Abu Hanifah/iStock via Getty Images

With investors expecting consumer prices to fall month-over-month heading into the day, this morning’s higher-than-expected headline and core CPI reports caused an instantaneous reversal in market sentiment heading into the opening bell. While equity index futures were indicating a gain of around 75 basis points heading into the print, after the release, indications were for a decline of 2%. When the opening bell finally rang, the S&P 500 gapped down 2.27% as indicated by the tracking ETF – SPY.

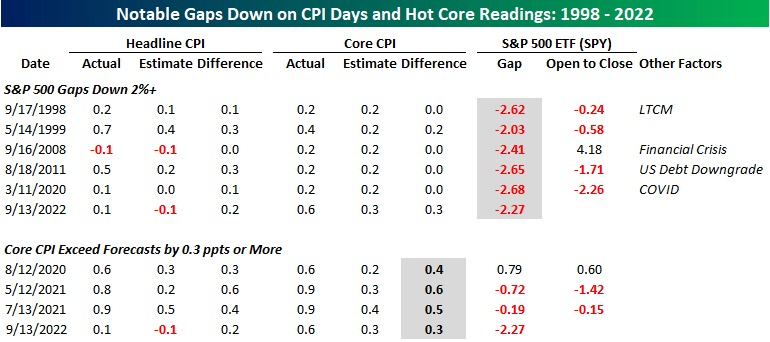

Going back to 1998, today marked just the sixth time that SPY gapped down in excess of 2% on the day of a CPI release. As shown in the top of the table below, on four of the five prior 2%+ gaps down on CPI days, SPY not only gapped down by over 2%, but it continued lower throughout the trading day. While that doesn’t necessarily bode well for today, we would note that on many of those prior occurrences, there were other overriding factors impacting the market. From the Russian debt default and collapse of Long-Term Capital Management (LTCM) in 1998 to the Financial Crisis in 2008, the US debt downgrade in 2011, and then COVID in 2020, on most of these other days, investors had other issues besides inflation to worry about. The only time that there wasn’t another major issue impacting the market was on 5/14/99 when headline CPI exceeded forecasts by 0.3 ppts and core CPI exceeded consensus estimates by 0.2 ppts.

At the bottom of the table, we have listed every other time since 1998 that core CPI exceeded consensus forecasts by 0.3 ppts or more. Today’s report is just the fourth time that core CPI has topped estimates by such a wide margin, but what stands out most is that every other prior occurrence since 1998 came after COVID. We noted numerous times in the past how COVID has created so many distortions in the economy that the job of forecasting it has become exceedingly difficult, and the fact that every ‘beat’ of this magnitude in core CPI has occurred since COVID only reinforces this point.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment