imaginima

Nearly all investors have experienced a rough 2022 as there were very few places to hide. Escaping the bloodbath that occurred in the equity and fixed income markets was tough, but with such a tough year coming to a close, we decided to get a jump start on reviewing our buy/hold/sell lists and looking over all of our trades for the year.

We keep a list of companies we trade, or buy and tuck away for the long-term play, as these do not necessarily show up in every portfolio or certain model portfolios we construct. Each year, and sometimes as often as each quarter, we go through and update the analysis while also weighing management’s execution on the strategic plan. One company we recently took a look back on was Frontier Communications Parent, Inc. (NASDAQ:FYBR), which we covered back on March 24, 2022 in an article titled ‘A New Frontier’.

Performance

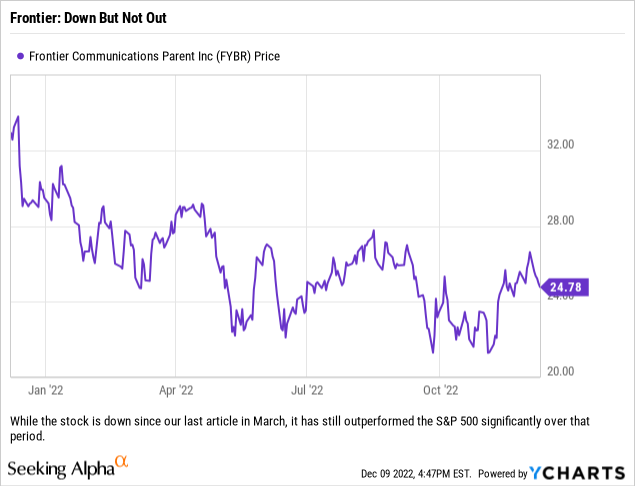

Since the date of publication, Frontier has traded down 7.28%. In any other year, we would mark this as a bad call and make sure we were not early to the trade or missing some key data. However, over the same period, the S&P 500 is down 12.35% highlighting just how tough of a year it was for equities in general. Add in the fact that Frontier has no downside protection from a dividend and the performance makes sense.

Execution

In our previous article we discussed the path forward for Frontier, and much of it hinged on the company being able to execute on the Wave 2 fiber buildout, delivering on cost cuts and maintaining a disciplined balance sheet. Roughly six months later, it appears that management is exceeding expectations based on the company’s latest quarterly results conference call.

The balance sheet remains strong, and while the net leverage has climbed from to 2.4x to 3.1x, it remains below management’s stated mid-3s target. As the fiber build progresses this will come more in line with the long-term goal, but we would also point out that as the company ramps up the fiber deployment that a quarter-to-quarter measurement, or tracking, of this metric might not be ideal as it takes time to begin to realize revenue from passings (you have to sign up customers) and at the same time you have costs associated with each customer acquisition/conversion. So really you get hit on a few fronts during this period:

- costs associated with buildout

- little to no revenue as passings are brought online

- customer acquisition costs

So cash flow (and by extension cash) gets hit on the outflows for the buildout and customer acquisition costs, which itself increases your leverage, but you also get hit with an asset that early on will underperform an established route and thus have lower EBITDA impact that also impacts you as you continue with the buildout. The point here is that while many are paying attention to various companies’ leverage ratios, balance sheets, etc. it is our belief that this will not be a good approach to take when looking at Frontier because the Wave 2 buildout is in the early phases, and the first impact is a negative impact which is only truly offset in later years of large buildouts such as these, as the majority of your passings age into your base fiber penetration.

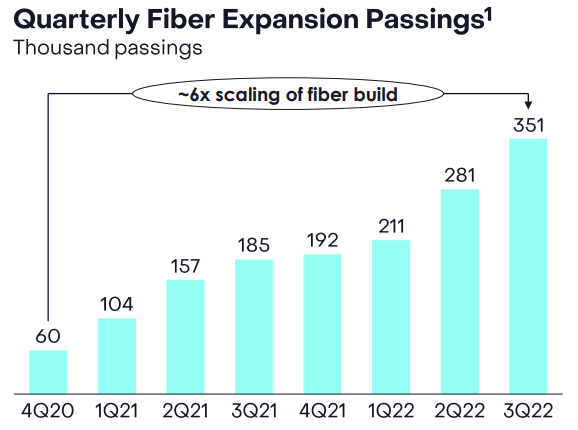

Frontier has ramped up their buildout over the last two quarters. (Frontier Investor Q3 2022 Presentation)

The buildout has ramped up over the past two quarters, which impacts cash on the front-end, but also requires time to ramp up new customer adds via penetration and get past those onboarding/acquisition costs.

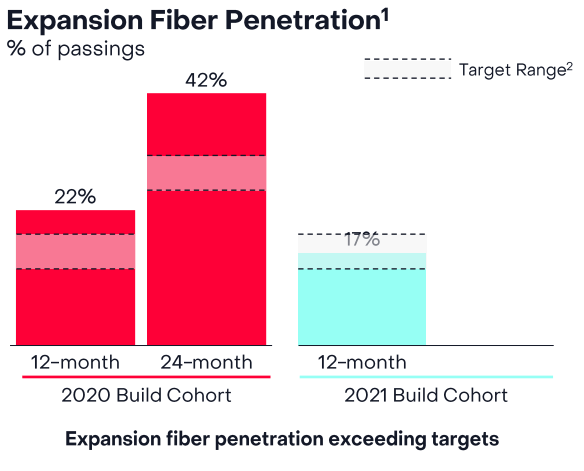

Frontier is ahead of schedule on fiber penetration on their new passings. This should bode well moving forward – so long as trends hold. (Frontier Investor Q3 2022 Presentation )

We would point out some highlights for Frontier are that their 2020 buildout is now coming in right about at their base fiber penetration 24 months after completion. That level is above the expected range and could be highlighting good things to come as we get further into the Wave 2 buildout.

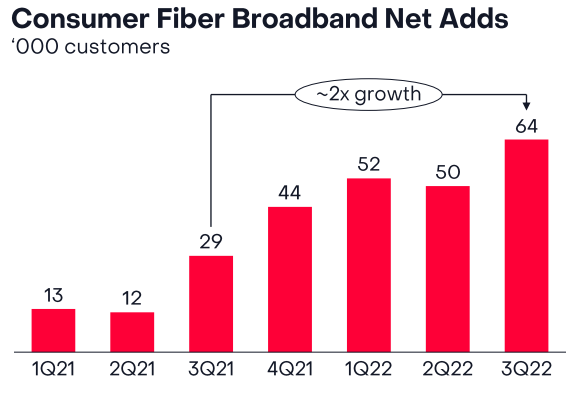

While net adds ticked higher in Q3, we expect to see a ramp up in net adds through mid-2023 before leveling off. (Frontier Q3 2022 Investor Presentation)

Net adds will be a key metric moving forward. We saw in Q3 2022 that they ticked higher, but with the increase in passings over the past two quarters and the improvement in customer experience, we should see this figure trend higher, especially once we get into the middle of 2023. By then, Frontier should have around 500-600k passings aged around +/- the one-year mark, with that ramped up rate holding moving forward. If current penetration trends hold, this could lead to around 100k net adds as the 2021 and 2022 cohorts build up to a normalized penetration rate and the company continues with the Wave 2 buildout.

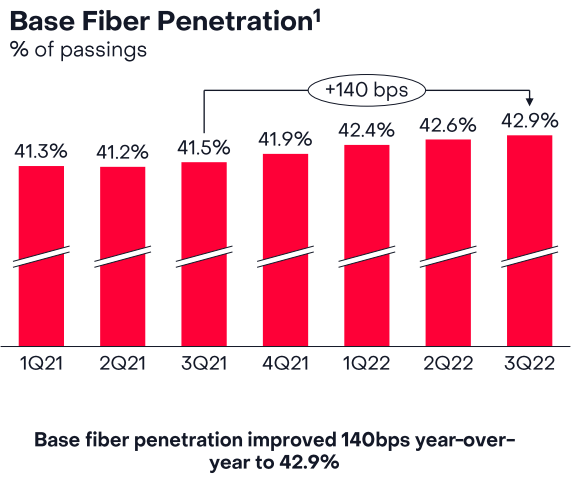

Frontier’s base fiber penetration has been trending higher, due in part to smart buildouts, better pricing strategies and management’s focus on improving the customer experience. (Frontier Investor Q3 2022 Presentation)

We would point out that while the 2020 buildout is far above its expected range, the 2021 (through the first 12 months) is trending right in the middle of its expected range. So while the data as a whole is very strong, right now the 2020 is delivering all of the excess strength (which is less apparent when looking at a blended model because 2020 is a much smaller buildout than 2021). While this is good news, we would point out that the one worry would be that the early expansion may have occurred in the prime service areas and moving forward it might be more difficult for the company to convert passings to customers at the same rate.

Debt/Liquidity Outlook

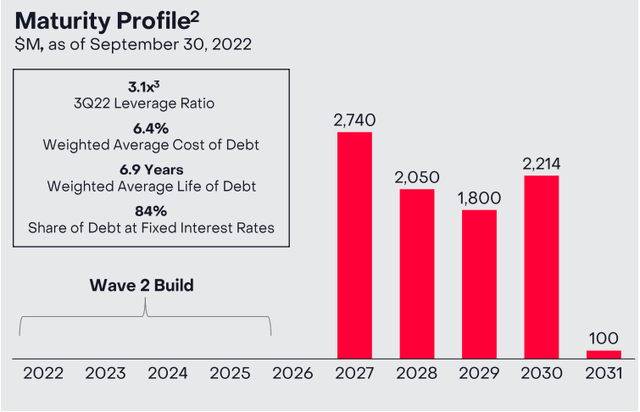

Frontier’s debt looks quite manageable and has the proper mix of fixed v floating. In today’s world, floating rate debt is less desirable, but the company did the right thing when tapping the debt markets and locked in fixed rates rather than trying to save a few basis points by going the floating rate route. This is why the company has a roughly 6.4% weighted average coupon rate and will see interest expense tick up only marginally (due to the fact that only about 15% of debt is currently floating rate).

Add in the fact that the company should complete their Wave 2 build in the year prior to when their next debt maturity takes place, and we suspect that the company will have a much better investment case for the market than they have had historically when they need to address that maturity.

Frontier’s debt maturity schedule is set up to accommodate the current fiber buildout. (Frontier Q3 2022 Investor Presentation)

One key point about the maturity schedule is that if you actually dig down into the debt, while the company shows $2.74 billion in maturities in 2027, the reality of the matter is that nearly $1.4 billion of that is a loan which matures then and there are two bond maturities totaling $1.35 billion. Why is this important? Well, the company should have no problem rolling the loan with their current credit profile and could even address the situation in 2026 in order to provide clarity for investors and design plans for rolling the maturing bonds.

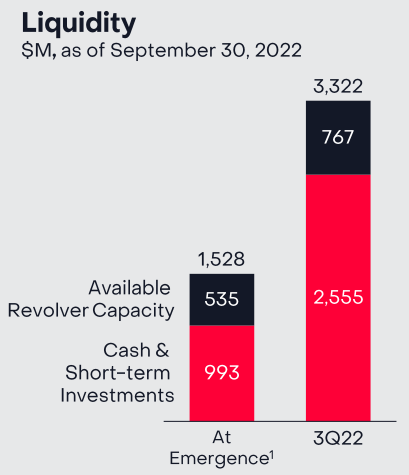

Frontier’s liquidity position has been enhanced from debt offerings and a restructuring of the revolver. (Frontier Q3 2022 Investor Presentation)

Frontier’s liquidity position is strong, and the company has plenty of cash and capacity on its revolver to continue its buildout even if it runs into some bottlenecks (such as delays or a slowdown in customer sign-ups). The buildout is not dependent on their FCF generating ability currently, so there is breathing room should any issues arise. The company does not need to look at capital markets until early to mid-2024, but could delay any debt deal as they continue to cut costs, sell noncore real estate or find other avenues to provided added flexibility.

Closing Thoughts

This is one of the less risky speculative plays we like in the market right now, and think that the risk-reward is tilted into investors’ favor right now as the company has a strong balance sheet with interest rates essentially locked in and no maturities before the end of the Wave 2 buildout growth initiative. There are not many instances where investors can get a free ride with smooth sailing (no debt maturities, interest rate headaches, etc.) through major restructuring or growth initiatives, but Frontier is one name where this is the case. The fact that the buildouts are already performing as expected, or better than expected, is a plus, and we should see EBITDA ramp up moving forward (Q4 of 2022 and into 2023).

With Frontier having locked in a lot of the resources needed for their expansion ahead of inflationary pressures and peers, their cost per passing is still coming in around $900-$1,000 and the company is comfortable with the projection. With estimated costs on the buildout coming in as expected, the company’s only inflationary headaches right now are due to energy and other operating costs, which they might be able to offset with higher ARPUs from fiber conversion and upsell as well as possible price hikes to match competitors.

Overall, we still like this story and think that 2023 could be the year where investors see the stock react to the positive news. Inflationary and economic headwinds might pick up and slow progress, but right now the data looks to be pointing to a ramp-up on the top and bottom line with a story of net adds for the company’s consumer broadband for the next few years.

Be the first to comment