MargaretW/iStock via Getty Images

Mid-America Apartment Communities, Inc (NYSE:MAA) is a REIT and S&P 500 component that is focused on multi-family apartment communities in the Sunbelt regions of the U.S. Over its 28-year history, it has built a portfolio of over 100K apartment units and has recently capitalized on favorable migration trends into its markets. In March of 2021, for example, 11.1% of total move-ins into MAA’s markets were from non-MAA states. That figure has increased to 14.6% in the current period and is expected to continue trending higher in future periods.

Affordability constraints of single-family ownership is also forcing many to apartment communities, which has lower barriers to entry for individuals but little reprieve on affordability, with rent growth at some of the highest levels, especially in the Sunbelt region. Despite the rapid rise in rents, the region is still expected to see continuing population growth due to its attractive economic and regulatory environment. These trends are a few tailwinds for MAA, who is uniquely positioned in this market.

For income-focused investors, MAA is strongly committed to its dividend payout, with a strong record that includes continued growth and no suspensions and reductions since IPO. At present, the annual payout is $5.00/share, which is a yield of about 3% at current pricing.

MAA offers prospective investors assurance of continued dividend growth, supported in part by an industry-leading balance sheet with +$1B in total liquidity. Strong leasing activity in the Sunbelt region provides further support to continued rental growth. While there are concerns regarding the broader macroeconomic environment, MAA is led by a management team with an average of 20 years of executive tenure. This positions them strongly to navigate through challenging conditions. At its lows, MAA is a safe addition to any long-term, income-oriented portfolio.

Earnings Review and Other Reportable Events

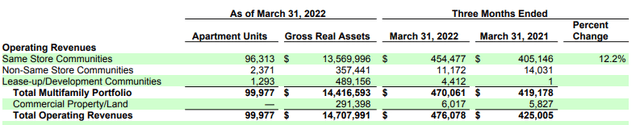

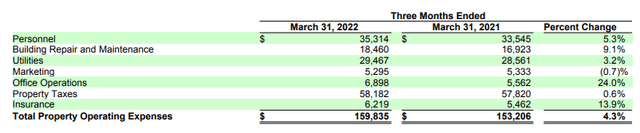

In the most recent quarter ended March 31, 2022, MAA reported total rental revenues of +$476M, which was up 12% from the same period last year and slightly better than expected. The increase in revenues far outpaced the increase in operating expenses, which were elevated due to inflationary pressures in personnel and the cost of materials. The strong top line performance resulted in net income that was up nearly 140% from the prior year and reported FFO/share that surpassed both analyst expectations and the midpoint of guidance provided for the quarter.

Q1FY22 Investor Supplement – Total Revenue Summary Q1FY22 Investor Supplement – Breakout of Total Operating Expenses

A variety of factors contributed to revenue growth during the quarter, including accelerating migration trends to Sunbelt markets and wide-spread affordability constraints on single-family ownership, which is forcing an increasing number of individuals to apartment housing.

Regarding migration trends, nearly 14% of MAA’s new leases in the quarter came from relocations to the Sunbelt. This represented a 190-basis point increase from last year. Furthermore, turnover remained low, with move-outs declining by about 6%. These tailwinds are enabling MAA to capture strong rent growth, with same-store rents up 12.4% and blended leases up 16.8%.

Strong leasing activity continued through the date of its earnings release in April, with lease-over-lease pricing on new leases up 16.5% and renewal lease pricing up 16.7% from the prior year.

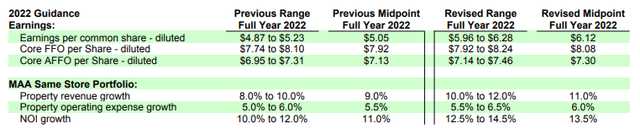

Robust performance during the quarter supported enhancements to expectations for the remainder of the year. The full-year range for core FFO, for example, was adjusted to reflect a midpoint of $8.08/share, which is an increase of $0.16/share, 13% greater than the prior year. Additionally, management now expects same-store revenue growth to be at a midpoint of 11% versus 9% as initially stated. Despite higher expectations of expense growth, NOI is still projected to be higher due to strong pricing trends.

Q1FY22 Investor Supplement – Updated 2022 Guidance

The Fundamentals

As of March 31, 2022, MAA had total assets of +$11.2B, comprised principally of net real estate assets of +$10.9B, and total liabilities of +$5.1B. Combined with available capacity under its revolving credit facility, MAA had total liquidity of cash and equivalents of +$1B.

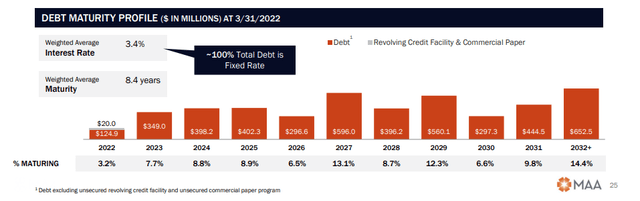

At period end, net debt to EBITDA stood at a record low of 4.27x, which is significantly better than the sector median of 5.56x, which includes peers such as AvalonBay Communities, Inc (AVB) and Equity Residential (EQR), among others. Furthermore, virtually all its debt is fixed rate and laddered over 8.4 years. With limited near-term maturities and sizeable liquidity, MAA faces minimal repayment risk.

June 2022 Investor Presentation – Summary of Debt Maturities

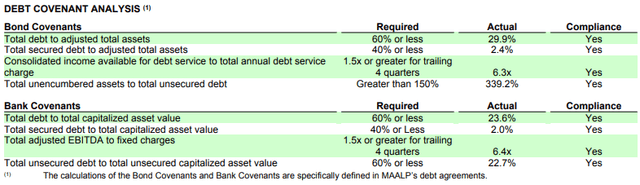

MAA is also well in compliance with all its debt covenants. The company, for example, has a fixed charge ratio of 6.4x versus a requirement of 1.5x. This is also better than the sector median of 5.71x. The strong level of coverage ensures the company will be able to continue meeting its debt servicing obligations prior to maturity with ease.

Q1FY22 Investor Supplement – Summary of Debt Covenants

Supporting MAA’s strong balance sheet is its average daily occupancy of 95.7%, with limited exposure to vacancies and delinquencies. The strength in leasing, in addition to favorable migration trends into the Sunbelt region, support continued rent growth, which has been exceeding expectations.

A consistent ability to generate positive operating cash flows enables the company to invest in new developments and return excess cash to shareholders in the form dividend payouts. In the current quarter, for example, MAA reported +$179.6M in total operating cash flows and +$125.4M in total dividend payments. At 1.4x operating coverage, the payout was adequately covered, as evidenced further by the forward AFFO payout ratio of 60%, which indicates a strong degree of safety.

For income-investors, the current payout is yielding about 3% after having been recently increased by 15%. The increase marks a continuing trend of growth, which is unlikely to be impacted by broader macroeconomic concerns, given the company’s current financial position.

Risks to Consider

As of the full year ended December 31, 2021, 40.5% of MAA’s portfolio was located in its top five markets. Additionally, due to its overall operational concentration in certain regions of the U.S., MAA faces heightened geographical exposure risk. If the local operating markets were to experience recessionary pressures or other negative economic effects, the company could incur reductions in rental and occupancy rates, in addition to heightened turnover expenses and property impairment.

MAA is also subject to the concentration risks of being exposed to only one asset class, the multi-family sector. While substantial investment in these properties has certain advantages, such as a greater degree of specialization, any downturn in the industry or negative event pertaining to the asset class would result in material ramifications for the company.

MAA could also be negatively impacted by adverse developments in the broader national economy. An increase in the supply of multi-family and other rental markets, for example, would impact the company’s ability to lease its apartment communities at favorable rates. Additionally, job losses combined with declining household wealth could result in delinquencies and/or decreased occupancy. While rent control is not an immediate threat in MAA’s market, the issue can gain momentum among politicians, especially during election years.

Since many of the company’s apartment communities are located near coastal areas, the properties are at greater risk of adverse weather-related events, such as hurricanes and other tropical storms. Aside from property damage, increased frequency or more intense weather events could ultimately negatively impact demand for MAA’s properties. Furthermore, it is possible, too, that the company would not be able to recover in a timely manner or at all the costs of property damage through insurance claims. Additionally, changes in federal, state, and local laws and regulations in response to these events could result in increased compliance costs for the company.

Conclusion

MAA is a multi-family focused REIT that is uniquely positioned to capitalize on favorable long-term housing trends in the Sunbelt region of the U.S. Over the past two years, the company has already reaped the rewards of inbound migration, as reflected in its strong quarterly earnings results. Favorable population estimates in the region provide confidence the trend is likely to continue in future periods.

Despite a long track record of success, MAA is down nearly 30% YTD, which is vastly worse than the 20% decline suffered by the broader index. The company is also underperforming related peers AVB and EQR. While the current valuation of 20x forward FFO seems high, shares appear undervalued based on the CAGR of its dividend, which is about 4.5% over five years. At an estimated cost of equity of 7%, shares would be undervalued by about 20% when utilizing a standard dividend growth model.

Though investors are exercising caution in the current environment, MAA is well-positioned to exceed expectations in future periods. Management is actively focusing on further strengthening its balance sheet, which is already among the best in the industry, with a positive outlook from all three major credit agencies. In addition, MAA is also benefitting from above-average rent growth that will prove stickier during recessionary periods. The lack of interest in rent control in the Sunbelt region are further competitive operating advantages.

In a bear market, timing the bottom will prove challenging for any investor. Initiating incremental positions on a quality REIT such as MAA, however, is likely to ultimately reward prospective investors over the long term with material share-price appreciation and continued dividend growth.

Be the first to comment