Lawrence Glass/iStock Editorial via Getty Images

Investment Thesis

Carvana (NYSE:CVNA) has been a disappointment to nearly anyone that’s become involved with the stock. And even though the stock is down nearly all the way, I argue that part of the problem here is that analysts’ expectations for Carvana are still woefully high.

There’s an expectation that Q1 2023 will kick off with a +20% y/y CAGR. However, common sense alone would put that figure into question. There’s a myriad of macro factors that are bringing the economy to a grinding halt.

With that in mind, I believe that expectations for Carvana are still too high, even now.

That doesn’t mean I suggest selling out of this stock. But it does mean that investors should take a wait-and-see approach rather than looking to buy this falling knife.

Revenue Growth Rates Will Decelerate Further

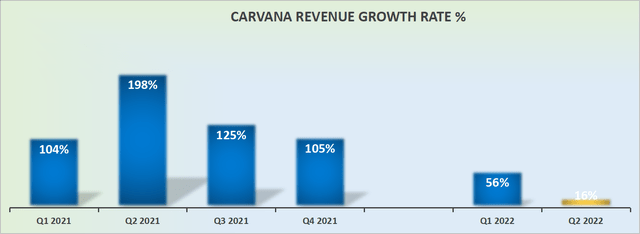

CVNA revenue growth rates

I believe that Carvana’s growth rates will continue to migrate lower still. Even though Q2 only saw 16% y/y revenue growth rates, I believe that there’s still room for these growth rates to end up flat y/y in the coming quarters.

This is contrary to analysts’ expectations, as you can see below.

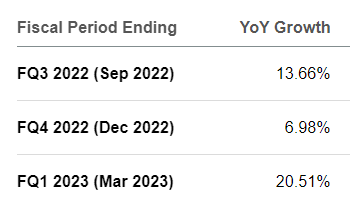

Carvana’s consensus revenues

What analysts project is that once Carvana gets into 2023, its revenue growth rates will accelerate. How? In what world is that going to happen? Let’s get some perspective.

Getting Some Perspective

Carvana’s business model is about delivering lower-priced second-hand cars than traditional car dealers. Consumers are able to peruse their preferred car online and thereby removing a lot of inefficiencies from having dealers spend time trying to sell cars.

Indeed, the idea certainly has a lot of appeal as very few customers want to negotiate with second-hand car dealers in a process that consumers know they’ll be hoodwinked.

Hence, there is a lot to like about the business model and that’s what I wish to emphasize. The problem is not with Carvana itself. The problem is that the economy is simply not strong enough to allow Carvana to thrive.

Not only is there high inflation and low wage growth, but on the back of rapidly rising interest rates, mortgage payments have moved substantially higher too.

Today that’s not a problem, as consumers still have some savings and excess disposable income. But rapidly, in the coming months, the situation will change.

And households that were contemplating replacing their old car will now try to delay their upgrade as long as possible.

Indeed, I believe that households that were looking for an upgrade would have already done it, at any rate, last year when there was free money flying around. Today, the setup is diametrically opposite.

Today household budgets are restricted. And against that backdrop, I simply struggle to see how Carvana will enter 2023 and post any growth to its top line. Let alone +20% CAGR. I find this absurd.

The New Focus, Path to Profitability

On the back of both its debt and equity raise earlier this year, Carvana holds $6.6 billion net debt. Meanwhile, Carvana’s EBITDA is still in negative territory.

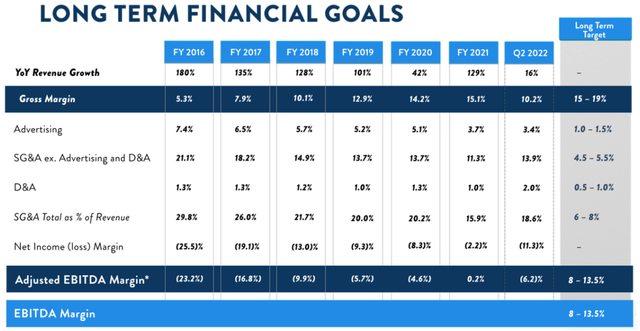

CVNA Q2 2022

Now, this is where things become even more restrictive for Carvana.

On the surface, Carvana’s EBITDA was negative $239 million in Q2 2022, a figure that isn’t particularly troubling. But of that figure, close to 50% is interest expense that gets added back to EBITDA.

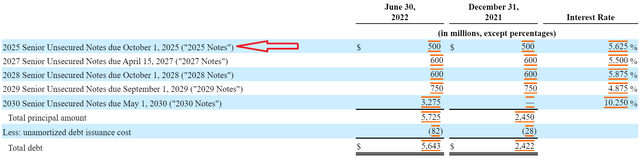

What’s more, Carvana holds $500 million worth of its 2025 notes.

CVNA SEC filing

And those notes will have to be refinanced sooner rather than later. Carvana can’t let the clock run out. And when these notes get refinanced at some point in the next 18 months, their rates will be substantially higher than 5.6%.

Recall, Carvana astutely raised its 2025 notes in October 2020, at a time when interest rates were at rock bottom. Today, that is no longer the case, as you know.

CVNA Stock Valuation – Difficult to Estimate Intrinsic Value

The problem with investing in unprofitable businesses that are steadfastly focused on growth at any cost strategies is that when the economy is no longer compliant, what was once perceived to be a secular growth story, rapidly becomes a “show-me story“.

And even if in the long-run Carvana will be fine, between now and the long run, it can be a very long time. And equity investors aren’t the most patient people at the best of times.

But when a stock is down so significantly and everyone is asking difficult questions from the business, even if the business has proclamations of reaching positive free cash flow, investors refuse to give a hemorrhaging business the benefit of the doubt.

The Bottom Line

Today, the commentary around investing in stocks has become sullen on good days. And ghastly on other days. I believe that we are so close to a full-on capitulation, one can feel it. Investors are today beyond the point of throwing good money after bad money.

Investors rarely talk of diamond hands anymore. While the passion to “buy the dip” is now something that people say, but never convincingly do. That is, if they do it at all.

We are on the cusp of a new market. Where investors buying a basket of companies today will feel like geniuses 12 months from now. Indeed, as difficult as it may seem to believe, there’ll be huge gains to be made from this point forward.

And despite all that, I’m not convinced that Carvana will participate in that upside movement.

Be the first to comment