PonyWang/iStock via Getty Images

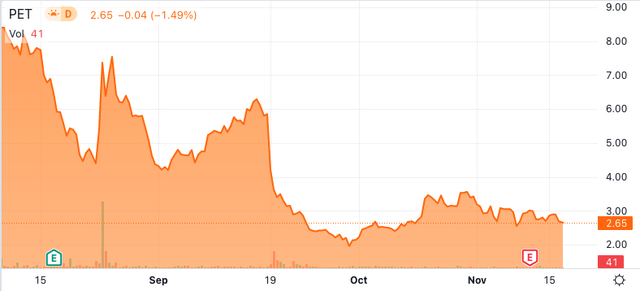

Wag! Group Co. (NASDAQ:PET) started trading publicly at an initial stock price of $8.20 on the 10th of August 2022, and the market has yet to react well to the stock, as shown in the graph below.

Stock Trend Since IPO (SeekingAlpha.com)

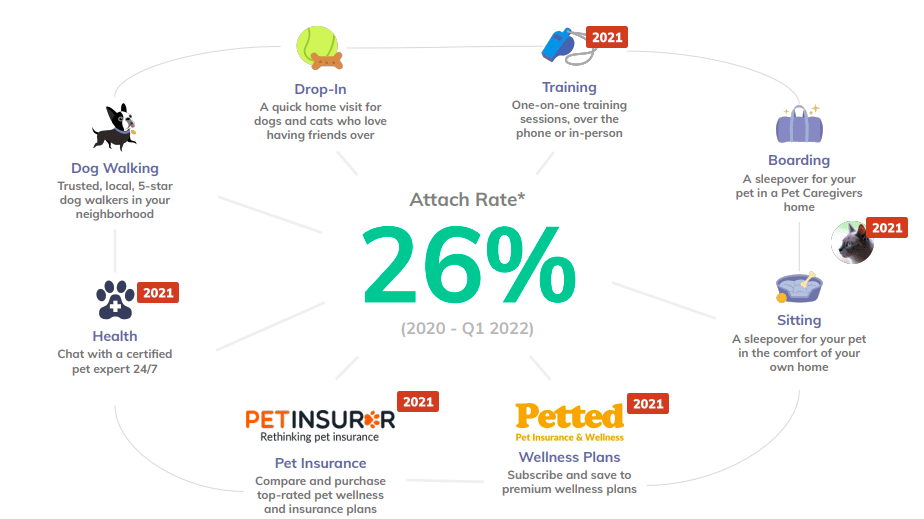

However, it is one of the leading online pet service companies disrupting the traditional pet industry in the States, a highly fragmented industry worth $76.8 billion. It has delivered consecutively upward revenue figures, increased its number of platform users and is increasing the value per customer with a higher penetration of premium paying users. Although, there are several alternative applications, including Rover (ROVR), which went public one year earlier. PET’s strength and growth catalyst is its diversified approach to delivering pet services, focusing not only on walking and sitting activities but providing the full scope of animal-related care, including health care which has quickly become the dominant force in its revenue growth. Most recently, the company has also acquired a cloud-based animal pharmacy solution. With the new acquisition and diversified approach to its business model, there is upside potential for this micro-stock that has not yet convinced the trading world of its value.

Investors may want to take a bullish stance on this company, although wary that it is unprofitable and is still too early on in its lifecycle to make predictions about future performance based on its short performance history.

Overview

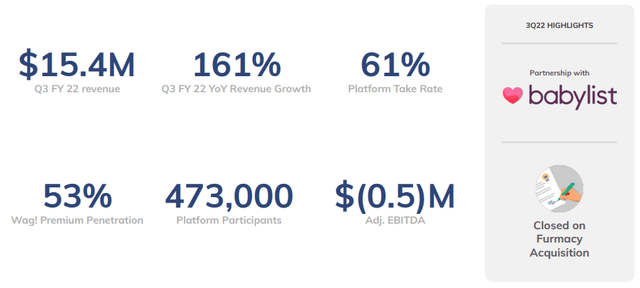

My previous article introduced PET and the born online pet care industry. PET connects animal owners to animal service providers. It is increasing the number of users and the value per user. PET initiated a premium membership program and achieved 53% penetration in the last quarter, 3% above its long-term target. It has 473,000 platform participants, 22% more than the previous quarter.

The company is investing in technological improvements for scalability and usability, such as the Neighbourhood Network filter, which allows filtering by neighbourhood and speciality to increase the likelihood of a better match between the pet owner and the pet caregiver.

It is diversifying through partnerships and acquisitions such as its partnership with Babylist, an online marketplace for expecting parents, and its acquisition with online animal pharmacy Furmacy. All the above aim to give a better user experience and the ability to find what you need for your pet from one platform.

Diversified Pet Services (Investor Presentation 2022)

Financials and Valuation

PET is still a young, small company. Focusing on growth in various monetary and non-monetary aspects of the business is essential, although we should remain cautious of the high costs this quarter and whether these can be recurring. PET delivered a robust set of third-quarter results. The company saw revenues increase by 161% compared to last year’s Q3 to $15.4 million. The adjusted EBITDA increased to negative $0.5 million. An impressive number to look at is the growth in bookings which increased by 85% year on year to total $25.3 million, and the number of platform participants has increased by 23% over the last quarter to reach 473,000. The wellness part of the business makes up 62% of the revenue, showing the strength of investing in this part of animal services.

Q3 Non-GAAP Performance Overview (Investor Presentation 2022)

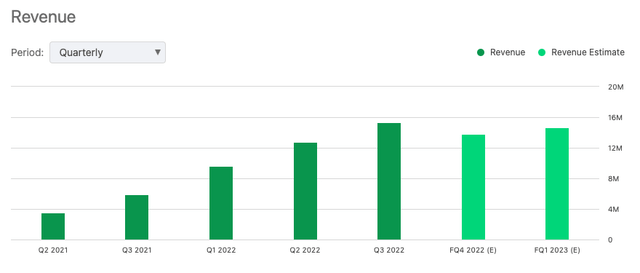

This quarter the company had a net loss of negative $40.9 million. The total included a one-time transaction cost of $39.5 million for various business operations. If we were to remove this number, the $1.4 million loss would represent a $0.5 million improvement from last year’s third quarter. Although it is too early to give much weight to the company’s historical performance, the graph below shows that the revenue has trended upward for the last five quarters, which is promising to see.

Quarterly Revenue (SeekingAlpha.com)

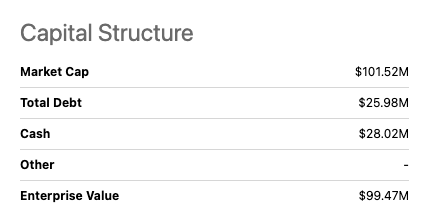

The company reported $28.02 million in cash and cash equivalents last quarter. The company has adequate funds to meet its growth plans and look further into possible M&As in the future.

Capital Structure (SeekingAlpha.com)

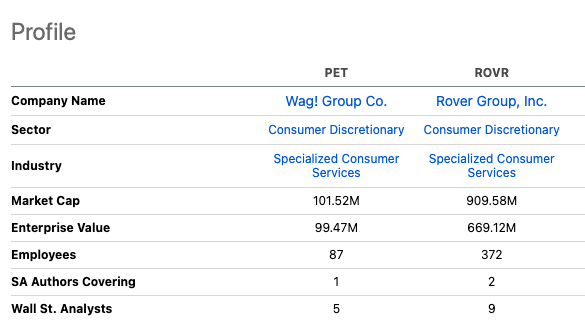

In terms of valuation, it is worth comparing the two main rivals, Rover and Wag! Furthermore, it is worthwhile to compare PET’s trading journey to ROVR, which was also not well received until very recently. Both these companies are disrupting a fractured billion-dollar pet care industry; although fierce competitors, there is room in the industry for multiple players.

Company Comparison (SeekingAlpha.com)

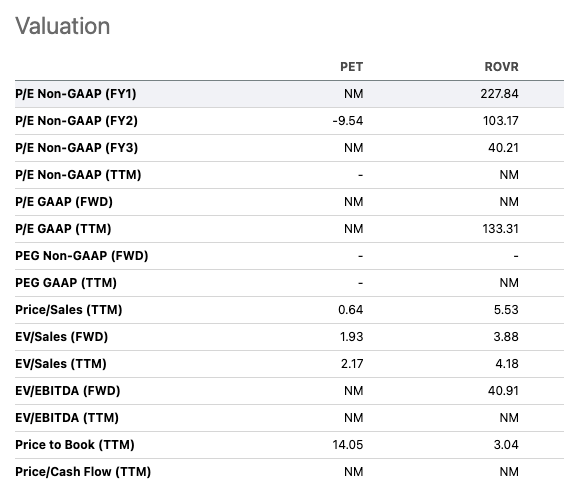

If we compare the valuation between PET and ROVR in the table below, we can see that on specific ratios, PET is undervalued. It has a price-to-sales ratio of 0.64x, indicating that shareholders assign the company a valuation that’s lower than PET’s revenue. It is also well below ROVR’s P/S ratio of 5.53x.

Relative Valuation (SeekingAlpha.com)

Risks

Since its IPO on the market, PET has not been well received, and the stock price has trended downward for the last three months. The company went public via SPAC. It took much longer than initially planned and received much less than the initially planned funding. Investors have a right to be wary of the company’s short historical performance and lack of profitability. The company has already experienced poor managerial decisions, bad publicity and security breaches to be aware of. However, unlike many unprofitable companies, revenues have been increasing for five consecutive quarters, and management has raised their guidance for year-end results. Furthermore, the company had very high costs this last quarter. Although many of these costs were connected to one-time expenses, it is something to keep track of and be wary of.

Final Thoughts

PET is connecting the dots in a fragmented billion-dollar pet industry. It is unprofitable, and the journey to success still needs to be laid out. However, one of the critical catalysts for further growth is its investment in diversifying, especially into the pet healthcare sector, quickly becoming the dominant force in its revenue build-up. With consecutive growth numbers, new acquisitions and investing in a scalable platform, this micro-cap stock has a lot of upside potential. The management team have strong expectations to end the year off well. Although there is uncertainty with such a new stock, the company is building up a strong business foundation and therefore, investors may want to take a bullish stance on this company.

Be the first to comment