Iryna Tolmachova/iStock Editorial via Getty Images

Investment Thesis: Revenue and earnings growth for Loblaw Companies Limited has been encouraging. However, I take the view that an improvement in short and long-term balance sheet metrics would make for a stronger bullish case in the stock going forward.

Loblaw Companies Limited (TSX:L:CA) is a leading Canadian retailer that serves as one of the largest food distributors in the country, as well as operating within the health, fashion and payments sectors.

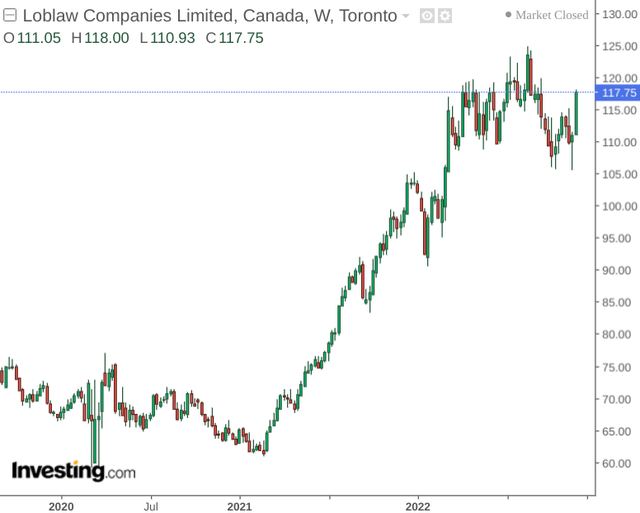

As we can see, the stock saw strong upside in 2021, but has seen more or less stationary performance this year.

investing.com

The purpose of this article is to assess whether the stock could start to see upside once again, taking recent performance and macroeconomic conditions into consideration.

Performance

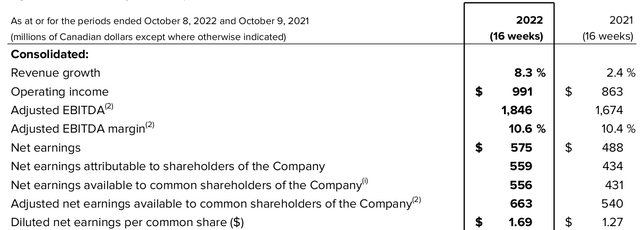

When looking at Q3 2022 performance, we can see that diluted earnings per share saw a strong increase as compared to the same period for 2021.

Loblaw Companies Limited: 2022 Third Quarter Report to Shareholders

Additionally, earnings are substantially higher as compared to the CAD $0.90 level as seen for Q3 2019.

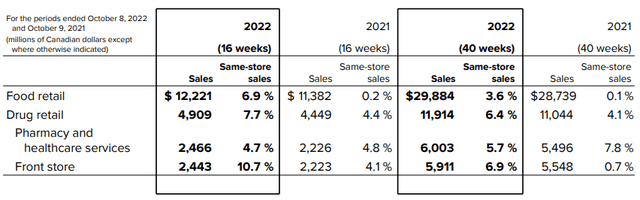

When looking at sales performance across the retail segment, we can see that over a 40-week period – the Drug retail segment saw the most growth on an absolute basis, with the front store showing the most percentage growth of 6.9%.

Loblaw Companies Limited: 2022 Third Quarter Report to Shareholders

With that being said, food retail sales are still up strongly by 6.9% on a 16-week basis. For context, the company had only seen growth of 0.1% on a 16-week basis from Q3 2018 to Q3 2019. In this regard, it does not appear as though inflationary pressures have dampened demand on the part of consumers – revenue continues to grow at a healthy pace.

From a balance sheet standpoint, we can see that the company’s quick ratio (calculated as total current assets less inventories all over total current liabilities) has remained at 0.75.

| October 2021 | October 2022 | |

| Total current assets | 12,010 | 13,014 |

| Inventories | 5,214 | 5,763 |

| Total current liabilities | 9,002 | 9,709 |

| Quick ratio | 0.75 | 0.75 |

Source: Figures sourced from Loblaw Companies Limited 2022 Third Quarter Report to Shareholders. Figures provided in millions of Canadian dollars, except the quick ratio. Quick ratio calculated by author.

While the fact that the quick ratio has not decreased is encouraging – it would be preferable to see the ratio rise above 1 – as this would indicate that the company has more than sufficient liquid assets to meet its current liabilities. Indeed, I take the view that investors may start to pay more attention to such balance sheet metrics over revenue growth going forward, in order to ensure that the company is effectively converting revenue growth into cash flow.

We can see that when comparing Q3 2019 with Q3 2022 – the long-term debt to total assets ratio has also risen slightly.

| Q3 2019 | Q3 2022 | |

| Long-term debt | 6,105 | 6,978 |

| Total assets | 35,463 | 37,695 |

| Long-term debt to total assets ratio | 0.17 | 0.19 |

Source: Figures sourced from Loblaw Companies Limited 2019 and 2022 Third Quarter Report to Shareholders. Figures provided in millions of Canadian dollars, except the long-term debt to total assets ratio. Long-term debt to total assets ratio calculated by author.

While Loblaw Companies Limited has continued to show strong revenue and earnings growth – it is my view that an improvement in certain balance sheet metrics would provide a stronger case for upside.

Looking Forward

Going forward, Loblaw Companies Limited should be in a good position to withstand inflationary pressures, given its dominant role across the Canadian retail industry and encouraging revenue growth to date.

With that being said, there is the risk that the strong performance we have been seeing has been artificially lifted by inflation – as competitors have also seen stronger performance as a result of rising prices.

It is unclear whether the reason for the boost in sales growth is linked to inflation, or what specific product categories are leading to higher revenue. As a result, there is always the possibility that a plateau in inflation could also lead to a plateau in revenue growth.

Conclusion

To conclude, Loblaw Companies Limited has seen strong revenue and earnings growth. However, it is unclear as to what portion of the strong performance we have been seeing has been linked to inflation, and whether such performance could plateau in the short to medium-term.

Additionally, while earnings growth has been encouraging, I take the view that an improvement in short and long-term balance sheet metrics would make for a stronger bullish case in the stock going forward.

Be the first to comment