bfk92

Q3 recap and thesis

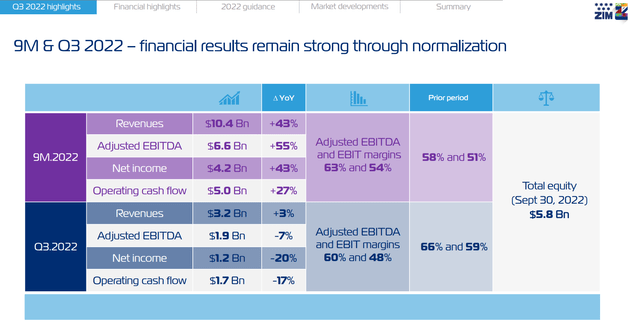

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) just released its earnings report (“ER”) for Q3 2022. It is another strong quarter, with results beating consensus estimates on both lines. Net earnings came in at $1.16 billion in Q3, translating into $9.66 on a per-share basis and beating the consensus estimates by $0.21. Revenue came in at $3.23B, translating into an annual growth of 3.2% and also beating consensus estimates by $70M.

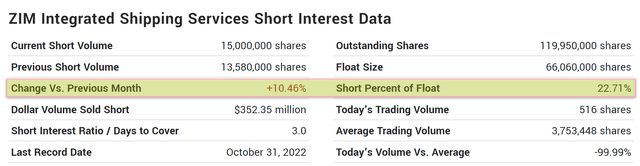

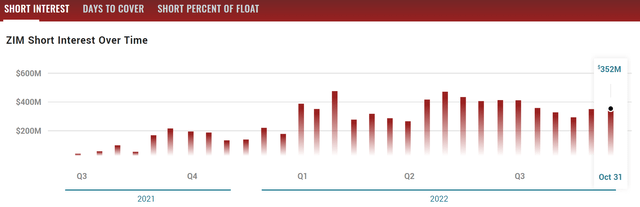

However, short interest on the stock surged to 22.7%, by far the highest level in recent years as you can see from the following two charts provided by MarketBeat. As seen from the first chart, the current short volume stands at 15M shares, representing 22.7% of the total number of shares floating (about 66M shares). Compared to the short volume in the previous month (13.58M shares), this month’s short interest surged by more than 10.4%. And from the second chart, you can see that last month’s short interest (about $352M in dollar amount) already ranks at a high level since 2021. With the further surge this month, the current short interest is among the highest level in recent years.

The signal is quite clear here to me: the market – or at least the many short investors – views ZIM’s profitability has already passed its peak in Q3, and its current stock prices cannot be supported by the fundamentals anymore.

And next, you will see why I strongly agree with the above view.

Source: MarketBeat.com data Source: MarketBeat.com data

ZIM: do not be misled by its dividend yield

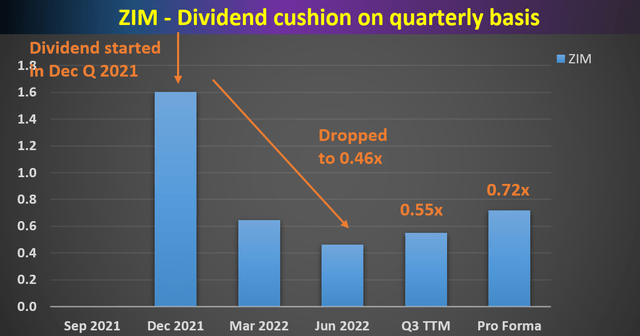

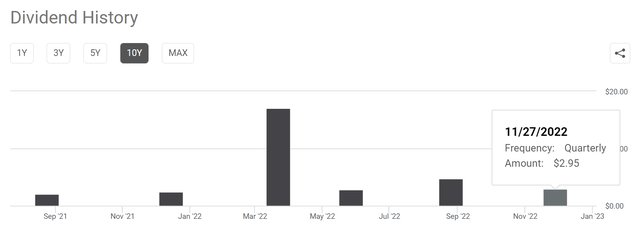

First off, by all means, do not be misled by the dividend yield. It is so erratic and uncertain (see the next chart below) that you should just totally ignore it. I am sure you won’t expect its 100%+ dividend yield (or 40%+ depending on how your slice the numbers) to last at all. Even if you are just hoping to apply the famous dividend capture strategy here (by timing your purchases and sales just to receive the fat dividends), there are still strong reasons against it. The dividend cut may come sooner and deeper than many ZIM bulls anticipate (as to be detailed by its dividend cushion ratio next) and the earnings decline could trigger a large price correction, leading to sizable total losses even if you manage to capture the dividend(s).

On a TTM basis, ZIM currently yields 100.6%. In its Q3 ER, it announced a dividend of $2.95 per share, which is about 30% of its income. If you assume the $2.95 dividend to last, then the annualized yield (i.e., the FW yield) would still be 43.8% at its current price.

On the surface, a 30% payout ratio is well-covered and safe. But, when its whole financial picture is considered by the dividend cushion ratio (DCR, a concept detailed in my earlier article) as shown in the next chart, its dividends are anything but safe. The DCR currently stands at 0.55x after taking into account its cash position, debt, CAPEX expenditures, and dividend obligations. It is far below the threshold level of 1x.

To drive the point further, let’s consider a pro forma analysis for its future dividends. The company lowered its full-year 2022 outlook in the Q3 ER. The guidance now expects Adjusted EBITDA in the range of $7.4 billion and $7.7 billion and Adjusted EBIT in the range of $6.0 billion and $6.3 billion (compared to $7.8~$8.2 billion and $6.3~$6.7 billion). The new guidance represents a cut of almost ~50% sequentially. And based on the lower end of the new guidance, its net income would be ~$300M. A 30% payout then translates into a dividend of around $0.75 per share. And as seen in the chart below, even assuming a $0.75 dividend forward, its DCR is still only 0.72x.

Its current DCR of 0.55x roughly means it would have to cut dividends if any earnings contractions occur in the next quarter or so. And the pro forma analysis shows that the dividend won’t be the same even when cut to $0.75. And next, we will see that there are many reasons to expect earnings contractions in the near future.

Source: Author based on Seeking Alpha data

ZIM: large earnings uncertainties ahead

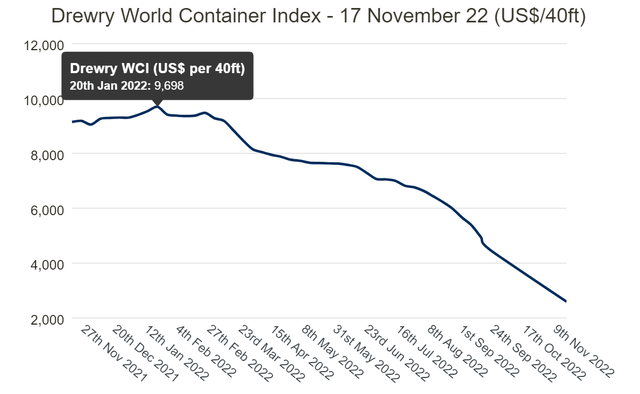

Let’s start with a broader perspective. The global shipping rates soured in the past 1 or 2 years, and the whole shipping sector (ZIM included) enjoyed spectacular profits as a result. As shown from the following Drewry’s report, the spot shipping container prices peaked above $10k in September 2021 and remained at that level till Jan 2022 (around $9698 at that time). To put these numbers under perspective, the five-year average shipping container prices have been about $3.7k only.

Such peak shipping costs simply cannot last. As seen, it started to drop in early 2022. The index decreased to $2,591 per 40ft container in the week of Nov 17, a 7% decrease even compared to the previous week. The current shipping rate is actually now far below the five-year average mentioned above now.

Looking ahead, I anticipate the shipping rates either continue to decline or stay at the current renormalized level. In the scenario of a widespread recession, the decline would continue rapidly and hurts ZIM’s profitability immensely.

ZIM: fundamentals cannot support its valuation

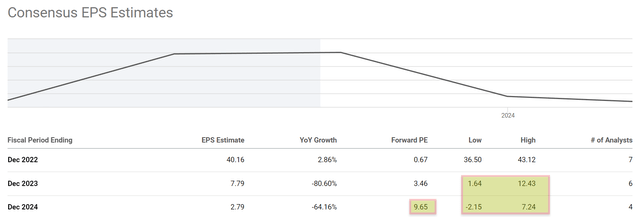

As shown in the following chart, despite the large uncertainties ahead, ZIM’s valuation is by no means cheap (again, you should ignore its current 0.67x P/E).

As aforementioned, ZIM’s earnings in the next few quarters face tremendous variances, as reflected in consensus estimates. As seen, especially those numbers highlighted in yellow, its FW P/E is 9.65x based on the 2024 EPS forecast. And note that this FW P/E is based off the mid-point of the consensus estimates, while the wide variance among the consensus estimates pretty much renders the mid-point to be meaningless. To wit, consensus estimates expect an EPS in the range of $1.64 to $12.4 for 2023. The high-end estimate of $12.4 is almost 8x higher than the low-end of $1.64. The variance is even larger for 2024, ranging from a loss of $2.15 to $7.24.

Source: Author based on Seeking Alpha data

Risks and final thoughts

To recap, I see too many risks ahead to support its current stock prices. The cheap valuation (0.67x P/E) and current dividend yield (100%+ or 40%+ depending on how you slice the data) are misleading. I foresee the freight rates to keep declining or to stabilize at the current renormalized level. A recession would further quicken the price decline and also hurt shipping volume at the same time. There could be some upside risks to my bear thesis too. The Russian/Ukraine war could end, and a global recession averted. On the other extreme, the government could interfere with freight rates to stabilize them at a profitable level for shipping companies if geopolitical conflicts keep escalating.

To conclude, the short interest in ZIM is currently near a peak level in multi years. And my interpretation of such a high level of short ratio is that ZIM’s profitability has passed its peak in Q3 2022 already. I see little chance for its current valuation (which is not cheap at all) to be supported given the risks ahead.

Be the first to comment