ehrlif

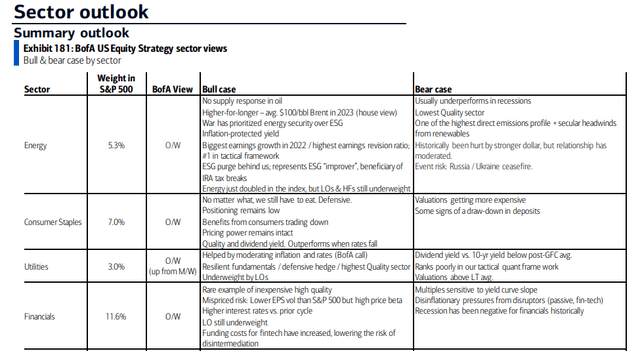

Late November is an ideal time to peruse sell-side sector outlooks for the coming year. The research is useful information, but it’s always important for investors to perform their own due diligence. BofA sees Utilities as a strong area in 2023. Strategists there see disinflation and easing interest rates as bullish catalysts for the steady sector. Moreover, quality is found among many established utility companies. I generally take the bearish case, given extremely high valuations. Is DTE cheap enough to warrant a buy? Let’s dig into the fundamentals and technicals.

BofA Favors Utilities In 2023

According to Bank of America Global Research, DTE Energy (NYSE:DTE) is the largest utility in Michigan. Its largest operating units are DTE Electric, an electric utility serving 2.2 million customers in Southeastern Michigan, and DTE Gas, a natural gas utility serving 1.2 million customers in Michigan. DTE Energy also has non-utility energy businesses which focus on renewable natural gas (RNG), energy infrastructure, and energy trading.

The Detroit-based $23.5 billion market cap Multi-Utilities industry company within the Utilities sector trades at an above-market 19.8 trailing 12-month GAAP price-to-earnings ratio and pays a 3.3% dividend yield, according to The Wall Street Journal. The company recently raised its dividend by 8% to $0.9525, according to Seeking Alpha, after topping Q3 earnings estimates back in October.

Like most large utility firms, regulatory uncertainty and tax changes are constant risks. Moreover, poor CapEx investments can hurt long-term profitability. Rising interest rates typically hurt the equity value of said companies due to a higher weighted-average cost of capital.

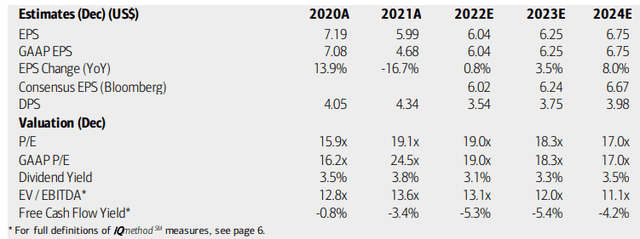

On valuation, analysts at BofA see DTE’s earnings growing modestly in 2023 after a year of flat EPS growth this year. That comes after two strong annual per-share profit growth periods. The Bloomberg consensus forecast is about on par with what BofA sees. Dividends should grow despite negative free cash flow (which is common with high-CapEx utility stocks). The EV/EBITDA multiple is high, but not far from its 5-year average and industry median, according to Seeking Alpha. Overall, with both operating and GAAP P/Es near 20, the stock looks pricey. The forward PEG ratio is also above 3.

DTE: Earnings, Valuation, Dividend Forecasts

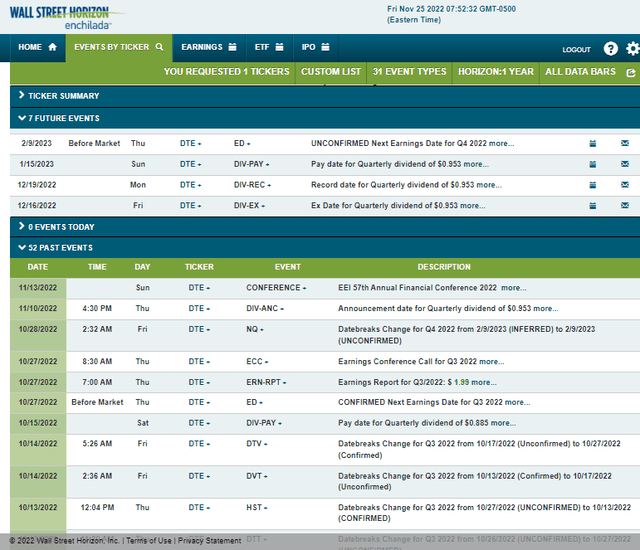

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q4 earnings date of Thursday, February 9, 2023, BMO. Before that, DTE has an ex-div date of Friday, December 16.

Corporate Event Calendar

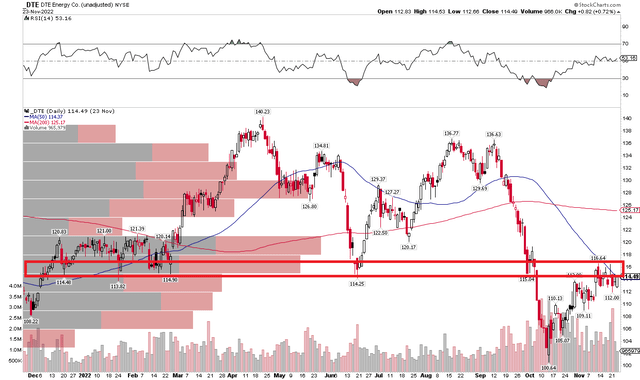

The Technical Take

DTE is encountering resistance at the current price range. With a high valuation and nearing resistance, shares might not be ideal for most investors. A bullish factor, though, is if we see shares rise above the $117 level on a daily closing basis, then DTE can perhaps rise to near $130. That is where an ample amount of shares traded should lead to some selling. Also, a near-term breakout above $117 would trigger a bullish price objective to about $133 based on a bull flag pattern off the October low near $101.

Overall, the stock has outperformed the broad market over the past year, but the current area has been a tough zone to break out from.

DTE: Shares Reaching Resistance After A Rebound

The Bottom Line

DTE appears expensive for my taste with forward P/E ratios near $20. The technical chart is also lackluster despite some alpha against the S&P 500 in the last 12 months. I think it could be a safety play in volatility and can benefit from lower rates, but that upside appears largely priced in.

Be the first to comment