Andrzej Rostek

Thesis

It has been an incredible run for investors in Alliance Resource Partners, L.P. (NASDAQ:ARLP), as it posted a YTD total return of 100%, outperforming the broad market significantly.

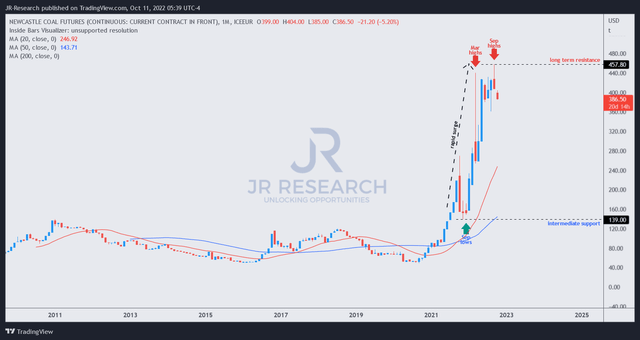

The energy crisis has reignited the demand for coal, as Newcastle coal futures (NCF1) surged nearly 230% from their September 2021 lows to their recent September 2022 highs. Coupled with surging inflation levels and structurally tight supply/demand dynamics due to underinvestment in energy sources, coal as a low-cost fuel has become critically important.

However, we urge investors to consider whether the massive run in ARLP and coal futures have reached their peak in the near term as we move closer to a global recession.

While we think it’s highly unlikely for ARLP to revisit its 2021 lows moving ahead, we postulate that adding at the current levels seems unattractive from a reward-to-risk perspective.

As such, we rate ARLP as a Sell and urge investors to take some exposure off and protect their massive gains.

Don’t Ignore A Global Recession

The prognosis of a global recession has fallen on deaf ears for coal stock investors in 2022, as NCF1 remains close to its September highs. However, as we shall discuss subsequently, we gleaned highly ominous price action in coal futures, suggesting that investors need to be extremely cautious.

ARLP has also cautioned in its filings about the impact of an economic recession, causing demand destruction among its customers. It highlighted:

Weakness in global economic conditions or economic conditions in any of the industries we serve or in the financial markets could materially adversely affect our business and financial condition. The demand for electricity in the United States and globally could decline if economic conditions deteriorate, which could negatively impact the revenues, margins, and profitability of our business. (ARLP 10-Q)

Several notable institutions, economists, and CEOs have recently emerged, highlighting the increasing risks of a global economic recession. For instance, the IMF and World Bank “warned of a rising risk of a global recession as advanced economies slow and faster inflation forces the Federal Reserve to keep raising interest rates, adding to the debt pressures on developing nations.”

The CEO of the leading US banking institution JPMorgan (JPM) accentuated that global economies would likely fall into a recession by “the middle of next year.” Jamie Dimon articulated:

These are very, very serious things which I think are likely to push the US and the world — I mean, Europe is already in recession — and they’re likely to put the US in some kind of recession six to nine months from now. – Bloomberg

Former Fed Chair Ben Bernanke, who recently won a Nobel Prize in Economics for his research on financial crises, highlighted to regulators and central bank governors to be very mindful of the cadence of their rate hikes. He signaled the risks of rapid rate hikes could have a profound and unanticipated impact on the financial markets and global economies. Bernanke expounded:

Even if financial problems don’t begin an episode, over time, if the episode makes financial conditions worse, they can add to the problem and intensify it, so that’s something I think that we really have to pay close attention to. What should be kept in mind is that the inflation target is a medium-term target. It doesn’t have to be met within six months or anything like that. – Bloomberg

Hence, we urge investors to be cautious about adding to stocks that have surged tremendously over 2022. Investors sitting on massive gains would unlikely want to see their gains dissipate. Therefore, selling pressure could build up, forcing gains to be digested rapidly as investors rush to lock in profits.

Alliance Resource Partners’ Growth Is Set To Slow Through FY23

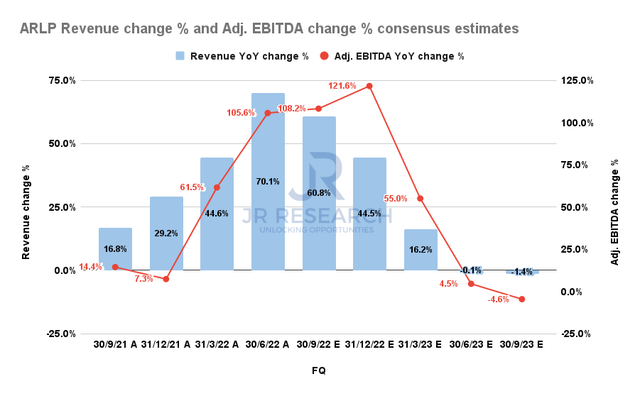

ARLP Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

As seen above, even the very bullish consensus estimates have modeled for ARLP’s growth to slow markedly through FY23. Therefore, it could put further pressure on the near-term upside in ARLP moving forward.

Coupled with the increased risks of a global recession, these estimates could be cut further if the underlying coal futures prices suffer a massive selldown.

Is ARLP Stock A Buy, Sell, Or Hold?

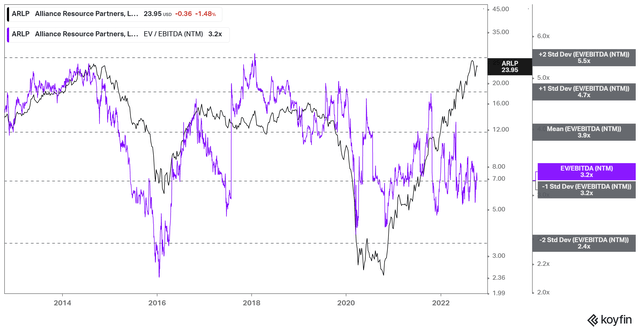

ARLP NTM EBITDA multiples valuation trend (koyfin)

With an NTM EBITDA multiple of just 3.2x, bullish investors could argue that the market has yet to re-rate ARLP, despite posting remarkable performances in 2022.

However, given the looming recession, we think the market has been anticipating potential estimate cuts that could impact its valuation. Therefore, investors are urged to wait patiently for Wall Street to go into a panic, slashing estimates, and assess the potential value compression from there.

Newcastle coal futures price chart (monthly) (TradingView)

Furthermore, we gleaned that NCF1 futures have likely reached their peak, as buying momentum has consistently failed at its long-term resistance. We believe the rapid surge from 2022 is unsustainable, with the market consolidating since March 2022.

The price action over the past few months looks increasingly like an astute distribution phase, suggesting the reward-to-risk profile points to the downside at the current levels.

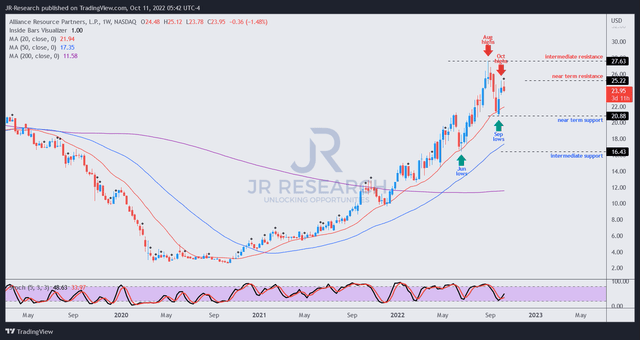

ARLP price chart (weekly) (TradingView)

Furthermore, we observed that ARLP has been unable to form a higher high in October above its previous August highs, suggesting its buying momentum seems to have weakened.

Also, the price action at its October highs is emblematic of a buying momentum failure, which could portend further downside ahead.

Therefore, we urge investors to show significant caution at the current levels and watch for a potential re-test of its near-term support. Moreover, we believe a recessionary scenario should send its valuation further down to the gap between its near-tern and intermediate support before consolidating.

Hence, investors sitting on massive gains in 2022 are urged to cut exposure and rotate to protect their profits ahead of others.

As such, we rate ARLP as a Sell.

Be the first to comment