Delmaine Donson/E+ via Getty Images

Investment Thesis

Nu Holdings Ltd. (NYSE:NU) is growing extremely fast in the emerging markets of Brazil, Mexico, and Colombia. They are expanding their product range in a way that leads to strong synergy effects, which can be seen in the fact that customers are using more and more of Nu’s offers. In the future, they will benefit from the developing digitalization, which still has a lot of room to grow in South America. The company is now on the verge of profitability and should reach it next year. Since the IPO, the share price has fallen by 50% and now represents an attractive entry opportunity, in my view.

Nubank Overview

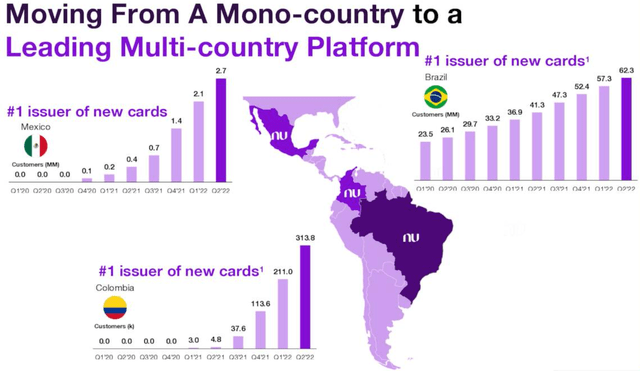

Nubank is a digital banking platform in Brazil, Colombia, and Mexico. The company’s goal is to build an entire ecosystem around money. A super app for saving, spending, investing, and borrowing money. In addition, the company also offers life insurance and mobile insurance. Comparable fintechs are Revolut or Wise (OTCPK:WPLCF) (an interesting company I wrote about here). Currently, they have 63M private and 2M small and medium-sized enterprises (SMEs) customers. More than 90% of customers come from Brazil, though they didn’t add Colombia as a market until Q1 2021 and Mexico in Q4 2020.

Nu Holdings earnings call presentation

Structural tailwinds in South America

In my research, I will focus primarily on Brazil, the most important market for Nu, although very similar trends apply to Colombia and Mexico. There are several structural tailwinds here. The first one is the age structure. Brazil has a very young population with an average age of 34 (U.S. 39; Europe 44). Younger populations are more likely to use online banking and digital payment options. In addition, Brazil also has stronger population growth: 0.7% in 2020 (in Mexico even 1.1%; USA 0.4%).

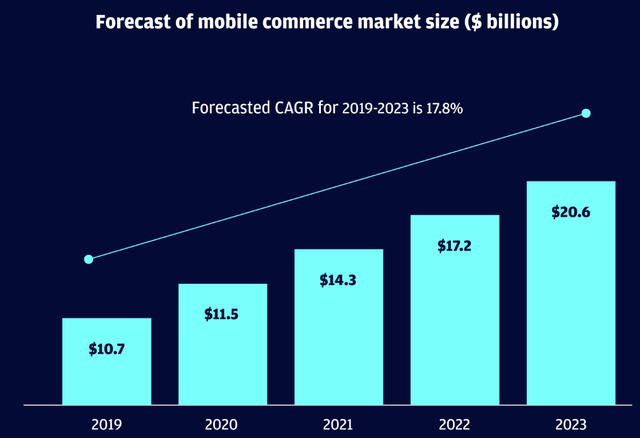

Another growth driver will be that online spending is still in a vital growth phase, comparable to Europe and the USA 10 – 15 years ago. The percentage of online shopping is still meager at 4.3%, “with 72 percent of the population yet to make their first online purchase” (JPMorgan research). For Nu, of course, it is not only online shopping that is important, but also that as many small businesses and merchants on the street as possible accept digital payment solutions. Overall, there is still much room for growth, as the infrastructure is not yet mature enough in terms of Internet access and high-quality cell phones that can also manage these digital solutions.

Just over four out of 10 Brazilians (41 percent) say their internet connection is too unstable to make online purchases, with Brazilian internet speeds (18 Mbps) almost three times slower than the global average of 49 Mbps.

JPMorgan research.

All in all, everything suggests that digital payment solutions and online banking will grow very strongly. It was important for me to mention all these points because a company with such a tailwind will find it much easier to continue growing.

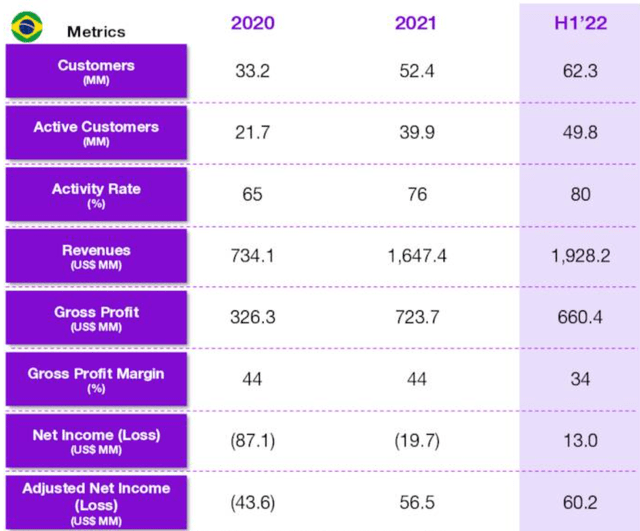

Exploding Customer Base

These are the figures for Brazil, which show explosive growth. The activity rate is particularly encouraging here, and the company already has positive cash flow in Brazil. Of course, the fintech industry was a big pandemic winner. The growth rate has slowed post-pandemic, but it is far from stagnant, as we saw at times with Netflix (NFLX), for example.

Nu Holdings earnings call presentation

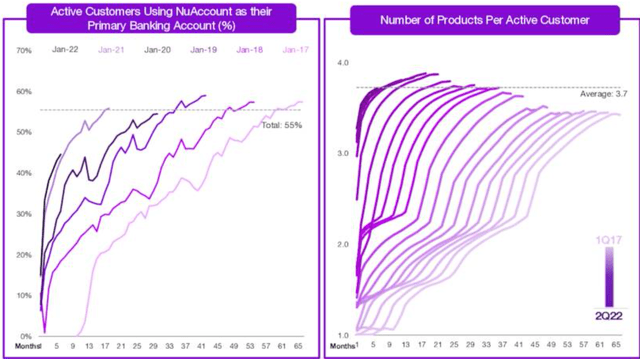

In the Nu ecosystem, it seems that over time customers become more loyal to the app and use more and more of the different products. This increases revenue per customer. They have some fantastic graphics in their investor presentation.

Nu Holdings earnings call presentation

This suggests that Nu has made some very effective improvements to its app. It seems to accelerate that customers are using the app as their primary bank account. Also, early customers from 2017 and 2018 started using only one of the products offered, whereas now, most start with several. This suggests that the company is doing an excellent job in offering additional services such as insurance or loans. I think the graph on the right is a bit misleading because the company probably had fewer products on offer in the beginning. Nevertheless, the trend seems to be very clear.

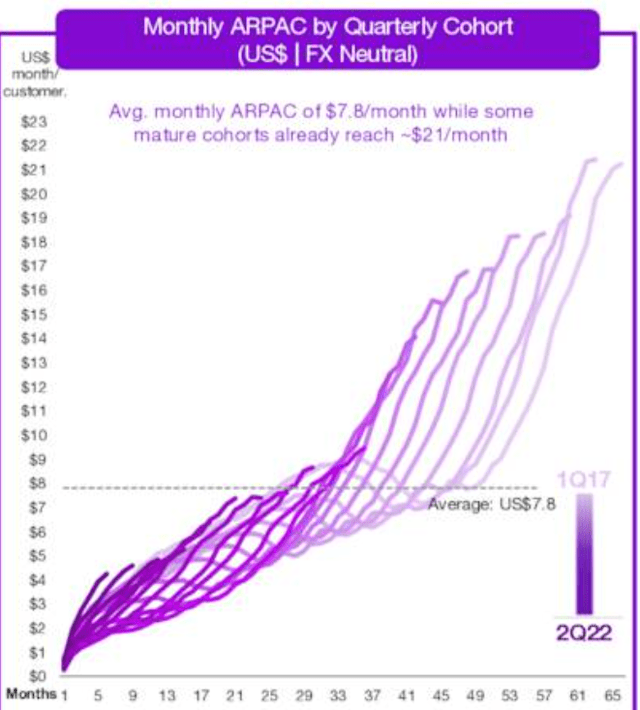

Especially in relation to the following chart: Revenue per customer. The current average is $7.8 per month per customer. However, here we see that the users become more and more valuable over time, generating increasing revenue as they use a greater number of the company’s offers. ARPAC is defined as average monthly revenue divided by the average number of individual monthly active users for a given period. I think this number is one of the most important, and I will observe this in further articles in the future. In Brazil, the market will eventually be saturated so further growth will come from more revenue per customer. In Colombia and Mexico, the company is only at the beginning of its development (this development is also essential to continue to monitor).

Nu Holdings earnings call presentation

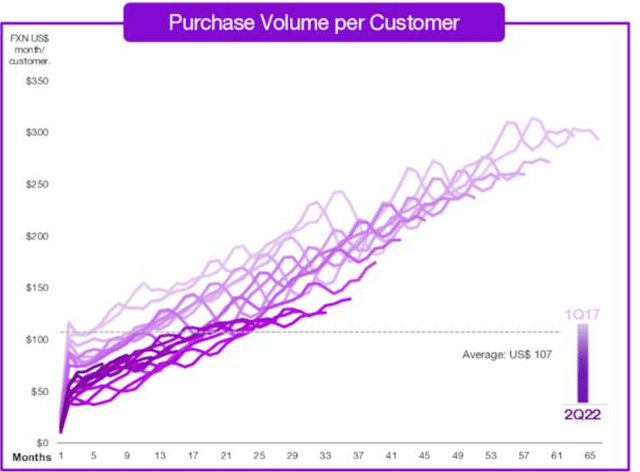

Another exciting and meaningful graph is the number Volume per customer. Here, we see a very similar picture: the longer a customer uses the app, the more he uses it for purchases. I understand this development very well, as a customer of Revolut. Their product is also better and more customer-friendly in all areas; therefore, I use their card more and more and my 15-year-old classic bank account less and less. It seems to me that Nu achieves in South America what I experience with Revolut in Europe.

Nu Holdings earnings call presentation

Recent Results & Valuation

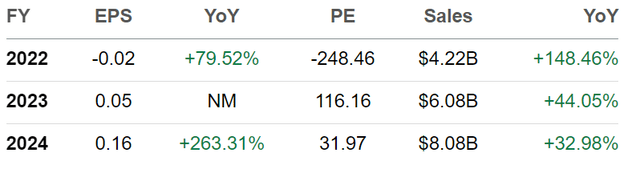

In the second quarter, the company achieved revenue of $1.16 billion, beating the consensus estimate of $1.04 billion. 2021 revenue was only $336.1 million. Overall, there was a loss per share of $0.01. Since the Brazilian business is already cash flow positive and the loss per share minimal, estimates suggest that the company will achieve positive earnings per share starting next year; according to Seeking Alpha, $0.05; according to Yahoo Finance, $0.07. At the current share price of $4.98, an EPS of $0.06 would correspond to a P/E ratio of 83.

I am usually very cautious about highly valued shares, but I must say that, in this case, the valuation does not seem too extreme if the estimates are halfway accurate. The stock’s actual value should only become apparent in the long term. Financially, the company is very healthy with $600M debt and $3.2B cash

Share Dilution and Insider Selling

One thing I always want to look at, especially with companies that are not yet profitable, is stock dilution and whether there is insider selling. But I have not found any data on this. According to Yahoo Finance, there was no insider selling in the last six months. Since the IPO, there has also been no significant share dilution.

Risks

Every company has risks, and fast-growing companies even more so. One of them is the exchange rate risk. The company generates its revenues in currencies other than the dollar and is, therefore, exchange-rate dependent when reporting EPS. However, the more the business grows in Colombia and Mexico, the less this risk will be, as the internal diversification will spread more over different currencies.

As mentioned at the beginning, while the company benefits from long-term tailwinds within the sector and the region, it is very dependent on the development of the economy in the short term. A recession would hit the company’s revenues hard as consumer spending would decline.

And, of course, there is a considerable risk of more competition. Many companies want to participate where a lot of money can be made. This development can also be observed in the fintech sector in developed countries. There are now many digital banks to choose from, and from the customer’s point of view, there is hardly any difference between them. Nu’s advantage is that it already has a vast customer base, as long-term customers change less frequently. However, it could make it more challenging to acquire new customers.

Conclusion

The growth potential continues to be enormous regarding the number of customers and their monetization. Nu could create a super app in South and Central America. As economic growth and purchasing power per person increase, the company will directly benefit. It is a speculative investment, but it seems to be an attractive risk-reward setting given the approaching profitability and the already massive user base.

Be the first to comment