$10.63 |

-$2.11 |

-16.56% |

|

Total |

$90.03 |

$100.01 |

$9.98 |

11.09% |

After looking at the earnings forecasts for each of the top 10 positions within VOO, there is an overall increase of 11.09% projected across the top 10 positions. Only XOM is expected to see an earnings decline YoY, but the other 9 positions more than make up for it. The S&P earnings trendline has formed a stepladder pattern where it appreciates, takes a brief pause, then appreciates again since the pandemic crash. VOO’s top ten holdings indicate that a downward trend in earnings for 2023 is unlikely. If these examples are extrapolated out into their respective sectors, XOM’s decline won’t be enough to flatline earnings or cause them to decline, as energy represents 4.7% of VOO. VOO could continue to decline in 2022 as the markets digest additional rate hikes from the Fed, and the midterms, but long-term VOO is likely to appreciate from its current levels.

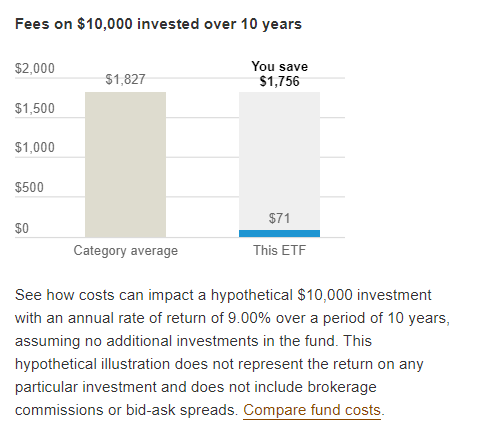

Under the hood of VOO

VOO is an S&P 500 index fund from Vanguard. It’s one of the largest index funds, and ETFs in the market, with $754.1 billion in net assets. VOO has 503 positions, and the median market cap for one of its holdings is $165.8 billion. VOO charges 0.03% for its management fee compared to a 0.80% average expense ratio from similar funds. I am cheap when it comes to investing in ETFs, and the management fee spread is a huge advantage to your investible capital. For every $10,000 invested in VOO, Vanguard would have charged you $71 in management fees over a ten-year period. This is a savings of $1,756 compared to the average expense ratio of similar funds from other companies, which charge 0.80%. I would rather keep as much of my capital invested in the market rather than see fees add up to a sizable amount over time.

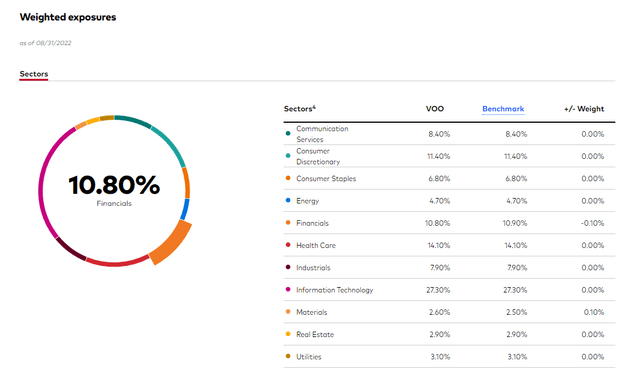

Vanguard

Investing in VOO provides a basket of America’s largest companies. This is a well-balanced approach as VOO allocates its assets across 11 sectors of the economy, including Communication Services, Consumer Discretionary, Consumer Staples, Energy, Financials, Health Care, Industrials, Information Technology, Materials, Real Estate, and Utilities. VOO has an indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index. I find this to be a conservative hands-off approach to investing because there are always companies entering and exiting the index, and VOO provides a vehicle to stay invested in the creme de la crème of American enterprises.

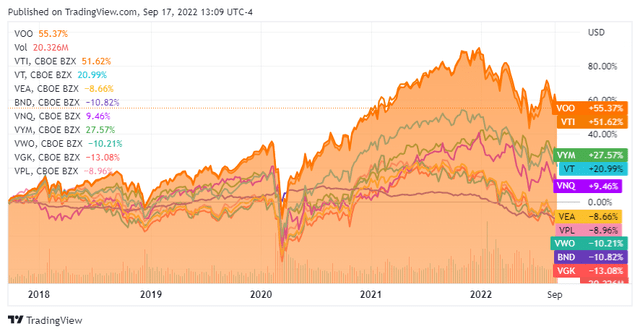

Since its inception on 9/7/2010, VOO has appreciated by 357.12%. Over the past 10 years, VOO has appreciated by 240.52%, while appreciating by 74.55% over the past 5 years. VOO has also appreciated more than many other ETF products they offer, which track broad markets. I compared VOO to the Vanguard Total Stock Market ETF (VTI), Vanguard High Dividend Yield ETF (VYM), Vanguard Total World Stock ETF (VT), Vanguard Real Estate ETF (VNQ), Vanguard FTSE Developed Markets ETF (VEA), Vanguard FTSE Pacific ETF (VPL), Vanguard FTSE Emerging Markets ETF (VWO), Vanguard Total Bond Market ETF (BND), and Vanguard FTSE Europe ETF (VGK).

Over the previous 5 years, VOO has outperformed all these ETFs from Vanguard. Many investors have often debated between S&P index funds and total market funds, and which approach delivers the most upside. While VTI is more diverse and has over 4,000 holdings, VOO is only focused on the largest companies in the strongest economy globally. VOO has slightly outperformed VTI over the years. While I am invested in various funds, I have 100% of my 401k invested in an S&P index fund because I believe it’s a conservative approach to delivering the largest amount of alpha over a long period.

Conclusion

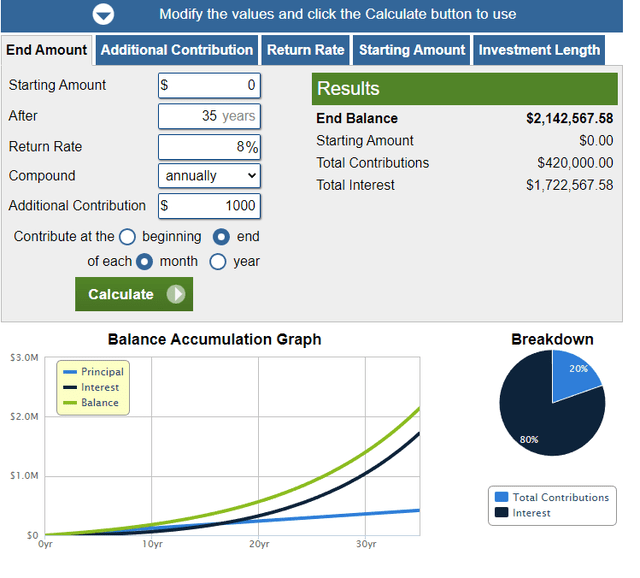

The S&P 500 has delivered an 11.88% annualized rate of return from 1957 through the end of 2021. Taking a conservative approach, if we assume an 8% average rate of return, a monthly investment of $100 into an S&P index fund over the course of 35 years would grow to $214,256.76. $42,000 of this sum would be from contributions, and $172,256.76 would be the investment appreciation. If you can save $1,000 per month over 35 years, your contributions will total $420,000, with an ending balance of $2.14 million. I believe starting an initial investment in VOO and adding capital monthly is one of the best ways to generate wealth. There are many advantages to just investing in VOO, which include risk mitigation, not spending time conducting research, not trying to pick single stocks, and knowing that your capital will always be invested in the largest companies that make up the U.S economy. Vanguard charges 0.03% and takes all the guesswork out of investing. For many investors, I believe VOO is one of the best investments they can allocate capital to.

Be the first to comment