RomoloTavani/iStock via Getty Images

Introduction

Even though the long-struggling NOV (NYSE:NOV) reinstated their dividends in late 2021, it seemed prudent for their shareholders to keep expectations low, as my previous article warned. Since more than half a year has subsequently elapsed, it seems timely to provide a follow-up analysis, which excitingly sees emerging green shoots that stand to grow stronger and thus create an improved outlook for dividends that presently only offer a very low yield of 1.07%.

Executive Summary & Ratings

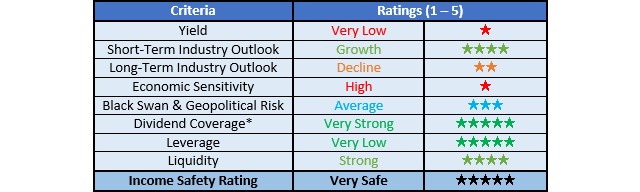

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

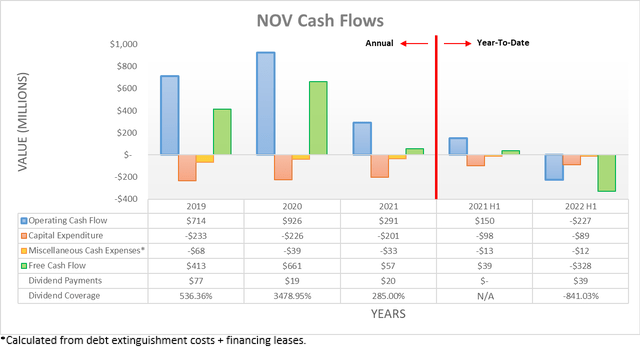

Following their chronically weak cash flow performance during 2021, as my previously linked article discussed, on the surface they saw a cash burn during the first half of 2022 with their operating cash flow landing at negative $227m, which was also significantly below their previous result of positive $150m during the first half of 2021. To the relief of their long-suffering shareholders, thankfully this merely stemmed from a relatively outsized working capital build of $463m that if removed, would see their underlying operating cash flow at $236m. If the working capital draw of $61m seen during the first half of 2021 is also removed to improve this comparison, it sees an equivalent result of $89m and thus their underlying operating cash flow for the first half of 2022 was actually a massive 165% higher year-on-year.

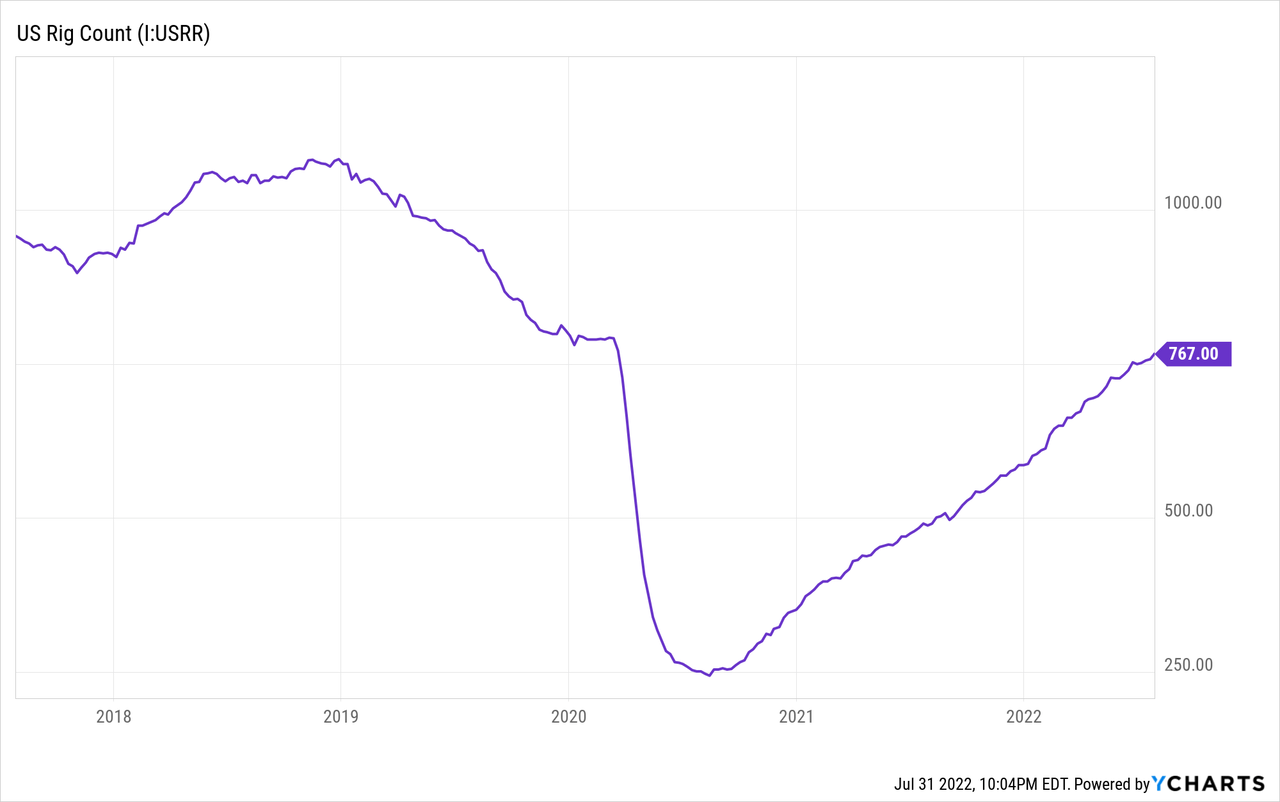

Upon removing this relatively outsized working capital build, it lifts their free cash flow of negative $328m during the first half of 2022 to a positive $135m, which would have provided very strong coverage of near 350% to their dividend payments of $39m and thus makes room for growth on the horizon. This far exceeds the free cash flow expectations when conducting my previous analysis, which has obviously been helped significantly by the booming oil and gas prices following the Russia-Ukraine war that provided an unexpected boost, notwithstanding the humanitarian disaster. When looking ahead, these emerging green shoots appear likely to grow stronger with oil and gas drilling in the United States continuing to ramp up towards its pre-Covid-19 level, as the graph included below displays.

It can be seen that as oil and gas surged throughout the first half of 2022, naturally, the oil and gas rig count in the United States followed in tandem to now reach 767, which marks a sizeable difference versus when conducting the previous analysis at the end of 2021 when there were only 586 rigs. The heightened prospects of a recession on the horizon create risks, although the continued carnage in Eastern Europe should provide significant support to oil and gas prices in the foreseeable future as Europe seeks supply elsewhere. Once oil and gas markets rebalance, this is almost certainly going to levy more demand upon supplies from North America and as a result, support increased drilling and thus increased demand for their related oilfield equipment, which should only see these emerging green shoots grow stronger in the short to medium-term that create an improved outlook for dividends.

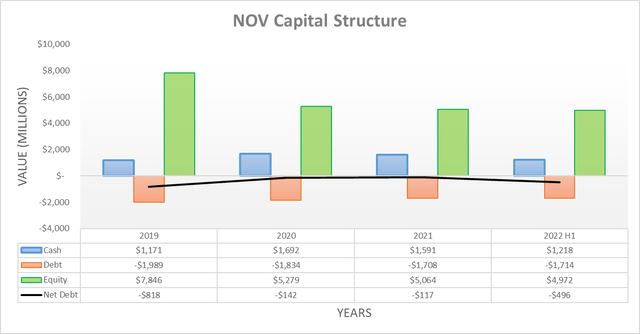

After seeing their net debt trending down during 2020 and 2021, unsurprisingly, their relatively outsized working capital build during the first half of 2022 saw it expand to $496m versus its previous level of $117m at the end of 2021, which also saw their cash balance dipping lower to $1.218b versus $1.591b respectively. If not for their working capital build of $463m, they would have only had a net debt of $33m and thus when looking ahead into the second half of 2022, at the barest minimum their net debt should drop significantly as this working capital movement reverses.

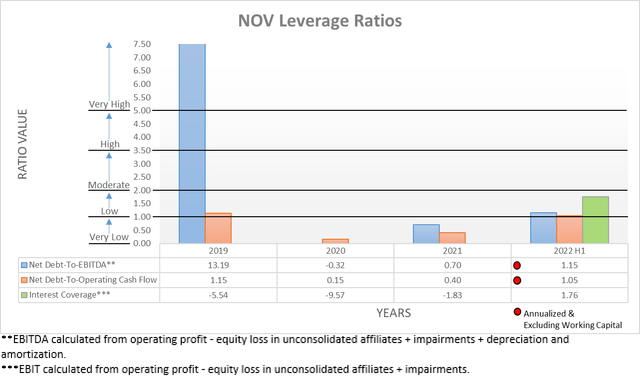

Despite their net debt increasing, thankfully their leverage remains easily manageable with a net debt-to-EBITDA of 1.15 and a net debt-to-operating cash flow of 1.05 and because their net debt only temporarily increased, these should soon fall back beneath the 1.00 threshold for the very low territory. More importantly, it was also very positive to see their interest coverage finally claw its way out of negative results and alleviate one area of concern when conducting the previous analysis. Even though their latest result of 1.76 remains low, it should see further improvements as their financial performance hopefully benefits from increased oil and gas drilling.

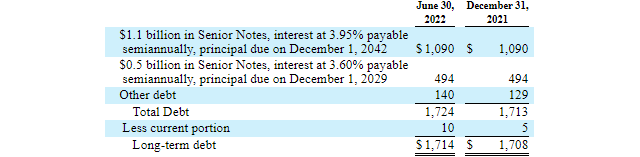

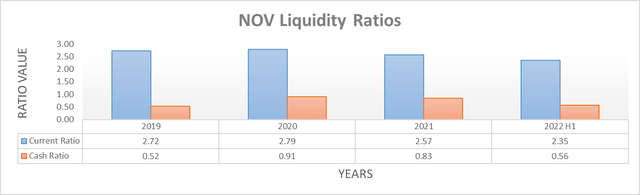

Even though the first half of 2022 saw their cash balance dipping lower due to their cash burn, their liquidity nevertheless remained strong with a current ratio of 2.35 and a cash ratio of 0.56, which are down only modestly versus their previous result of 2.57 and 0.83 at the end of 2021. If required, they still retain a further $2b of availability under their credit facility and given the majority of their debt does not mature until as far away as 2042 with no smaller maturity until even 2029 at the earliest, as the table included below displays, it leaves them very well positioned to capitalize on any recovery in oil and gas drilling.

NOV Q2 2022 10-Q

Conclusion

Whilst the road forward is never linear or bump-free, when digging under the surface these emerging green shoots are positive with their cash flow performance hopefully turning a corner after seeing chronically weak performance during 2021, which bodes well for dividend growth. When combined with the stronger short to medium-term outlook for oil and gas drilling in the United States following the Russian invasion of Ukraine, I believe that it is now appropriate to upgrade my hold rating to a buy rating.

Notes: Unless specified otherwise, all figures in this article were taken from NOV’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment