gopixa/iStock via Getty Images

The EV charging station models never made any sense and the executive shakeups at Volta (NYSE:VLTA) continue to confirm this view. At one point, the company had the most promising business model in the sector with a focus on charging station screen advertising. My investment thesis remains Neutral on the stock following another shuffle in the C-suite with the stock trading in the $1s.

Executive Shuffle

Volta just announced a shuffle of the interim CEO position and the CFO recently announced plans to leave the firm on August 22 to pursue another professional opportunity. The company is now actively in searches to replace both the CEO and CFO while other executives were moved around.

The interim CEO was only announced back in April on the original shuffle and he is now the Chief Commercial Officer. New interim CEO Vince Cubbage was the SPAC CEO, so Volta is now run by the financial arm with no experience in EV charging stations while the founders left the company and CFO plans to exit.

Troubling Financials

All of these executives shuffles in the middle of the last month of a quarter definitely places some fears the Q2’22 results aren’t progressing as expected when the company reported Q1’22 results just a month ago. At the time, Volta guided to 2022 revenue of $70 to $80 million with a Q2’22 target of $13 to $14 million.

Another executive shuffle wouldn’t be occurring, if the company wasn’t struggling to meet these financial targets. Remember, Volta reported Q1’22 revenues of only $8.4 million after reaching $12.1 million for Q4’21, but failing to meet year-end targets.

The business would be firing on pretty strong legs with such a jump in revenues in Q2. Volta was a strong pipeline of new screens to install, but the charging station companies have never made a good case for why consumers need networked charging stations when the best solution was to charge at home in a garage.

The company recently announced an expanded relationship with Six Flags (SIX) and a deal with Tanger Factory Outlet Centers (SKT) in nine markets throughout the US. These use cases meet random charging demand from consumers which infrequently travel to a Six Flags park or shop at a Tanger Outlet center. A consumer with an EV isn’t even guaranteed to need a charge when visiting these sites.

A big basis of the business is turning 3,723 signed stall agreements in the pipeline into actual commercial charging stations. The guidance is for ~50% of those to turn into installations the rest of 2022, but Volta is forecasting massive increases for the rest of the year.

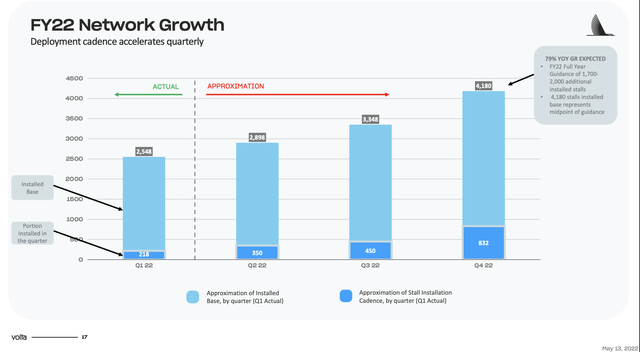

Source: Volta Q1’22 presentation

The interim management team only managed to install 218 stalls during Q1’22 and forecasts ramping up to 832 stalls for Q4’22. Volta only connected 193 stalls last Q4 in an indication of the limited capacity of the business to turn pipeline demand into actual revenue.

While the company struggles to ramp up installs, the business is actually not much more than a media organization. Volta gets paid per impressions at the over 4,700 screens displaying ads at their charging stations. In such a manner, the company has to deal with the costs of building an ad network on top of the costs with building a charging station network. Though, customers using the charging stations aren’t actually required for the media impressions questioning the actual need for charging stations at a Walgreens (WBA), or at least those charging stations up front selling media impressions.

Unlike other SPACs, Volta didn’t raise a large amount of cash. The recent weak financial results and the signals about the future with this second executive shuffle bring up concerns over liquidity. Cantor Fitzgerald had concerns about the financial position weeks ago before this second change in the CEO position and the departure of the CFO.

Volta ended March with a cash balance of only $205 million. The company burned $33.8 million via the large operating losses in Q1’22 and the slow pace of new installs isn’t going to help the cash flows dramatically improve anytime soon.

The company spent $17.4 million on capex during Q1 pushing the total free cash burn for the quarter higher. Another few quarters repeating such losses will push cash balances down to $100 million and bring up the liquidity concerns of a company with 2022 revenues targets as low as $70 million before losing the CFO and quarterly cash SG&A expenses up at $39.7 million.

On the Q1’22 earnings call, the departing CFO fully discussed a plan to still spend $140 to $160 million on capex this year. Volta wants to borrow $250 to $300 million this year to finance the installation of new charging stations with DC fast stalls costing up to $100,000.

Takeaway

The key investor takeaway is that Volta has the wrong business model for the current economy and market. The media concept is promising, but the company needs more scale to fully monetize the media assets and such scale requires cash Volta doesn’t currently have in the bank.

The second executive shuffle in months is all that investors need to stay away from this stock with questionable financials.

Be the first to comment