Sean Gallup

Thesis

Although significant macro-economic challenges – most notably supply chain disruptions for semiconductors and the zero-COVID headwinds in China – continue to pressure Volkswagen’s (OTCPK:VWAGY) fundamentals, Europe’s largest carmaker delivered a solid Q3 2022. Investors should consider that, while most macro headwinds will likely turn out to be temporary, Volkswagen’s EV strategy gains momentum and the company’s long-term outlooks skew favorably.

As compared to the company’s fundamentals and future potential, Volkswagen stock continues to trade too cheap to ignore – priced at a one year forward P/E of x3.

Although I slightly downgrade my EPS expectations through 2025, continue to see enormous potential for price appreciation – calculating a EUR 322.42/share target price (VOW.DE reference; approximately $33/share US-listed VWAGY reference).

Volkswagen Delivers Strong Q3

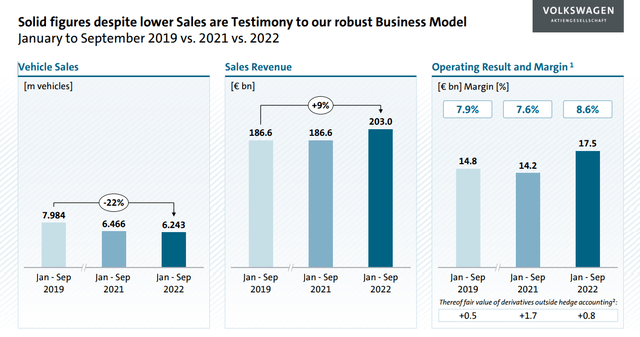

Despite macro-economic headwinds, that are especially aggressive in Volkswagen Group’s core/home market, the largest European automotive conglomerate delivered solid results.

During the period from July to end of September, Volkswagen Group generated total revenues of EUR 70.7 billion. This compares very favorably to the same period in 2021, when the group recorded revenues of EUR 56.9 billion (24% year over year growth). Operating profit for the period came in at EUR 4.3 billion, which was approximately 53% higher than in Q3 2021, although ‘supply chain requirements’ pressured the group’s operating performance and the business in China was strongly affected by zero-COVID policies despite high demand.

But in any case, investors should consider that a EUR 4.3 billion operating income would translate into an annualized yield of greater than 20% (for reference, Volkswagen’s market capitalization is currently priced at around EUR 84 billion).

Outlook Remains Solid

The Group has confirmed its previous outlook for 2022 and expects sales to be between 8% to 13% up versus 2021 – as strong pricing power more than offsets flat year over year sales volume. The operating margin in 2022 is estimated to fall somewhere between 7% and 8.5%, which would translate into approximately EUR 21.5 billion of profits at mid-point assumptions.

As potential challenges going into 2023, management named (1) [the] economic environment, (2) increasing competitive intensity, (3) volatile raw material and foreign exchange markets, (4) securing supply chains, (5) and stricter emissions-related requirements. But management has also voiced confidence that supply bottlenecks should ease in Q4 2022.

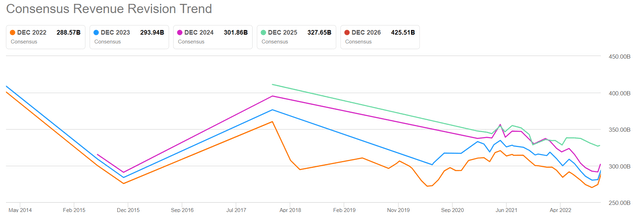

Notably, it appears that revenue expectations for the Volkswagen Group in 2023 and 2024 have bottomed out, and analysts have started to revise their estimates upwards. Thus, market timers could consider the current rebound as a possible inflection point.

EV Strategy Gaining Momentum

Investors are arguably well advised to acknowledge that most macro headwinds that pressure Volkswagen are likely temporary and should gradually fade once economic conditions improve.

Meanwhile, the Group continues to make excellent progress towards the ‘New Auto’ strategy, as BEV deliveries become the company’s key growth driver. In Q3 2022, fully electric vehicles accounted for 6.8% of total deliveries. Year to date, Volkswagen delivered 366,400 battery-electric-vehicles, which represents a more than 25% year over year growth versus the first nine months in 2021. The Volkswagen Group said that the BEV order book in Western Europe alone has grown to over 350,000 vehicles. Notably, despite significant headwinds due to zero-COVID, China remained the Group’s key growth engine.

Valuation Is Cheap

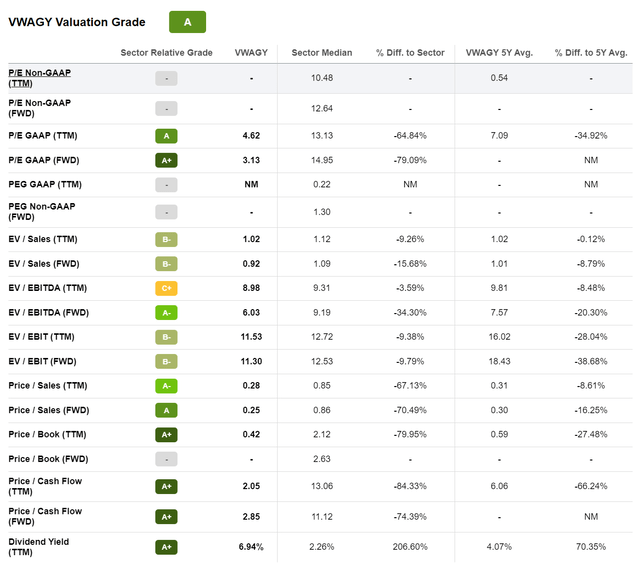

As compared to the company’s fundamentals and future potential, Volkswagen stock continues to trade cheaply – priced at a one year forward P/E of x3 and a P/S of x0.25. According to data compiled by Seeking Alpha, the company’s P/E and P/S are valued at a discount to the comparable sector median of approximately 80% and 70% respectively.

Residual Earnings Model: Update Target Price

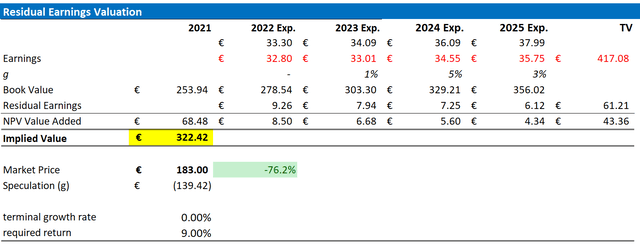

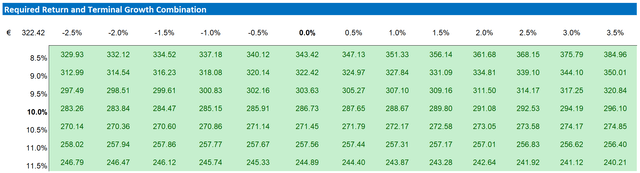

Reflecting on macro headwinds and supply chain challenges, I adjust my residual earnings model for Volkswagen to account for somewhat lower EPS expectations through 2025. However, I continue to anchor on a 9% cost of equity and a 0%, terminal growth rate (which I continue to regard as very conservative).

Given the EPS updates as highlighted below, I now calculate a fair implied share price of EUR 322.42, versus EUR 325.95 prior (European-listing VOW.DE reference; approximately $33/share US-listed VWAGY reference)

Analyst Consensus, Author’s Calculations

Below is also the updated sensitivity table.

Analyst Consensus EPS Estimates; Author’s Calculation

Risks To Consider

As I see it, there has been no major risk-updated since I have last covered Volkswagen stock. Thus, I would like to highlight what I have written before:

… investors should monitor the following: 1) slowing consumer confidence due to inflation outpacing wage growth; 2) geopolitical risks including the Ukraine war and Volkswagen’s exposure to China; 3) supply-chain challenges including semi-conductor shortages, which could become even more challenging due to the Covid-19 lockdowns in China; 4) higher than expected CAPEX and R&D investments in order to realize the strategic repositioning towards an electric mobility provider; 5) timid EV adoption due to concerns about the EV technology and charging infrastructure build-up; 6) macro-economic uncertainty relating to the monetary policy actions of the ECB and actions of the European/German government against Russia.

Conclusion

Investing in Volkswagen stock remains a solid value play, as the company’s valuation is mispriced versus fundamentals and investor sentiment somehow fails to appreciate the long-term potential of the carmaker’s EV strategy.

Investors should consider that there are not many opportunities when a global industry leader is priced at a one year forward P/E of x3 and a P/S of x0.25.

I reiterate my ‘Buy’ rating for Volkswagen stock, although I slightly lower my target price to EUR 322.42 /share ( approximately $33/share US-listed VWAGY reference).

Be the first to comment