CatLane/E+ via Getty Images

If you have owned a home long enough, it is a guarantee that at some point you will have to worry about that home’s roof. And unless you are homeless, a roof of some form had to, at one point, been placed above your head. One company on the market that is described as the largest publicly traded distributor of roofing materials and complementary building products in North America is Beacon Roofing Supply (NASDAQ:NASDAQ:BECN). Over the past three years, the financial picture of the company has been quite positive. This year, in particular, growth continues to impress. Add on top of this the fact that shares of the company look quite cheap and it is definitely worth some consideration. To be fair, some investors may be worried about the state of the housing market, with rising interest rates, rising inflation, and other concerns potentially proving to weaken the demand for housing and, in turn, weaken the demand for roofing materials as property owners might choose to delay costly replacements or repairs until some point in the future. But even if the company sees its financial performance drop back to the kind of levels experienced in 2020, it’s difficult to say that shares are unattractively priced.

A roof over your head

As I mentioned already, Beacon Roofing Supply operates as a distributor of roofing materials and complementary building products. As of the end of its latest completed fiscal year, the company ran its operations out of 446 branches that were spread across all 50 States and throughout six provinces in Canada. The company currently has a rather significant portfolio of products comprising over 100,000 SKUs that it uses to serve more than 80,000 customers in both the residential and non-residential markets. To keep track of it all and to optimize business activities, the company operates something called the Beacon OTC Network. This is an operating model where the branches the company has are networked for the purpose of sharing inventory, fleet, equipment, systems, and even employees, all for the purpose of optimizing the customer delivery experience. Though not ubiquitous yet, the company is moving in that direction. As of the end of the latest fiscal year, these networked branches totaled 250 in all.

Although the company may seem like a low-tech outfit, management does take pride in some of the digital initiatives the company has undertaken. For instance, the company currently has a software solution called Beacon PRO+ that operates as its proprietary digital account management suite. Through this, customers are able to manage their business with the enterprise online. The company also has another software solution called Beacon 3D+ that operates as a roofing estimating tool for its residential customers. Customers are also able to search the catalog of products the company has, accessing real-time pricing. Customers are also able to place orders, track deliveries, monitor local storm activity, and more through the company’s software solutions.

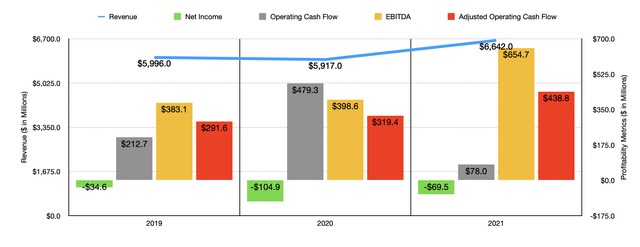

Normally when I analyze a company, I like to look at fundamental performance covering five years. Sadly, this is not always possible to do with accuracy. In the case of Beacon Roofing Supply, the picture is complicated by the fact that, in early 2021, the business completed the sale of its interior products and insulation businesses in exchange for $850 million in cash. Because of the timing of this transaction, we only have financial statements that would be comparable for the past three years ending in 2021. What data we do have, however, does look promising. Considering revenue, between 2019 and 2021, sales for the company grew from $6 billion to $6.64 billion. This increase was driven by strong demand for both residential and complementary products across all the regions in which the company operates. It also was successful in raising prices for its three main product lines. These are the residential roofing products, non-residential roofing products, and complementary building products that it sells. The greatest growth for the company (from a dollar perspective) from 2020 to 2021 when essentially all of that revenue increase took place came from the residential roofing products category, with revenue skyrocketing by 14.2%.

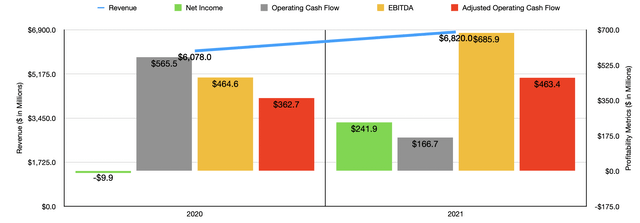

The picture for the business, it should be said, is rather odd because management elected to move their year-end reporting period to December of each year. This has resulted in two different measures of annual performance for the 2020 and 2021 fiscal years. Using the new time period the company elected, sales last year would have been $6.82 billion instead of $6.65 billion. And for 2020 it would be $6.08 billion. Management attributed this move to the company’s desire to better align their financial reporting calendar with many of the other players in the space and to provide internal benefits by shifting the timing of budgeting, physical inventory, and performance review cycles away from the busiest time of the year for it. This also happened to coincide with multiple transactions that occurred near the end of last year, including the sale of its solar products business, an entity that generated about $111 million in sales annually.

Profitability for the company has been a bit more complicated to understand. In each of the past three years, for instance, net income came in negative. And on that front, there was no real trend. However, operating cash flow was positive, even though it was volatile. After rising from $212.7 million in 2019 to $479.3 million in 2020, it then plunged to $78 million last year. But if we were to adjust for changes in working capital, it would have risen consistently, climbing from $291.6 million to $438.8 million. Meanwhile, EBITDA for the firm also improved nicely, climbing from $383.1 million to $654.7 million over the same window of time.

Once again, we also need to pay attention to the updated financial results of the company to account for the transition period. Net income in 2020 using this convention was negative to the tune of $9.9 million. In 2021, profits rose to $241.9 million. Adjusted net income, meanwhile, rose from $198.6 million to $394.4 million. Operating cash flow did fall, dropping from $565.5 million to $166.7 million. But if we adjust for changes in working capital, it would have risen from $362.7 million to $463.4 million. Meanwhile, EBITDA for the company also increased, climbing from $464.6 million to $685.9 million.

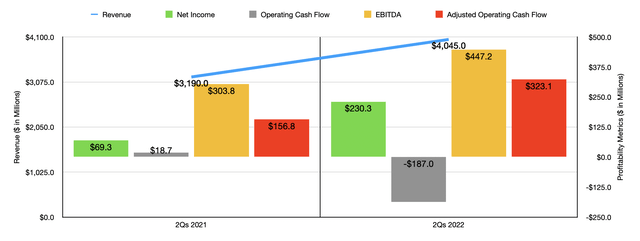

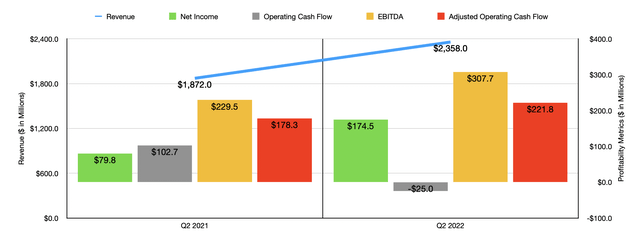

When it comes to the 2022 fiscal year, the company has continued to see strong performance. Revenue in the first half of the year came in at $4.05 billion. This is 26.8% higher than the $3.19 billion seen just one year earlier. Growth in the second quarter alone was still robust, with sales of $2.36 billion coming in 26% above the $1.87 billion achieved last year. Once again, the company has continued to benefit from favorable industry conditions. On the bottom line, performance has also been favorable. Net income in the first half of last year came in at $69.3 million. This increased to $230.3 million in the first half of 2022. Operating cash flow did decline, dropping from $18.7 million to negative $187 million. But if we were to adjust for changes in working capital, it would have more than doubled from $156.8 million to $323.1 million. Meanwhile, EBITDA for the company also improved, climbing from $303.8 million to $447.2 million.

Although investors might be worried about current market conditions, management remains hopeful for the future. Their current goal, despite problems in the industry, is to grow sales to $9 billion per year by 2025. That implies an annualized growth rate of roughly 8%. In that vein, the company has embarked on a number of interesting transactions. In April of this year, for instance, the company announced the acquisition of Wichita Falls Builders Wholesale for an undisclosed sum. The company also completed, in early June, the acquisition of Complete Supply. Even as the company continues to invest for growth, it also seems to be committed to the idea of buying back stock. In June of this year, the company announced one of two accelerated share repurchase programs. This particular repurchase was in the amount of $250 million and followed one from March in the amount of $125 million.

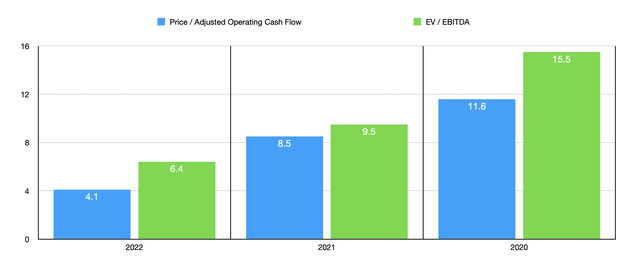

Unfortunately, we don’t really know what to expect in the near term. But if we were to annualize results experienced so far in 2022, we should anticipate adjusted operating cash flow of $904.2 million and EBITDA of $963.7 million. This implies a forward price to adjusted operating cash flow multiple on the company’s shares of 4.1 today. That compares to the 8 multiple we would get if we were to use data from the revised 2021 fiscal year and the 10.2 if the company were to revert back to the kind of profitability seen back in 2020. The EV to EBITDA multiple of the business, meanwhile, should come in at 6.4. That’s down from the 9 we would get if we used figures from 2021 and compares to the 13.3 we would get if we used data from 2020. As part of my analysis, I also compared the company to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 4.7 to a high of 21.5. In this case, Beacon Roofing Supply was the cheapest of the group. And using the EV to EBITDA approach, the range would be from 3.4 to 10.7. In this scenario, two of the five companies were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Beacon Roofing Supply | 4.1 | 6.4 |

| Owens Corning (OC) | 4.7 | 4.5 |

| Builders FirstSource (BLDR) | 4.9 | 3.4 |

| Gibraltar Industries (ROCK) | N/A | 7.7 |

| Applied Industrial Technologies (AIT) | 21.5 | 10.7 |

| MSC Industrial Direct Co. (MSM) | 11.9 | 9.7 |

Takeaway

These are rather volatile times and I can understand why investors would want nothing to do with the construction space. In the near term, it is true that the industry could experience some pain. However, in the long run, so long as population growth continues, I suspect that this would be a good place to be invested. Shares of this particular player, Beacon Roofing Supply are incredibly low on a forward basis now. But even if financial performance reverts back to what it was in 2021 or even 2020, shares don’t look outrageously pricey. In fact, using the 2021 figures, I would still argue that they’re trading on the cheap. Because of these reasons, I have decided to rate the business a solid ‘buy’ at this time.

Be the first to comment