LeventKonuk/iStock Editorial via Getty Images

Investment thesis

All of the major credit card companies are down in 2022 and the question is if their valuation is good enough for investors to buy in. Although, American Express Company (NYSE:AXP) is a different kind of brand than Visa Inc. (NYSE:V) they technically compete with each other. Both of them are maintaining a significant competitive advantage in their segments and both of them have high free cash flow generating business models.

Highlights of AXP and V

American Express

American Express Company, provides charge and credit payment card products, and travel-related services worldwide. They target companies and individuals who have higher credit scores and spend more money. They are a premium credit card company, but now they offer several zero-fee cards, and to capitalize on new trends, they offer buy now pay later (BNPL) cards as well. Warren Buffett has been a proud owner of AXP since the 1990s and at some point (around 2005) its share was approximately 24% of Berkshire Hathaway’s (BRK.A) (BRK.B) portfolio. Since then, the share decreased but he still owns a substantial amount of AXP shares (6.8% of the portfolio) and it is still his 5th largest holding.

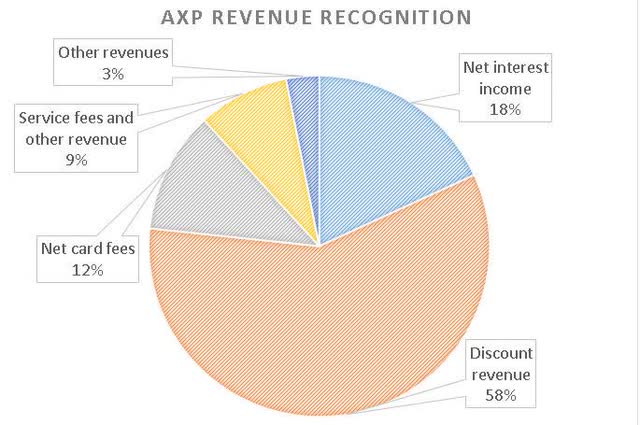

The company’s largest income segment is the discount revenues which are mostly merchant fees. AXP also earns revenues as a credit card issuer and cardholders pay an annual fee for it. They also have an interest income segment which is the same as banks earn their NII. Because of that AXP functions like a bank in terms of capital reserves. American Express’s focus on loan growth means this activity is more capital-intensive than only credit card issuers such as Visa, and the company has to retain a sizeable portion of its earnings to maintain adequate capital ratios. They have to maintain larger “cash cushions” and just like all the banking sector in 2022 and AXP has been increasing its provisions for credit losses since the beginning of the year. AXP had to retain more of its earnings as its lending volume and travel demand started to pick up again. AXP has always been highly exposed to U.S. economic downturns, (as we see in AXP’s revenue in 2008 and 2020) since the U.S. is responsible for more than 70% of its income.

The chart is created by the author. All the figures are from the company’s financial statements.

The company pays extraordinary attention to strong brand loyalty and membership benefits, points, rewards programs, and discounts. Due to this, AXP is strongly correlated with the travel industry. The company also has a significant ownership position in, and extensive commercial arrangements with, Global Business Travel Group, Inc. (GBTG). This is why investors can see much larger revenue fluctuations than Visa investors. The company had a significant revenue decrease in 2008-09 and took AXP 5 years to surpass the 2007 revenue numbers. We see a similar trend unfolding, the company had a big revenue drop during the pandemic and they will not surpass their 2019 revenue figures at the end of 2022. I expect that Amex will surpass its 2019 revenue numbers in 2023 in the best-case scenario. The company has a great competitive advantage in the marketplace and I believe it is almost impossible that AXP will be simply overtaken. I am not worried that their current client base will switch to any new fintech company because they have a highly loyal customer base. However, young fintech companies and DeFi could decrease AXP’s market share in the long term and they could lose market share among new, younger-generation clients. The other risk factor is the trust issue. If the brand is damaged by any scandal or misuse of money customers will no longer trust AXP.

Visa

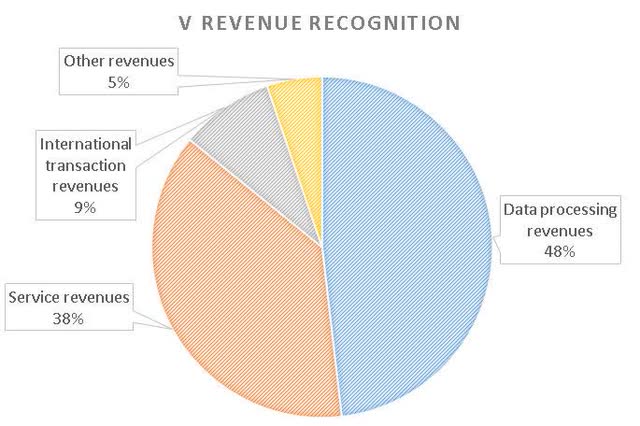

Visa Inc. operates as a payments technology company worldwide. The company has a wide economic moat and also the industry has huge barriers to entry which protects Visa from future competitors. The company mainly faces challenges from already existing firms such as Mastercard (MA), PayPal (PYPL), and American Express. Visa’s biggest competitive advantage is its reliable payment network and its brand recognition and trust among customers. The company could increase its revenue since its 2008 IPO every year except for 2020. Data processing fees and service fees have been growing steadily even during the financial crisis and the pandemic. The only segment that declined in revenue was the international transaction fees and due to this, investors saw a slight dip in Visa’s 2020 revenue.

The chart is created by the author. All the figures are from the company’s financial statements.

V and AXP are both transaction-based businesses. Because of high inflation, the same products and services are more expensive and Visa’s revenue will increase. Previously you spent $100 on a product which is now $110 due to inflation but Visa gets the same transaction fees of 1.29%-3.29% no matter the price. On the other hand, high inflation slows down the economy and fewer transactions are being made which will decrease the company’s revenue. Put this into perspective, during 2008-09 the revenue of Visa grew significantly, and during the pandemic, the same happened except for international transactions. So I expect that the revenue of Visa will grow even during the current recession and economic downturn environment especially because it seems that inflation is slowly but surely decreasing. In addition, the recovery of international traffic after the pandemic fueled Visa’s revenue growth and by the end of 2021, they already surpassed 2019 revenue figures. In the third quarter of 2022 net revenues achieved 19% growth year-on-year, a great result considering the current recessionary environment. The growth is almost embedded into Visa’s business model due to the long-term trend of a cashless society.

Visa faces almost identical risks to AXP except for AXP’s credit loss risk factor due to their loan-providing activities. V operates in an industry where new technologies can emerge within a couple of years and change the market. In addition, new competitors emerge continuously, which makes it necessary for both Visa and American Express to constantly develop new technologies in order to remain competitive and to set aside a sizeable budget to acquire competition. The other risk factor is the brand image and trust. If it gets damaged, consumers might no longer trust the company and switch to one of its peers.

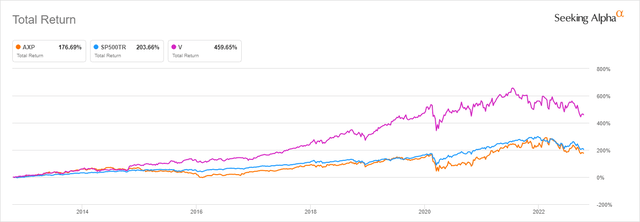

Valuation

In the 1990s and 2000s Amex produced superior returns to the S&P 500 and it was the first major credit card company to be traded publicly. From 2005-06 a new generation of companies come into the trading marketplace like V or Mastercard and in the last 10 years, AXP slightly underperformed the market while V and MA outperformed it. I believe that was because of the business model difference mentioned above and the revenue recovery phase of AXP in the early 2010s.

Looking at a discounted cash flow model, both companies are undervalued. Visa’s fair value per share is approximately $205-206. I calculated with an EPS of $6.81 (TTM), earnings are expected to grow at a rate of 9% annually for the next 5 years then leveling off at around 6% on average. American Express’ fair value per share is approximately $189-190. I calculated with an EPS of $9.75 (TTM) and earnings are expected to grow at a rate of 9% annually for the next 4 years then leveling off at around 5-6% on average. According to the DCF model, it is a great bargain to buy both companies. I am not that optimistic about fair value pricing but investors might get a good deal for their investment if they are buying now.

Based on P/E ratios and P/B value the companies are only slightly undervalued. AXP’s 10-year average P/E ratio is around 16x its earnings and its 5-year average is approximately 18.5x. AXP is currently trading at 14x its earnings. In terms of book value, the company is trading at 4.4x, its 5-year average is 4.5x and its 10-year average is approximately 4.1x. Visa is trading at 25x its earnings, below its 5-year average of about 35.5. Its price-to-earnings ratio is relatively undervalued compared to its 10-year average of 28.5 but investors should keep in mind that V owners saw great EPS growth in the previous years. The same can be said about its price to book value. It is trading at 11.8x its book value and compared to its 5-year average of 12.5x. However, looking at its 10-year average of approximately 9.5x the company is slightly overvalued.

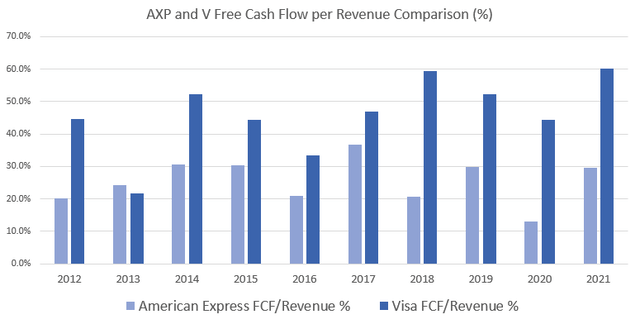

Investors should also have look at the company’s free cash flow to revenue metrics. Not focusing on the relation to each other because of the two different business models (you can expect to see V with a higher FCF/revenue percentage than AXP almost all the time) but rather focusing on how they are performing compared to themselves. Visa is performing well with around 60% FCF/revenue and AXP only had a single better year than last year in terms of its FCF/revenue.

The chart is made by the author.

As an investor, I always like to see companies with strong competitive advantages and great FCF/revenues, and both Visa and Amex qualify in this category. However, in terms of valuation, I am certain that they are fairly valued at the moment. I see a realistic chance that they might jump 8-10% in the short term but that could be only temporary. Long-term investors should know that they get quality companies at fair value with AXP and V.

Dividend comparison

American Express

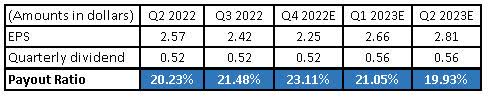

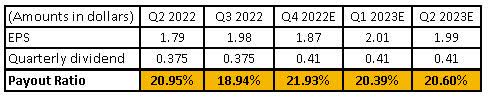

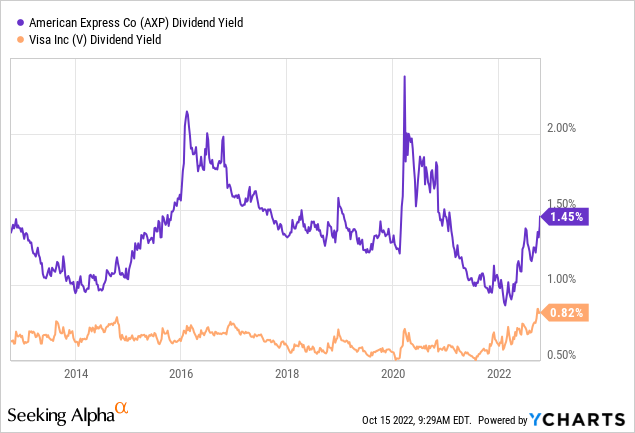

The company is a stable dividend payer; investors can be certain about that. It has been paying dividends consecutively for 33 years. At good times the management also raises the dividend, and at bad times they do not cut the dividend, only stop increasing it. The management is proud of the achievements in their dividend policy, the CEO sometimes mentions it in the earnings calls. “There are a number of reasons for our continued momentum. First, the decisions we made through the pandemic continue to pay dividends” Stephen Squeri – Chairman and CEO. “…the dividend is important to us…we have a long-standing policy of having a payout that is around 20% to 25% on the dividend” Stephen Squeri – Chairman and CEO. AXP’s payout ratio is within the range of management expectations. In the upcoming years, the expectation is that AXP will increase its dividends by an average of 6.3% per year which is a great number in this inflationary environment (the forward dividend per share growth is estimated to be almost 10%). Its dividend is well covered with a payout ratio of approximately 22%. Investors can buy AXP on its best yield in the last 14 months but the dividend yield is only slightly above the 10-year average.

The table is created by the author. All the figures are from the company’s financial statements and SA estimates.

Visa

Visa has been paying dividends since its 2008 IPO. For 14 years the company has been paying and increasing its dividends consecutively. The management has been maintaining a strong cash return policy for the same time. “We’ve always been returning cash to shareholders, most of our free cash flow in the form of dividends and buybacks” Vasant Prabhu – Vice Chairman and CFO. The company’s dividend growth is expected to outperform AXP’s. Visa’s forward dividend growth per share is over 10% and its 1-3-year estimate is above 7%. Investors can buy V on record yield, it has never been higher. This might sound fantastic but the yield is still not so income friendly and yielding only 0.82%. It is safe to say that investors are not buying AXP and V for their dividends it is rather just an additional positive factor.

The table is created by the author. All the figures are from the company’s financial statements and SA estimates.

Investor takeaway

Investors can buy both V and AXP at a relatively low price and decent earnings multiples thanks to the bear market. They are not extremely undervalued but the quality of the companies and their wide economic moat compensates for it. The margin of safety is close to 0% at the moment but over the long run, I believe both companies have places in a diversified portfolio. And for those who are already shareholders of these companies, their long-term return is in good hands. Do you already own Visa and American Express? If not which one would you choose?

Be the first to comment