Chonlatee Sangsawang/iStock via Getty Images

After analyzing Michelin’s performance and its latest released data on replacement tires and original equipment sales, today we are looking at Continental Aktiengesellschaft (OTCPK:CTTAF) implications.

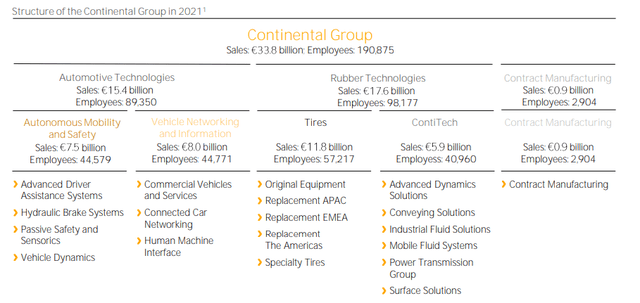

The German company is among the largest auto suppliers around the globe and was founded in 1871. Even if the company is well known for tire production, Continental’s revenue from tires accounts for only a third of total revenue. The company engages its activities thanks to the following structure:

Continental Group Structure (Continental Annual Report 2021)

Its wide product offering consists of mobility and safety solutions, interior products, automated and assisted driving solutions, and tire production for all kinds of worldwide transportation vehicles.

Looking ahead from the Q2 performance

Why are we positive?

- It is important to highlight the strong order backlog and its positive trend development since the Q1 results. Numbers in hand, the Automotive technologies division has €6.0 billion in orders in the second quarter (a higher number compared to the Q1 result) and a plus 40% on a year-on-year comparison;

- On a regional basis, despite the lower vehicle production, Europe is delivering superior performance, while North America and China are currently underperforming;

- In the tire division, revenue growth is coming from price increases that offset lower volume. As we also emphasized for Michelin, Continental might also benefit from Nokian that is exiting the Russian operation. As a memo, Nokian’s production capacity is going to be reduced from 23 million to 6 million tires. This might result in a new piece of cake in the old continent tire market.

Why are we negative?

- The automotive division continues to suffer and affects the company’s profitability. The CEO is proud of Conti’s ability to not increase its segment losses, however, almost all the competitors are now back to profit. This turned out to be a negative sentiment in the investor community;

- Europe is facing an energy crisis, and many companies that we cover are actually proactively looking for gas alternatives. It seems that Continental is minimizing the problem and its dependency. More importantly, if tire production is impacted, the company will have to prefer original equipment sales over replacement tires, which are going to be negative for the company’s profitability. Most of the Conti factories are located in Germany and given this apocalyptic scenario, this is also not supportive. Our internal team does not believe that pricing power will be sufficient to cover cost increases;

- In the first half-year, the tire division has benefited from inventory revaluation adjustment. We also noted that inflation pressure could translate into product switching to lower-priced tires. In our assessment, we are forecasting a lower margin in the second half of 2022;

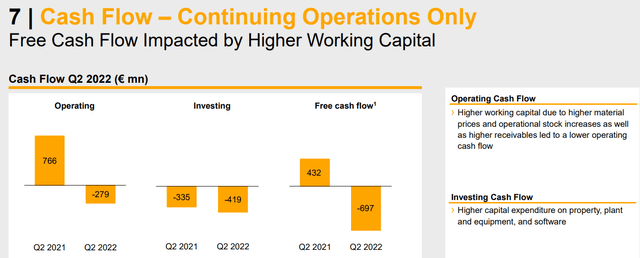

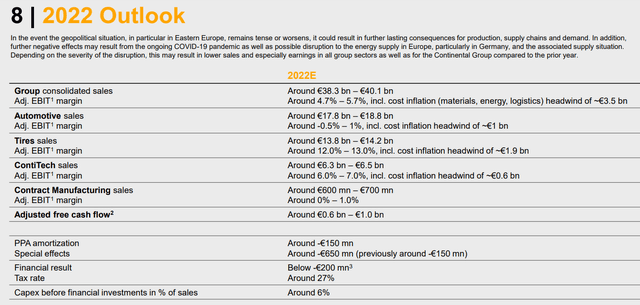

To sum up and based on Continental’s future guidance, our internal team is forecasting the low range of top-line sales guidance. Going down to the P&L, in Q1, the operating profit margin reached 4.5% against a yearly outlook of 4.7%-5.7% (including raw material cost pressure). This implies a rebound in the margin in the second part of the year. As explained by the management, the tire segment is likely to struggle, so is the Automotive business that needs to perform (and we are not optimistic). Again, even at the free cash flow level, Continental expects a positive flow and an improvement in the cash generation.

Continental Cash Flow Generation (Continental Q2 Results)

Continental Guidance (Continental Q2 Results)

Conclusion and valuation

Despite the ongoing Ukraine conflict, the company has always been optimistic (FY guidance confirmed our point). Later on and as expected by the market, Continental revised downwards its internal guidance. With the ongoing challenges, the company is facing turbulences. In our universe coverage, Continental is our least preferred company. Given the recent impairment, we value the company with a P/E (2023) of 7x on earnings per share of €8 arriving at a valuation of €56 in line with the current stock price. Mare Evidence Lab favoritism goes to OEMs over suppliers (Ferrari, Mercedes and Volkswagen are all buy-rated). Within the sector, we prefer Michelin.

Be the first to comment