zhongguo

Regular readers know that I am bullish on Nuclear Energy as a solution to our energy crunch. Not only does it produce near-zero carbon emissions, nuclear energy is also vital to our energy security. I have detailed some of my bullish arguments in my articles on the Global X Uranium ETF (URA).

I recently came across Centrus Energy Corp. (NYSE:LEU), a company that is a little different from the uranium miners that people are more familiar with.

LEU has the only deployment ready American centrifuge that can enrich uranium for utilities in North America and other allied countries. Its margins are currently benefitting from the price increase in enrichment services, as well as recently renegotiated uranium supply contracts. I think investors can consider accumulating shares, although there is headline risk from potential Russian sanctions.

Company Overview

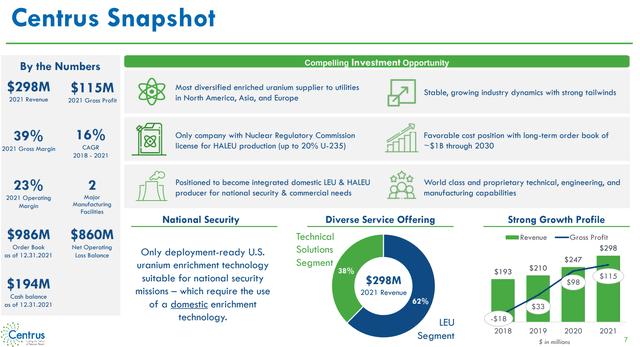

Centrus Energy is a leading nuclear fuels supplier to North American, European, and Asian utilities.

Figure 1 – Centrus Overview (Centrus investor presentation)

Centrus operates in two business segments: low-enriched uranium (“LEU”), which supplies nuclear fuel to commercial customers, and technical solutions, which provides engineering, design, and manufacturing services to governments and private sector customers.

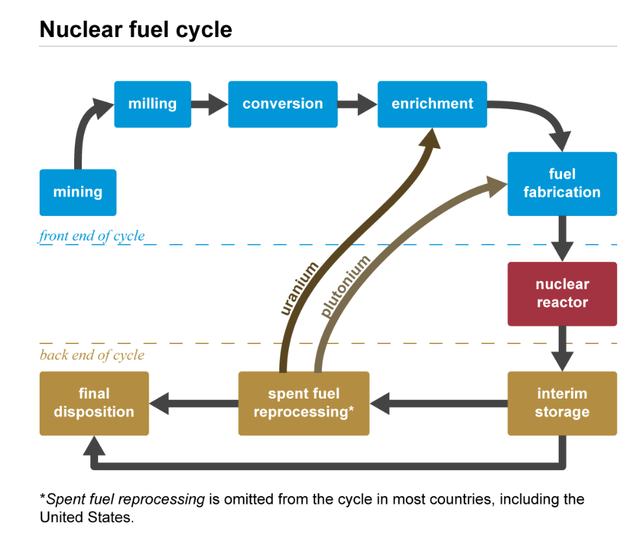

Centrus’ LEU segment plays in the nuclear conversion and enrichment part of the nuclear fuel cycle, and provides the majority of the company’s revenues and almost all of its earnings (Figure 2).

Figure 2 – Nuclear fuel cycle (eia.gov)

Centrus’ LEU segment derives revenue from the sale of the Separative Work Units (“SWU”, a standard unit of measurement representing the effort to transform a given amount of natural uranium into enriched and depleted uranium) and natural uranium components of LEU.

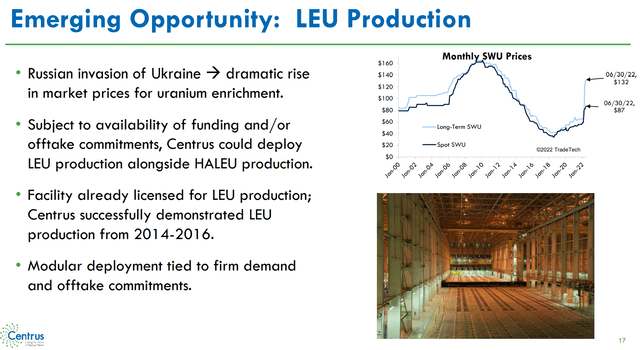

Russia’s invasion of Ukraine has dramatically increased the price of SWU, as Russian enrichment facilities were effectively taken ‘off-market’ (Figure 3).

Figure 3 – Russian invasion caused rise price of enrichment services. (Centrus investor presentation)

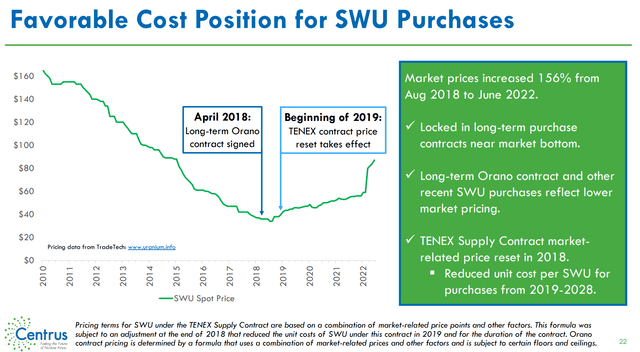

At the same time, Centrus’ uranium supply were locked in near the uranium price lows a few years ago, hence Centrus is currently enjoying favourable margins in its LEU business segment.

Figure 4 – Centrus locked in low cost uranium supply (Centrus investor presentation)

Financials

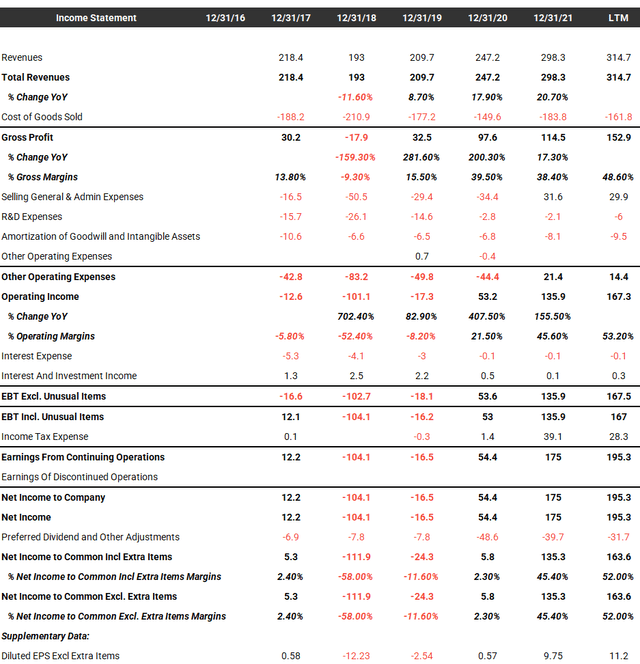

The expanded margin picture shows up in Centrus’ financials. Figure 4 is a condensed financial summary of Centrus, showing the dramatic improvement in earnings.

Note that 2021 and LTM results include a $44 million settlement of claims related to the reimbursement of pension and postretirement benefits from prior work. This settlement is recorded as revenues in the Technical Solutions segment and is worth ~$3/sh in pre-tax income.

Figure 4 – LEU Condensed financials (tikr.com)

On an adjusted basis (backing out the settlement from both revenues and operating income), operating income for 2021 and LTM would have been $92 million and $123 million respectively, or 36% and 45% operating margin.

Valuation

At a current market cap of $680 million or enterprise value of $718 million, Centrus is trading at adjusted LTM P/E multiple of just 7.4x (assuming LEU pays no current tax, as explained in the next section) or adj. LTM EV/EBITDA of 5.4x. Both metrics highlight Centrus’ cheap valuation.

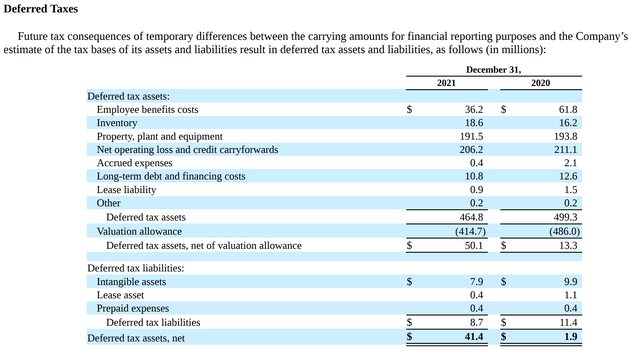

Deferred Tax Assets Worth $28/share

From figure 4 above, we see that historically, LEU has not had significant income tax expenses. The reason is that the economics in the fuel enrichment business had been poor and Centrus had racked up hundreds of millions in deferred tax assets (Figure 5). However, due to the poor profitability, LEU had to discount the deferred tax asset with a large valuation allowance (as it was uncertain whether the deferred taxes could be used in the future). In Q4/2021, with increased profitability, Centrus was able to release $41 million from its deferred tax allowance, which actually added $2.80 / sh to 2021 and LTM earnings.

Figure 5 – LEU deferred tax asset (LEU 10K report)

As Centrus continues to show improved earnings in the coming quarters and years, we can expect further releases from this allowance account. The full valuation allowance of $415 million is worth $28.40 / share.

Russian Supply Risk

The biggest risk to the Centrus story is its Russian supply of enriched uranium. Currently, Centrus imports a significant portion of its uranium from Russia under the ‘TENEX Supply Contract’. Although Centrus has multiple sources of supply, including a long-term supply agreement with the French nuclear conglomerate Orano, the company noted in its annual report risk section that:

If measures were taken to limit the supply of Russian LEU or to prohibit or limit dealings with Russian entities, including, but not limited to, TENEX or ROSATOM, the Company would seek a license, waiver or other approval from the government imposing such measures to ensure that the Company could continue to fulfill its purchase and sales obligations. There is no assurance that such a license, waiver, or approval would be granted. If a license, waiver or approval were not granted, the Company would need to look to alternative sources of LEU to replace the LEU that it could not procure from TENEX. The Company has contracts for alternative sources that could be used to mitigate a portion of the near term impacts. However, to the extent these sources were insufficient or more expensive or additional supply cannot be obtained, it could have a material adverse impact on our business, results of operations, and competitive position.

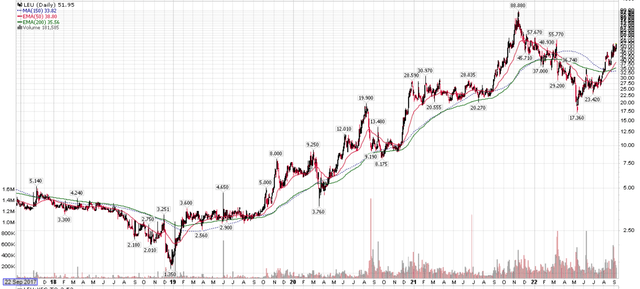

In fact, in the early days of Russia’s invasion of Ukraine, Centrus Energy’s stock price actually swooned to a low of $17 / share because there was talks of possible U.S. sanctions against Russian nuclear energy or ROSATOM (Figure 6). Although LEU’s stock price has recovered, the stock is still very sensitive to any potential headlines on Russian nuclear sanctions.

Figure 6 – LEU stock price (stockcharts.com)

Conclusion

Centrus Energy is an interesting way to play the nuclear energy theme via uranium fuel enrichment. Centrus has the only deployment ready American centrifuge that can enrich uranium for utilities in North America and other allied countries. It is currently seeing enhanced margins from the increased cost to enrich uranium. I would recommend investors accumulate shares, although there is Russian sanction headline risk, as a large portion of LEU’s uranium is sourced from Russia.

Be the first to comment