Chip Somodevilla

Thesis

The Vanguard Real Estate ETF (NYSEARCA:VNQ) suffered a steep drop after our previous article in September, as an increasingly hawkish Fed spooked the market.

However, we also gleaned that VNQ has likely formed its long-term bottom at its October panic selloff, recovering nearly 20% (in price gains). Our analysis suggests that VNQ’s upward momentum has been consolidating as we enter the FOMC’s interest rate decision week, with Fed Chair Jerome Powell due for his press conference on December 14.

Today’s (December 13) November CPI release could offer the market critical clues into the Fed’s decision tomorrow. As such, we believe VNQ’s recent recovery could face selling pressure if the CPI surprises to the upside (negative), even as VNQ has likely bottomed out in October.

Despite that, we urge investors to consider leveraging on any potential pullback, as VNQ is no longer overvalued. Coupled with our base case of a mild-to-moderate recession, we assess that a pullback could proffer investors another solid opportunity to add exposure if they missed VNQ’s October lows.

However, given the cautious positioning and the rapid recovery from the steep selloff from its August highs, we encourage investors to wait patiently for a potential pullback before adding.

Revising from Buy to Hold for now, as we anticipate a pullback.

VNQ’s Leading Holdings Are No Longer Overvalued

| Holding | Weighting % |

| Prologis (PLD) | 7.26% |

| American Tower Corporation (AMT) | 6.71% |

| Crown Castle (CCI) | 4.1% |

| Equinix (EQIX) | 3.66% |

| Public Storage (PSA) | 3.48% |

VNQ’s leading non-fund holdings. Data source: S&P Cap IQ

VNQ’s leading non-fund holdings accounted for more than 25% of its total weight. Notably, we gleaned that four of the five stocks last traded below their 10Y valuation average, with one just slightly ahead.

| Holding | NTM AFFO per share multiple (x) | 10Y average (x) |

| Prologis (PLD) | 25x | 27.4x |

| American Tower Corporation (AMT) | 20.8x | 21.9x |

| Crown Castle (CCI) | 18.6x | 20.9x |

| Equinix (EQIX) | 22.3x | 21.1x |

| Public Storage (PSA) | 20.5x | 22.9x |

VNQ’s leading non-fund holdings valuation comps. Data source: S&P Cap IQ

As seen above, with the exception of EQIX, the valuation of the rest are discernibly below their 10Y averages. Hence, we assess that the market has likely reflected significant pessimism, despite the recent recovery from VNQ’s October lows.

Notwithstanding, we believe the valuations suggest that the Fed could temper its hawkish stance in 2023, as elevated interest rates have been significant headwinds for REITs, widening bid/ask spreads between buyers/sellers. It has also raised market volatility and reduced investment activity as investors grappled with the need for higher cap rates, given the Fed’s rapid rate hikes.

Hence, we assess that the market has likely priced in the worst of the Fed’s rate hikes but would need more clarity from Jerome Powell and his team tomorrow on their revised dot plot.

The mood going into the Fed’s decision week remains uncertain, as Fed speakers provided split views on how long the Fed should maintain its hawkish stance. The hawkish monetary policymakers are understandably concerned with a resurgence of unwelcome inflation if they temper their stance too early. In contrast, the more dovish Fed speakers are concerned with the impact of policy lags and are worried about overtightening, resulting in unintended consequences, such as a significant recession.

Our analysis suggests that investors have likely priced in a slowdown or a moderate recession at the worst, but not a severe one. Our thesis is also consistent with the buy-side perspective, as they deployed dry powder, anticipating that the worst of the Fed’s record rate hike cadence is over.

Is VNQ ETF A Buy, Sell, Or Hold?

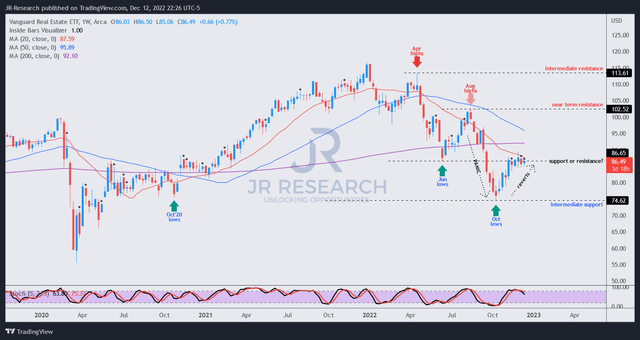

VNQ price chart (weekly) (TradingView)

With the VNQ having recovered remarkably, it’s also testing its previous support-turned-resistance level predicated against June lows. Also, the 50-week moving average (blue line) has continued to hinder further upward momentum, as buyers are likely taking a pause before the Fed’s press conference.

Hence, we believe it’s appropriate for buyers to take a timeout and assess the consolidation zone, with a bias toward a potential pullback if the market uses the Fed’s presser to digest its recent surge.

However, we view its October lows constructively and believe the panic selloff from its August highs is not likely to be repeated, resulting in October lows being decisively broken.

For now, we switch from Buy to Hold, as we anticipate a pullback.

Be the first to comment