ipopba/iStock via Getty Images

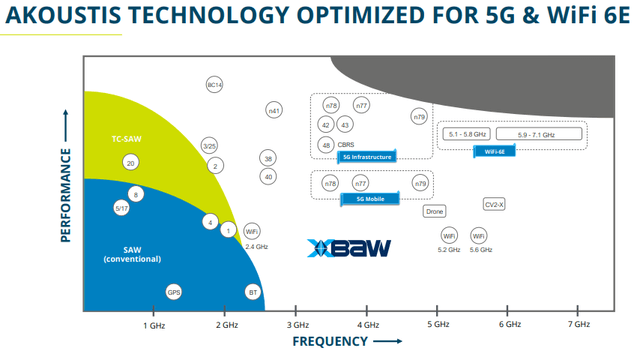

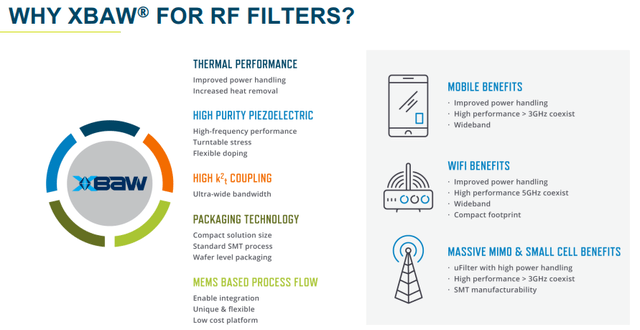

Akoustis (NASDAQ:AKTS) is a designer and producer of RF filters that are used in networks like mobile networks and WiFi. Their core tech is their patented XBAW filter technology which is optimized for the most advanced networks:

We were following another company, Resonant (RESN) that makes similar claims and it’s hard to distinguish between these for a non-industry insider. Resonant has been acquired by its main customer Murata in the meantime, for nearly 4x its share price. Something similar could happen to Akoustis, but there are no guarantees here of course.

But ultimately, we don’t have to, the market decides and apart from the fact that the market can support more than one solution, it’s market acceptance that will be the differentiator.

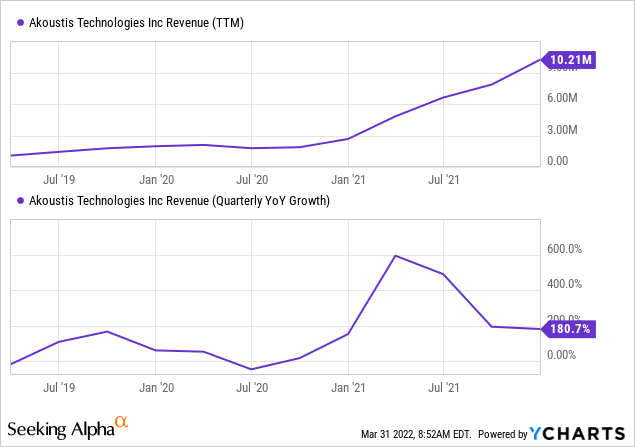

With respect to market acceptance, Akoustis is doing very well as they have a rapidly increasing number of design wins and clients already in production and customers tend to come back for more. They have to scale pretty fast, as the company is still bleeding cash, and revenues while rising rapidly, are still tiny:

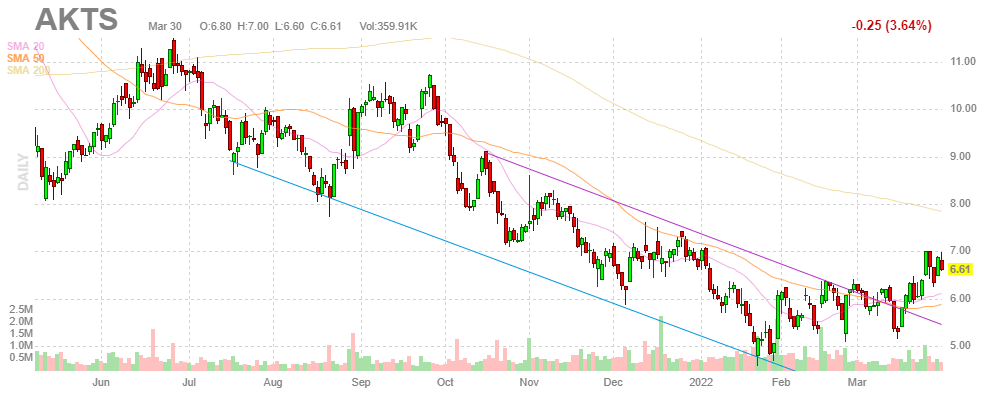

The shares have started to stabilize:

FinViz

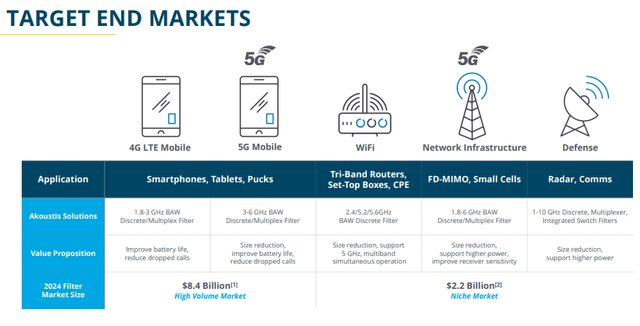

Markets

Here are the market segments the company serves:

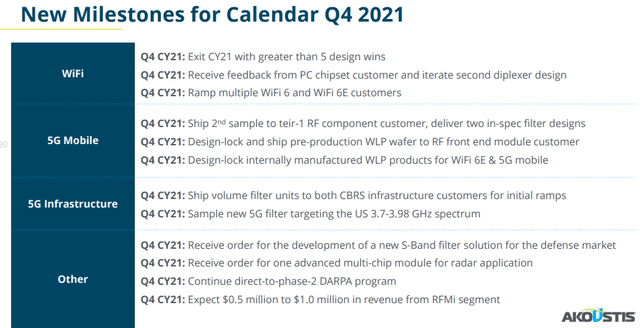

The company produced a lengthy list of design and production wins in their earnings PR and in a slide from the earnings deck (Q4CY21 = Q2FY22):

So we summarize:

5G market

This is the market with the biggest TAM, the company won two new customers in Q2 and now has 4 customers. New customers are a Tier-1 module maker and a Tier-2 module maker focused on Asian markets.

If the company moves successfully with the Tier-1 module maker, management expects them to enter into a foundry agreement with a production ramp for H2 2023 (calendar).

The company already has a foundry agreement with their other Tier-1 customer, but production will have to wait as the customer is redesigning its filter design.

The two previous customers are in the sampling stage still, a production ramp is not expected before the end of calendar 2022.

WiFi

The company has two customers in production and added two design wins in the quarter with 5 additional WiFi design wins after the quarter closed, taking the total to 13 (up from 5 in Q1), of which 8 in WiFi 6E (WiFi 6E produces higher margins on a price that’s some 25% higher as the filter content is more substantial).

The company is also developing WiFi 6E diplexer for one of the largest PC makers, with the first design already shipped to the customer. The production of WLP is brought in-house in their New York facility in order to control the quality, cost, and customization of advanced packages. The diplexer isn’t an isolated production line (Q2CC):

One of the key features of our technology is being able to integrate more than one filter in an integrated module. And I think the first example that’s a diplexer that we have ongoing.

5G Network infrastructure

The company has two CBRS (Citizens Broadband Radio Service) customers, one of which is scheduled to enter production in Q3 (December quarter) and the other one in Q4 (March quarter).

There were three design wins for CBRS in the quarter, in all the company has over ten customers with five of these already having placed purchase orders.

Other market segment

Akoustis is entering the RF timing and frequency market with their XBAW resonators, working with a leading maker of timing RF components. This segment is a significant opportunity.

The company has an existing R&D contract with DARPA and submitted a proposal for a multi-million dollar contract to extend the operating range of their XBAW RF filters up to 18 GHz.

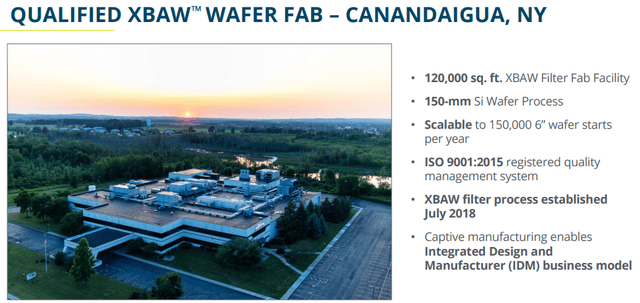

Capacity

- There are long-lead times for CapEx expansion

- US support

- Bringing WPL production in-house doesn’t really require much additional CapEx.

Innovation

The company has 56 issued and 93 pending patents, but they keep on innovating, from the Q2CC:

We continue to work towards the introduction of the first samples of a new breakthrough material that offers both leading BAW micro filter power handling capability, as well as the ability to cover wide bandwidths for macro base stations and other applications that require high power.

RFMi acquisition

Akoustis acquired a 51% majority stake in October 2021 for $6M in cash and 2.5M shares, with a right to purchase the other 49% this year. For the rationale see the PR, the emphasis on new markets and new sales channels. RFMi exceeded guidance in Q2, flat to down in Q3, sequentially up in Q4.

Q2 results

- Revenue at $3.7M, up 96% sequentially

- non-GAAP operating loss was $12.3M

- CapEx spend was $7.1M, up from $5.7M in Q1.

- There are supply-chain issues especially on the SoC and laminate supplies and CapEx equipment which all have extended lead times.

Outlook

Q3 revenue will be up 25% sequentially on production customers increasing from 5 to more than 8 by the end of the quarter. The company exited 2021 with five customers in production stage and aim to double that this year. Keep in mind that the cycle time is 9-15 months from design to production.

They have a list of Q3 (March) milestones per segment in the Q2CC which offers a detailed checklist, they are expecting 8 customers in production already by March so the 10 for 2022 seems pretty doable.

There is also some conservatism built in the guidance as a result of the supply chain issues.

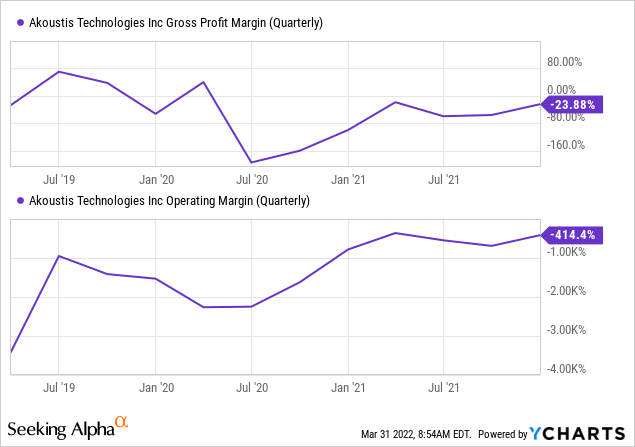

Margins

Margins are still well below board, but with the production ramp things should improve substantially, from the Q2CC:

And also, utilization of the fab, which is going to drive down cost of the wafers as well. So yields, laminate cost, size of product, and then, as I mentioned earlier, just the amount of integration that we can do and functionality we can bring within the module. It’s going to allow us to get higher ASPs at a lower cost point. So integration is certainly one of the paths to profitability.

Valuation

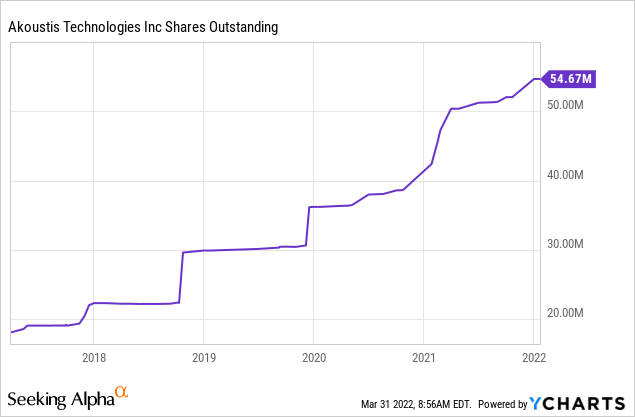

Investors in this type of stock face questions about the speed of market adaptation, and hence revenue ramp, versus cash bleed and the risk of dilution.

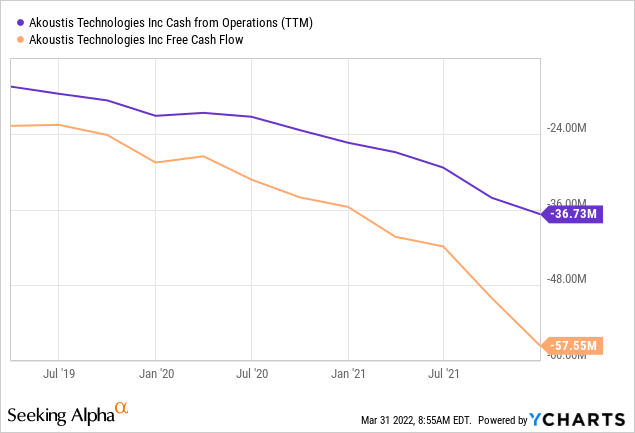

Well, the revenue ramp is pretty impressive, but it’s from a very small base so the company isn’t near the end of bleeding cash, which is in fact accelerating:

The company had $67.5M in cash at the end of Q2 (including rating $13.4M from ATM share sales). We’re inclined to say this will probably last them less than a year as the revenue is rapidly increasing, but then there are increasing CapEx requirements as well.

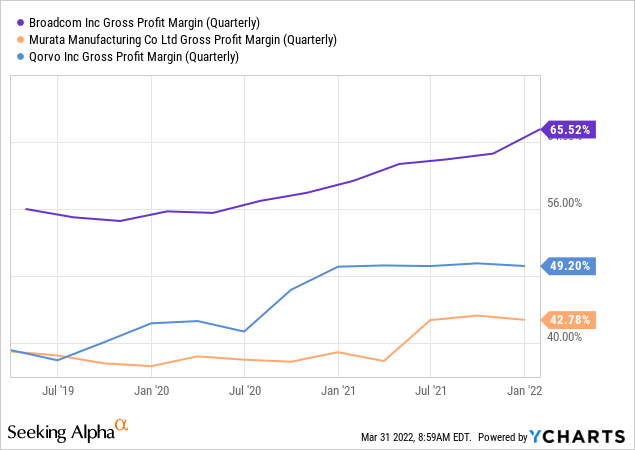

The company has $14.3M in operating expenses per quarter but it is difficult to calculate any breakeven point without a firm grip on gross margins (as these are still negative). Looking at gross margins of competitors provides only a rough indication as none of these are RF filter pure plays.

Assuming 40% gross margin requires $150M revenue run rate to reach breakeven, the company is a long way from that. A 50% gross margin would reduce that to $120M.

Given the CapEx expenditures, being cash flow positive might be a little further out. In the first 6 months, the operational cash outflow was $23.5M with another $12.8M spent on machinery, so despite the $67.4M in cash, we’re likely to continue to see dilution:

The company has no debt, although outstanding warrants and performance options, No total quantities were provided in the 10-Q, but they haven’t deviated all that much from the levels provided in the 10-K:

- 2.5M options

- 1.75M restricted stock units

- 167K warrants

So there are an additional 4.4M shares coming for a total of 59M shares fully diluted. The company’s market cap is at least $490M while its EV is roughly $420M. Sales are nowhere near, so valuation metrics make little sense at the moment.

SA contributor Michael Fitzsimmons produced an indicative valuation method based on production capacity (500M filters) and an average ASP of $5 of which $2.5 befalls the company, producing a potential $1.25B in revenue.

This suggests the shares are very cheap but keep in mind we don’t know when the company is going to max out its production capacity, nor how much further dilution is required to reach that.

The company is indeed building out its production capacity to 500M filters on the back of a recent order from a leading tier-1 RF module maker and filter provider for a new 5G mobile XBAW filter.

Even so, the margins for error are pretty generous, if the company nears that 500M figure in 2-3 years the shares are indeed fairly cheap.

Conclusion

- The company is ramping production fast and is raking up design wins and customers moving into production.

- Customers tend to stick around for additional designs.

- Given the speed of market adoption, it’s reasonable to assume that the company will be able to win a considerable slice of a big market, but how big a slice that is a bit of a leap of faith and so is buying the shares.

- Buying the shares here can work out very well in 12-18 months, but as we have seen the past year, there are no guarantees, so this is a fairly risky bet, but one that can bring in considerable rewards.

Be the first to comment