daboost

(This article was co-produced with Hoya Capital Real Estate)

Introduction

Despite a couple of CSP assignments, overall the 3rd quarter was successful, though the market did not provide a smooth ride. Premiums generated topped $10,000, the highest for a quarter since I restarted option trading three years ago. There was one really bad trade as measured by ROI, but dollar-wise, little damage was done. Another allowed me to pick up shares $22 below the going price, only to watch it fall another $40. Good thing my plan was long-term ownership on that ticker!

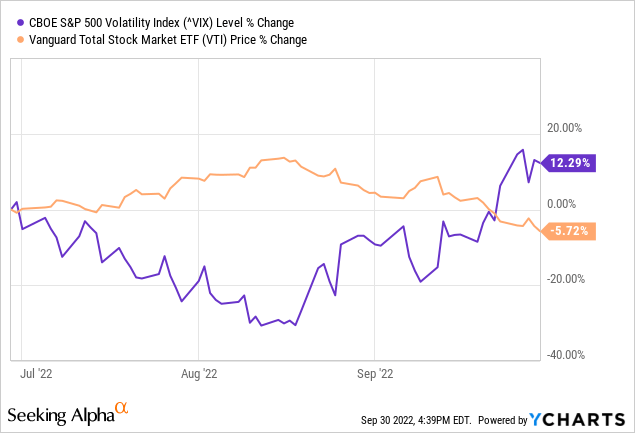

The market advanced early in the quarter, volatility dropped; then both starting reversing by late August, with the VIX Volatility Index ending up and the S&P 500 Index ending down. Those movements made timing of when to sell and whether to close early more important than when the market movement is more consistent.

I broke the trades into the strategy I was executing for that particular trade, listing each ticker used. I included the overall quarterly results and a list of open positions as of quarter end also. For those new to options trading, I included links at the article’s conclusion to several articles beginners should find helpful.

CSPs as CDs, a new strategy

This past summer, I wrote Using Cash Secured Puts, Not CDs to highlight a new Cash-Secured-Put strategy I was trying out. At the time, 3-mo CDs were at 2% (now 3.3%, down from 4%), but by selling CSPs on two popular equity ETFs with quarter-end Puts available offered 6-8% yields even with 15% downside protection strikes.

I wrote one set using the 9/30/22 $310 Puts on SPDR S&P 500 ETF (SPY) when the ETF was at $375. With 18% protection in place, this “CD” yielded 4.7%.

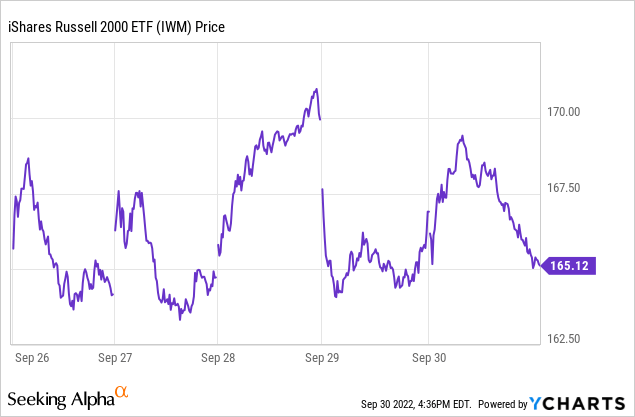

I executed two on iShares Russell 2000 ETF (IWM), one at the start of the quarter; one later on. The first was a 9/30/22 $150 Put with a 14% safety margin. I closed this out a few days early as the market was weakening, and it earned 7.07%. The following chart shows why I tracked the 9/30/22 $167 Put so closely; finally closing it out early on expiration day when IWM was about $1.25 OTM. Good I did, as it closed ITM by more than what the premium was.

It might appear I could have done better closing on the 28th, but I got a better price waiting until Friday when more of the time premium had evaporated. I netted a 5.25% ROI this “CD” trade. By closing early, I had the funds available to open 2 DEC $140 contracts for the new “CD” position. An OTM close will net 8.4%, more than twice the going CD rate. This worked really well as IWM rose 6% early the next week.

So far, I have only used my taxable account for this strategy. There, the premiums can escape taxes by the offsetting trading losses elsewhere, which this year I have plenty available. With CD rates up, I will be re-evaluating the risk/reward of this strategy before writing more 12/31/22 options.

Author’s note: All listed ROIs are annualized to allow for cross-trade comparisons. The shorter the trade, the harder it would be to achieve that ROI over the course of an entire year.

Covered Call activity

I commented about a second strategy change and that concerns my Covered Call activity. I mainly use my IRAs (regular and Roth) for this activity, a few in my taxable account besides the CSP-CD trades. With the number of assignments over the summer, my available cash has limited my CSP activity, which is really what I want to be using my “idle” cash for. I haven’t quite got fully into the spirit of writing tighter Calls or buying back Puts before assignment. This section reviews these trades.

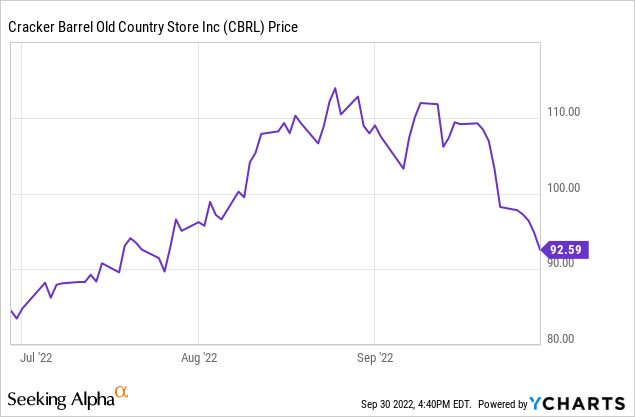

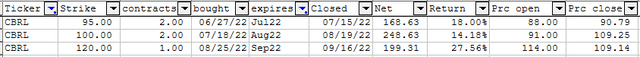

Cracker Barrel Old Country Store (CBRL):

This long-time holding is hammering into me why closing out should be heavily considered. I think my original ownership is now over a year old and even with dividends, I am in a losing position that could have been avoided by writing tighter Covered Calls instead of hoping for price appreciation. That said, I had three trades close this quarter.

All three were CC trades, with the middle one resulting in 100 shares being called away. I estimate those shares cost me 9%. I have the current 100 shares covered and entered into two separate CSP trades, which are still open and listed later. As you can see, the trades generated high ROIs; unfortunately, the stock price movement resulted in constantly lowering the strikes used.

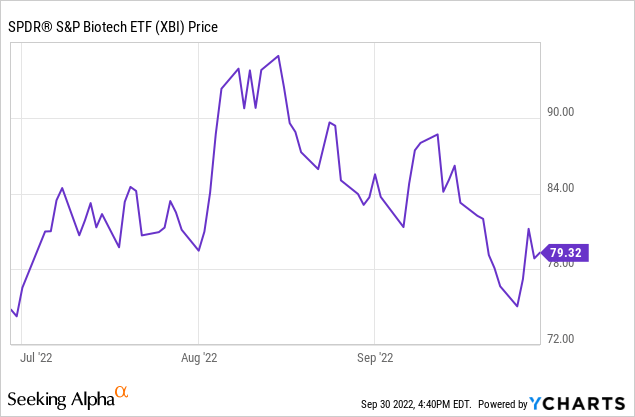

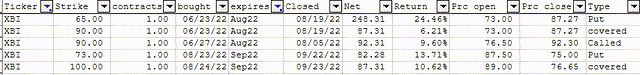

SPDR S&P Biotech ETF (XBI):

This activity is slightly different from CBRL as I want to own these shares long-term, but I am willing to risk some of the shares being called. I write both CCs on part of my XBI position and CSPs when attractive. The one $90 CC was called (at a small loss), leaving me with 200 shares.

My XBI Puts usually have generated higher ROIs as can be seen above. For an ETF, this has enough option volume to get trades executed. Since I hold XBI in a taxable account, I am thinking of selling and writing CSPs on the iShares Biotechnology ETF (IBB) to capture the XBI tax loss.

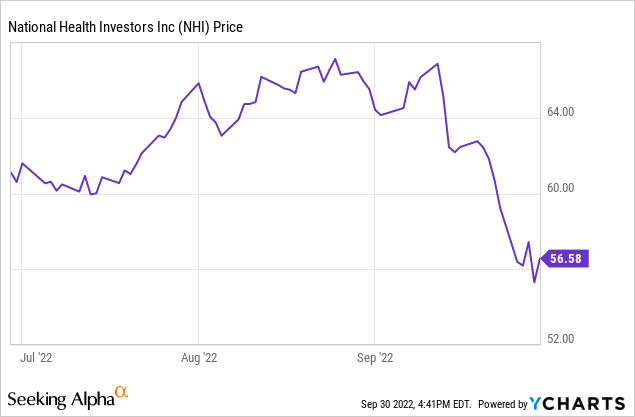

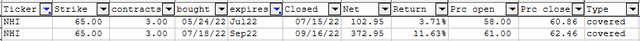

National Health Investors (NHI):

This was originally bought years ago as a long-term holding. Outside of the dividend, the price has gyrated but hasn’t advanced in years, resulting in little return. I have set a $65 price for exiting and write CCs based on that.

NHI option volume is small which explains why I go out two months when writing Calls against it. I have November $65s in place now. Tight covers can yield over 10% as shown above, plus I collect about a 6% yield while holding.

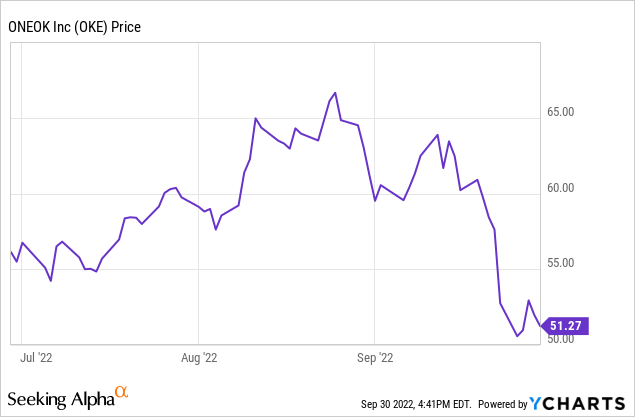

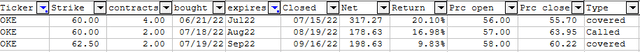

ONEOK (OKE):

Here I decided to use different strikes and occasionally different expiration dates. This resulted in some shares being called. OKE provides a nice 7% yield while I wait to be called as I think the Puts offer better trades.

The two July CC trades illustrates how the selection of a higher strike price reduces the premium ROI, though the overall ROI would be higher if called. I have both CCs and CSPs expiring in October on this ticker.

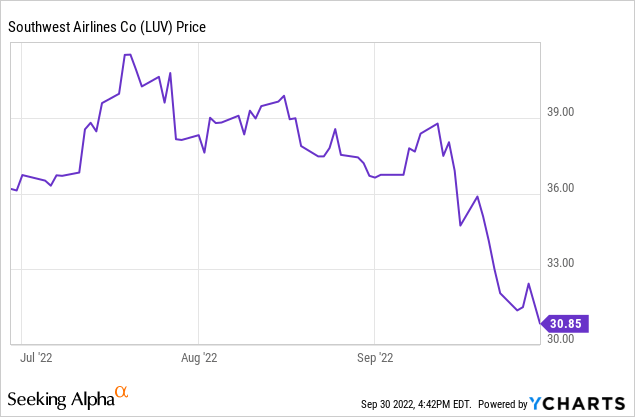

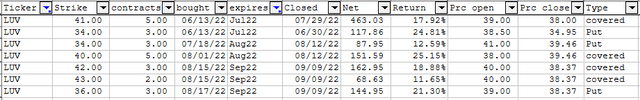

Southwest Airlines (LUV):

I like this stock as it seems to have a bottom price that holds, though fuel, wages, and a questionable economy are weighing on its performance. From what I read, and my own experience, some of those added costs are being offset by full planes and higher fares. All of that results in nice ROIs on most trades, even with 10% OTM strikes.

Like many of the stocks I write CCs against, here I also do CSPs as my overall exposure would still be small if assigned. In calculating my return when a CC is assigned, I add the CSP premiums to those earned by the CCs to come up with the position’s ROI; others might treat them as completely separate trades.

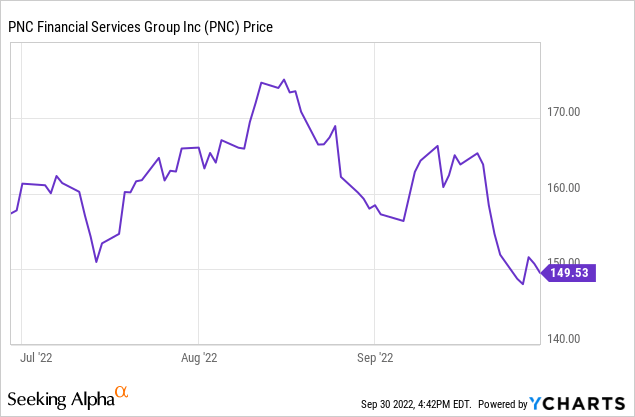

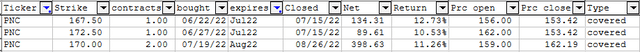

PNC Financial Services Group (PNC):

I picked up these shares last spring and its on my “okay to be called” list. Premiums and a 4% yield making holding okay and opinions on PNC are very positive. My shares were almost called, then market weakness pushed off my new CC until October, thus no September expiration.

This was one of the first stocks I started using less upside strikes as I would rather have the cash and write CSPs against this ticker.

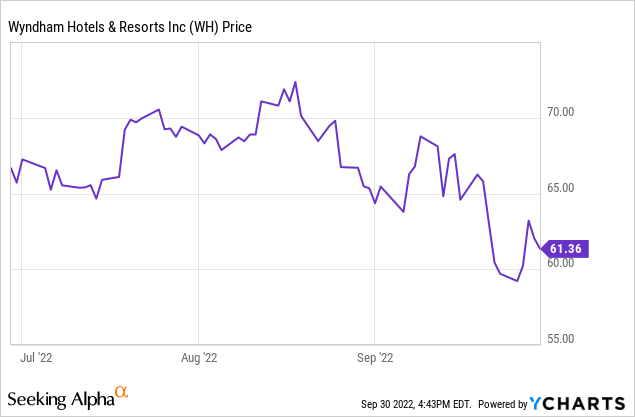

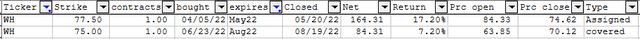

Wyndham Hotels & Resorts (WH):

Along with Southwest Airlines, one of my COVID recovery plays that is currently being harmed by recession fears. I only have the 100 shares (lack of free cash) as I was assigned back in May. I was almost called in June, and would have been in August if I selected the strike that would have allowed for a profitable exit. Probably have committed the same “error” on the October strike chosen.

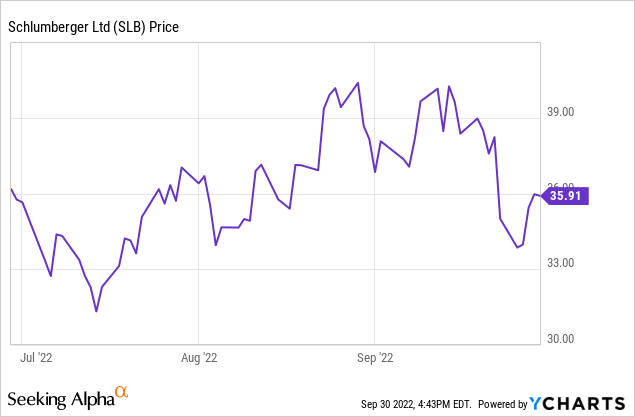

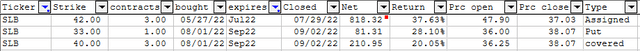

Schlumberger Limited (SLB):

SLB has been an optionable stock in my portfolio on/off for over two years due to its high ROIs. I would have more CSPs open except for the fact too much cash is tied up in assigned stocks. With the price of oil down (recession fears mostly), SLB seems stuck below $40. It does provide a 2% yield. My preference is getting called and writing more CSPs on this ticker too. By writing the $42 Put when SLB was under $36, my cost was reduced greatly by the premium earned, which also explains the ROI.

Another type a Covered Call strategy is ‘Writing Covered Calls To Capture Volatility Enhanced Premiums’, which occurs on a regular basis it seems. I only employ this, so far, on stocks already owned.

Cash-Secured-Put activity

I covered my main reason for a CSP strategy in ‘Adding Income Using Cash-Covered Puts And Covered Calls’. There are others I covered too.

These are the stocks where there was only CSP trades executed as I already reviewed the ones attached to Covered-Call tickers. I will start with the special situation CSP trades.

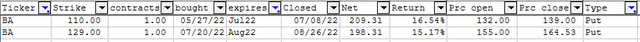

Boeing Company (BA): Poor news from Boeing and travel concerns had cut the price almost in half by late spring. After stabilizing above $130, I saw an opportunity to take a well protected trade (17%) with a JUL $110 Put. With BA at $139 at expiration, the trade netted a 16.54% ROI. I entered a second trade for the AUG $129 with a similar level of protection, which also expired OTM for a 15.17% ROI. My current trade is underwater but still has time to recover.

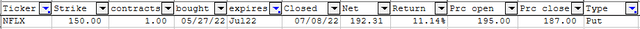

Netflix (NFLX): After the 1Q report and expectations of negative 2Q subscriber growth, NFLX plunged but it took me awhile to find an option with the proper mix of risk/reward. I finally wrote a JUL $150 Put with NFLX at $195, a huge 23% level of protection. Even so, the trade yielded a 11.14% ROI.

Altria Group (MO): The last special situation occurred when rumors, then actual, about action from the FTC to remove e-cigarettes from the US market. The stock dropped from over $55 to under $42 over the next 5-6 weeks. Figuring if hit, the yield justified the trade, I wrote 4 SEP $40 after MO bounced up to $45+; risky but more than the 10% protection I like as a minimum. After some more negativity in late August, I closed out early and earned over 24%. At that point, I had captured 93% of the premium. Those are the trades I need to close out more!

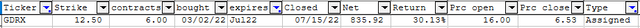

GoodRx Holdings (GDRX): Sometimes even putting your hand on a hot stove doesn’t sink in. After my previous GDRX ended poorly, the lure of a high ROI had me writing 6 JUL $12.50, which came with a 22% protection level and potential 30% ROI (see below).

“If it is too good to be true”; isn’t that what investors are warned about! It was and I was assigned and currently stand at a 50% loss. It did rally but I failed to exit at a much smaller loss. With the position under $3600, I will probably hang on and hope for a miracle recovery (or a buyout). If I had settled for my usual 10% ROI, I bet I could exited at a profit in July.

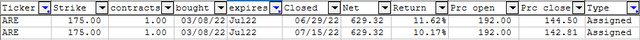

Alexandria Real Estate Equities (ARE): ARE uniquely focuses on collaborative life science, technology, and AgTech campuses in AAA innovation cluster locations. The ARE trade is an example of another use of CSPs: potentially purchasing a stock at a price below the current market price.

It had been awhile since I wrote a CSP against this stock but the price had come off a recent peak so I wrote 2 JUL $175 Puts with less protection as I was okay taking ownership.

While I bought them on the same day, one risk of writing options is they can be assigned weeks before they expire, and one contract was after the owner captured the $1.18 dividend payment. I tried writing CCs for $190 when ARE rallied to $175 but the ARE options are thinly traded with wide bid/ask spreads so no execution occurred. At its current price below $140, I am tempted to write 1 more CSP. Currently, ARE is tying up 10% of the cash I was using to write Puts against. I won’t attempt to earn extra income writing CCs at this price level.

Quarterly results

Even counting the money tied up on CSP-CDs, most of the quarter did not have my $250,000 set aside for option trading employed. That said, I based the quarterly ROI on that, and use all premiums written, even if assigned. It would be lower by 5-7% if the paper losses on CSP assignments were included. I do not include the income the cash earned which backed the CSP trades, now about 2.5%. Others do it differently. Thus, my ROI for the quarter was 15.96% or about 8% depending on what’s included. I’ve chosen to ignore the price movements on assigned Put stocks here but track them when evaluating my overall option activity, which can take multiple quarters.

| Option activity | Count | Premiums |

| Puts unassigned | 13 | $3163 |

| Puts assigned | 4 | $2912 |

| Covered Calls unassigned | 18 | $3383 |

| Covered Calls assigned | 3 | $520 |

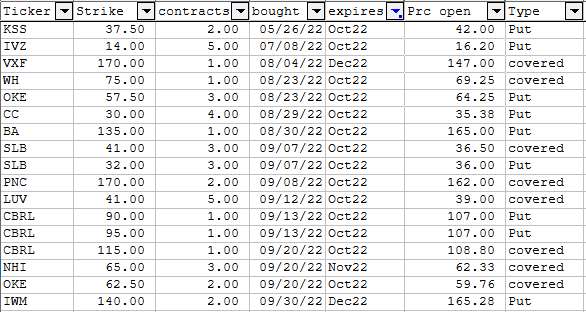

Open option contracts

Author’s options XLS

The list contains one special situation trade that is going bad (KSS) and one I wrote Puts against for the first time (IVZ). I believe there are October trades expiring every Friday during the month.

Portfolio strategy

Since I haven’t done it yet, here is my disclaimers:

- Option trading is not for everyone; just as inverse ETFs or Futures trading are not.

- While you can control the level of risk you take by the option strategy you employ, and there are many, you cannot control the market’s movement or world events.

My overriding option strategy is income generation on the cash I want in my accounts. While this might seem to be a contradictory statement from someone who writes CSPs, I consider myself a conservative investor (45% equity ratio), but there are conservative strategies that can earn 6-8% with minimal risk. My option trading is under 10% of my investment values, which also limits the impact when things go bad.

With my cash now earning 2.5%, versus .1% before July, I can take even less risk to get to my 8-9% total return on my cash holdings.

Final thought

For those not familiar with options, I suggest reading the following as a short introduction to the pros/cons of using options for whatever reason.

- Don’t Trade Options Without Studying Greek(s)

- 10 Rules For Option Traders

- Mistakes Made By Novice (And Maybe Seasoned) Option Traders

Be the first to comment