Andrzej Rostek

In my last article on Peabody Energy (NYSE:BTU), I went over a basic summary of the company and the options trade I made. I also covered Transocean (RIG), in the same article. Transocean was in the news last week for adding two contracts worth just over $1B to its backlog. In today’s article, I wanted to focus in on Peabody’s Q3 results as well as the company’s recent investor day presentation.

Investment Thesis

Peabody is the epitome of the dirt-cheap company in an out of favor sector, the coal industry. The company has operations in Australia and America, and the financials have rapidly improved in 2022. Debt has continued to come down, and the capital returns could be impressive once they are able to pay dividends and buyback shares. They recently released an investor day presentation in November, and combined with the most recent 10-Q, there is a lot to like. The biggest focus for myself and other investors is the improvement of the balance sheet, which should unlock significant value for shareholders as debt continues to come down.

Investor Day Presentation

If you are interested in Peabody, I would strongly recommend going through the recent investor presentation. I’m not going to go into too much detail, because there is 63 pages discussing various topics, from long term demand for coal, an overview of the operating segments, to developments with specific projects. They also include a couple slides on ESG (which I couldn’t care less about to be honest) and the plans for debt reduction and future capital returns. If you aren’t familiar with the company or want some information on their projects and capital returns plan, the recent investor presentation is worth a closer look.

10-Q

The 10-Q also has a lot to like, from the impressive revenue growth to the improvement of the balance sheet. While it is obvious to investors that Peabody is cheap and has the potential to generate massive amounts of cash in the next couple years, the balance sheet gets the most attention. Cash has begun to pile up on the balance sheet in 2022 (going from $954M to $1.4B in nine months). This has happened as the company has continued to aggressively pay down debt.

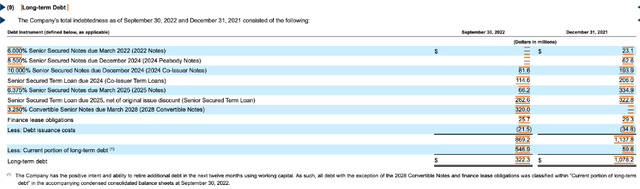

Total Debt (as of 9/30/22) (sec.gov)

Since the fine print is small on the website view, I wanted to add the line below the debt table.

The Company has the positive intent and ability to retire additional debt in the next twelve months using working capital. As such, all debt with the exception of the 2028 Convertible Notes and finance lease obligations was classified within “Current portion of long-term debt” in the accompanying condensed consolidated balance sheets at September 30, 2022.

Future Capital Returns

Basically, the company is working its way through a three-step program that will end up with significant potential for capital returns in the form of buybacks and dividends. The first step is to repay the remaining secured debt, which should occur quickly with the amount of cash that the company is generating. The second step is to pay the surety bonds related to project reclamation. These currently have a covenant with a restriction on share buybacks and dividends.

The Company suspended share repurchases in 2019, and similar to the payment of dividends as described above, the same agreement with its surety bond providers prohibits share repurchases through the earlier of December 31, 2025, or the maturity of the Credit Agreement (currently March 31, 2025) unless otherwise agreed to by the parties to the agreement. Additionally, restrictive covenants in its credit facility and in the indentures governing its senior secured notes also limit the Company’s ability to repurchase shares. Prior to the suspension, repurchases were made at the Company’s discretion. The specific timing, price and size of purchases depended upon the share price, general market and economic conditions and other considerations, including compliance with various debt agreements in effect at the time the repurchases were made.

– Q3 10-Q

Once they have repaid those liabilities, the floodgates should open on capital returns. They are looking to amend the current agreement that restricts shareholder returns. In my opinion, it is only a matter of time before the restrictions are lifted. Whether it is through an agreement, or the company simply pays back the liabilities will impact the timing, but it will be a huge catalyst for a rerating in shares when it does happen.

Selling Puts

In my last article, I wrote about the call that I bought, which has performed poorly to be honest. I recently made another options trade on Peabody when shares sold off into the mid-$20s. Instead of buying another call with a different strike price or expiration date, I chose to sell a put for the same January 20th expiration with a $30 strike.

BTU Put (Author’s Schwab Account)

If shares rally above $30 in the next month or so, that nets me a 16% return, which is pretty attractive for a couple month trade. If the shares stay below $30, then I get to buy Peabody shares which look dirt cheap to me today. I would plan to hold onto them for a while because I think shares will be trading at a materially higher price in a couple years as debt comes down and they can start returning capital.

Conclusion

I know that many investors avoid the energy sector, and the coal sector certainly isn’t as sexy as technology for example. However, it is something that we are going to need for many years to come, and many stocks in the sector are still dirt cheap, despite massive increases in share price over the last couple years. Peabody is certainly an example of that, and they haven’t even been able to reward investors with dividends or buybacks like other companies in the sector (like Arch Resources (ARCH) for example) due to capital covenants.

Investors interested in Peabody should read the most recent investor day presentation and 10-Q for themselves, but I found a lot to like, primarily the balance sheet improvement. I chose to sell a put expiring in late January with the $30 strike instead of adding calls or shares, but I would be fine if the shares are assigned. The biggest reasons to be bullish in my mind is the improving balance sheet, which will eventually lead to buybacks and/or dividends after the capital return restriction is lifted. When that happens, chances are we will look back at shares below $30 as the steal that it is.

Be the first to comment