onurdongel/iStock via Getty Images

Investment Thesis:

Vicor Corporation (NASDAQ:VICR) lost credibility with a significant number of investors over the past year as perceived delays in opening their new factory, missing quarterly projections, supply chain delays, and an illusion of a loss of a significant customer have caused their share price to plummet from a high of $164 to a low of $50.22.

As per the last conference call, it is clear that these issues are behind them, and this news has set the stage for a dramatic rebound in share price.

Background:

Vicor designs, markets, and sells power converters. Most of their advanced product sales come from data centers and high-performance computing. Customers include Nvidia (NVDA), AMD (AMD), Intel (INTC), IBM (IBM), Google (GOOG) (GOOGL), Cray, now HP Enterprise (HPE), Marvell (MRVL), and Broadcom (AVGO).

These companies selected the Vicor solutions because they enable higher-performance processors with cost-effective solutions.

Vicor is the dominant supplier for converters used in AI processors. The AI market is experiencing accelerating growth, as is evident by Nvidia’s recent announcement that their Data Center business grew at a rate of 61% year over year. The Nvidia A100, primarily responsible for that growth, uses Vicor’s converters.

Vicor’s New Factory:

Vicor’s New Factory (Vicor’s website)

Vicor’s (VICR) new CHIP, Converter Housed in a Package, fabrication facility is pictured above. The CHIP fab is currently running at limited capacity, and additional capacity is coming online. All of the critical production equipment for Advanced Products are planned to be in place in Q4. They expect to be 80 to 90% vertically integrated by the end of the 4th quarter. This integration delivers its goal of increased production, cost reduction, and reduced cycle time. Vicor originally stated that the fab would add a capacity of $250,000,000 a year. Vicor now says the new fab adds capacity of $500,000,000 for a total of $1,000,000,000 per year.

The new facility, engineered for streamlined operations, promises to add significant economies of scale to the Vicor production process. The most significant benefit of the new factory is bringing the plating process in-house. Previously a subcontractor performed the plating. Unfinished Vicor converters were boxed up and transported to the subcontractor. The sub would unpack the parts, plate the converters, rebox, and send them back to Vicor. This inefficient system adds significant time to the manufacturing process and increases costs and lead times. On top of the inefficiencies, Vicor was stuck with a 5X price increase and limited capacity from this sub. Recently, this relationship cost Vicor dearly, as was reflected in the declining share price.

Vicor now has a new state-of-the-art plating line equipped with new production machines. The plating subcontractor trained Vicor’s workforce. With the latest machinery, training, and vertical integration, Vicor expects their plating quality and output to be better than they had with the sub.

The efficiencies from the new factory will increase margins, capacity, and turns. All of these improvements significantly improve revenue and earnings. As this new factory approaches operating near its total capacity, economies of scale kick in big time. Gross Margins will increase from 42.6% in Q1 2022 to Vicor’s long-term goal of 65%. Lead times will shrink, turns increase, and substantial dollars drop to the bottom line.

Years ago, an analyst asked Dr. Patrizio Vinciarelli, CEO, why don’t you produce your products overseas? The CEO replied, “I can make them as cost-effective here.” Most investors don’t understand that Dr. Vinciarelli engineered his company for efficiency from when an order is entered to when the product is shipped. He was years ahead of others in keeping manufacturing in the USA.

Vicor has plans to build a second factory, and they may benefit from the CHIPS Act and associated R&D tax credits.

Vicor is a model company as they treat their employees very well, keep manufacturing in the USA, and their products reduce greenhouse gases and save energy. I am a proud Vicor shareholder.

Business Plan to get to $1,000,000,000

Phil Davies, Corporate Vice President of Global Sales and Marketing, laid out Vicor’s business plan at the June annual meeting. He presented their products and target markets, enabling them to grow revenues to $1,000,000,000 a year while increasing their Gross Margins to 65%. They are focused on 100 prime customers, developing new products, and increasing their engineering and manufacturing lead.

Vicor’s backlog at the end of Q2 was $410,000,000 and is larger than last year’s total sales. Assuming they can get the parts and materials necessary, this backlog will facilitate accelerating revenue growth. Some investors may have been concerned about the bookings decline in Q2. However, while the book-to-bill ratio was slightly below 1:1, the CEO and the Corporate VP emphatically stated that bookings were not a concern. They elaborated that in previous quarters customers accelerated orders to accommodate the long lead times.

Patents and IP:

Vicor has recent patents covering packaging, magnetics, manufacturing, AC/DC, integrated switching, capacitor, and terminal connections. The Vicor patent moat is substantial. Many of the patents are in the name of Patrizio Vinciarelli.

Dr. Vinciarelli takes a modest salary, and the rest of his compensation is in stock options. The options he receives are what he rightly deserves, as evident by the value he brings with his leadership, experience, and patents. His compensation plan puts his interests directly in line with mine.

Vicor’s ingenuity and attention to detail are second to none. This trait was articulated and highlighted in the Q2 conference call when the CEO made the following comment on how far they are willing to go to ensure their products are unique and cost-effective:

“We have lots of lasers and unique equipment that we have conceived and developed with partners to accomplish these unique packaging steps, which I firmly believe will give Vicor a long-term sustainable cost advantage in addition to a major performance advantage.”

Historically Vicor has been known for unique solutions, performance, and customization. Now the products are engineered to be cost-effective.

The CEO has often stated that they can scale their technology up or down. This means they can scale up for the most demanding performance requirements or scale their products down to capture more cost-sensitive opportunities. Currently, they are seeking and capturing the most demanding applications and are selling every module they can make. Because of the cost advantages they have secured with their innovation, Vicor can be competitive in lower-performance applications, as demonstrated by their success in capturing lower-power memory rails.

New Markets:

Auto is the big target for Vicor.

While the automobile market is highly competitive, Vicor’s management estimated a Serviceable Available Market, SAM, of $5,000,000,000 for 2026. If Vicor just captures 10%, that will be more than their current annual revenue.

A recently announced product from Vicor is bidirectional and provides a Virtual battery. Bidirectional allows one converter for charging and discharging. The virtual battery enables electric vehicles to charge with either a 400V or 800V charging station. In 2020 98% of the charging stations were 400V, and only 2% were 800V. Vicor’s virtual battery solves this problem.

Another problem this virtual battery solves is switching from 800V to 400V for city driving. Since city driving uses fewer RPMs, inverter efficiencies fall by more than 15% at the higher voltage. This voltage conversion extends the range of the battery.

Vicor has a battery delete solution. Currently, EVs have two batteries. A very high voltage battery and a legacy 12V lead acid battery. Existing electronic accessories in the car use 12V. Vicor has intellectual property for their virtual battery that eliminates 12V battery and saves up to 25 lbs. This solution enables longer driving ranges per charge.

In the automotive arena, Vicor has three Customer design wins, with production starting in 2023 and 2024. Seven active OEM collaborations and four active Tier 1 collaborations. In the Q2 conference call, Vicor announced their latest funded OEM collaboration agreement. Funded means Vicor receives Non-Recurring Engineering, NRE dollars from the OEM. This funding illustrates the intense interest in the Vicor solutions.

In my previous Seeking Alpha article, entitled A Better Way to Invest in the Automobile market, you can find additional information on Vicor and the automobile market. I also highlighted other markets that Vicor services. While these markets are not as large as the Auto and computing markets, they provide excellent diversification while using Vicor’s standard products.

High Voltage, “Front End Products”

Phil Davies, VP of Global Marketing and Sales, updated investors on their Front End Products, including AC/DC solutions, at the June annual meeting: Vicor is now delivering prototypes for this new $1,000,000,000 SAM. Capturing a portion of this SAM is another significant catalyst for an accelerating share price. The expected incremental revenue from front-end products is not fully recognized in the sell-side analyst’s estimates. And the market has not factored in future revenues from front-end products into the Vicor share price.

Additional information regarding Vicor’s Front End Products can be found in my last Seeking Alpha Article entitled 2022, an inflection point for Vicor.

Vertical Solutions for Power on a Package:

Vicor is the undisputed leader in powering high-current processors. They started with a horizontal, Power on a Package, solution years ahead of the competition. As I previously reported, the Nvidia SXM-3, V100 GPU, and other similarly powered processors used this solution.

As the processor’s die sizes shrink, soon to be 5nm, the electrical current requirements continue to rise. Processors now need up to 2,000 amps. A new power architecture was required to provide the power necessary for these processors without significant voltage drop and energy lost to heat. Hence Vicor designed solutions with Vertical architectures.

Vicor has three patent-protected vertical solutions:

The first is a pure vertical solution which is the most efficient and places the converters directly under the processors. This solution is at the leading edge of technology. Vicor has design wins with two separate companies for this solution. As currents continue to increase, this is the only viable solution. Vicor has a patented Geared Current Multiplier, GCM, as part of this solution. This GCM allows their vertical solution to integrate easily with an assortment of different processors.

For processors using up to 1,500 amps, Vicor has a horizontal/vertical solution. This hybrid solution uses standard Vicor converters, one placed directly under the processor and the rest horizontal. Vicor expects production delivery in the middle of next year.

For processors using 2,000 to 3,000 amps, Vicor has the vertical/horizontal solution. This solution uses multiple converters under the processor but still has horizontal converters as part of the solution.

In the last conference call, the CEO mentioned that there is no alternative than vertical for wafers that consume 50,000 to 100,000 amps. This electrical current demand is an order of magnitude above today’s solutions. My takeaway from his statement is that Vicor already envisioned solutions for these extraordinary current levels.

Vicor’s Fifth Generation Technology:

Vicor is not standing still with its technology. They have discussed their fifth-generation technology multiple times in the last year. This generation promises to be smaller and more efficient. Their new front-end products, along with their NBM modules, use Vicor’s fifth-generation technology. Vicor’s road map, presented at the annual meeting, has a new NBM module slated for 2023 delivery capable of up to 2,000 watts, up from the current 800-watt version.

Vicor’s long-term goal is to maintain R&D spending at 15%. As revenues rapidly grow over the next several years, Vicor will continue aggressive spending on R&D to maintain their technology lead for demanding applications.

Competition:

The power supply industry is fragmented, with lots of competitors. Many investors see power supplies as a commodity, including Jim Cramer, who stated that Vicor was a commodity supplier in response to a question on his Mad Money show. He was wrong.

Vicor distanced itself from its competitors by investing over $500,000,000 in proprietary and patented technology. This investment has Vicor solutions enabling high-performance computing, as Vicor is uniquely positioned to power new high-current AI processors with cost-effective and proprietary solutions.

Investors and analysts were surprised to see a competitive Monolithic Power (MPWR) 48V solution show up on a picture of Nvidia’s new H100 GPU. This revelation caused Vicor’s share price to tumble 17.6% in March this year as some investors feared it had lost its competitive advantage.

Quinn Bolton, an analyst from Needham, quickly dispelled the notion that Vicor had lost Nvidia as a customer. In a note to investors, Quinn wrote that Monolithic might be in a specific Nvidia SKU. However, other upcoming processors will use Vicor converters. In response to a question I posed at the annual meeting, Phil Davies confirmed that Vicor still has Nvidia as a significant customer, and they expect increasing bookings and revenue from them in 2023.

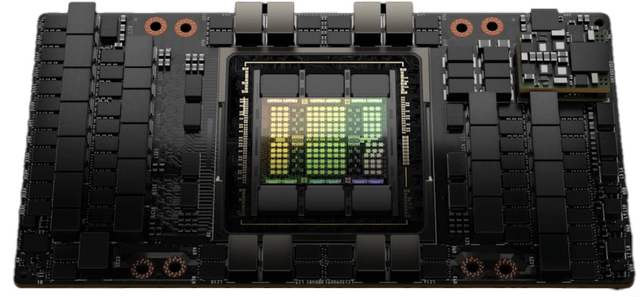

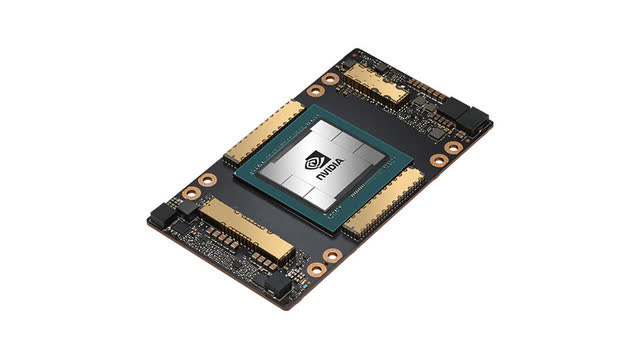

Below are two pictures. The first picture is an Nvidia H100 with a Monolithic solution with over 100 parts. The second is an Nvidia A100 with the Vicor solution.

Nvidia H100 (Nvidia’s website)

Nvidia A100 (Nvidia’s website)

The gold bars shown above are the Vicor converters. Notice how much cleaner the A100 is with the Vicor converters vs. the H100 with the multi-phase solution. Vicor’s solution steps down the 48 Volts to sub 1 Volt in one step, while the multi-phase solution is a two-step approach. Vicor’s solution is a better and more efficient solution with significantly fewer parts.

I believe the only reason Nvidia even considered the Monolithic solution was because Vicor could not guarantee delivery due to the factory not being complete. I think Nvidia had competing designs and decided to go with the Monolithic for the first SKU, but as stated above, they are switching back to Vicor’s solution.

While companies like Monolithic Power produce commodity products suitable for lower power applications, Vicor is accelerating its lead in the high-power AI processors with the vertical solutions I discussed above.

Forecast:

With the help of @aahicks and @shortybovine, I have the following forecast: FY 2022 revenue of $420,000,000 with EPS of $1.00. FY 2023 revenue of $600,000,000 and EPS of $3.00. Considering Vicor’s backlog, capacity, and future products, I am very comfortable with these numbers.

If I apply a 40 PE ratio (easily justified by the accelerating growth rate) to the FY 23 EPS of $3.00, I get a $120 share price. Or if I take a 10 X of the FY23 sales (again justified by the growth rates), I get a share price of approximately $133.

A lot has to go right to get to those numbers, and I want to be conservative, so I am putting a $100 a share price target on Vicor.

As a side note, advanced products grew 65% year over year for the second quarter. This growth occurred with restrained capacity. Again, the current share price does not reflect this exceptional growth.

Risks:

Vicor is a very volatile stock. The share price recently dropped from $164 a share to a bit over $50. While the share price is now approximately 50% higher than the year’s low, some may feel it is fully priced. As you can see, owning Vicor shares is not for the faint of heart.

Investors have had a string of disappointments. After reporting its numbers for Q3 of 2021, Vicor lost credibility with many investors as Vicor missed its forecasted numbers due to capacity constraints and supply chain issues. While Vicor missed projections for a couple of quarters, it should be noted that Vicor still reported a respectable 21% yearly revenue increase in FY 2021 over FY 2020. Many investors were surprised when Vicor announced that the factory would not have end-to-end production until the 3rd quarter of 2022, as they were expecting a sooner date. Finally, investors were disappointed to see the Monolithic solution on the H100 picture.

Any new negative surprises could dramatically affect the share price and permanently dissuade many investors.

While it appears that Vicor has a commanding lead in the high-power AI market, a new competitor with better technology and price could develop.

Vicor is a newcomer to the Automobile market. That market is very competitive and demanding. While Vicor has high expectations and a great start securing design wins and funded collaborations, they have yet to deliver production products into this market.

Conclusion:

Vicor’s volatility has created an opportunity for investors. If you look at Vicor’s chart, it has fallen sharply from its high of $164 last November. I believe it overshot to the downside.

In the Vicor Q2 conference call, it became evident that the problems Vicor experienced, as I articulated in this article, are behind us, and as a result, the share price increased by over 50% in three weeks. While 50% is a significant increase, the share price is still less than half its $164 high from last November. The benefits from vertical integration are happening now, and new products are imminent; therefore, in time, I believe the shares can return to their old high.

Analysts have taken a conservative approach to their forecasts. This was evident when Vicor easily and significantly beat Craig Hallum and Needham’s Q2 forecasted revenue numbers by about $15.6 MM and $12.2 MM, respectively. The Craig Hallum number was approximately 15% lower than Vicor’s actual results. I believe both firms are still low on their forecasts for 22 and 23.

Vicor is determined to beat expectations, as is evident by this answer by the CEO during the Q&A portion of the last conference call. “I think we are at a very interesting inflection point in the business, which makes it in terms of growth rates and opportunity a bit difficult to forecast…. We want to be able to pleasantly surprise in terms of results.”

Despite all of Vicor’s challenges, their backlog continued to grow significantly. The backlog is like a coiled spring waiting to be sprung. Vicor’s new factory eliminates the bottlenecks that led to their capacity constraint, and the revenue and earnings are about to spring to new highs, and the share price will follow.

I believe that the new factory and new advanced products are a catalyst that the market and analysts have not fully priced into their projections.

Be the first to comment