hapabapa/iStock Editorial via Getty Images

Things were really not meant to turn out this way for Volta (NYSE:VLTA). The EV charging company was one of the more unique charging companies to go public on the back of the SPAC phenomenon last year with a business model that co-located digital advertising screens with EV charging stalls. The 55″ digital display screens would diversify Volta’s revenue beyond just EVs and morph the company into an outdoor advertising infrastructure play. Hence, against a crowded EV charging investment field from ChargePoint (CHPT) to Blink (BLNK), Volta would garner enthusiasm from its relative contrarian approach to the ongoing EV boom. The company entered partnerships with companies like Wegmans and Albertsons to roll out its charging points and the future looked bright.

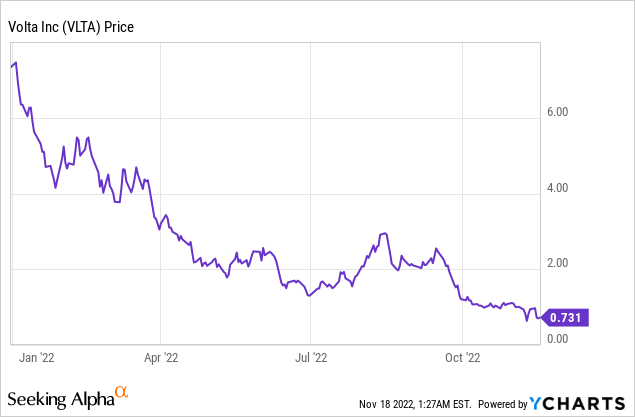

With less than 1% of all passenger vehicles on US roads being EVs, a percent is rising fast, how has Volta’s year-to-date common share performance come to be so torrid? The secular shift towards zero-emission transportation is now somewhat embedded in the post-pandemic economic direction of US states from California to New York. Both have instituted planned dates for the phase-out of sales of new gas and diesel-powered vehicles.

The shift to EVs is still in a very early stage and the pace of growth ahead will be material and dramatic. Indeed, in 2012 just 120,000 EVs were sold globally. Last year saw this figure being sold on a weekly basis with 10% of cars sold in 2021 being electric, 4x the market share in 2019. Bloomberg New Energy Finance released a report in the summer which stated that sales of gas and diesel-powered vehicles already look to be realizing a permanent decline as more and more consumers opt to go for EVs or plug-in hybrids. EVs are forecasted to grow to at least 26.8 million by 2030, up from 6.6 million in 2021.

Poor Liquidity In View As Net Loss Slows

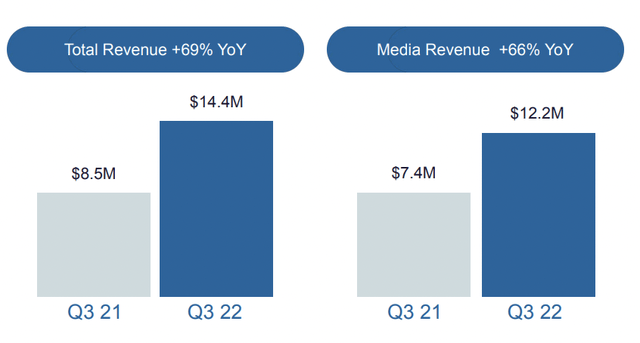

To be clear here, Volta’s total addressable market is fast expanding which places future revenue expansion from the ramp of its hybrid charging stalls on the type of upward adoption ramp that can only be described as hyper. When the San Francisco-based company reported earnings for its fiscal 2022 third quarter it brought in revenue of $14.36 million, an increase of 69.1% over the year-ago quarter but a miss of $340,000 on consensus estimates.

Volta Charging

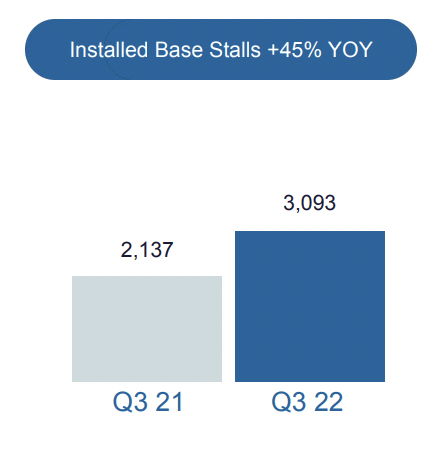

Revenue growth was largely driven by the company’s ad division which grew 66% year-over-year to reach $12.2 million with its network surpassing 5,700 screens and one billion monthly media impressions. This came as stalls grew to reach 3,093, up 45% from 2,137 in the year-ago period. It’s important to note that not all stalls have screens whilst some wall-mounted stalls have a single screen.

Volta Charging

The gross profit margin during the quarter at 38% was a 740 basis points increase from the year-ago quarter and brought in a gross profit of $5.5 million. This was in line with the company’s second quarter, but was not enough to push the company to profitability with a net loss of $42.5 million during the period. Positively, this was a decline from nearly $70 million in the year-ago comp, a move which came on the back of the company shrinking its operational footprint heavily to reduce cash burn.

Management has moved to reduce its FTEs by 54% as part of a pivot to cash conservation mode with this seeking to drive a 43% reduction in cash SG&A. They’re also outsourcing certain operations to third parties and are looking to conservatively manage their stall rollout. The push to become a leaner and more agile company is a forced one. Cash and equivalents have dwindled to $15.6 million, the 173 stalls built during the quarter were lower than expectations, and full fiscal year 2022 revenue guidance has been pulled.

This put Volta in an awkward spot where its network development revenue for the quarter actually declined to $1.9 million versus $3.6 million in the prior quarter, a fall offset by higher ad revenue.

Ad-Based EV Charging Model Faces Uncertain Future

Volta’s move to offer ad-based EV charging in high-traffic locations from shopping malls, grocery stores, banks, and pharmacies will continue to set the company apart from its competitors as it locks in a revenue stream capital expenditure that otherwise would have accrued revenue purely from selling electricity.

But without enhanced access to capital, the company’s growth plans and viability will be at risk. Management during the third quarter earnings call said that they will continue to slow the velocity of new installations until capital is more readily available. This will likely unfortunately mean a continued decline in network development revenue placing Volta as an avoid until more clarity on funding is shared by management.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment