AsiaVision

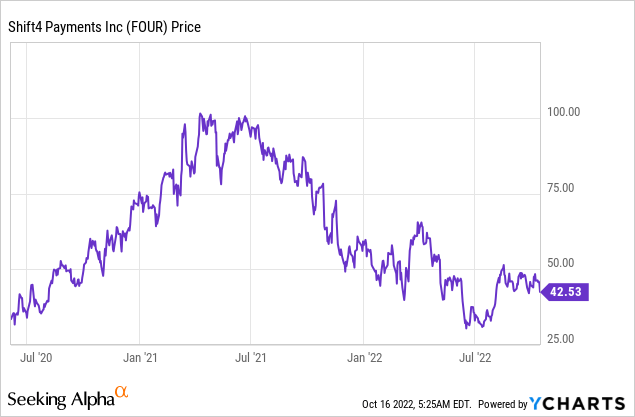

Shift4 (NYSE:FOUR) is a payments company that is often overlooked when compared to more well-known payment providers such as Square (now Block). However, Shift4 has best-in-class technology and provides the backbone payments for many leading brands from Burger King to Elon Musk’s Starlink. The company was formerly known as “United Bank Card” and was founded in 1999 by a 16-year-old genius named Jared Isaacman. Shift4 finally went public in 2020 as they saw an opportunity to benefit from the surge in popularity around fintech solutions. Since June 2021, the stock price has slid down by over 54% despite the company producing consistently strong and growing financial results. The company is poised to benefit from huge payment tailwinds such as the growth in digital payment processing. The global payment processing solutions market was valued at $39.6 billion in 2020 and is projected to grow at a 13.7% Compounded Annual Growth Rate [CAGR] reaching $146.5 billion by 2030. Thus in this post, I’m going to breakdown the business model, financials, and valuation for Shift4, let’s dive in.

Business Model

Shift4 Payments has over 200,000 customers which mainly consist of brick-and-mortar restaurants, hotels, casinos, sports arenas, gyms, etc. Its most well-known customers include; Hilton, Caesers, DoubleTree, Burger King, Applebees, Popeyes, Dennys, TGI Fridays, the LA Galaxy Arena, and many more. The company’s value proposition is simple, a seamless end-to-end payments solution that includes; POS [Point of Sale] terminals, Payment Gateway integration, and processing.

Shift4 makes its revenue by charging a payment processing fee which is usually a small percentage of payment volume. In a legacy payment setup, a restaurant may be working with multiple suppliers and have a complex system. Whereas Shift4 integrates all the payments together in a seamless manner. The business also provides customer analytics which helps to track spending patterns, peak times and optimize staff/inventory as a result. The platform also integrates with over 450 software providers from Microsoft Dynamics to Oracle Hospitality.

The business also has an e-commerce payments solution called Shift4 SHOP which is gaining traction. Management’s strategy moving forward is to focus on expanding to new industry verticals such as Theme Parks, Colleges, and Sports centers. For instance, in the second quarter of 2022, the company won Wisconsin and Alabama Universities. Shift4 also powers the payments for Elon Musk’s Starlink, the Satellite internet service. The business started processing payments for Starlink in the last week of Q2,22 and thus the majority of revenue from this customer will start to show up in the third quarter onwards.

Shift4 also is active in M&A and has announced the planned acquisition of Finaro a fintech payments solution provider. This is expected to help improve the business’s solution globally and enter new verticals more easily.

Growing Financials

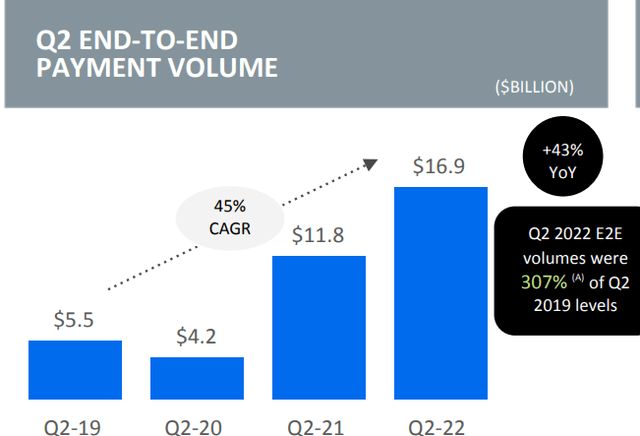

Shift4 generated solid financial results for the second quarter of 2022. End to End payment volume was a staggering $16.9 billion which increased by a rapid 43% year over year. This growth has mainly been driven by pent-up travel demand which has caused a surge in the payments of its hotel customers. Overall hospitality payment volume was up 170% on a 4 year compounded annual growth rate. Restaurant payment volume has also continued to grow strong with new wins such as Nobu Atlanta.

Shift4 (Investor presentation)

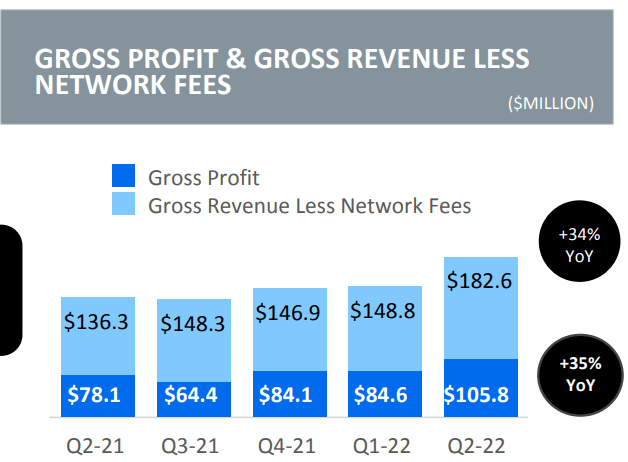

The business generated Gross revenue of $506.7 million, which increased by a rapid 44% year over year. With Gross profit of $105.8 million, which popped by 35% from Q2 2021. This was driven by the aforementioned core growth but offset slightly by its Gateway Sunset strategy. The company is “sunsetting” its older gateway-only technology with customers as a way to entice them to move to its new end-to-end platform. For example, Shift4 had been trying to get large motorcycle franchise customer to upgrade for nearly 5 years, but with no luck. However, by using the Sunset strategy the customer has agreed and it will be better for both parties longer term.

Shift4 (Q2 earnings report)

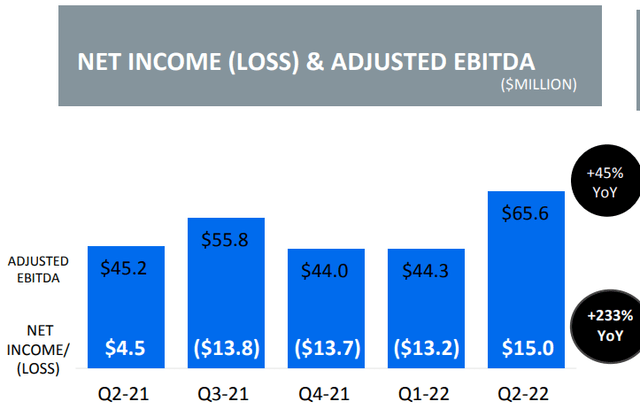

The company generated solid Adjusted EBITDA of $65.6 million in Q2,22, which increased by 45% year over year. Net Income has also improved by a substantial 233% year over year to $15 million which beat analyst expectations.

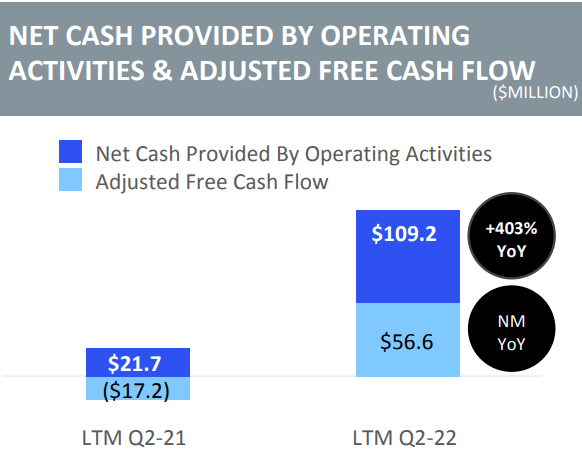

The company generated net cash from operations of $109.2 million which increased by a blistering 403% year over year.

Shift4 has an ironclad balance sheet of over $1 billion in cash and short-term investments. It does have total debt of $1.76 billion but the vast majority of this is long-term debt and thus manageable. Management also bought back 3.6 million shares in the second quarter and they believe the stock is “meaningfully undervalued”, but I will dive into the valuation in my next section.

Shift4 (Q2 Earnings)

Advanced Valuation

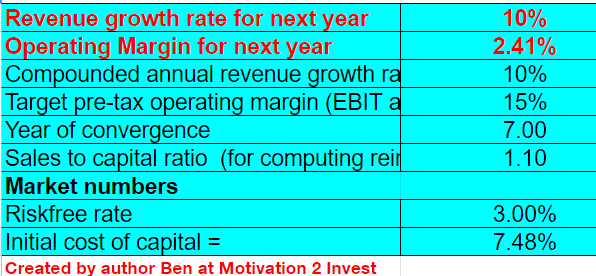

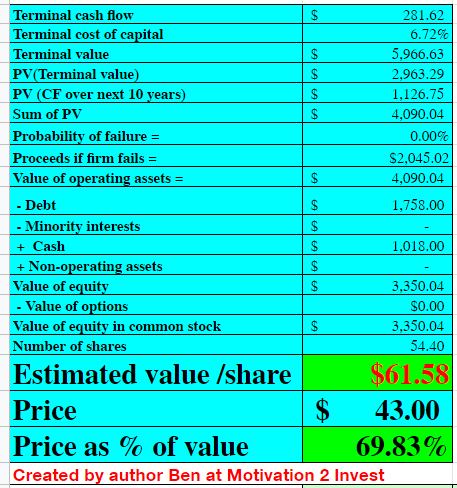

In order to value Shift4 I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 10% revenue growth per year over the next 5 years. This is extremely conservative given the prior growth rate and new customers coming online such as Starlink.

Shift4 stock valuation (created by author Ben at Motivation 2 invest)

I have forecasted the business to steadily increase its operating margin to 15% over the next 7 years, as the company benefits from economies of scale and acquisition synergies pay off.

Shift4 stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $61/share, the stock is trading at $43 per share at the time of writing and thus is ~30% undervalued.

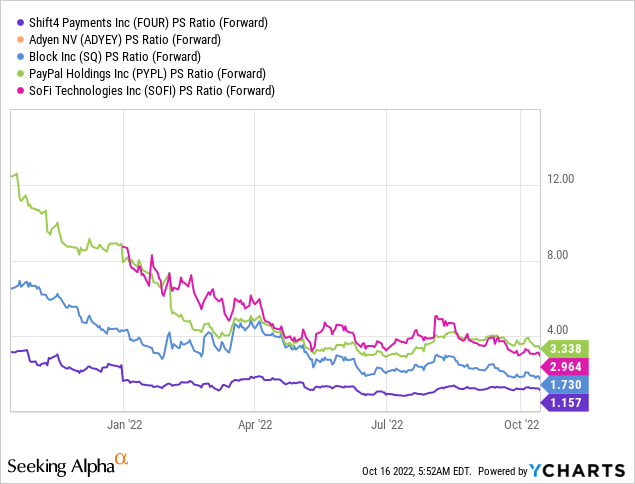

Relative to other fintech payment companies, Shift4 trades at one of the cheapest Price to Sales ratios = 1.16.

Risks

Recession/Lower Payment Volume

The high inflation and rising interest rate environment has caused analysts to forecast a recession. This is not great for fintech companies as consumers will likely make less transactions and thus this means lower payment volume for Shift4. The good news is I do not predict heavy customer churn as payment products tend to be very “sticky” by nature.

Final Thoughts

Shift4 is a leading payment company that has a strong track record of consistent execution and winning new business. The value proposition is strong and simple, while the valuation is relatively cheap. I do expect some volatility in the short term due to the upcoming recession, but longer-term Shift4 will be read to process payments once consumer demand returns.

Be the first to comment