GlobalP/iStock via Getty Images

Zoetis (NYSE:ZTS) is a company that is rarely cheap, and for good reason. It is a very stable, high-quality company, that does well in most economic environments, including high inflation and recessions. People will cut on many expenses before compromising their pets’ health, and in the case of livestock it is an essential part of the process that cannot be easily eliminated.

Business Background

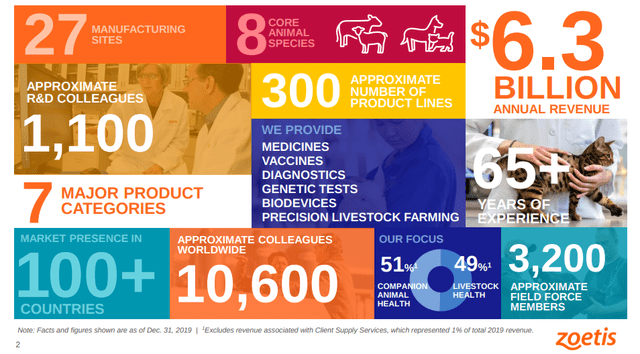

The company is one of the leaders in the attractive animal health market, addressing traditional use cases like medicines, vaccines, parasiticides, and medicated feed additives, as well as more recent growth segments like diagnostics, bio-devices, genetics, and precision livestock farming. Its solutions go from predicting and preventing disease, to detecting it and treating it. About half of the company’s revenue comes from companion animal health, and the other half from livestock health. Zoetis has market presence in over 100 countries and has 27 manufacturing sites.

Zoetis Investor Presentation

Financials

Zoetis has been growing revenue and earnings at a very fast pace, for example, in 2021 it generated 15% operational revenue growth and 19% operational increase in adjusted net income. Revenue growth was 14% in the US and 17% internationally, and 27% for companion animal and 1% growth for the livestock segment for the year. Guidance for 2022 includes 9-11% revenue growth, and 10-13% operational growth in adjusted net income.

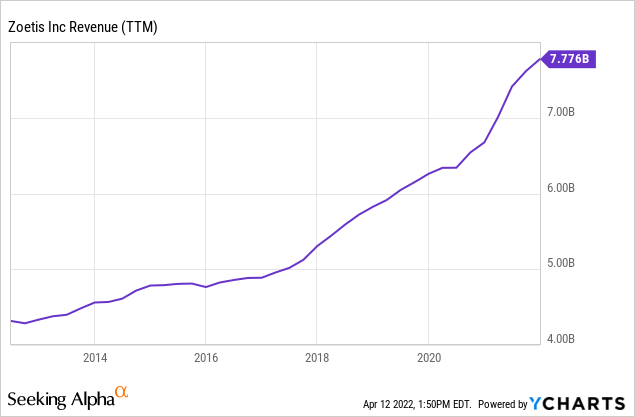

Zooming out, we can see that revenue growth has been very consistent, and the company has basically doubled its revenues in the last ten years.

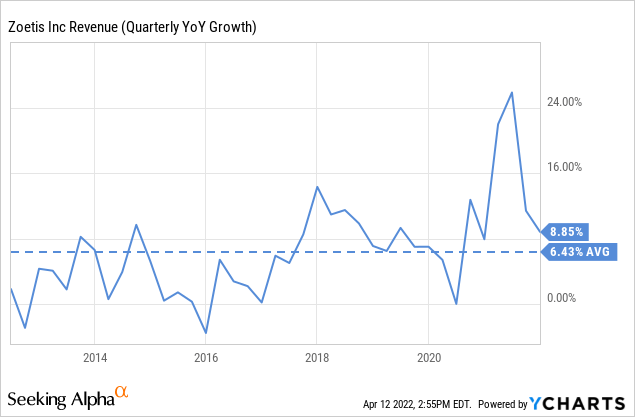

The revenue growth rate has been a little bit lumpy, but has averaged a decent 6.4% over the last ten years, with the last five years seeing a higher growth rate, which is a good sign that growth is actually accelerating.

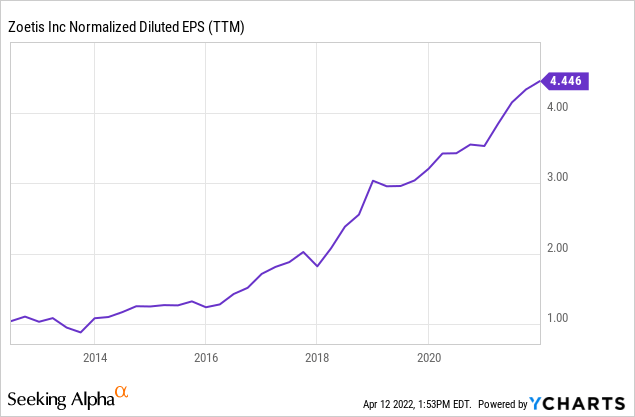

Earnings have been growing faster than revenue, and the company is guiding for that to continue. In the last ten years Zoetis has managed to increase almost 5x the earnings per share, which is quite impressive.

Inflation and Recession Resistant

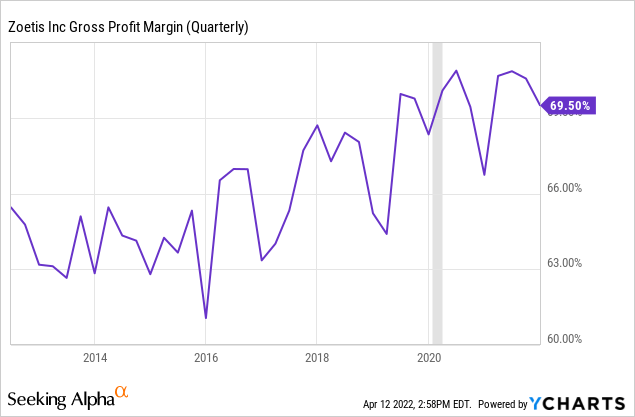

One of the things we really like about Zoetis is how resilient it is to both inflation and recessions. It has a lot of pricing power, as can be seen with its high and growing gross profit margin, it even increased during the 2020 Covid recession.

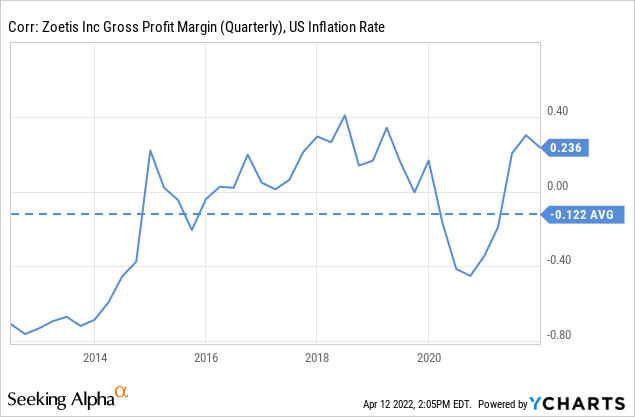

Similarly the company is able to pass inflation pressures to customers without impacting much of its gross profit margin. As can be seen below, the correlation between its gross profit margin and the US inflation rate is not very significant at only -0.122 on average.

Business Quality

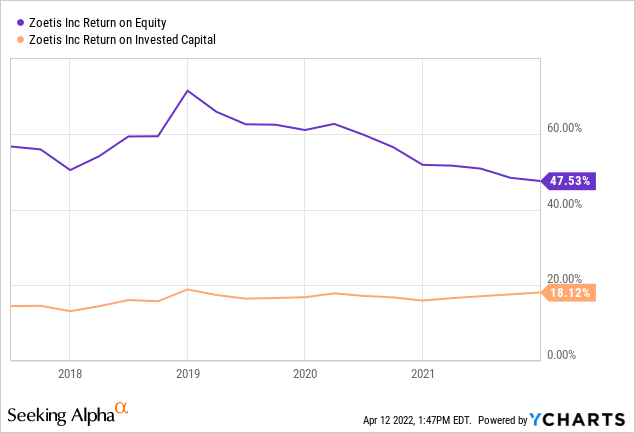

The business quality of Zoetis is reflected in its incredibly high return on equity (ROE) and return on invested capital (ROIC). That is why reinvested profits result in meaningful increases in earnings per share, even when the company returns most of the earnings to investors via dividends and share buybacks.

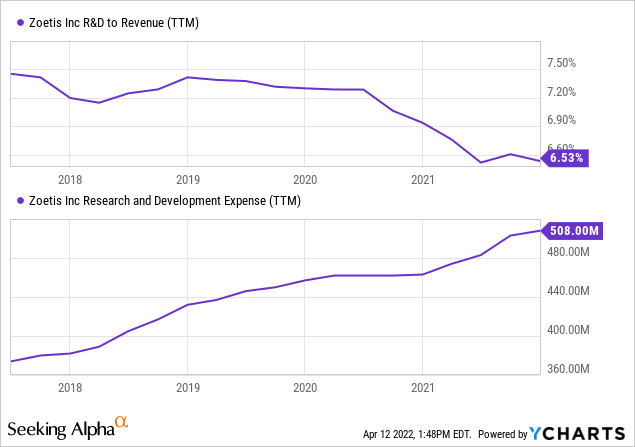

We also like that the company invests heavily in R&D, with a significant percentage of sales reinvested in research and development activities. The percentage has gone down over the years, but it is mostly due to operating leverage due to increasing revenues, the total amount has actually been rising as can be seen in the second graph.

Talking about innovation, the company prides itself of innovating across the continuum of care. Meaning it is spending R&D dollars in solutions that go from predicting and preventing sickness (such as genetics and vaccines), to detecting and treating (diagnostics and medicines).

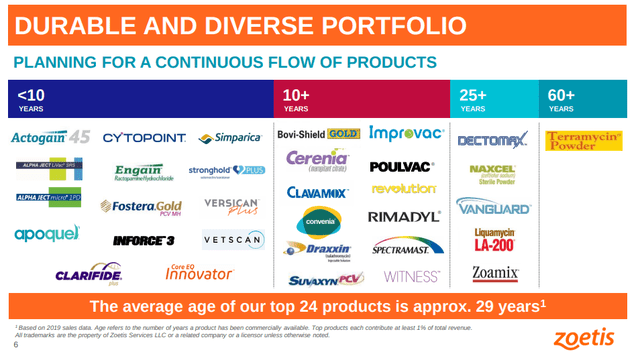

Finally, it is worth noting that another interesting characteristic of Zoetis’ product portfolio is that it is very durable and diverse. The average age of its top 24 products is an impressive 29 years! This reduces the risk of a patent cliff, as often happens with other pharmaceutical companies.

Zoetis Investor Presentation

Valuation

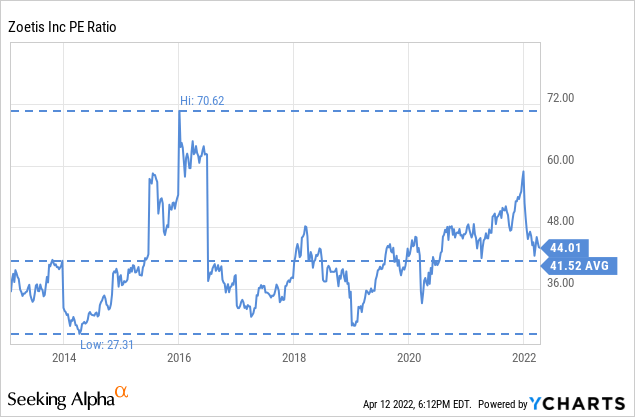

Shares are not cheap, but they rarely have been, as can be seen below. They currently are not far from its average P/E ratio of ~41x.

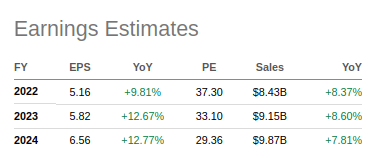

While not cheap, we believe the company can grow into its valuation in a few years, as long as it keeps posting double-digit growth in its earnings per share. Below we can see the future earnings estimates as compiled by Seeking Alpha, there we see that FY24 P/E ratio is a much more reasonable 29x, based on estimated earnings per share of $6.56. If the company can keep this growth for several more years, investors buying today can still be handsomely rewarded.

Seeking Alpha

Conclusion

Zoetis is a very high-quality company that is rarely on sale. We believe the company can grow into its valuation in a few years, and despite the expensive looking multiples it could still provide reasonable returns to investors as long as rapid growth continues for a few more years. Other advantages of the company include the fact that it is fairly recession-resistant and inflation-resistant, thanks to its high gross profit margin and significant pricing power.

Be the first to comment