designer491

In recent years, investors have become used to lower yields on a variety of investments. The financial crisis that accompanied the Great Recession led to previously unthinkable rates, and just as the Federal Reserve began to normalize higher rates, the COVID-19 pandemic hit. The Fed dropped rates to near 0 again, and they stayed there for nearly two years.

For more than a decade, low yields on CDs and bonds became the norm. Increased inflation has led the Federal Reserve to rapidly increase interest rates over the past several months. This has been one reason for lower stock prices throughout 2022.

One investment category that gets little attention from most individual investors is preferred stock. These investments provide ownership in a company, as do common stocks. However, there are major differences. Those who hold preferred shares have a preference when it comes to dividends. A company cannot cut dividends on preferred shares without first cutting dividends on common shares. In return for this preference, investors in preferred shares do not have voting rights at the annual shareholder’s meeting.

There are many options when it comes to investing in preferred shares. Many companies issue them as they attempt to raise capital. The dividends are stable. They are a fixed percentage of the “face” or par value of the shares. The actual yield will vary based upon the price of the stock, which is tied to the market, as investors can buy and sell shares.

Some investors might not want to wade through the preferred shares that are available. Therefore, some companies have set up mutual funds and ETFs that buy a basket of preferred shares to diversify. One that has a solid track record of paying dividends is Invesco Preferred ETF (NYSEARCA:PGX).

Who Might Invest in PGX?

Investors who are looking for income might find PGX an interesting fund. Preferred stocks tend to have higher dividend yields than common stocks. Therefore, there is a strong cash flow from owning these shares at present. The current yield of PGX comes to 5.93% on a trailing twelve month basis, which is quite healthy. Just a year ago, the yield was below 5% because of the higher price of the fund’s shares and a slightly lower monthly payout. However, even that lower yield was much higher than that of the S&P 500 (VOO).

Currently, a $100,000 investment would provide around $6,000 in annual income, although this can vary over time. Companies can call old preferred shares and issue new preferred series. Regardless, a passive income stream of $500 a month, give or take, is not insignificant when compared to the ~$125 an investment in the S&P 500 might provide.

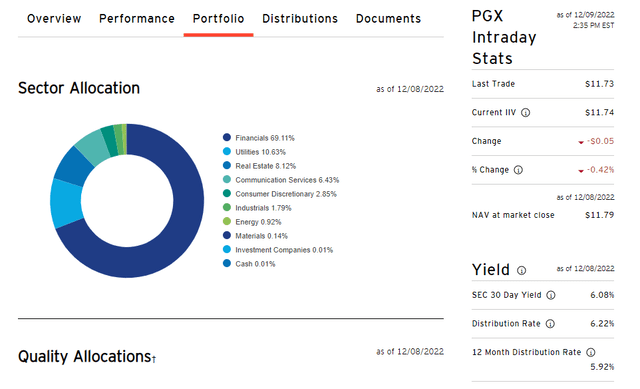

Those who are interested in purchasing ETFs over individual stocks might find PGX a solid option. The fund currently holds 295 different preferred stock issues. The fund is relatively diversified, but it is fairly heavily invested in financial company stocks, which make up nearly 70% of its portfolio weight.

PGX Sector Allocations (PGX Fund Website)

Five of the top 10 holdings in the fund are preferred issues from JPMorgan Chase (JPM), and those yields vary from 4.2% to 6%. Only preferred stock from AT&T (T) is outside the financial sector when it comes to the fund’s holdings.

The strategy Invesco uses in selecting preferred stocks involves a sampling of options available in the ICE BofAML Core Plus Fixed Rate Preferred Securities Index. Therefore, it is not a true index fund in that it does not purchase shares of all options available. It focuses on investment-grade securities to further diminish risk.

Performance

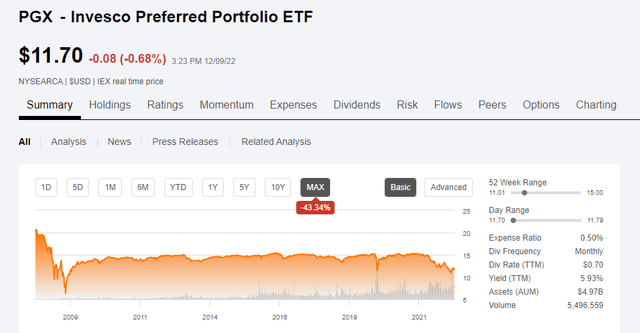

Shares of PGX have not performed well over the past year. The price of the fund is down more than 21% since the beginning of 2022. Additionally, preferred funds will not have the upside potential that an ETF that focuses on common shares would likely have over the long run. Therefore, investors who are interested in growth and have a long time horizon might want to steer clear.

Prior to the beginning of this year, the fund has had a share price that has varied little since the Great Recession. It has gone down a bit, and it has gone up a bit, rarely deviating much from a $15 price point. Because of lower rates, as companies called old series, the yield went down over that same time.

PGX Price Chart over time (Seeking Alpha)

Over the past year, however, this has shifted a bit. As noted above, shares have dropped in price. This situation has led to the higher dividend yield. Therefore, while investors with a long investing horizon might want to invest in funds that focus on common stocks with higher growth potential, those who are investing for income might view this as an opportunity to purchase shares at a lower price with a relatively high yield.

Other Benefits

Unlike many mutual funds and ETFs, PGX has an advantageous pay schedule. Rather than paying dividends out on a quarterly basis, Invesco pays dividends for investors in PGX monthly. Because the payout varies little on a month-to-month basis, investors who want to live entirely or partially off passive income from dividends might find this an attractive feature (although some other preferred funds like the iShares Preferred and Income Securities ETF (PFF) also pay on a monthly basis).

Another benefit that preferred stocks can provide is the tax treatment of their dividends. Some of these dividends are taxed as ordinary dividends, but most are taxed as qualified dividends. I owned shares of PGX throughout 2021 and much of 2022 (I sold to avoid massive portfolio losses right before buying a new house – I was not sure how much cash I needed to close the loan or if my old house would sell before I needed a down payment). I looked back over my tax statement for 2021, and my dividends from PGX appeared to be, on average, weighted toward nearly 60% on the qualified side.

Those who are looking to live off passive income could benefit from this if they are in the 0% to 12% tax brackets, because qualified dividends are taxed at the capital gains rate. Therefore, the qualified portion of the dividends would incur $0 in federal income taxes. This tax treatment differs from investments in other high-yield securities like REITs and BDCs. Of course, readers will want to consult with a tax professional to ascertain the tax treatment of a given investment given their unique circumstances.

Conclusion

Invesco Preferred ETF can be a great source of monthly income for those who consider themselves income investors. Shares are not likely to give much in the way of price appreciation, and yields can vary based upon current rates. When interest rates drop, companies can call their higher-yielding preferred shares. Nonetheless, the yield provided by the fund greatly exceeds that of funds that invest in common shares. Those who want to generate cash flow without selling shares could benefit from PGX. Those who rely on the 4% Rule could even reinvest the dividends that exceed 4%. This could provide an increasing flow of dividend income over time to help offset inflation.

Those who are interested in growth might want to steer clear of preferred shares and this ETF for a while. However, PGX should receive strong consideration from those who want a higher income that’s somewhat stable.

Be the first to comment