Leon Neal

If you have kids or nieces and nephews that are young, chances are you are familiar with Roblox (NYSE:RBLX). I have spent a fair amount of money purchasing Robux for my Nephews account. If you’re not familiar with RBLX, it’s home to over 30 million immersive experiences, from gaming to concerts and almost everything in between. In Q3, 58.8 million daily active users spent 13.4 billion hours engaged throughout the RBLX universe. What I find to be brilliant is that RBLX has associated credits called Robux to each account which can be purchased with fiat currency. Robux essentially allows individuals to purchase in-game upgrades for their avatar in addition to unlocking different experiences. Granted, my nephew is 6, and when he asks me for Robux, I always add some to his account. After spending $25 here and $50 there, I decided to look into RBLX as an investment because if I am spending money on digital currency for a game my 6-year-old nephew plays, I assume there are many other people spending money in the RBLX universe and it may make an interesting investment. After researching the company, I want to be an investor, but the financials scare me. RBLX is down -72.79% over the past year, and I am not seeing a path to profitability. While RBLX remains well capitalized from its cash position, they need to figure out a path to profitability, or RBLX could see further declines.

Roblox’s valuation doesn’t make sense, considering they have never turned a profit and the losses keep widening

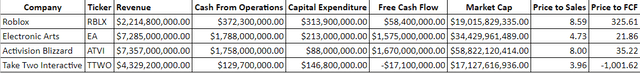

Before going through RBLX’s financials, I wanted to see how Mr. Market valued the company compared to other video game makers. I compared RBLX against Electronic Arts (EA), Activision Blizzard (ATVI), and Take-Two Interactive (TTWO). These companies are responsible for video game franchises, including John Madden Football, Call of Duty, World of Warcraft, Red Dead Redemption, and Grand Theft Auto. Since RBLX is a much younger company, I will look at its price-to-sales ratio in addition to the free cash flow ((or FCF)) multiple that has been placed on it. I am not a fan of P/S, but there are many investors who are, so I wanted to see how this metric correlated to what could be considered its peers.

Steven Fiorillo, Seeking Alpha

RBLX has a market cap of $19.02 billion compared to $17.13 billion for TTWO, $34.43 billion for EA, and $58.82 billion for ATVI. In the table above, I have listed revenue, cash from operations, capital expenditure, and FCF, which I will use a trailing twelve-month ((or TTM)) number for.

RBLX trades at an 8.59x P/S multiple, which is the largest of the group. ATVI trades at a P/S multiple of 8 and generated $5.14 billion (332.17%) more revenue over the TTM. EA trades at a P/S of 4.73, and TTWO trades at a P/S of 3.96x. On a P/S methodology, RBLX looks to trade at a large premium, considering ATVI generates an additional $5.14 billion in revenue and trades at a slightly lower P/S multiple.

Price to FCF is one of my favorite metrics to compare companies. Every investment is the present value of all future cash flow. Therefore, as an investor, I factor into my investment thesis a company’s FCF valuation. I have discussed FCF for years because I feel one of the most important valuation metrics is the FCF to Market Cap multiple a company trades at. Coincidently this hasn’t been a widely discussed valuation metric. FCF represents a company’s cash after accounting for cash outflows to support operations. I like to use this metric rather than net income because FCF is a measure of profitability that excludes the non-cash expenses and includes spending on equipment and assets. It’s also a harder number to distort or manipulate due to how companies account for taxes and other interest expenses. This is also the pool of capital companies utilize to pay back debt, reinvest in the business, pay dividends, buy back shares, and make acquisitions.

Currently, TTWO trades at a negative FCF valuation, as this is the first time in a decade that TTWO has generated a negative FCF. I will need to look more into this in the future. After its recent earnings, RBLX has generated $372.3 million in cash from operations and spent $313.9 million on capital expenditures, placing its FCF over the TTM at $58.4 million. This seems like a small amount of FCF to me, considering its market cap is almost $20 billion. Today Mr. Market has placed a 325.61x multiple on RBLX’s FCF. When I look at RBLX as an investment and see this valuation, it doesn’t make sense. If a company was looking to acquire RBLX at its current valuation, it would be paying $19.02 billion for a company that is producing $58.4 million in FCF. If RBLX was to increase its FCF output by 10% YoY, it would take 36 years to generate $19.27 billion in cumulative FCF. That just doesn’t seem like a good use of capital.

EA has generated $1.58 billion in FCF over the TTM, and trades at a 21.86x price to FCF multiple. ATVI has generated $1.67 billion in FCF over the TTM and trades at a 35.22x price to FCF multiple. Even if you were to make the argument that RBLX has much more growth ahead of them than the legacy companies and placed a price to FCF valuation that was double ATVI, it would be 70.44x its price to FCF. I think the current valuation is out of sync with the larger competitors, and paying 325.61x RBLX’s FCF is too rich for me, considering that they continue to lose money on a bottom-line level, and the losses continue to expand.

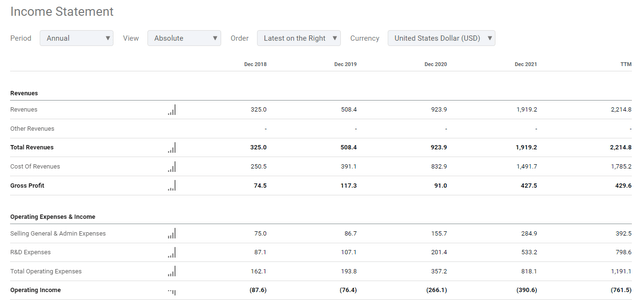

Roblox’s financials are a disaster, despite the fact its well-capitalized

RBLX is witnessing its top-line growth rapidly decline, while its gross margin has fallen under 20%. This isn’t a good combination. In 2020, RBLX saw an 81.73% jump in revenue YoY and another YoY increase of 107.73% in 2021. From the close of 2019 to the close of 2021, RBLX’s revenue increased by 277.5% as it added $1.41 billion to its annual revenue. This is a fantastic accomplishment, but RBLX has been unable to sustain its previous growth rates. Over the TTM, RBLX’s revenue has grown by 15.4% YoY, which is significantly lower than its previous years. There wasn’t a winding down period, as revenue growth rapidly declined.

Operationally, I do not see a path to being profitable on a net income level. RBLX had its best year on a gross profit metric in 2018, when it had a 31.7% gross profit margin. This has declined to 19.4% in the TTM. RBLX’s cost of revenue continues to increase YoY, eating away at the remaining capital to pay for its operational expenses. On an operating level, RBLX’s losses increased by 94.96% YoY, increasing from -$390.6 million to -$761.5 million. In the TTM, it has cost RBLX $2.98 billion to run its company when all of its expenses, from the cost of revenue to its operating expenses, are accounted for while they produced $2.21 billion in revenue. Seeing its operating income loss widen over the years doesn’t give me a reassuring feeling that, operationally, things will get better anytime soon. At the end of the day, RBLX’s net income loss has widened YoY, and this is a company that has never turned a profit. Paying the price to FCF multiple of 325.61x for a company that has never been profitable on the bottom line, and continues to see the losses widen doesn’t sit well with me.

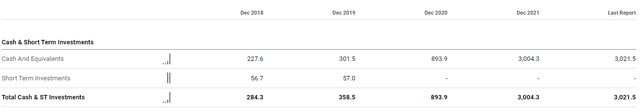

While RBLX continues to see its losses expand, it’s a well-capitalized company at the moment which can withstand the losses. RBLX has $3.02 billion in cash on its balance sheet, with $988.7 million of long-term debt. Going back to the income statement for a moment, RBLX is paying $36.9 million in interest expenses, and the net interest expense it’s paying after the $17.2 million it generated from its interest & investment income is $19.7 million. RBLX could eliminate its long-term debt with a check and clear out its interest payments, but if it’s at a fixed rate, the $17.2 million net interest expense isn’t something management should be worried about.

RBLX is well capitalized as it can sustain its current losses for a number of years without issuing additional debt based on the current trend. What worries me is their margins and established forward growth rates. RBLX will need to either grow its revenue by a tremendous amount without increasing its current expenses too much or find a way to drastically reduce costs to become profitable. Every company is in the business of turning a profit, and at some point, RBLX will need to. I love their business and have contributed to their revenue by purchasing Robux for my nephew, but their financials don’t look very enticing.

Conclusion

I am going to pay attention to RBLX over the next several quarters, and if RBLX falls to a valuation that makes sense to me or its income statement drastically improves, I would consider adding RBLX to my portfolio. I am not seeing that RBLX is in any immediate danger, but if this trend continues, I don’t see how RBLX will continue operating without burning through its cash, issuing shares and diluting shareholders, or issuing debt. I think the valuation that RBLX trades at is too high and that trading at an 8.59x P/S ratio when they generate $58.4 million in FCF compared to ATVI generating $1.67 billion in FCF and trading at 8x sales is crazy. While there isn’t a clear-cut method to valuating stocks, RBLX looks out of sync with its industry, and I am staying away as downward pressure on shares could continue until RBLX becomes stronger operationally.

Be the first to comment