kmatija

Thesis

We updated in our pre-earnings article that the leading Cannabis REIT, Innovative Industrial Properties, Inc. (NYSE:IIPR) stock was close to a buy after the default of one of its leading tenants, Kings Garden. While we were pretty confident of its bottoming process, we wanted to give the market more time to convince us.

Therefore, we are pleased to update investors that we believe IIPR has formed its long-term bottom, despite the worsening macroeconomic headwinds. IIPR remains nearly 70% below its November 2021 highs, as it recently fell back toward its July lows. Innovative Industrial could also face near-term headwinds, as its investment activity is expected to slow further in H2’22, given the market’s current price discovery and dislocation, affecting its cost of funds.

Coupled with a hawkish Fed, which has strengthened its inflation-fighting credentials recently, we believe the market has justifiably priced in further headwinds on its tenants. Therefore, we urge investors to continue assessing management’s commentary in H2, as we could potentially move closer to a recession.

Notwithstanding, Innovative Industrial’s long lease expiration profile (no expiry until 2029) should continue to provide strong visibility into its operations. Furthermore, more than 80% of its committed capital is invested with multi-state operators, affording investors better stability in the harsh funding and operating environment.

Given IIPR’s well-battered valuations and constructive price action, we are confident of its long-term bottom. As such, we revise our rating on IIPR from Hold to Buy.

IIPR Investors Need To Look Ahead To Better Days

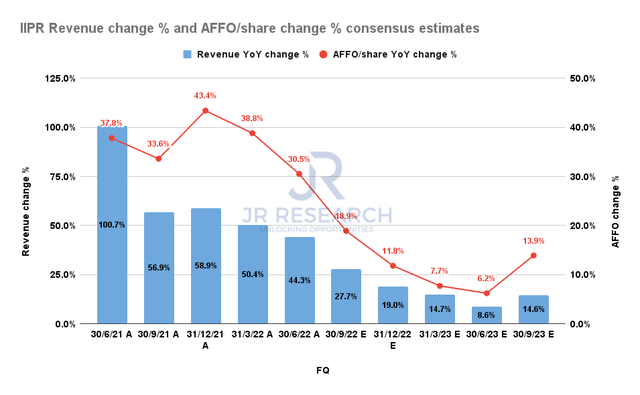

Innovative Industrial revenue change % and AFFO per share change % consensus estimates (S&P Cap IQ)

Innovative Industrial’s better-than-expected Q2 revenue growth of 44.3% assured investors that its investment activity remained robust, despite facing tremendous headwinds in H1.

As a result, Innovative Industrial has invested nearly $350M in capital commitments in H1’22 as it continues to build. However, its FY22 investment activity guidance of $400M suggests that its growth cadence should slow in H2.

We believe the current market mayhem has likely affected its cost of funds and the quality of its investment opportunities. Therefore, we think it’s prudent for IIPR to monitor the market carefully and assess its opportunities appropriately, given the increasing cost and pricing challenges faced by cannabis operators.

As a result, it’s expected to have a marked impact on its AFFO per share growth, as its revenue growth is projected to fall markedly.

IIPR’s Valuations Have Reflected Its Headwinds

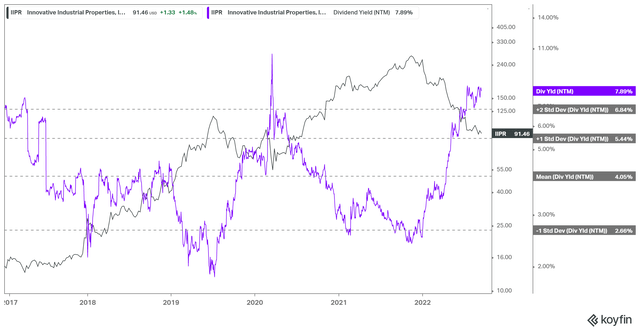

IIPR NTM Dividend yield % valuation trend (Koyfin)

Given the marked collapse in IIPR’s price levels, its NTM dividend yields have improved dramatically through H2’22. As a result, IIPR last traded at an NTM dividend yield of 7.89%, well above the two standard deviation zone above its mean.

Therefore, we believe the market has reflected its near-term challenges sufficiently, despite the multitudinous headwinds impacting its tenants and funding costs.

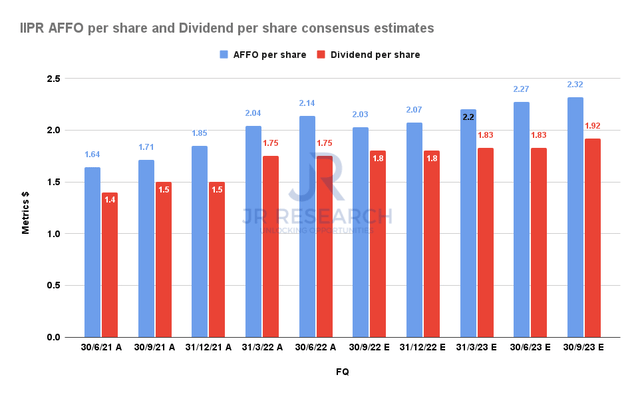

IIPR AFFO per share and Dividend per share consensus estimates (S&P Cap IQ)

Despite its near-term challenges, Innovative Industrial’s distribution remains well covered by its robust AFFO through FY23. Consequently, we believe the increase of its dividend per share from $1.75 to $1.80 (ex-dividend date: September 29) reflects management’s strong confidence in its strategy.

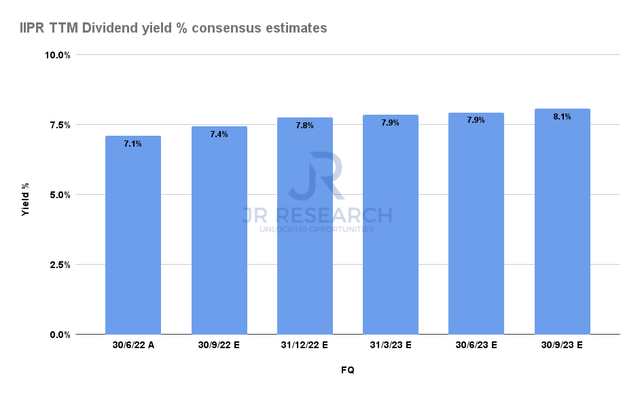

IIPR TTM Dividend yield % consensus estimates (S&P Cap IQ)

As a result, its forward dividend yields continue to look highly attractive, given the security of its payout ratios, within management’s guidance range of 75% to 85%.

Is IIPR Stock A Buy, Sell, Or Hold?

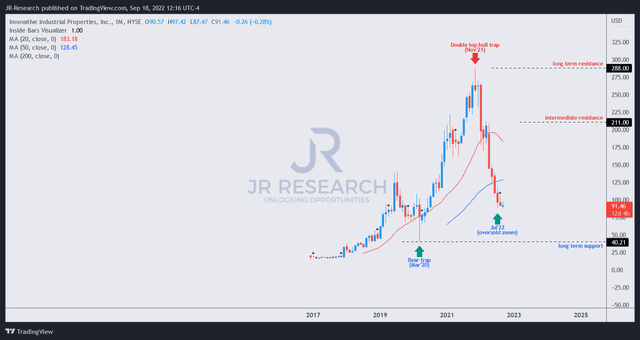

IIPR price chart (monthly) (TradingView)

We know the argument against IIPR. Fundamentally-weak tenants, unprofitable operating models, commoditized products, and now pressured further by high inflation, tight labor supply, and rate hikes impacting their funding environment.

However, we also believe that the market is forward-looking. The battering from its November 2021 highs has likely reflected these challenges. The market has correctly anticipated these headwinds that have impacted Innovative Industrial’s growth cadence, as the pandemic-driven froth was significantly digested.

We also gleaned that the selling momentum on IIPR has subsided markedly since its lows in July. As a result, IIPR seems to be consolidating robustly as it continues to form its bottoming process.

Therefore, we believe it’s appropriate for patient investors who have been biding their time on the sidelines to add exposure.

As such, we revise our rating on IIPR from Hold to Buy.

Be the first to comment