monsitj

Investment Thesis

Enphase Energy (NASDAQ:ENPH) and First Solar (NASDAQ:FSLR) have been handsomely rewarded thus far, due to the massive boost from the Inflation Reduction Act and the upbeat development in California’s solar incentive program. It is no wonder, since the global renewable energy market is expected to aggressively expand to $1.99T in value by 2030, at a CAGR of 8.6%. The global solar energy demand is also expected to grow tremendously from one Terawatt in April 2022 to 2.3 Terawatt by 2025, with China accounting for approximately 30% of that demand, while the EU and the US doubled to 2.86% and 2.95%, respectively.

It comes as no surprise, then, that ENPH experiences no slowdown in global demand, with healthy bookings through Q1’23 despite the rising inflationary pressures. FSLR reported even more impressive backlogs through 2027, tremendously expanding by 31.15% QoQ to 58.1 GWs by the latest quarter, with total booking opportunities of up to 114 GW. There is absolutely no destruction of demand here, indeed.

Mr. Market Has Optimistically Awarded ENPH & FSLR With Massive Baked-In Growth

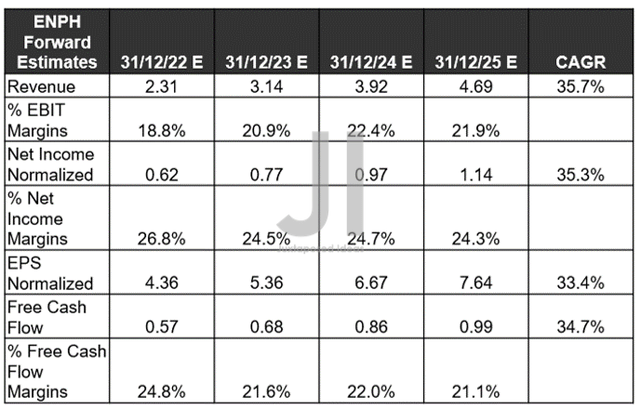

ENPH Projected Revenue, Net Income (in billion $) %, EBIT %, and EPS, FCF %

Due to its excellent FQ3’22 earnings call, ENPH has proven our previous sell rating terribly wrong due to the subsequent rally. It is natural, then, that the company is expected to further deliver an upgraded top and bottom line growth of 9.06% and 16.32% through FY2025, since our previous analysis in August 2022. Notably, market analysts project that the company will deliver impressive YoY revenue growth of 35.93% despite the potential recession in 2023, while expanding its profitability by 22.93%.

Through ENPH’s recent GreenCom acquisition and ClipperCreek, there is no doubt that the company will consolidate its renewable offerings and offer a complete system for home energy management, complete with EV chargers, IQ8 Microinverters, IQ batteries, and third-party solar panels. The management has already guided an early launch in the US by H1’23 and potentially the EU afterward.

We expect this market segment to perform exceedingly well, due to the early promising signs of 70% QoQ and 136% YoY revenue growth in the region. Though the US still comprises 70.13% of ENPH’s revenues by FQ3’22, it is likely that the EU may outpace the former, since the EU government expects to rapidly expand the adoption of EVs from 1.2M in 2020 to 30M by 2030, while growing the total solar installation from 165 GW to 1 TW at the same time.

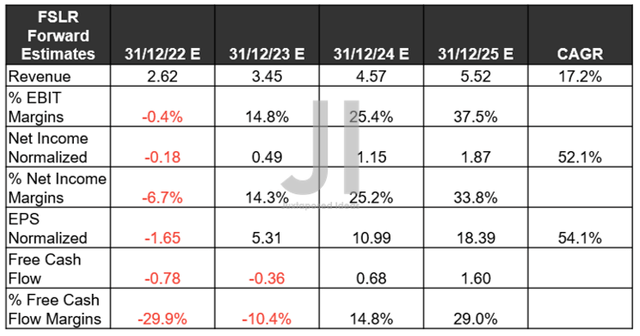

FSLR Projected Revenue, Net Income (in billion $)%, EBIT %, and EPS, FCF %

In the meantime, FSLR has also been massively upgraded by market analysts, with notable top and bottom line expansion by 11.29% and 17.64%, since October 2022. The company is now expected to grow at a more ambitious revenue CAGR of 17.2% and EPS CAGR of 54.1%, against hyper-pandemic levels of -2.3% and 48.2%, respectively. The expansion in its profitability is impressive as well, given the projected EBIT margins of 37.5%, net income margins of 33.8%, and FCF margins of 29% by FY2025.

Naturally, this is assuming that there is no cancellation of orders over the next few years, as currently experienced by Taiwan Semiconductor Manufacturing Company Limited (TSM) due to the peak recessionary fears and semiconductor chips inventory correction. It is important to note that the energy industry is a highly cyclical industry as well, as with the semiconductor, housing, and shipping markets. Assuming that the renewable energy sector takes on the same nature due to the massive inflow of demand and supply, we may see part of this optimism easily digested before FSLR’s final delivery in 2027. The latter three end markets are already on their down cycles post-pandemic highs, prompting tragic forward guidance and stock losses thus far.

We are already starting to see some early signs of this happening, with many Chinese solar panel producers, such as Daqo New Energy (DQ), Tongwei, and GCL, expecting to aggressively produce up to 1,010K MT polysilicon by 2024 (or the estimated equivalent of 336 GW capacity, based on 1.2 kg per 400W solar panel). That would indicate a massive increase of up to 353.14% over the next two years, potentially triggering a supply glut in the solar market, since it is incremental to the total domestic supply output of over 3 MT at the same time. That event would definitely put a damper on solar prices and, thus, a deceleration in Capex growth moving ahead.

Then again, with the solar tariff still in place, Chinese-made solar panels remain unwelcomed in the US and, soon, the EU. Therefore, potentially alleviating some of these headwinds. We’ll see, since FSLR only expects to report an annual production capacity of 10.7GW by 2026 within the US and another 10GW internationally by 2025. These numbers seem reasonably cautious, indicating the management’s prudent expansion despite the record-high backlog thus far. Perhaps, this is due to its massive concentration of bookings in the US at 88%, in order to take full advantage of the Inflation Reduction Act.

In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- First Solar: Mr. Market Overcompensates – Don’t Be Trapped By The Rally

- Enphase: Time To Sell And Cash In This Stellar Stock

So, Are ENPH & FSLR Stocks Buy, Sell, or Hold?

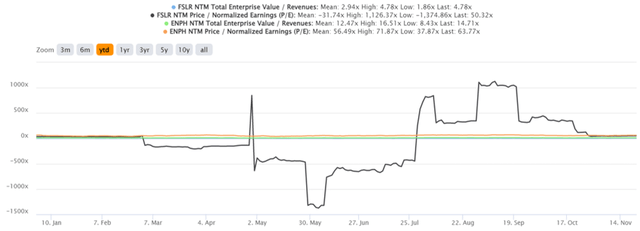

ENPH & FSLR YTD EV/Revenue and P/E Valuations

As a result, it is no wonder that both ENPH and FSLR are trading at an extreme premium now. The former is currently at an EV/NTM Revenue of 14.71x and NTM P/E of 63.77x, nearing its YTD high of 16.51x and 71.87x, respectively. At $320.44, the stock is obviously nearer to its 52 weeks high of $324.84 and at an eye-watering premium of 282.57% from its 52 weeks low of $113.40.

If one had thought that was extraordinary, FSLR is even more absurd, trading at EV/NTM Revenue of 4.78x and NTM P/E of 50.32x. These numbers represent a record-breaking jump from its previous normal valuations of 1.09x and 9.75x, respectively, prior to these hyper optimism levels. The stock had recorded an extreme 218.42% rally since its FQ2’22 earnings call on 27 July 2022. Thereby, maxing out its potential, given the minimal 1.57% upside from consensus price targets.

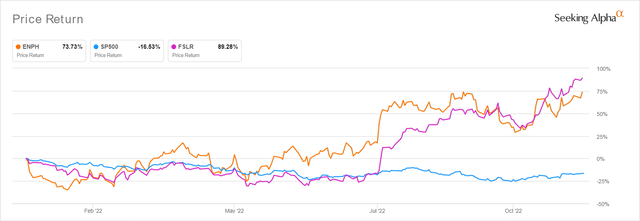

ENPH & FSLR YTD Stock Price

Needless to say, both stocks are riding the massive tsunami of confidence, especially after the upbeat October CPI. 75.8% of market analysts now expect the Feds to pivot earlier, with a 50 basis points hike in December, similar to the Bank of Canada’s recent moderation. Assuming so, we would likely see the whole market lift above these peak recessionary fears, despite the raised terminal rates to over 6%. Naturally, it remains to be seen if these sentiments can sustain through the rest of the hikes in 2023, though we are less hopeful given the extremely rich valuation limiting their upside potential. Digestion will come sooner or later.

Therefore, ENPH and FSLR remain as Holds for those who remain convinced of their potential next decade. Otherwise, some may want to take some of those handsome profits off the table, since Mr. Market will be quick to punish once growth decelerates and sentiment normalizes. The same has been observed for high-growth tech stocks previously well-loved by market analysts and now, overly battered due to the slowing top and bottom line growth during these catastrophic market-wide corrections.

On the other hand, investors who add ENPH and FSLR now will likely underperform in the long term, due to the minimal margin of safety. Patience will definitely pay off better, with our price target of low $200s for ENPH and low $100s for FSLR. Do not chase the current rally.

Be the first to comment