Sundry Photography

No one is certain about the direction of the economy these days. The market is reacting in a hyper-sensitive way to all the macro news, especially around inflation and interest rates. Amid the turbulent up-and-down swings over the past few weeks, however, long-term oriented investors still have a tremendous opportunity to buy deeply discounted, high-quality growth stocks.

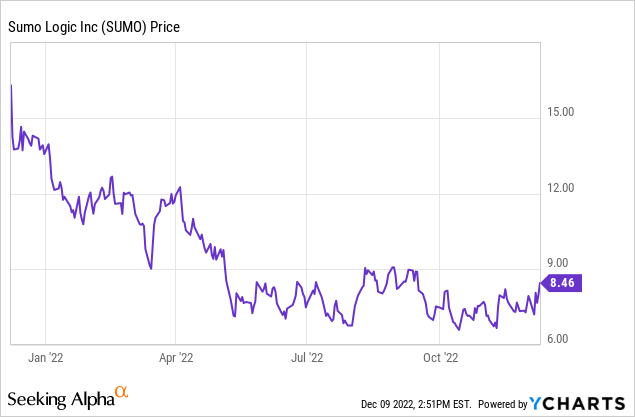

Sumo Logic (NASDAQ:SUMO) is one of the few standouts in this space. The big data/machine learning company, a lesser-known competitor to Splunk (SPLK), has quietly been outperforming peers and beating expectations in a very tough macro environment for software companies. While many of Sumo Logic’s software peers have reported slowing deal closure rates amid enterprise spend weakness, Sumo Logic has instead shown accelerated revenue growth amid profitability gains. Down 40% year-to-date, it’s a great time to pick up shares of Sumo Logic for a rebound.

I remain very bullish on Sumo Logic. I have been an investor in this stock since its IPO, and though the descent from the $20s immediately post-COVID has been painful, the moves have largely all been sentiment-driven. I continue to view Sumo Logic as an excellent way to gain exposure to the nascent big data space (which will regain investor enthusiasm once the current risk-off attitude subsides), as well as a company that has already amassed remarkable traction among large customers such as SAP (SAP), Alaska Airlines (ALK), and AB InBev.

- Big data has limitless use cases across industries and functions – Think about it in these terms: Sumo Logic is not a product but a platform. It’s a tool by which you can do many things. As more and more companies attempt to harness the value of big data, use cases will explode – and though Sumo Logic is in a competitive space with high-profile competitors, this is a large enough market for multiple key players. Sumo Logic estimates its TAM at a hefty $55 billion, indicating that it’s currently only about ~0.5% penetrated into this overall market.

- Recharged sales leadership has shown results so far – Sumo Logic knows that its growth in 2021 was disappointing to the markets and that it needed a go-to-market overhaul. The company has seen accelerated growth rates in 2022 so far as it brought on a new president at the end of last year.

- Consistency is better than boom and bust – Sumo Logic is far from the most exciting software company these days. There are competitors like Datadog (DDOG) growing much faster (but also, priced much higher). But Sumo Logic has also gotten into a nice cadence of producing ~20% y/y revenue growth, which is on the cusp of what investors would consider to be a growth stock.

- Substantial cash war chest – For a company of Sumo Logic’s relatively small revenue size, the fact that the company has ~$300 million of cash, unencumbered of debt, on its balance sheet is a promising sign that the company can continue to invest in further growth.

- Cheap enough to invite M&A chatter – While I’m of the opinion that we should never bank an investment thesis on the hopes of M&A alone, I think Sumo Logic is exactly the type of declining software company that invites potential buyers’ attention as a small, tuck-in acquisition.

At current share prices near $8, Sumo Logic trades at a market cap of just $1.01 billion. After we net off the $322.2 million of cash on the company’s balance sheet (which is unencumbered of debt), the company’s resulting enterprise value is $688 million.

Versus Wall Street’s consensus FY24 (the year for Sun Logic ending in January 2024) revenue expectations of $348.6 million (representing 17% y/y growth; data from Yahoo Finance), the company’s resulting valuation is just 2.0x EV/FY22 revenue – a deep value stock that I’d consider to be in underwater territory.

Sumo Logic, in my view, is just waiting to be recognized again. It is a rare tech company that has produced a string of recent earnings beats in a very tough macro environment. Stay long here and take advantage of recent weakness to load up on this stock.

Q3 download

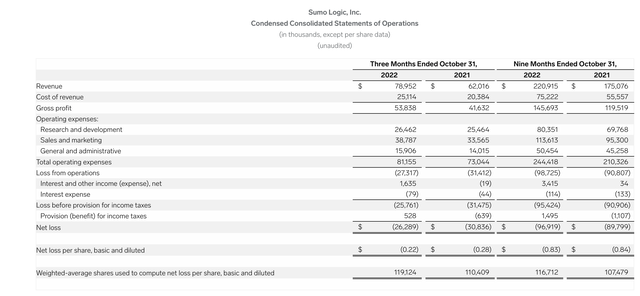

Let’s now touch on Sumo Logic’s most recent quarterly results in greater detail. The Q3 earnings summary is shown below:

Sumo Logic Q3 results (Sumo Logic Q3 earnings release)

Sumo Logic’s revenue in Q3 grew 27% y/y to $78.9 million, beating Wall Street’s expectations of $74.2 million (+20% y/y) by a huge seven point margin. Not only was the beat quite substantial, but Sumo Logic’s revenue also accelerated slightly over 26% y/y growth in Q2 – a rarity in a quarter where most tech companies have cited macro issues as the driver behind sizable slowdowns.

The company also grew ARR at a 22% y/y pace to $298.9 million in the quarter, and we note that this already covers 86% of the consensus revenue expectation for FY24 – indicating that expectations are quite “safe”.

Management noted that the new go-to-market strategies implemented under its new president have started to bear fruit. While Sumo Logic certainly acknowledges economic uncertainty, so far the company notes that its execution has remained robust. Per CEO Ramin Sayar’s prepared remarks on the Q3 earnings call:

While in the near term, there is less certainty and more noise in the macroeconomic climate. We have control over how we manage the business and remain committed to delivering more durable growth and accelerating our path to profitability. Despite the macro uncertainty, we are still in the early innings of a multiyear growth cycle driven by digital transformation, cloud migration and security modernization.

Companies are increasingly relying on digital services to help grow and operate their business. And we play a critical role in ensuring that these experiences are both reliable as well secure. These long-term trends drive our business and are contributing to our strength, that we are seeing in our results. In Q3, we continue to see strong win rates with our customers increasing their adoption and usage of our platform. We ended the quarter with 501 customers with more than $100,000 in ARR, representing a year-over-year growth of 14%.”

The company also noted that dollar-based net retention rates stayed flat quarter over quarter at 115%, noting that both customer retention as well as expansion rates improved from the prior year. It is expecting a few points of macro impact to hit in Q4, however, from customers’ budgetary pressures.

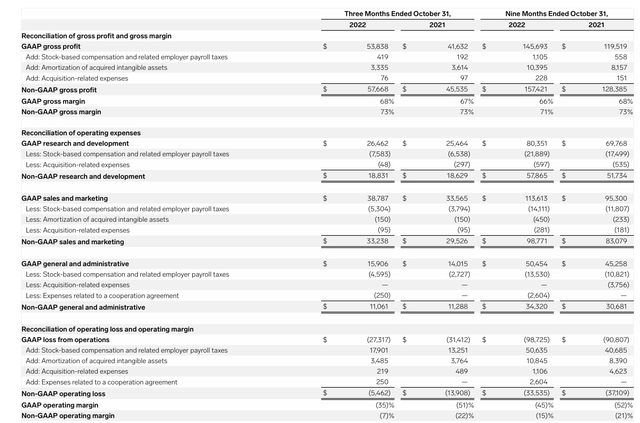

Amid strong top-line results, Sumo Logic has also delivered admirable bottom-line progress. Note that pro forma operating margins improved fifteen points year-over-year to -7%, a result of the company’s early and focused efforts to cull down its cost structure.

Sumo Logic Q3 margins (Sumo Logic Q3 earnings release)

Management notes that it reduced headcount and cost across each of its functional areas, and that by the end of this year it will have eliminated $27 million in annual opex (roughly 8% of consensus revenue for FY24).

Key takeaways

Strong growth that so far has resisted macro headwinds, a commitment to chasing bottom-line profitability, and a fantastic product that plays in a wide-open addressable market: there’s a lot to like about Sumo Logic, not to mention the fact that it’s a deep bargain at just 2x forward revenue. Don’t miss the opportunity to invest cheaply in this stock.

Be the first to comment