urbazon/E+ via Getty Images

Initiating Coverage

We are initiating coverage on Victoria’s Secret & Co (NYSE:VSCO) and recommending a “HOLD” rating. We are basing our rating based on the assessment that the company’s financial performance has been rapidly declining and there remains further risks that will suppress any upside catalysts. We also recognize the fact that the markets are volatile and can trigger a rally unrelated to the fundamentals, and that the current valuation appears to be reasonable and reflective of current market conditions. Therefore, we recommend investors to be on the sidelines with regards to the stock.

Company Overview

Victoria’s Secret & Co is a specialty retailer offering an assortment of fashion products, such as bras, lingerie, sleepwear, athleisure, fragrances, and more. Victoria’s Secret IPO’ed recently in August 2021 and traded on the first day at a $5.2 billion valuation. Since then, the company’s valuation has cratered by more than 50%, and the market capitalization currently remains at $2.50 billion. Year-to-date, the company’s stock price declined -45.28% compared to the S&P 500’s decline of -21.00%.

Major Headwinds

Growth Problems

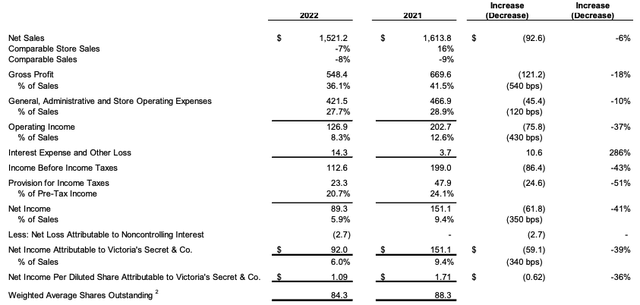

Victoria’s Secret announced its Q2 2022 earnings in late August. The results were disappointing to investors as the quarter showed major slowdown in key financial metrics. Victoria’s Secret had year-over-year decreases in net sales, reporting $1.5 billion in sales this quarter compared to $1.6 billion in sales in Q2 2021. The decline is a substantial decline of 6% YoY, and was driven by 7% decline in comparable store sales and 8% decline in comparable sales. The bottom line was even worse as the company reported a net income of $89.3 million, which is a 41% decline from $151.1 million reported in the preceding year. Given the 8-9% YoY increases in inflation, the declines in sales and net income are even worse in real-terms, as the company’s financial performance could not even keep up with increases in inflation. Such deterioration in top line and bottom line performance should make investors cautious.

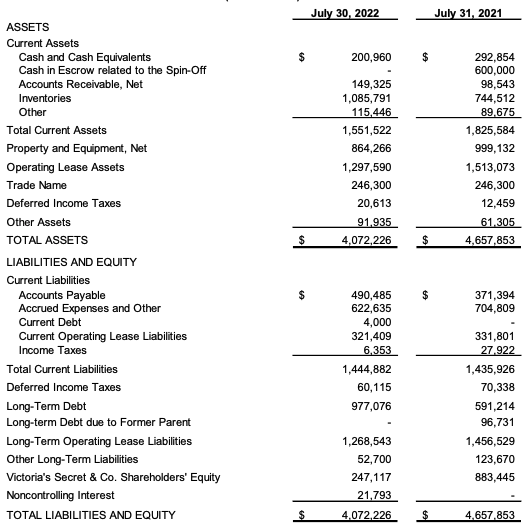

Declining Balance Sheet

Similarly, the company’s balance sheet has also weakened substantially. The company’s cash position has declined ~31% YoY and now stands at $200 million. Compared to long-term debt of $977 million (a 65% increase from $591 million Q2 2021), the net debt position is now $777 million or more than 3x the current shareholder’s equity. This is fairly high leverage for a company with declining growth prospects. Furthermore, the company’s cash on hand is far lower than the long-term debt that the company has, and we find that there’s going to be increasing liquidity risks as interest rates remain high and the company’s financial performance worsens.

Q2 2022 Earnings Presentation

Economic Risks

As a fashion company operating mostly in the brick-and-mortar retail space, the company is exposed to risks related to inflation and monetary policy. As the Federal Reserve continues to raise rates to combat inflation, chances of a recession continue to go up. In a recession, U.S. consumption will likely dry up and purchase of fashion goods will be impacted as consumers seek to save money and reduce discretionary spend. Such scenario puts Victoria’s Secret’s business at a substantial risk from further financial losses as the company faces lower demand from customers and higher raw material costs from inflationary pressures.

Upside Risks

Short Float

The company has a high short float of ~9.47% which puts the company at a high risk of a short squeeze. As mentioned in other articles, a stock can be the victim of a short squeeze when short interest ratio nears 10%. Such high short interest ratio demonstrates the negative sentiment already baked into the stock, and we believe investors should be wary of potential stock price spikes based on non-fundamental related market movements.

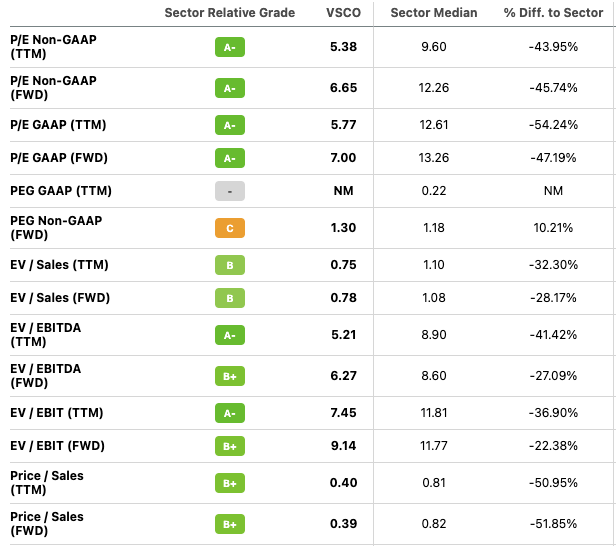

Low Valuation

Given the deteriorating market conditions and the negative perception of recent earnings, Victoria’s Secret’s valuation is very low compared to the sector. The company’s current P/E ratio and forward P/E ratio ranges from 5x to 6x, which translates to an earnings yield of 15%-20%. Compared to the sector median, the company’s valuation metrics are well below the sector median. We believe enough negativity has already been factored into the stock, and we don’t see any catalysts to boost the valuation at any time soon given the declining fundamentals and the uncertain macroeconomic environment.

Seeking Alpha

Conclusion

We are recommending a “HOLD” for the stock as we believe that though the company’s financial performance has been declining substantially and are likely to be impacted by further economic deterioration, the company’s valuation remains reflective of those conditions and the likelihood of a short squeeze remains. We will keep watch on this stock and make recommendations as the economic picture gets clearer.

Be the first to comment