Pijitra Phomkham/iStock via Getty Images

Investment Thesis

Illumina’s (NASDAQ:ILMN) technological advancements in gene sequencing aided the development of the genetic testing market by improving testing accuracy while also drastically lowering the cost of disseminating genome analysis data. However, it was the efforts of Invitae (NYSE:NVTA) that ultimately led to the revolutionization of the sector. By undercutting competitors on pricing and establishing reimbursement pathways with payors, NVTA democratized the market and paved the way for broader access to precision diagnostics and preventive screening.

Price as a mechanism to increase the size of the market and meet the unmet demand is definitely a tool. – Sean George, Q4 2017 Earnings Call

Despite its poor financials, the company’s paladin role gave it an air of legitimacy within the investment community. Many saw it as an industry pioneer leveraging its volume-based strategy and big data to grasp the connection between genes and health.

As we decrease cost, we expect to see an increase in content. As we add more content, we expect to see an uptick in volume. And as volume increases, we’re beginning to see an impact on payer discussions and revenue. We believe these four dominos become an engine for growth as we scale our business and will drive us toward future profitability. Q3 2015 Earnings Call

In my view, investors (and management) appear to have given up on the company’s strategy after spending many years chasing profitability, which for a long time seemed to be just around the corner. Gross margins haven’t increased with volumes, and despite its investment in clinical trials to establish germline mutation screening pathways, the lack of competitive moat hindered its ability to achieve an adequate return on investment. For example, the company studied germline mutations in prostate cancer using its biobank data, but I think this just encouraged its competitors to do the same. The US Supreme Court decision against Myriad (MYGN) restricting the patentability of DNA mutations allowed NTVA to enter the market but also lowered the ability to achieve ROI on its clinical trials, such as the one mentioned above. In other words, I believe that the premise that genetic testing is a commodity, which underlines the company’s business model, also underpins its lack of profitability. This sentiment was captured by NTVA’s co-founder:

Our view is that prices are going to come down in this space like they do in any generic industry where there is competition – Randy Scott Q1 2016 Earnings Call

One can’t lean on the leadership shuffling going on at the company. Key management positions have already been assigned to insiders, namely the CEO and Chairman roles, and I believe they are unlikely to disrupt the status quo, at least as much as an outsider would have. In the press release announcing the leadership transition, the company describes the new CEO (former COO) as “a growth-oriented business leader,” which, I believe, could result in the same profitless growth that led to eroding shareholders’ wealth in the first place.

As for what will happen to NVTA shares, I believe that the company will lower cash burn and beat EPS forecasts in Q3 after laying off a third of its workforce. Thus, there might be a tactical opportunity to capitalize on some volatility. But in the long term, I believe that its market position remains untested after spending the better half of the past decade building a market position with artificially low prices.

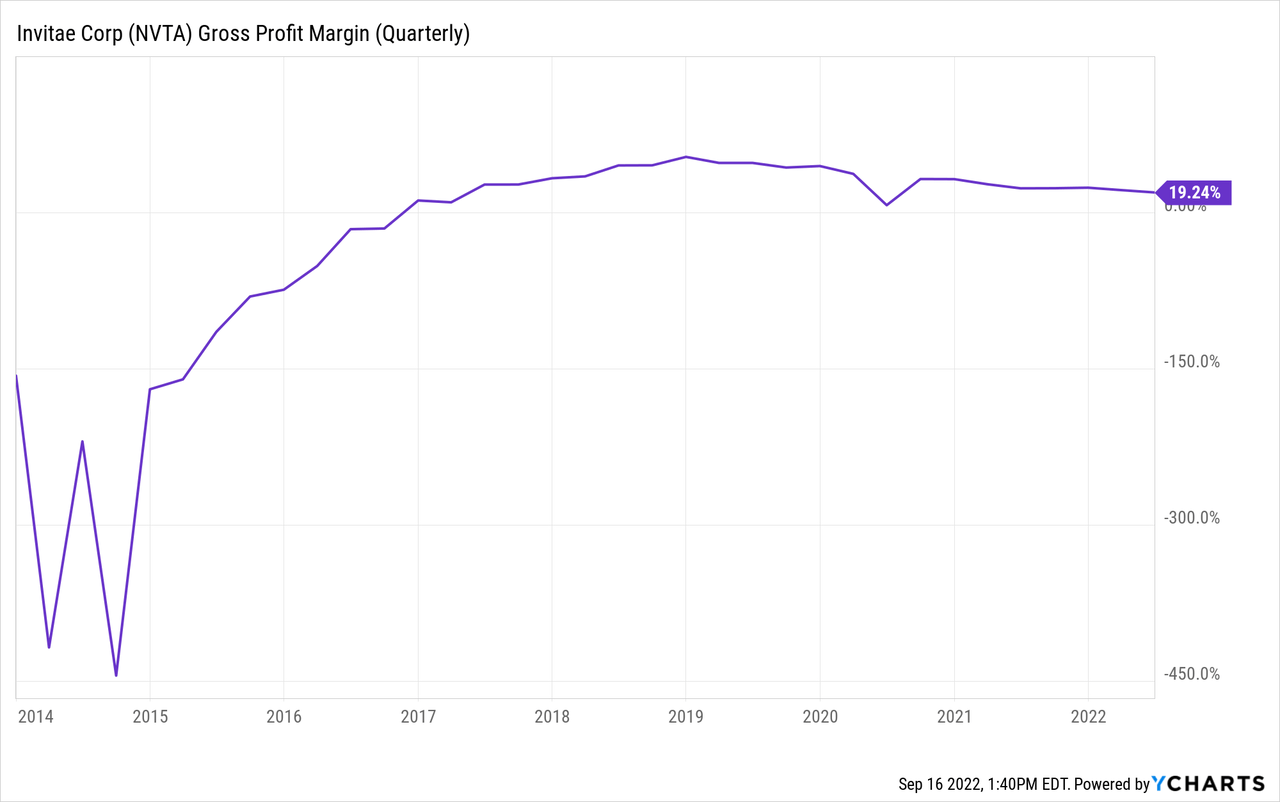

Margins

Early on, management laid out their plan of attack, which entailed a relentless focus on reducing the price of gene tests in order to create volume-based profitability. To achieve this goal, the company cut unnecessary expenses wherever possible and invested in expensive IT initiatives to streamline operations and increase productivity.

The reason we next focus on volume apart from its obvious measure of commercial success is because our business model is built on an assumption of scale. Randy Scott, Q1 2016

Every one of our sales reps would tell you that when they go out into a sale there leading with the mission, and that is that we are providing more affordable, high-quality genetic testing for patients and physicians. Randy Scott, Q4 2015 Earnings Call

However, this cost-cutting approach came at the expense of profitability. The turnaround plan crowned a long list of reneged promises and missed profitability deadlines, including the 2016 “inflection point,” 2018 “positive cash flow,” and the “50% gross margin” target throughout the years.

I feel management is part of the problem comparing NVTA’s business model to that of Amazon (AMZN) and requesting investors’ patience based on this premise.

So as we’ve often said, this is an Amazon like business model for genetics. And I think we’re seeing a lot of positive signs in-house we call it pound the rock. Randy Scott, Q4 2015 Earnings Call

Although one would be remiss not to exercise patience for an AMZN-like opportunity, I believe certain factors muddy the comparison. First, the genetic testing business is not as scalable as online retailing due to regulatory reasons. For example, the Clinical Laboratory Improvement Act framework “CLIA” requires NTVA to make available a technician to interpret the complex testing data for patients, increasing variable cost and decreasing scalability. Moreover, the healthcare sector is fragmented and inefficient, making it impossible for a company to achieve market dominance.

Valuation

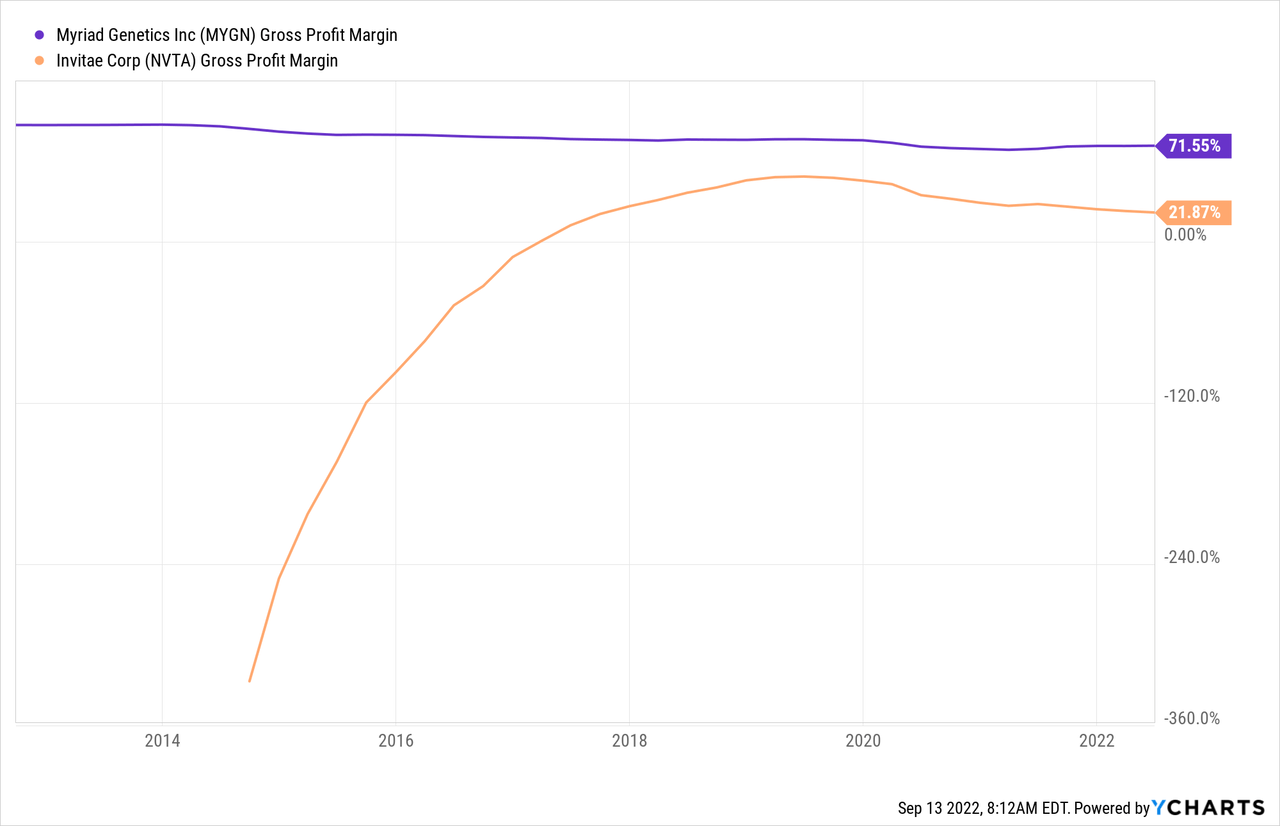

NVTA’s main rival, Myriad (MYGN), has been more conservative in its product pricing, earning more per test sold, as shown in the graph below. This admittingly cost it market share but left it with a stronger financial position, as mirrored in its superior balance sheet metrics.

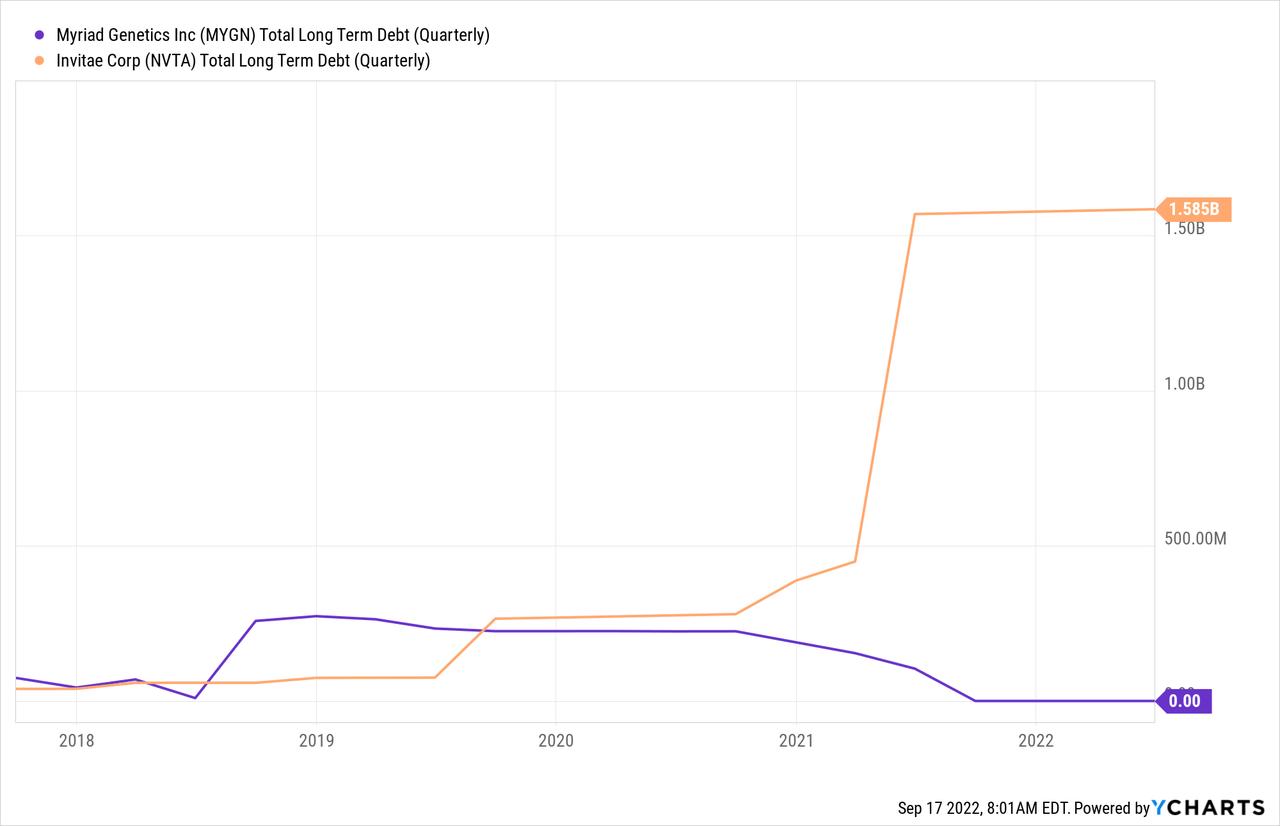

In pursuit of its volume-based business model, NTVA amassed $1.6 billion in debt, acquiring Ciitizen, Genosity, One Codex, and ArcherDX, to name a few. MYGN, on the other hand, has no long-term debt and, in my opinion, has been more cautious in its acquisitions.

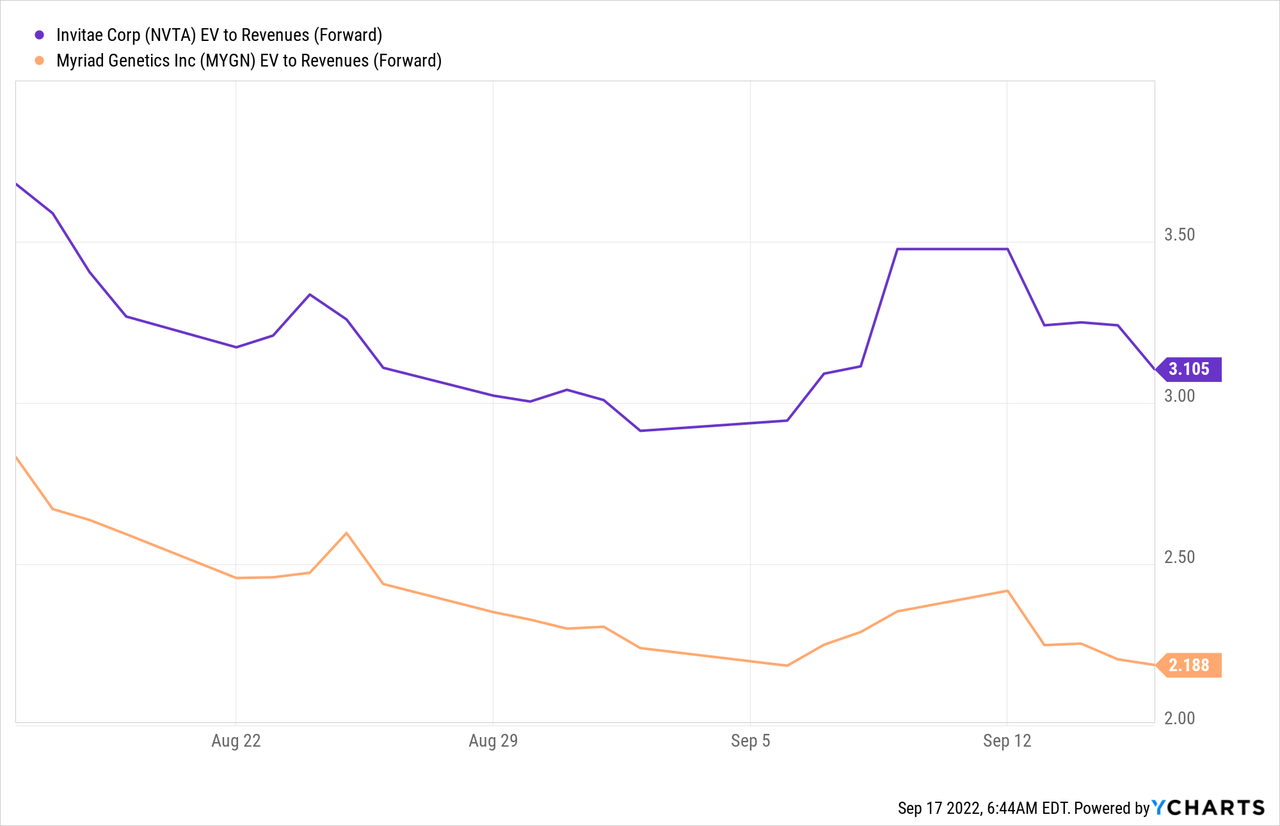

When the debt discrepancies between the two clinical diagnostic companies are taken into account, MYGN appears to be undervalued compared to NVTA. One way to incorporate debt in valuation comparison is to use EV/Sales multiples. Looking at the two rival companies, we see NVTA trading at 3.4x, while MYGN is trading at 2.4x EV/Sales.

How I Might Be Wrong

Our hold rating on NVTA reflects our view that the ticker will underperform its peers over the coming quarters due to increased competition in the genetic testing market, the abrupt exiting of the IVF business, and continued pressure to lower cash burn. However, one should note the ticker’s increasing volatility in recent months, mirroring the company’s high-risk/reward opportunity. These dynamics pose a threat to our hold hypothesis.

Moreover, even if NVTA underperformed its peers, there is a possibility that it would outperform the broader index. The gene testing market is expanding, offering an accommodative trend that casts uncertainty on our hold rating. For example, the company stands to profit from the rapid introduction of gene therapies fueled by recent technological advancements in molecular biology. For example, Spark Therapeutics sponsors a partnership with NTVA offering free genetic testing necessary to determine eligibility for its LCA medicine, Luxturna.

Summary

In summary, although NTVA stock is trading at a discount compared to its peers on some metrics, taking leverage and lack of profitability into account, the company seems to be trading at a premium valuation. Management appears to have lost focus on their top priority, increasing sales through lowering prices while at the same time trying to compensate for the lack of profitable sales growth with expensive acquisitions of smaller rivals.

As part of its plan to turn things around, management cut nearly a third of the workforce. I believe that this should be good for EPSand cash flows in the third quarter, giving investors a chance to take advantage of recent volatility in the short term.

In my view, investors seeking a defensive position in the healthcare sector or exposure to the genomics industry are better off trading in market leaders with established market dominance, such as Laboratory Corporation of America (NYSE:LH) and Quest Diagnostics (NYSE:DGX) or NVTA suppliers such as ILMN, Qiagen (NYSE:QGEN) and Roche (OTCMKTS:RHHBY.)

Be the first to comment