Nikita Burdenkov/iStock via Getty Images

One very interesting investment opportunity in my opinion is a company called ACCO Brands (NYSE:ACCO). I find the company interesting because it owns a variety of valuable brands spread across the consumer, school, technology, and office products categories. Primary brand names that it owns include, but are not limited to, AT-A-GLANCE, Five Star, and Mead. An estimated 70% of the company’s revenue comes from brands that occupy either the top or second largest position in their respective categories. And the top 12 brands owned by the company made up $1.5 billion of the $2.03 billion in revenue the company generated in 2021. Given concerns about the broader economy, shares have not exactly performed well. Although revenue continues to increase, some of the firm’s profitability metrics have shown signs of weakening. Management has also revised down guidance for the 2022 fiscal year, leaving investors somewhat pessimistic. But from what data that we have today, shares of the business do look to be trading on the cheap. I have no doubt that a prolonged economic downturn would negatively affect the company’s top and bottom lines. But considering how cheap shares are right now, I do think that investor pessimism has been overplayed.

The market has not been kind

The last time I wrote an article about ACCO Brands was on March 12th of this year. In that article, I lauded the relatively consistent financial performance that the company had achieved in terms of sales, profits, and cash flows over the prior few years. I mentioned that this kind of stability could prove to be valuable for the right kind of investor. In addition to that, I was impressed with how cheap shares were, both on an absolute basis and relative to similar firms. Fast forward to today, and my ‘buy’ rating on the company does not look all that great. While the S&P 500 has declined by 10.4%, investors buying into ACCO Brands would be down by 34.5% over that same window of time.

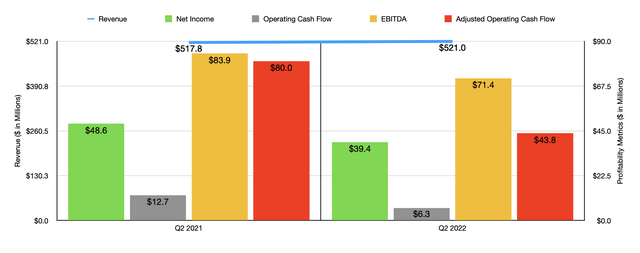

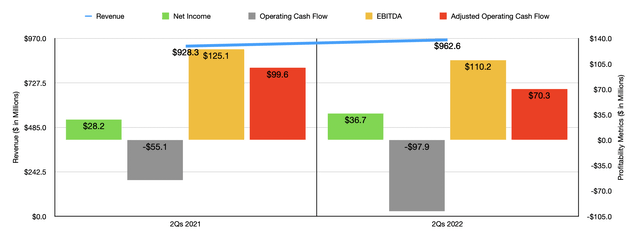

This massive disparity from a return perspective looks rather painful. However, I do believe the market is being overly dramatic in its pessimism regarding this particular firm’s prospects. That is not to say, however, that the company did not deserve to be punished to some degree. Consider recent financial performance. In the second quarter of the company’s 2022 fiscal year, sales came in at $521 million. That’s a modest improvement over the $517.8 million generated the same time one year earlier. This particular quarter was the weaker of the first half of 2022, with revenue for the entirety of the first half totaling $962.6 million. That compares favorably to the $928.3 million generated in the first half of 2021. When it comes to the second quarter of the 2022 fiscal year alone, the company benefited to the tune of 8.1% from price increases. However, a decline in gaming accessories sales pushed volume down by 2.9%. By comparison, for the first half of the year in its totality, higher prices helped add 7.4% to the company’s top line, while volume rose by 0.5% It is worth noting that unfavorable foreign currency fluctuations also impacted the company, with the impact in the first half of the year as a whole totaling 4.1%.

While it’s great to see any sort of revenue increase in this market, the situation looks worse when it comes to profitability. Net income in the latest quarter came in at $39.4 million. That’s down from the $48.6 million scene at the same time last year. Management attributed much of this decline to cost inflation and, to a lesser extent, to lower sales volume. The company was also hit to the tune of $5.9 million from unfavorable foreign currency fluctuations. Despite this, net income for the first half of the year as a whole still has increased, rising from $28.2 million last year to $36.7 million this year. Unfortunately, this does point to a trend of worsening profitability as the quarters go on. This trend can be seen when looking at other profitability metrics as well. In the second quarter, operating cash flow totaled $6.3 million. That’s less than half the $12.7 million experienced one year earlier. If we adjust for changes in working capital, cash flow would have fallen from $80 million to $43.8 million. And when it comes to EBITDA, the decline was from $83.9 million to $71.4 million. Without exception, the performance for all of these metrics for the first half of the year as a whole also came in lower than what it was the same time last year.

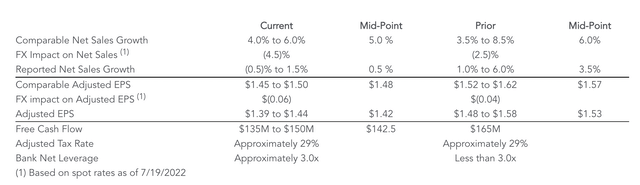

Due to recent market conditions, management has said that investors should anticipate comparable sales increases of between 4% and 6% for 2022 as a whole. However, foreign currency fluctuations will hit revenue to the tune of 4.5%, bringing midpoint sales down by 0.5% compared to the revenue reported in 2021. Prior guidance had called for comparable sales to rise by 1.5%. Earnings per share, meanwhile, should be $1.42 at the midpoint of guidance. That compares to the $1.53 per share previously anticipated. Even with this, however, net income should come in at around $138.3 million. Unfortunately, no guidance was given when it came to other profitability metrics. But if we were to annualize those based on what the company achieved in the first half of the year, we should anticipate adjusted operating cash flow of $148.5 million and EBITDA of roughly $257 million.

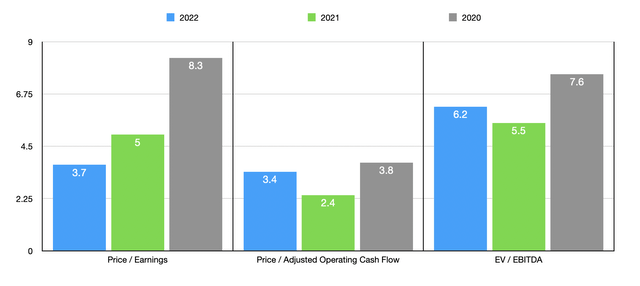

Using these figures, I calculated that the company is trading at a forward price-to-earnings multiple of 3.7. The forward price to adjusted operating cash flow multiple should be 3.4, while the EV to EBITDA should come in at roughly 6.2. As you can see in the chart above, the company does look cheaper on a forward basis when it comes to the price-to-earnings multiple. But it’s more expensive when it comes to the other two metrics. Even if financial performance worsens and matches more of what we saw in 2020 than in 2021 or so far this year, the trading multiples of the company look quite attractive. Of course, this doesn’t mean that everything about the business is great. Its balance sheet could definitely use some work. After all, the company has net debt of $1.09 billion as of this writing compared to a market capitalization of $511.8 million. Using our projected EBITDA for this year, the net leverage ratio for the company would be a lofty 4.2. As part of my analysis, I did compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 7 to a high of 321.2. Using the price to operating cash flow approach, the range was from 10.9 to 29.9. In both cases, ACCO Brands was the cheapest of the group. Meanwhile, using the EV to EBITDA approach, the range was from 3.6 to 74.8, with only one of the five companies being cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| ACCO Brands | 5.0 | 2.4 | 5.5 |

| NL Industries (NL) | 7.0 | 20.5 | 3.6 |

| MSA Safety (MSA) | 321.2 | 29.9 | 74.8 |

| HNI Corporation (HNI) | 31.2 | 14.1 | 11.6 |

| Interface (TILE) | 17.0 | 10.9 | 8.8 |

| Steelcase (SCS) | 106.6 | 17.4 | 13.4 |

Takeaway

Based on all the data provided, I understand that the market is concerned. Truly, the leverage the company has could prove problematic if fundamentals materially worsen. Having said that, it’s also important to keep in mind that the company held up well during the 2020 fiscal year when the pandemic was added worst. Even in that case, the company still managed to generate adjusted operating cash flow of $135.3 million and EBITDA of $210.5 million. It’s unlikely that any downturn we experience in the near future will be worse than what that downturn was. And given how cheap shares are, both on an absolute basis and relative to similar firms, the stock does look cheap enough to still warrants a solid ‘buy’ rating at this time.

Be the first to comment