Allard1/iStock Editorial via Getty Images

The news isn’t what it used to be anymore. The New York Times (NYSE:NYT) was born in an era where every American household used to pay to get the paper delivered to their front doorsteps. These days it’s difficult to get people to pay for the news at all, with free social media outlets essentially offering snippets of key news headlines to satisfy the casual consumer’s curiosity. The natural question to ask is: does the New York Times have a future?

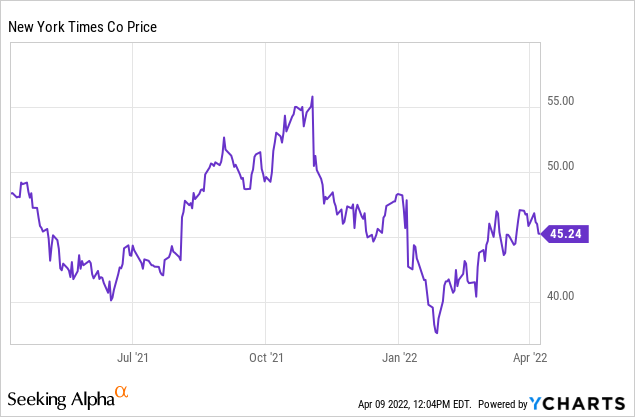

In my view, the answer is yes, but in a much shriveled form. Over the past year, trading in The New York Times’ stock has been volatile as investors debated the company’s direction. Initial enthusiasm for the Times’ digital push has waned, and now, as the company battles rising costs with a relative inability to boost subscription prices for fear of losing users, I think the stock has much more to lose.

I remain bearish on the New York Times for a number of reasons, into which I’ll dive in detail in this article.

But before we get into the fundamental reasons, let’s do a quick sanity check on the Times’ valuation. For the current year FY22, Wall Street analysts are expecting the company to generate $1.15 in pro forma EPS. This puts the company’s valuation at 39x forward P/E – approximately twice where the S&P 500 is trading today.

So the bottom line here: not only do I have doubts about the New York Times’ ability to continue growing, but its valuation already gives the stock the benefit of the doubt. Stay on the sidelines here.

M&A is a signal that organic growth needs to be bolstered

First things first: the New York Times’ growth story over the past few years has centered exclusively on digital subscriptions. To the company’s credit, this strategy has worked. Now, the company is growing digital revenue faster than it is losing print revenue.

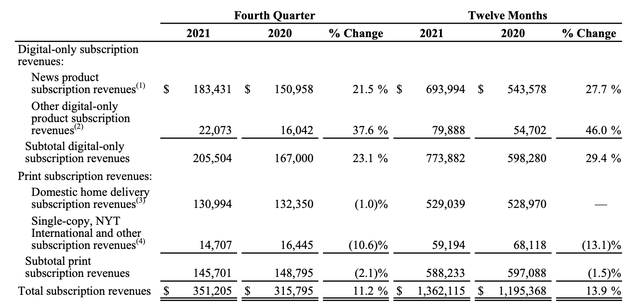

New York Times print vs. digital revenue breakdown (New York Times Q4 earnings release)

As seen in the chart above: overall subscription revenue in Q4 grew 11% y/y to $351.5 million, driven by a 23% y/y increase in digital revenue to $205.5 million, now representing 58% of total subscriptions (five points higher than 53% contribution in the year-ago Q4). Meanwhile, print revenue declined by only -2% y/y to $145.7 million.

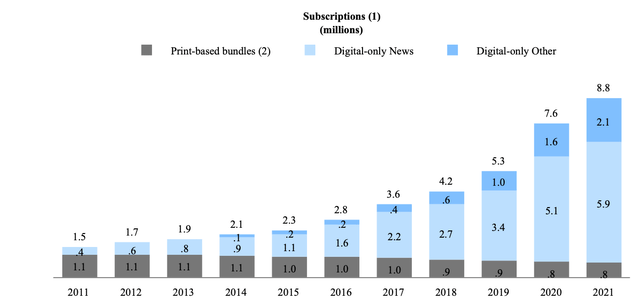

New York Times subscriber trends (New York Times Q4 earnings release)

The chart above also shows that while print subscribers have remained roughly flat at ~800k for the past two years, digital subscriptions have continued to soar. In particular, note the step-up in digital subscribers between 2019 and 2020, when the company added 2.3 million net-new digital subscribers. In 2021, that figure slowed to 1.3 million – and I do think the company will struggle to add numbers at this pace now.

There are a couple factors here to be aware of. First, the New York Times relies heavily on discounts to draw in new subscribers. Its most popular digital offer which runs continuously is “$1 per week for the first year”, which is a better deal than most peers like the Wall Street Journal are offering. But what happens here is that it creates a “cliff” – because many news sources are interchangeable and many readers don’t have a strong preference for Newspaper A to Newspaper B, the Times may lose the raft of discount subscribers it signed on as soon as their promotional periods are over.

Secondly, the competitive landscape is rather fierce. Never mind the company’s traditional rivals, but look at the “new age” media. Investors can access stories on popular business news site Quartz for free, though limits are imposed for non-subscribers. Social media outlets like Twitter dole out headlines for free. And increasingly popular daily newsletters like The Morning Brew also give readers convenient, quick news delivered to their inboxes for free.

In other words, paying for long-form, high-quality journalism may be The New York Times’ mission, but it feels rather more antiquated in the modern day when news consumption has shifted to smaller, quicker formats.

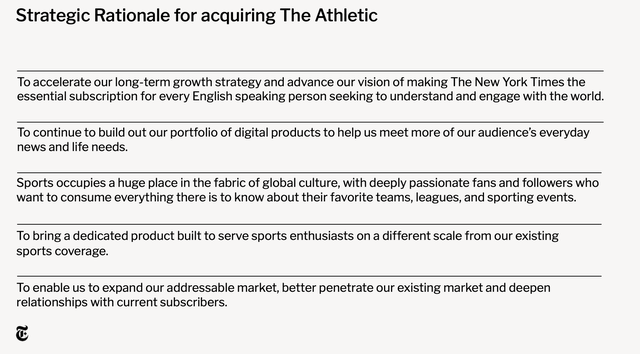

Against this backdrop is likely why The New York Times acquired The Athletic, paying $550 million in cash for the deal – its largest acquisition in recent memory. The chart below shows all the reasons why the company wants to fold in The Athletic into its umbrella:

The Athletic acquisition rationale (New York Times / The Athletic investor release)

Now, I don’t disagree that the acquisition was a smart move. The Athletic is a popular site that specializes in sports, which was never the Times’ forte. The Athletic brings with it 1.2 million digital subscribers and a 450-person newsroom.

There are two main questions I have, however. First – how much of a real revenue contributor will this be? Again, The Athletic lures in new members in the same way the New York Times does – it offers a heavily discounted $1/month subscription for the first six months, versus a standard price of $8/month. Its 2021 estimated revenue was $65 million, meaning that the Times paid a hefty 8.5x revenue multiple for this deal.

Is the M&A playbook a signal that The New York Times is no longer that confident in its organic growth roadmap? Separately, although a much smaller deal, The Times also bought the word game app Wordle – yet another signal that the company is looking at outside opportunities to foster growth and that internal opportunities for subscription growth may be capping out.

Cost pressures

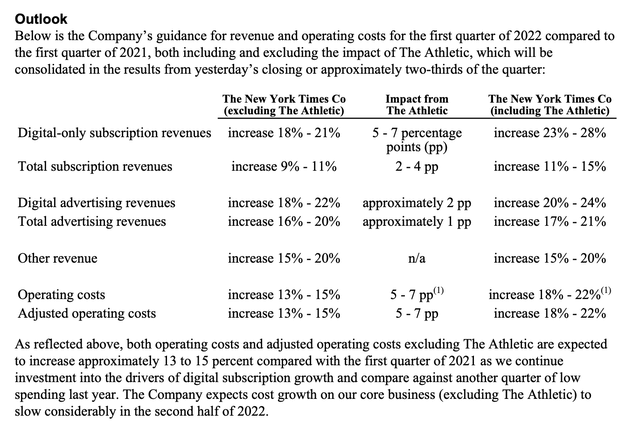

Alongside its recent Q4 earnings release, The New York Times also issued guidance for 2022:

New York Times outlook (New York Times Q4 earnings release)

Subscription revenue, which made up 66% of The Times’ revenue in FY21, is only expected to grow 11-15% y/y (and that’s with 2-4 points of growth contribution from The Athletic, which is going to close in the first quarter of FY22). Advertising revenue, roughly one-quarter of the pie in FY21, is expected to grow 17-21% y/y.

Here’s the kicker, though: operating costs are expected to grow at 18-22% y/y, far faster than revenue. M&A is helping costs to outstrip revenue: The Athletic generated $55 million in losses in FY21, and The Times doesn’t seem to have any plans to shrink or consolidate its newsroom or workforce, as in its guidance statement, it writes that management “currently forecasts a slight improvement in [The Athletic’s] operating losses in 2022, as the Company plans to make additional investments that will mostly offset revenue growth.”

Even standalone without The Athletic, which you can see on the far-left side of the guidance statement above, cost growth of 13-15% y/y would have exceeded subscription revenue growth of 9-11% y/y.

This calls to mind the original question: is the newspaper/quality journalism business really set up for success and profitability? The reality is that journalists skew toward the lower end of professional salaries, which will see a major bump / wage inflation in the current landscape (news broke out just last week that Walmart (WMT) is now offering truck drivers up to $110k in annual salary). This cost inflation will be deeply felt in 2022, but at the same time, The Times will find it difficult to pull back from its discounting mindset and its competitive pricing for fear of losing subscribers to the competition.

Key takeaways

Unfortunately, I see the New York Times as a “death by a thousand cuts” situation. Organic growth is slowly decelerating, and in 2022 will get far outstripped by cost inflation. M&A is one way to provide a one-time kick to the numbers, but The Times just spent half to its cash balances to acquire The Athletic (and only adding a $65 million revenue base to its $2.1 billion total, or 3%). Tread very cautiously here.

Be the first to comment