MarsBars

REITs have gotten really cheap in just a matter of weeks, with some now trading at multi-year lows. It pays to have dry powder handy but with so many bargains on the table, it may be hard for the average investor to buy everything that looks appealing.

Also, there are some investors that are buy and hold forever types, who prize income. These investors don’t like to cash buyouts, such as what we have seen with STORE Capital (STOR). That’s because cash buyouts trigger a taxable event, and investors who prize passive income now have to go through the task of replacing it with something else.

This brings me to Vanguard Real Estate ETF (NYSEARCA:VNQ), which offers investors immediate diversification, income, and which won’t be bought out, because it’s an ETF basket of many stocks. This article highlights why the recent share price downturn presents an excellent opportunity for income investors to layer in, so let’s get started.

Why VNQ?

VNQ is an ETF from Vanguard, arguably the gold standard of asset managers. Unlike other mutual fund and ETF providers, Vanguard does not have shareholders, and is owned by investors in its mutual funds. It uses its profits to lower fees that it charges shareholders. As one would expect VNQ charges a low 0.12% expense ratio, sitting well below the 0.45% ETF sector median.

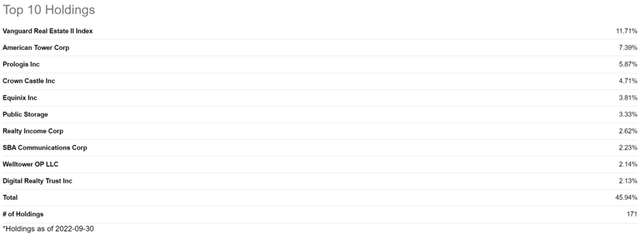

VNQ carries a number of familiar names among its top 10 individual holdings, including communications juggernauts American Tower Corp. (AMT), Crown Castle Inc. (CCI), an SBA Communications (SBA), as well as industrial giant Prologis (PLD), datacenter behemoth Equinix (EQIX), and the net lease favorite Realty Income Corp. (O). As shown below, VNQ’s top 10 holdings comprise nearly half (46%) of the portfolio total.

VNQ Top 10 Holdings (Seeking Alpha)

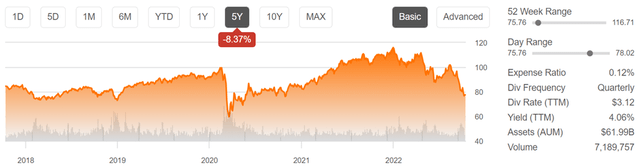

VNQ has fallen materially over the past several weeks, from its near-term high of $100 from as recently as August, and is now well below its 52-week high of $117. With a current price of $77.49, VNQ carries an RSI score of 30, indicating that it’s now in oversold territory. As shown below, outside of the early pandemic timeframe, VNQ is now trading at multi-year low not seen since the brief downturn in early 2019.

VNQ Stock (Seeking Alpha)

A common refrain for REITs is that they are vulnerable to inflation and higher interest rates, and are therefore not good investments in the current rising rate environment. This is an overly simplistic view, however, as publicly traded REITs have learned a great deal around the risks of being overly leveraged since the Great Recession of 2008 – 2009, and are entering in what’s potentially another recession with strong balance sheets. Moreover, REITs with strong balance sheets are actually in a good position to take advantage of distressed selling and lower competition for deals. The following excerpt from Agree Realty’s (ADC) recent conference call highlights this dynamic:

Given our improved cost of equity capital, we are able to invest in even greater spreads and provide additional cash flow accretion. Our superior cost of capital, combined with our fortress balance sheet positions us to pursue many exciting opportunities while levered competitors have exited the market. We are seeing distress amongst owners and developers and are intent on leveraging our strong positioning. While once again raising our acquisition guidance, we are cognizant of the dynamic macro environment and will remain disciplined to our strategy.

The following excerpt from Regency Centers (REG) conference call further reinforces the above notion:

Where we have begun to see some impact from the current environment is in the capital markets, but again we are extremely well positioned. The strength of our balance sheet and our low leverage afford us the luxury of not needing to raise capital when it’s not advantageous to do so.

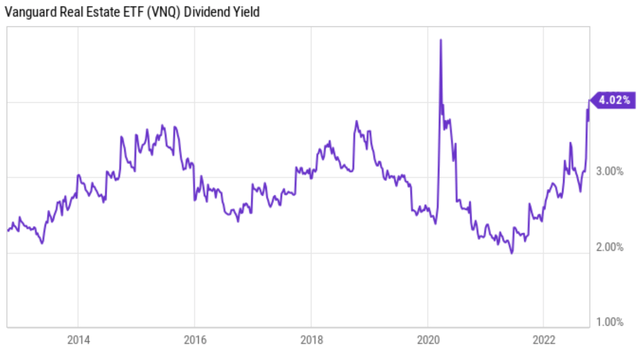

Meanwhile, income investors can take advantage of market irrationality by locking in a historically high dividend yield. As shown below, VNQ now offers a 4.0% yield, which is its highest level over the past 10+ years outside of the early 2020 timeframe.

VNQ Dividend Yield (YCharts)

Investor Takeaway

The current market environment presents an excellent opportunity for income investors to add to or initiate a position in VNQ. With a well-diversified portfolio of high quality REITs across multiple segments, and a dividend yield that’s at one of its highest points in over a decade, VNQ offers an attractive risk/reward proposition for long-term income investors.

Be the first to comment