takasuu

IWS strategy and portfolio

The iShares Russell Mid-Cap Value ETF (NYSEARCA:IWS) has been tracking the Russell Midcap Value Index since 7/17/2001. IWS has 699 holdings, a distribution yield of 1.78% and an expense ratio of 0.23%.

As described in the prospectus by iShares, “The Underlying Index measures the performance of equity securities of Russell Midcap Index issuers with relatively lower price-to-book ratios, lower sales-per-share historical growth and lower forecasted growth”. It represents about 67% of the total market value of the Russell Midcap Index. The turnover was 21% of the average portfolio value in the last fiscal year.

IWS invests almost exclusively in U.S. based companies (98.7% of asset value). Hereafter, I will use as a benchmark the parent index, represented by the iShares Russell Mid-Cap ETF (IWR). As expected, IWS is cheaper than IWR regarding usual valuation ratios, reported in the next table.

|

IWS |

IWR |

|

|

Price/Earnings TTM |

15.15 |

17.35 |

|

Price/Book |

2.2 |

2.8 |

|

Price/Sales |

1.44 |

1.68 |

|

Price/Cash Flow |

11.31 |

13.28 |

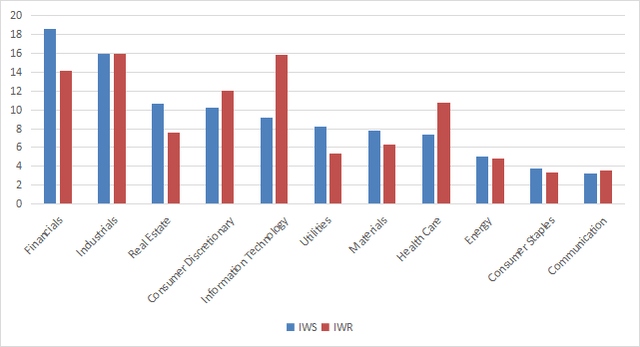

The top 3 sectors are financials (18.6%), industrials (15.9%) and real estate (10.7%). Compared to IWR, the fund overweights financials, real estate, utilities and materials. It underweights mostly technology and healthcare.

IWS sector breakdown (Chart: author; data: iShares)

The top 10 holdings, listed in the next table with valuation ratios, represent 6.4% of asset value. The heaviest one weighs less than 1%, so risks related to individual stocks are very low.

|

Ticker |

Name |

Weight |

P/E TTM |

P/E fwd |

P/Sales TTM |

P/Book |

P/Net Free Cash Flow |

Yield% |

|

Phillips 66 |

0.74 |

4.67 |

6.80 |

0.30 |

1.75 |

12.19 |

4.11 |

|

|

Corteva, Inc. |

0.69 |

39.94 |

21.48 |

2.56 |

1.77 |

N/A |

0.96 |

|

|

Aflac, Inc. |

0.66 |

10.61 |

12.27 |

2.22 |

1.80 |

15.67 |

2.41 |

|

|

Motorola Solutions, Inc. |

0.65 |

37.79 |

22.94 |

5.05 |

N/A |

91.12 |

1.37 |

|

|

Nucor Corp. |

0.65 |

5.69 |

12.95 |

1.01 |

2.27 |

5.51 |

1.25 |

|

|

Realty Income Corp. |

0.64 |

61.93 |

48.49 |

13.08 |

1.53 |

82.24 |

4.50 |

|

|

Biogen, Inc. |

0.63 |

14.62 |

16.78 |

4.31 |

3.25 |

19.12 |

0 |

|

|

DuPont de Nemours, Inc. |

0.59 |

6.35 |

20.06 |

2.78 |

1.37 |

N/A |

1.90 |

|

|

The Williams Cos., Inc. |

0.59 |

19.11 |

18.46 |

3.40 |

3.39 |

38.40 |

5.72 |

|

|

Prudential Financial, Inc. |

0.58 |

N/A |

8.55 |

0.67 |

2.33 |

5.18 |

4.86 |

Performance

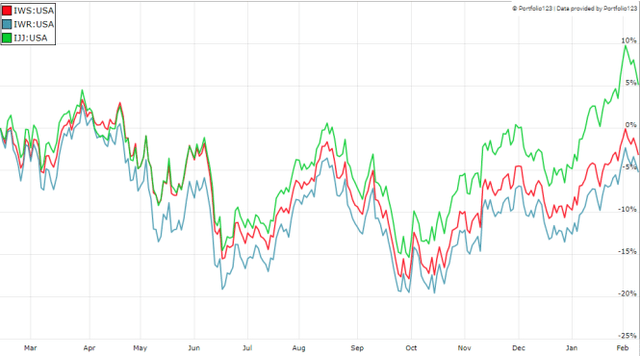

Since inception (7/17/2001), IWS and IWR have almost identical return and risk metrics (reported in the next table). They have underperformed the iShares S&P Mid-Cap 400 Value ETF (IJJ) by a short margin of about 40 bps in annualized return.

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

IWS |

582.83% |

9.32% |

-62.49% |

0.52 |

17.56% |

|

IWR |

580.15% |

9.30% |

-58.78% |

0.53 |

17.45% |

|

IJJ |

643.21% |

9.75% |

-58.00% |

0.52 |

18.74% |

Data calculated with Portfolio123

In the last 12 months, IWS is a bit ahead of its parent index, but it lags IJJ by about 8 percentage points:

IWS, IWR, IJJ, last 12 months (Portfolio123)

Comparing IWS with my Dashboard List model

The Dashboard List is a list of 60 to 80 stocks in the S&P 1500 index, updated every month based on a simple quantitative methodology. All stocks in the Dashboard List are cheaper than their respective industry median in Price/Earnings, Price/Sales and Price/Free Cash Flow. An exception in Utilities: the Price/Free Cash Flow is not taken into account to avoid some inconsistencies. Then, the 10 eligible companies with the highest Return on Equity in every sector are kept in the list. Some sectors are grouped together: energy with materials, communication with technology. Real Estate is excluded because these valuation metrics don’t work well in this sector. I have been updating the Dashboard List every month on Seeking Alpha since December 2015, first in free-access articles, then in Quantitative Risk & Value.

The next table compares IWS performance since inception with the Dashboard List model, with a tweak: here, the list is reconstituted once a year to make it comparable with a passive index.

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

IWS |

582.83% |

9.32% |

-62.49% |

0.52 |

17.56% |

|

Dashboard List (annual) |

948.12% |

11.52% |

-55.89% |

0.64 |

17.36% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123

The Dashboard List beats IWS by 2.2 percentage points in annualized return. A note of caution though: ETF performance is real, whereas the model is simulated.

IWS fundamental shortcomings

Most value indexes have two shortcomings, and IWS is no exception. The first one is to classify all stocks on the same criteria. It means the valuation ratios are considered comparable across sectors. Obviously they are not: my monthly dashboard here shows how 3 median valuation ratios may differ across sectors, in current values and in historical averages. A consequence is to overweight sectors where valuation ratios are naturally cheaper, especially financials. Some other sectors are disadvantaged: those with large intangible assets like technology. Companies with large intangible assets are those with a business model based on massive R&D, or a strong branding, or large user databases, or operating in a field where competition is limited by an expensive entry ticket. All these elements are not correctly reflected by valuation ratios.

The second weakness comes from the price/book ratio (P/B), which adds some risk in the strategy. Historical data show that a large group of companies with low P/B has a higher probability to hold value traps than a same-size group with low price/earnings, price/sales or price/free cash flow. Statistically, such a group will also have a higher volatility and deeper drawdowns in price. The next table shows the return and risk metrics of the cheapest quarter of the S&P 500 (i.e.125 stocks) measured in price/book, price/earnings, price/sales and price/free cash flow. The sets are reconstituted annually between 1/1/2000 and 1/1/2023 with elements in equal weight.

|

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

Cheapest quarter in P/B |

8.54% |

-81.55% |

0.35 |

37.06% |

|

Cheapest quarter in P/E |

10.71% |

-73.62% |

0.48 |

25.01% |

|

Cheapest quarter in P/S |

12.82% |

-76.16% |

0.47 |

34.83% |

|

Cheapest quarter in P/FCF |

15.32% |

-74.77% |

0.61 |

27.03% |

Data calculated with Portfolio123

This explains why I use P/FCF and not P/B in the Dashboard List model.

Takeaway

IWS implements a methodology classifying mid-cap stocks in value and growth subsets based on fundamental ratios, and invests in the value subset. The fund is well-diversified across sectors and holdings. It may be a valuable trading instrument for tactical allocation strategies switching between value and growth, and/or between large and mid-cap, depending on market conditions. However, as a buy-and-hold investment, it has failed to bring excess return over its parent index since 2001. Moreover, it has lagged its competitor IJJ. The underlying index has two shortcomings: it ranks stocks regardless of their industries, and it relies too much on the price/book ratio.

Be the first to comment