blackCAT/E+ via Getty Images

2022 have been a difficult year for investors so far. Broad market indexes have tumbled significantly on the back of geopolitical turmoil, interest rate hikes and fears of a recession. It looks like those challenges will likely remain into 2023 so extra prudence should be taken when picking potential winners from the stock market. For me, a potential winner should have the following characteristics:

- Resilient revenue growth and margins

- Strong competitive position

- Solid financial position and no need for capital raising

- Management team with a proven track record and skin in the game

- Attractive valuation with a near-term catalyst

Hims & Hers Health (NYSE:HIMS) seems to possess all of these characteristics, which makes it a great pick for 2023.

Company overview

Incorporated in 2013 in the state of Delaware, Hims & Hers Health began its mission to change healthcare for the better in 2017. In its blog, the company highlights its mission as:

We started hims & hers to eliminate stigmas around health and wellness issues and break down barriers for people when it comes to obtaining quality healthcare. In many cases, patients are discouraged from taking care of themselves due to high copays, drug prices, long wait times and an overall lack of accessibility.

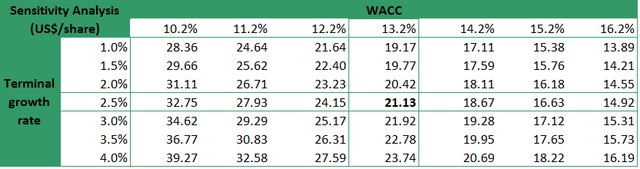

HIMS applies the direct-to-consumer business model by connecting its customers to healthcare professionals for online consultations. This makes the contact with a medical expert more convenient by minimizing waiting times and eliminating the face-to-face contact with other people in front of the cabinet or even the doctors themselves, saving the patients from a potential embarrassment, given that HIMS focuses on sexual health, hair loss and skincare.

If a treatment is prescribed, the patient gets his medications shipped to his door free of charge. This allows customers, subscribed to HIMS’s services to receive their prescribed drugs each month in the appropriate quantities, without the need to place additional orders, which minimizes the risk of patients’ running out of meds, due to delayed order placement.

In addition to the telehealth business, HIMS is establishing a strong wholesale presence with branded products in a wide range of stores. While the wholesale segment is not a major contributor to revenue as of now and it has lower margins, I think that there is a serious potential for synergies as establishing the brand and making it visible to consumers will likely drive traffic to the telehealth services.

What makes HIMS a good investment

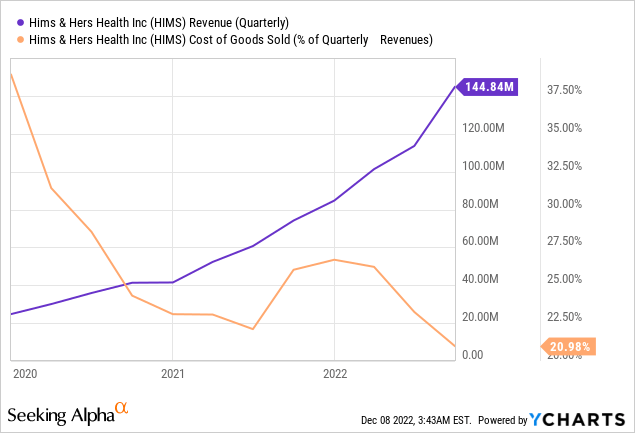

Strong revenue growth and margins

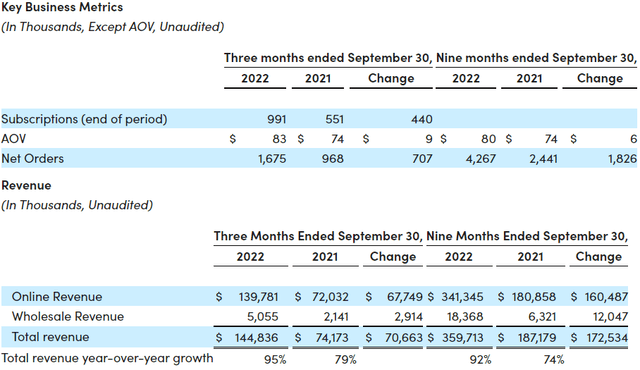

A lot of growth companies saw slowdown in their revenue expansion, due to some customers pulling back on spending as interest rates began rising, expenses for non-discretionary spending like utilities rose and recession fears kicked in. However, this was not the case with HIMS as the key metrics improved significantly YoY in all dimensions – revenue growth, average order value (AOV) and subscriptions. The latter reached 991k (+80% YoY) as of the end of Q3’22, paving the way for exceeding the 1M milestone in Q4’22.

2022 have been tough on a lot of sectors of the economy as they saw rapid increases in their input costs, driven by elevated energy prices and rise in some commodities. However, the business of HIMS is neither energy intensive, nor commodity intensive, which allowed the company not only to maintain, but to improve its gross margin through 2022 as it surpassed 79% in Q3’22 from 74% a year ago.

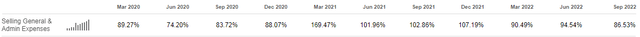

The lion’s share of expenses has been SG&A since as a growth company, HIMS needs to invest heavily into marketing in order to establish its presence and expand its customer base. That being said, for the last few quarters, there’s a clear downtrend in SG&A as a share of revenue, which would be key towards future profitability.

HIMS’ SG&A expenses as a % of revenue (Seeking Alpha)

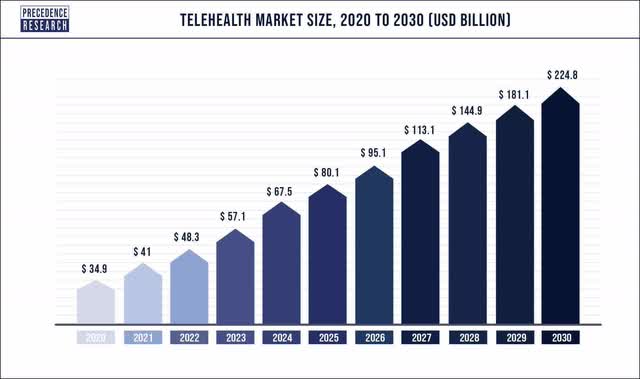

Going forward, revenue growth should be supported by the expansion of telehealth as a whole, since the sector is still at a very early stage of its development. According to data from Precedence Research, the telehealth market is expected to grow at a CAGR of more than 18.8% in 2022-2030.

Telehealth market outlook (Precedence Research)

Strong competitive position

The telehealth industry doesn’t have high barriers of entry. It doesn’t require significant capital investments like the industry sector, nor any hard to obtain permits as the business boils down to connecting patients with medical professionals in a virtual environment and carrying out the necessary logistics for drug delivery. For these reasons, it’s hard to talk about significant pricing power. That being said, branding and customer experience are the main factors that could drive one company ahead of the herd.

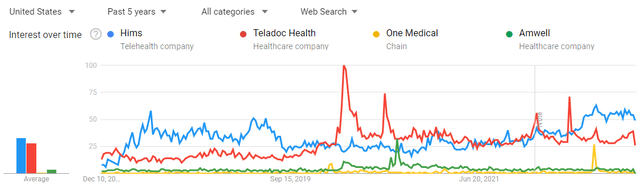

HIMS vs peers in web searches (Google Trends)

When compared to some of its public peers like Teladoc Health (TDOC), American Well Corp (AMWL) and 1Life Healthcare (ONEM), which is the process of being acquired by Amazon (AMZN) it appears that HIMS is ahead in popularity in the USA, judging by the ratings from Google Trends. What’s more, in 2022, HIMS has surpassed TDOC and is around all time high levels of interest amongst search engine users.

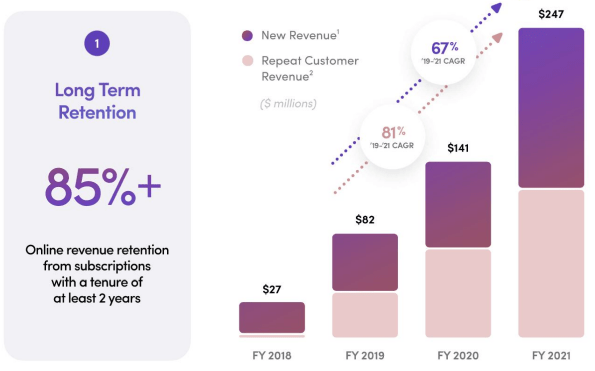

Customer retention and repeat revenue (HIMS)

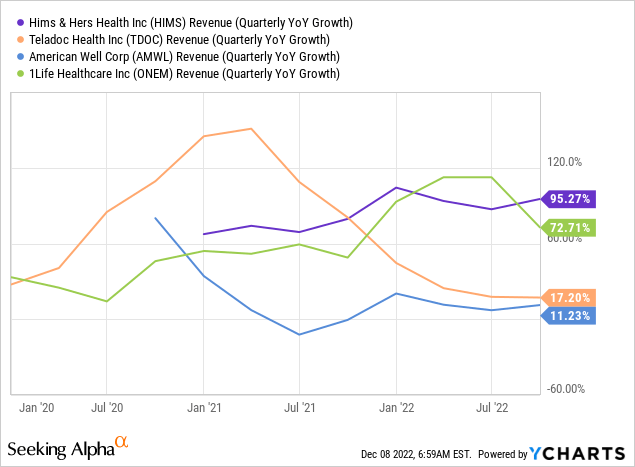

Granted, the data from Google Trends is not a proof of good customer experience on its own, but high share of repeat customer revenue as well as very high retention rate of more than 85% are also pointing towards this conclusion. Furthermore, sales dynamics of the four companies seem to solidify the thesis of strong competitive positioning as revenue growth of TDOC and AMWL is slowing down considerably, while that of HIMS is accelerating and surpassed that of ONEM as well.

Strong financial position and no need for capital raising

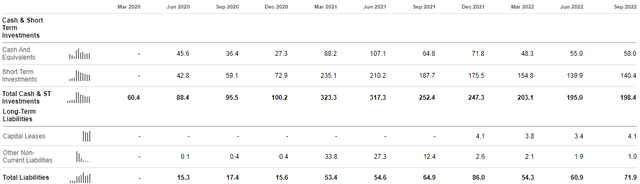

Looking at the financial position of HIMS in Q3’22, the company has cash and equivalents of USD$58M and short-term investments of US$140.4M in government and corporate bonds. At the same time, it has no interest-bearing long term debt, just US$4.1M of leases. Short term liabilities are about US$66.8M, which brings total liabilities to around 1/3 or cash and ST investments.

Highlights from HIMS’ balance sheet (Seeking Alpha)

At the same time, the cash and ST investments position of the company has been relatively stable in the last three quarters, which combined with the expected adjusted EBITDA profitability in Q4’22 should support the solid financial position of HIMS in the following quarters. This should eliminate the risk of equity raising, which could be at unfavourable conditions, given the overall risk-off market environment.

Management team with a proven track record and skin in the game

HIMS is a founder-led business as the co-founder Andrew Dudum serves as the CEO of the company. He has experience in private equity through participation in the team behind the investment fund Atomic Labs. I think Dudum’s involvement in the PE industry should be an advantage for a young, growing company like HIMS, since he likely observed many businesses succeed and fail. In addition, as of August’22, he’s the second largest shareholder in Hims & Hers Health with 9.6% ownership, implying significant skin in the game.

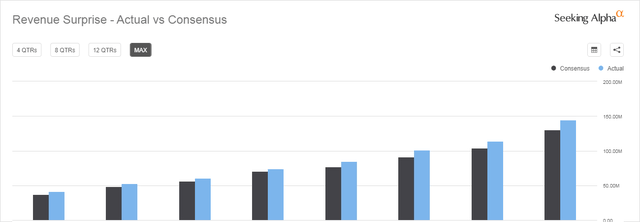

HIMS’ Revenue Consensus vs. Actual (Seeking Alpha)

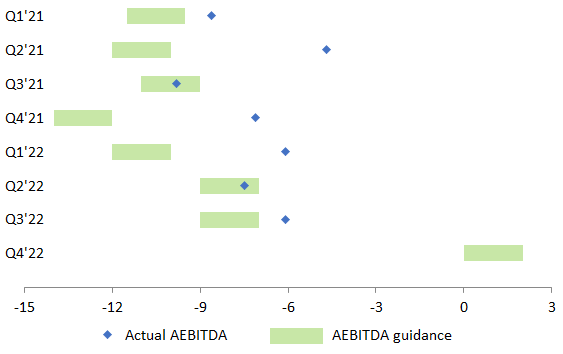

Turning to the performance track record of management, since the company went public, revenue consensus has been beaten every single quarter demonstrating management’s ability to overdeliver. The same could be said about management’s guidance regarding adjusted EBITDA (AEBITDA). Every quarter the AEBITDA guidance has either been met towards the upper band of the range, or more often exceeded.

HIMS’ AEBITDA Guidance vs Actual (HIMS data; compiled by the author)

Having that in mind, Q4’22 guidance suggests that HIMS will achieve a major milestone – AEBITDA profitability. In the Q3’22 earnings call, Andrew Dudum has said:

Even more exciting is the adjusted EBITDA guidance we are providing today, which anticipates our transition to profitability beginning in Q4. We have been on this path since inception, and it is particularly gratifying to see this organically materialize. The underlying strength of our model and ongoing momentum across the business gives us confidence that we can operate profitably on a go-forward basis while continuing to invest for growth.

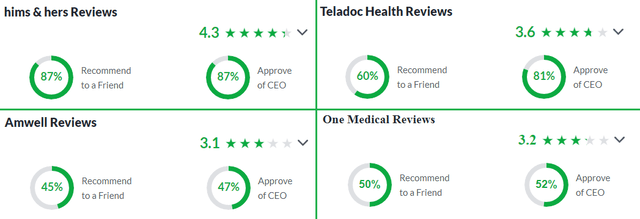

Another statistic, worthy of examining, are the Glassdoor ratings of HIMS compared to the three peer companies – TDOC, AMWL and ONEM. Such metrics could provide assessment of the entities from the standpoint of employees. In service based businesses, the workforce is especially important for delivering good customer experience, so labor force’s satisfaction with the company matters.

HIMS vs peers from the standpoint of employees (Glassdoor)

The data shows that HIMS’s employees are much more likely to recommend the company to a friend as a potential career path, implying relatively high satisfaction. The CEO – Andrew Dudum also has higher rating than his three colleagues from the peer group.

Valuation

After establishing the merits of HIMS performance in terms of operational results, let’s turn our attention to the valuation of the company. After all, even a stellar business could be fairly or even overpriced, making it a not so good investment.

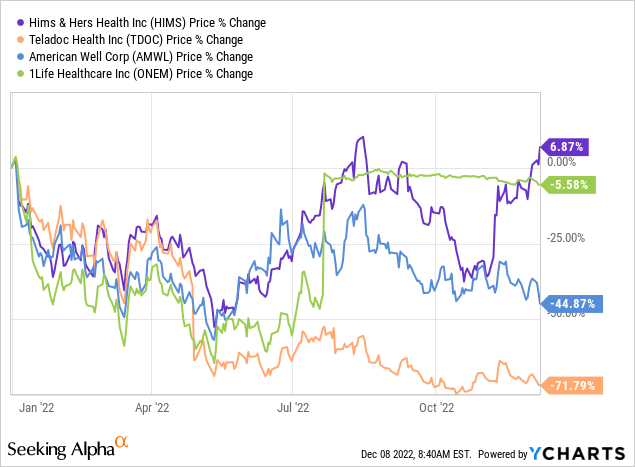

Looking at the YtD performance of the four telehealth companies I mentioned above, it appears that HIMS is the only one with a positive performance, due to the strong run-up in price following the release of the impressive Q3’22 results.

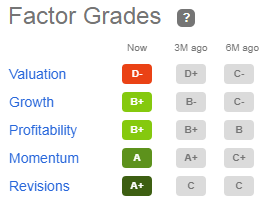

So is there any more upside and how much? At first glance, the Factor Grades section at Seeking Alpha suggests, that the company may be overvalued, implied by a D- grade.

HIMS’ Factor Grades (Seeking Alpha)

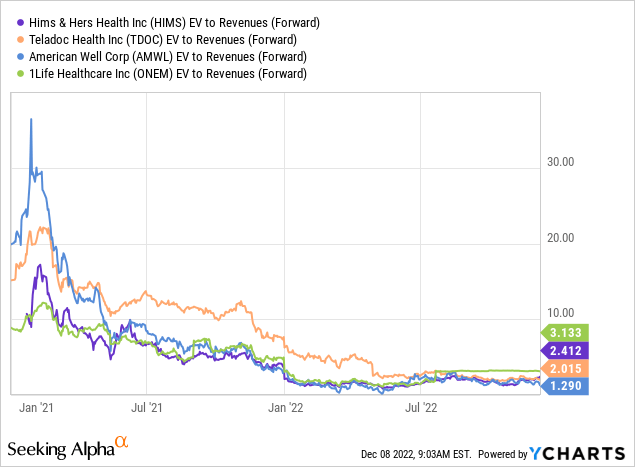

However, a deeper dive may suggest that the low valuation of the company is misleading. After all, HIMS is a growth company, that is yet to achieve profitability, while the sector for comparison is the whole Healthcare sector, which includes many mature businesses. So a better sense of HIMS valuation may be obtained by comparing the forward EV/Revenue ratio to that of the three peers.

Prior to the Q3’22 results, HIMS had the lowest forward EV/Revenue of the peer group. Now that the share price of HIMS has rallied, while the stocks of TDOC and AMWL have plummeted, it occupies the third place in terms of lowest forward EV/Revenue, which stands at 2.4. The peer with the highest multiple – ONEM is in a process of being acquired by Amazon, so taking a closer look at that case makes sense.

The acquisition of ONEM

In July 2022, Amazon initiated a buyout attempt at 1Life Healthcare, which operates under the brand One Medical (ONEM), which puts the EV of the target at US$3.9B. Guidance of One Medical from Q1’22, suggests revenue target for 2022 of slightly below US$1.1B, which puts the deal at a forward EV/Revenue multiple of about 3.54.

Turning back out attention to HIMS, in the Q3’22 release, management outlined 2022 annual revenue expectation of about US$520M. In calculating net debt, I took into account not only the cash and equivalents, but also the ST investments in bonds, as they’re not in any was part of the company’s business and are not held in cash purely in order to offset some of the effects of inflation.

| F2022 Revenue (US$M) | 520 |

| Implied f EV/Revenue multiple | 3.54 |

| implied EV (US$M) | 1 843.6 |

| Net debt (US$M) | -198.4 |

| Implied Equity Value (US$M) | 2 042 |

| Shares outstanding | 207.7 |

| Fv/share (US$) | 9.83 |

| Current price (US$) | 7.14 |

| Upside | 37.6% |

The results show, that applying the multiple of the ONEM deal to HIMS implies more than 37% upside to the current share price. And I would make the case that HIMS probably deserves a premium to ONEM, as it has superior revenue growth trajectory and seems to have better brand recognition, based on the data from Google Trends. So in addition to the valuation approach based on similar transaction I did a DCF model.

DCF Valuation

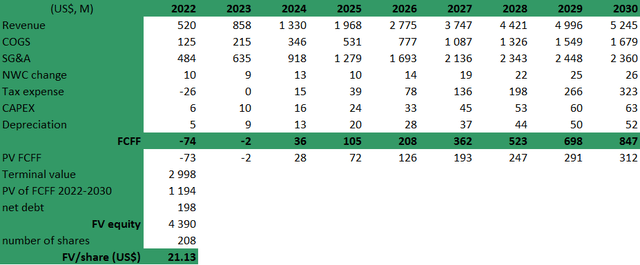

DCF valuation (author’s own assumptions)

My DCF model is based upon three main assumptions regarding the three elements of the company that appear to have the most influence on the free cash flow. Regarding revenue growth, I assume 91% for 2022, which then falls rather sharply to 65% and then gradually falls to 5% in 2030. I also used 2.5% for the terminal growth rate. For COGS I assume 24% of revenue, which is then increased by 1% each year in order to reflect potentially higher competition on the market, which could squeeze the gross margin to an extent. Note, that this is contrary to the current trend of the company to achieve higher gross margins as revenue grows. And finally, the biggest element of expenses SG&A are projected to fall gradually in a way to reflect possible AEBITDA profitability from 2023. Since HIMS is not a capital intensive business, CAPEX and Depreciation are expected to be just a tiny fraction of the bigger picture and to have little material effect on free cash flows. The tax rate that I used takes into account the state level corporate tax of Delaware as well as the federal corporate tax rate. The discount rate that I used is 13.2%, which may seem quite high, but I prefer it do be that way in order to obtain some margin of safety.

Sensitivity Analysis (Author’s own calculations)

The resulting estimated fair value per share is US$21.13, which implies that the share could triple from its current levels. In addition, a sensitivity analysis was performed in order to assess the effect on the estimated FV of changes in the discount rate as well as the terminal growth rate.

Final thoughts on valuation

Taking the average of the two approaches – US$9.83 using the ONEM deal as a proxy and the estimated FV through the DCF model of US$21.13 gives a target price of US$15.48/share implying more than 115% upside.

Regarding what could trigger another strong move in that direction, I think that the confirmation of management’s guidance for AEBITDA profitability in Q4’22 and afterwards could play that role. This, if achieved, will be a major milestone for HIMS, which will de-risk the company further. The Q4’22 statements should be released somewhere in the first half of February so then the picture will become more clear.

Risks

Interest rates risk

As HIMS is debt free, the effects of rising interest rates in terms of potentially higher outflows are minimal. However, there could be some effect regarding the ST investment position, which is in bonds, if they’re not held to maturity. That being said, higher interest rates will likely have negative effects on the valuation of the company as the risk-free rate rises.

Recession risk

A broad economic slowdown is generally bad for stocks, as companies see their revenue growth stall. However, healthcare is more of a non-discretionary sector and HIMS’ services could be an alternative to customers, who want price convenience, transparency, predictability and potentially lower costs of the prescribed medications.

Competition risk

This is probably the most serious risk faced by HIMS. The telehealth industry doesn’t have high barriers of entry and some notable names like Amazon are trying to enter into it too. On this front being one of the pioneers and the recognizable brand should help HIMS to maintain or even expand its share of what is expected to be a very large market.

Regulatory risk

Obviously, medicine is a highly regulated sector. There are conditions that couldn’t and probably shouldn’t be treated online, but require in person diagnosis and examinations. That being said, in lots of cases telehealth could be an advantage to those in need. And this seem to be recognized by many states within the US as regulations are being relaxed. Still, the digitalization of healthcare services is still at very early stage so the risk of unforeseen legislation changes remain.

Conclusion

Led by a management team with an impressive track record and skin in the game, HIMS seems to be doing all the right things in order to establish itself as one of the key players on the emerging telehealth market. Supported by a strong balance sheet, accelerating revenue growth and positive trends on the costs side, HIMS appear to be ready to achieve AEBITDA profitability in the next quarter and looks poised for a great 2023. Based on my estimate of fair value, the current share price offers upside in excess of 115%.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment