Kira-Yan/iStock Editorial via Getty Images

Meta Platforms (FB) stock recently fell after reporting earnings, recording the largest ever single-day loss of value by a public company. This may create the illusion of a buying opportunity, but any quick recoil here is probably more of a dead cat bounce. Shares appear more likely to languish for the next few weeks, or continue to break down, rather than quickly recover a substantial portion of that recent loss. For this reason, I believe FB shares remain risky this quarter.

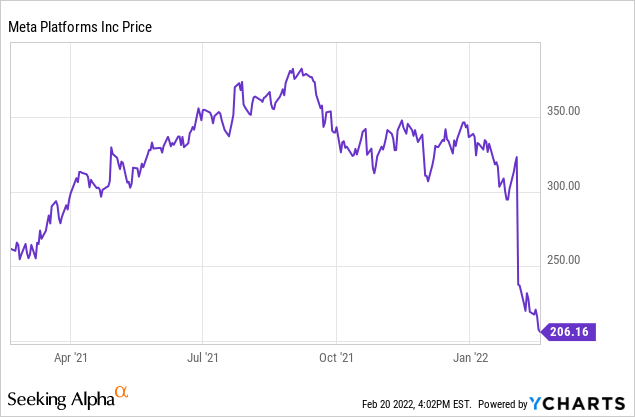

Facebook stock likely got overbought, and it may even be oversold here, but that does not mean it cannot get worse. Meta is now down around 40% from its peak in the early fall of 2021, and that does sound like a nice discount, but there must be quite a few people who bought on the way up and who are now looking to get out on any rebound.

FB repurchased around $44.8 billion of stock in 2021, with about $33 billion happening in the second half of the year. All of those repurchases occurred at prices well over the present price, and probably all over $300 per share.

In the fourth quarter, FB’s buybacks totaled about two percent of the company’s shares, which it bought for $19.2 billion. The company didn’t go broke though, as it held about $48 billion in cash at the end of 2021.

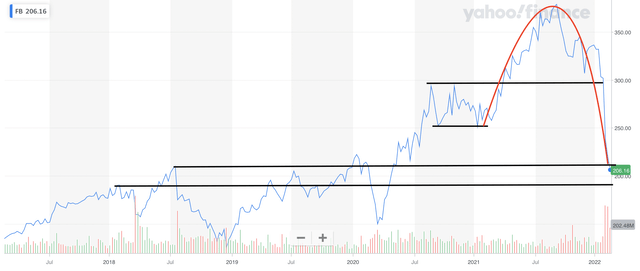

It appears that quite a few buyers stepped in above $300 just last quarter, and several were probably not just fake FB accounts. Also, it looks like quite a few were buying the January dip that bounced at around $300. But if we step back, it appears FB stock basically just created and blew off a dome top that it formed over the last year. That is not a good look.

FB levels (Yahoo! Finance with lines by Zvi Bar)

There also appears to be a significant level of uncertainty regarding FB’s capacity to overcome Apple’s (AAPL) privacy initiatives, among others. In FB’s last earnings conference call, the company acknowledged these changes have affected them, which also contributed to the stock decline. Meta’s name change signified the start of a major initiative in terms of spending cash.

The massive expense in developing this new phase could be the flushing away of billions, or the planting of seeds that will grow into a vast new world. It could work out, but in a couple of years. Due to rising interest rates, 2022 does not look like the best time to propose far off concepts. Instead, the market wants returnable cashflow. FB has the flow, but they are letting you know that they are not returning it, and instead reinvesting it on your behalf.

It is likely that a large percentage of the most expensive individual users for advertising are on iOS, so the change has the potential to be dramatic over time. Moreover, even if FB is capable of dealing with Apple’s iOS changes, it is likely that this shall be a continuing arms race between ad platforms and gatekeepers. This adjustment may just affect margins, but the responses could influence what platforms will succeed over the longer term.

The costs associated with simultaneously developing FB’s metaverse and adjusting to deal with enhanced data protection will be sizable. At the same time, there is a growing potential for the core business to be criticized, scrutinized, and further pilloried as United States mid-term elections heat up in the second half of the year. Much of that near-term political risk is likely already priced into the shares, as it is a reasonably known and understandable risk.

I believe that if FB shares decline through $200 in the near term, which appears exceedingly likely, a capitulatory selling phase may occur. Such a capitulation could bring FB shares to around $175 per share. This possibility is exacerbated by current market weakness.

FB spent a substantial amount of cash on its repurchase plan in the second half of 2021. Most of those purchases were poorly timed. The company may now slow down further its repurchasing, or refrain from maintaining that plan going forward. The company is likely to continue repurchases at some level, but enhanced uncertainty regarding the pace are yet another headwind.

At the same time, it appears FB shares face strong resistance at around $230 and $250 per share. It is unlikely that FB shares would substantially appreciate above these levels before providing the market with a material update, and probably not before reporting earnings next quarter. As a result, FB shares do not appear to offer a strong value at risk in the near term.

Be the first to comment