Alexander Shapovalov/iStock via Getty Images

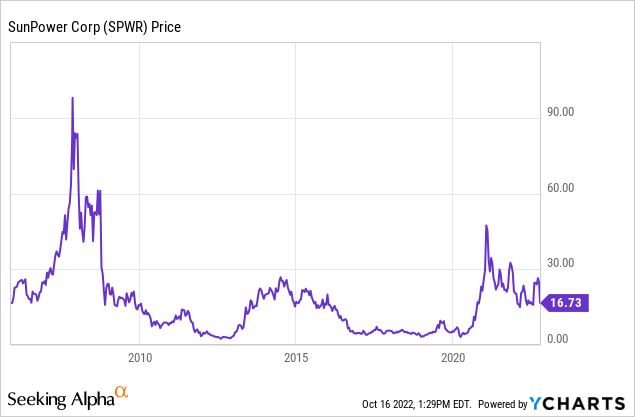

SunPower (NASDAQ:SPWR) has had quite a long and vivid history. Founded in 1985 by a Stanford University professor before going public in 2005, the Richmond, California-based company would see its stock price quickly shoot to just under $90 before collapsing during the 2008 financial crisis. The pandemic-era retail trading boom would see its common shares again reach highs attained more than a decade prior, but they have since fallen and are now trading hands at $16.73 per share.

The US is hungry for low carbon energy and SunPower stands to ride this hunger to new highs. This now forms one of the most immediate needs for policymakers racing to reduce the US contribution to anthropogenic climate change. Building on commitments made in the 2015 Paris Agreement, the White House has set a goal to reduce greenhouse gas emissions to 50% below 2005 levels by 2030. Whilst the bulk of these emissions reductions will be met by the ongoing rollout of utility-scale solar and wind energy projects, home solar power stands to play a significant part.

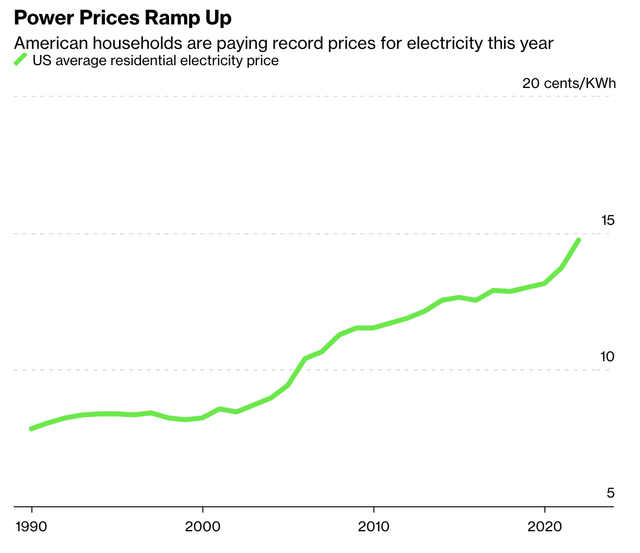

Whilst the concept of households generating energy from their own roofs has been around for decades and SunPower has had historically healthy demand, this has been volatile. For households the benefits are multifaceted. Firstly, by producing and storing energy at their own homes with rooftop solar panels and rechargeable lithium-ion batteries, they are able to drastically reduce their carbon footprint by partially decoupling their demand from what remains a fossil fuel-dominated electricity grid. Secondly, it builds in a certain type of resiliency which is needed in periods when rolling power cuts happen. Finally, and depending on the state, rooftop home solar could produce energy at a cheaper rate for households per KWh than their current utility bills. This would essentially create a source of positive cash flow after the initial cost of purchasing and installing the system is paid back. August electricity bills for US consumers were up by 15.8% year-over-year, the most significant gain since 1981.

This places into view the low sobering number that less than 2% of US homes have rooftop solar installed. Hence, growth ahead stands to be boosted as SunPower’s total addressable market shifts from being predominantly driven by those who simply want to decarbonize to those fully pulled in by the stronger economics.

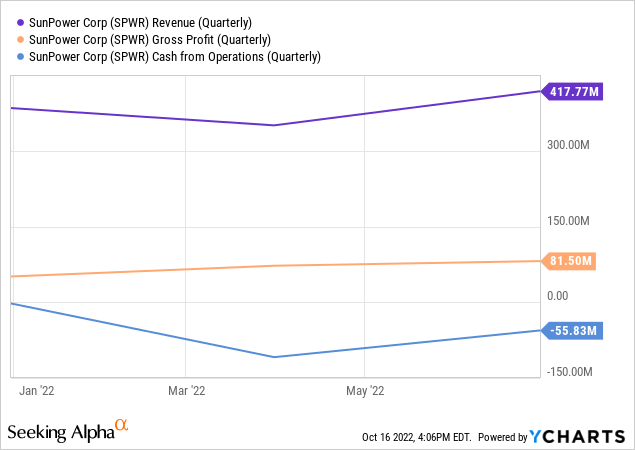

Strong Revenue Growth But Cash Flows Still Volatile

The company last reported earnings for its fiscal 2022 second quarter which saw revenue come in at $417.77 million, a 60.2% increase from its year-ago quarter and a beat by $53.3 million on consensus estimates. The company added 19,700 new customers, a record, and a 51% year-over-year increase. The backlog reached 53,000 which constituted 19,000 retrofit customers and 34,000 new home customers.

Gross profit of $81.5 million was a 34% increase from the year-ago quarter and a 12.7% sequential increase. This was as gross profit margin of 19.5% declined by 377 basis points from 23.27% in the year-ago quarter. This decline in gross margin was also seen sequentially with a 114 basis point fall. Management blamed this on cost inflation but mentioned that they have instituted price increases to manage this.

Cash burn from operations remained negative at $55.83 million and was a material deterioration from positive cash from operations of $22 million in the year-ago quarter. However, the company’s balance sheet is quite strong with a cash balance of $500 million and a lower net recourse debt. This company also held 1.5 million unsold Enphase (ENPH) shares which are currently valued at $356.8 million.

SunPower faces a material tailwind with the recently signed Inflation Reduction Act which seeks to allocate $370 billion over the next decade until 2032 to decarbonization initiatives. The benefits for homeowners centre on dual 30% tax credits on solar systems and energy storage technologies. This would see homeowners get back nearly a third of the cost of SunPower’s systems purchased from 2022 onward. However, the company faces near-term risk from California’s solar subsidy reforms. The state is SunPower’s main geography with the company recently signing a deal with IKEA to offer its solar systems to IKEA customers in the state. The proposed reforms stand to add new grid-use charges and shift to a net billing structure that would materially lower incentives for rooftop solar customers. If California proceeds with the stated reforms, the company could see a weakening of projected growth.

Solar Now And In The Future

At SunPower’s current market cap, the company is trading at a 1.76x price to forward sales multiple. This is around 52% more than its sector average of 1.16x. This potentially opens up the spectre of a further retracement of shares as the macroeconomic backdrop weakens further.

But the overall trajectory of home solar is clear, SunPower faces a future of strong demand growth and could make a good consideration for a climate focus investment portfolio but I’m not a buyer yet.

Be the first to comment